Global Soy Based Surfactants Market Size, Share, and COVID-19 Impact Analysis, By Type (Anionic Surfactants, Cationic Surfactants, Nonionic Surfactants, Amphoteric Surfactants), By Application (Personal Care Products, Household Cleaning Products, Industrial Cleaning, Agricultural Chemicals, Food Industry), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Soy Based Surfactants Market Insights Forecasts to 2035

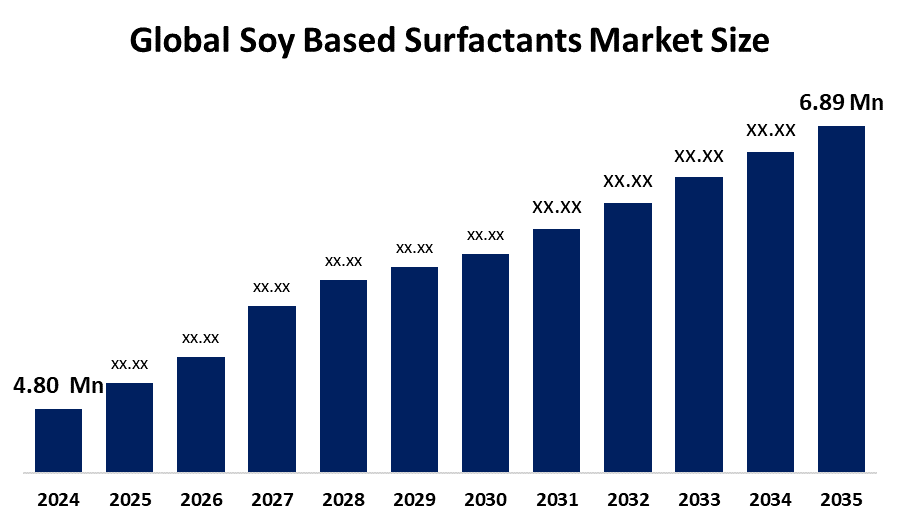

- The Global Soy Based Surfactants Market Size Was Estimated at USD 4.80 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.34% from 2025 to 2035

- The Worldwide Soy Based Surfactants Market Size is Expected to Reach USD 6.89 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Soy Based Surfactants Market Size was worth around USD 4.80 Million in 2024 and is predicted to grow to around USD 6.89 Million by 2035 with a compound annual growth rate (CAGR) of 3.34% from 2025 and 2035. The market for soy based surfactants has a number of opportunities to growth driven by improvements in production technologies that improve performance, growing customer demand for sustainable and biodegradable products, and encouraging legislative frameworks that encourage the use of renewable resources. Together, these elements support the market's growth in a number of applications, such as agriculture, domestic cleaning, and personal care.

Market Overview

Soy based surfactants are surface-active substances that come from biodegradable and renewable sources, mostly soybeans. The market for soy based surfactants is expanding significantly due to a combination of rising environmental consciousness, governmental backing for biodegradable alternatives, and customer preferences for sustainable products. Soy based surfactants, which are made from soybeans, are good substitutes for surfactants made from petrochemicals since they are more biodegradable and less harmful. The U.S. Department of Agriculture reports that soybean production exceeded 4.5 million bushels in 2021, demonstrating a strong supply that sustains the market for surfactants. This increase in supply is occurring at the same time that demand is rising in a number of industries, such as industrial applications, domestic goods, and personal care. Personal care goods are one of the biggest categories of the industry, which is distinguished by its wide range of applications. The U.S. Bureau of Economic Analysis projects that the global personal care industry will expand at a compound annual growth rate of 5.3% between 2021 and 2028. Due to their natural nature and mildness, soy-based surfactants are becoming more and more popular, and this increase is driving up demand for them. The cleaning agents sector is another important area of the industry, where soy surfactants are gaining traction because of their efficiency and environmentally favorable qualities. This tendency is further fueled by growing consumer awareness of environmental sustainability and health issues.

In India, state policies, particularly in Maharashtra, are promoting soybean production by providing funding for fertilizer, seeds, and irrigation infrastructure. These initiatives aim to ensure a consistent supply of raw materials for the surfactant industry by expanding the availability of soybeans. Research funds are also given to these areas in order to develop high yield, pest resistant soybean varieties and enhance extraction methods, which can increase production efficiency and product quality.

Report Coverage

This research report categorizes the soy based surfactants market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the soy based surfactants market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the soy based surfactants market.

Global Soy Based Surfactants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.80 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.34% |

| 2035 Value Projection: | USD 6.89 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Type, By Application and By Region |

| Companies covered:: | Archer Daniels Midland Company, Cargill, Incorporated, BASF SE, Croda International Plc, Stepan Company, Kao Corporation, Inolex Inc., Evonik Industries, Solvay S.A., Lubrizol Corporation, Oxiteno, Galaxy Surfactants, Solae LLC, Bunge Global, Wilmar International Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The soy based surfactants market is driven as producers are adopting renewable resources as a result of the expanding trend towards green chemistry. One important accelerator is the availability of raw materials like soybeans, which are less damaging to the environment than conventional petrochemicals. Regulations that support bio based products are also becoming more and more popular. The Biobased Products Directive of the European Union, for example, encourages the use of renewable resources in a variety of businesses, which increases the market's potential for growth. Furthermore, natural and organic products are becoming more and more popular among consumers, especially in the personal care industry. Demand for natural and sustainable products is rising, according to research by the Organic Trade Association. Sales of organic personal care products in the United States alone in 2021 totaled $1.4 billion..

Restraining Factors

The soy based surfactants market is restricted by factors like the fluctuation of raw material prices. Climate related or global supply chain related fluctuations in soybean prices might affect production costs, raising final consumer prices. Additionally, in some areas, especially in developing nations where traditional surfactants predominate, the infrastructure and technology currently in place may impede the use of soy based surfactants.

Market Segmentation

The soy based surfactants market share is classified into type and application.

- The cationic surfactants segment dominated the market in 2024, accounting for approximately 15% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the soy based surfactants market is divided into anionic surfactants, cationic surfactants, nonionic surfactants, amphoteric surfactants. Among these, the cationic surfactants segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven as the personal care and cosmetics sectors greatly benefit from cationic surfactants, which are known for their antibacterial qualities and guarantee product life and enhanced efficacy. Nonionic surfactants are perfect for sensitive formulations because of their mildness and versatility. At the same time, amphoteric surfactants are prized for their capacity to stabilize formulations and add to foaming properties, which allows them to dominate a variety of applications in personal and household care products.

Get more details on this report -

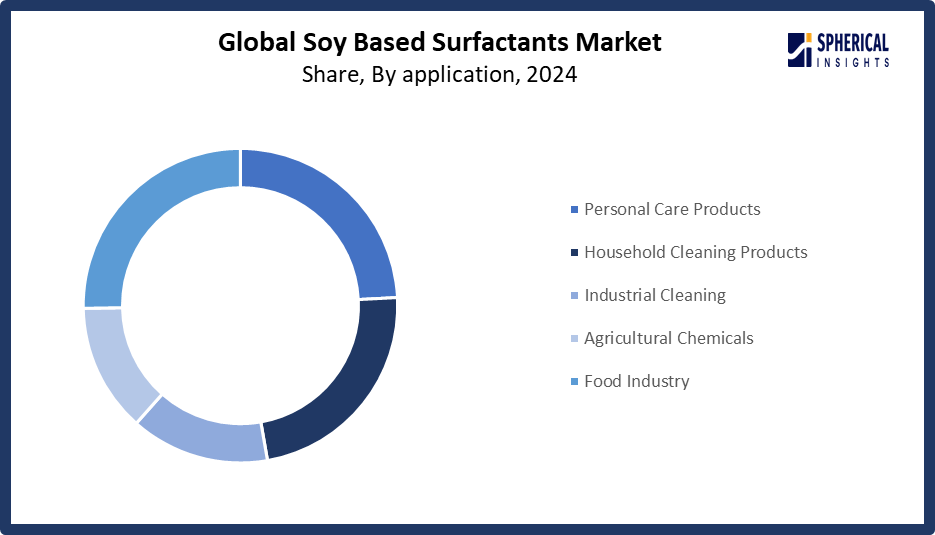

- The personal care products segment accounted for the largest share in 2024, accounting for approximately 24% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the soy based surfactants market is divided into personal care products, household cleaning products, industrial cleaning, agricultural chemicals, food industry. Among these, the personal care products segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the personal care products category being a prominent player in the industry, with a 2023 market value of 1.2 USD Million and a projected 2032 market value of 1.57 USD Million, demonstrating its dominance. This use is essential because soy based surfactants, which are known for their mildness and potent cleansing qualities, are in high demand as consumers' preferences for sustainable and natural ingredients in personal care products grow. The household cleaning products market, which is expected to grow from its 2023 valuation of 1.05 USD Million to 1.4 USD Million by 2032, is another significant segment of the soy based surfactant market.

Regional Segment Analysis of the Soy Based Surfactants Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 26% of the soy based surfactants market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share, representing nearly 26% of the soy based surfactants market over the predicted timeframe. The North America leads the soy based surfactant industry, which is regionally diverse but has a 2023 valuation of 1.2 USD Million and a 2032 growth estimate of 1.6 USD Million. Closely behind, Europe shows robust demand driven by ecofriendly packaging and sustainable product initiatives, with a 2023 estimate of 1.1 USD Million and a 2032 prediction of 1.45 USD Million.

The US dominated the market for soy based surfactants due to its robust soybean production, well established advanced chemical manufacturing infrastructure, and advantageous sustainability and regulatory frameworks that facilitate the development of bio-based surfactants on a wide scale.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 8.5% in the soy based surfactants market during the forecast period. The Asia Pacific area has a thriving market for soy based surfactants because of its fast industrial expansion and rising awareness of sustainable surfactants, with a 2023 valuation of 1.3 USD Million and a projected 2032 value of 1.7 USD Million. Despite its smaller size, which is projected to be 0.45 USD Million in 2023, South America is predicted to grow steadily to 0.6 USD Million as a result of improvements in agriculture and increased expenditures in green chemistry.

China is the market leader for soy-based surfactants. This dominance is explained by China's large-scale agricultural operations, extensive soybean production, and substantial use of agrochemicals, especially nitrogenous fertilizers and herbicides, which depend significantly on surfactants for optimal performance. Along with the extensive use of drones and automated sprayers, the nation's farming industry has become increasingly mechanized, which has raised demand for high performance surfactants that improve spray coverage and minimize drift.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the soy based surfactants market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer Daniels Midland Company

- Cargill, Incorporated

- BASF SE

- Croda International Plc

- Stepan Company

- Kao Corporation

- Inolex Inc.

- Evonik Industries

- Solvay S.A.

- Lubrizol Corporation

- Oxiteno

- Galaxy Surfactants

- Solae LLC

- Bunge Global

- Wilmar International Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2022, BASF introduced Plantapon Soy, a bio-based surfactant derived from soy protein for mild rinse off applications. It is an anionic surfactant with numerous sustainability benefits. This product is made from non GMO European soybeans and coconut oil, thereby making it appropriate for the making of vegan formulations and standards of natural cosmetics.

- In June 2022, Solvay introduced new bio surfactants for carbon-neutral and circular beauty care products. Mirasoft SL L60 and Mirasoft SL A60 are 100% biobased and biodegradable surfactants manufactured using a cost effective fermentation process, targeting a broad range of applications in hair and skin care.

- In February 2022, Clariant launched a range of 100% bio based surfactants for a transition to renewable carbon. Clariant's Vita ingredient list got a significant expansion with the introduction of a line of 100% bio-based surfactants and PEGs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the soy based surfactants market based on the below-mentioned segments:

Global Soy Based Surfactants Market, By Type

- Anionic Surfactants

- Cationic Surfactants

- Nonionic Surfactants

- Amphoteric Surfactants

Global Soy Based Surfactants Market, By Application

- Personal Care Products

- Household Cleaning Products

- Industrial Cleaning

- Agricultural Chemicals

- Food Industry

Global Soy Based Surfactants Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the soy based surfactants market over the forecast period?The global soy based surfactants market is projected to expand at a CAGR of 3.34% during the forecast period.

-

2. What is the market size of the soy based surfactants market?The global soy based surfactants market size is expected to grow from USD 4.80 Million in 2024 to USD 6.89 Million by 2035, at a CAGR of 3.34% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the soy based surfactants market?North America is anticipated to hold the largest share of the soy based surfactants market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global soy based surfactants market?Archer Daniels Midland Company, Cargill, Incorporated, BASF SE, Croda International Plc, Stepan Company, Kao Corporation, Inolex Inc., Evonik Industries, Solvay S.A., Lubrizol Corporation, Oxiteno, Galaxy Surfactants, Solae LLC, Bunge Global, Wilmar International Ltd., and Others.

-

5. What factors are driving the growth of the soy based surfactants market?The soy based surfactants market growth is driven by growing consumer demand for biodegradable and environmentally friendly products, technological developments in production, government backing for sustainable ingredients, and the adaptability of soy-based surfactants in a range of applications.

-

6. What are market trends in the soy based surfactants market?The soy based surfactants market trends include surging demand for eco-friendly ingredients, advancements in production technologies, regulatory support for sustainable alternatives, expansion in the food industry, and growth in agricultural applications.

-

7. What are the main challenges restricting wider adoption of the soy based surfactants market?The soy based surfactants market trends include high production costs because of complicated extraction procedures and restricted economies of scale, which are 30 50% higher than those of traditional petrochemical based surfactants.

Need help to buy this report?