South Korea Sulphuric Acid Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Elemental Sulfur, Base Metal Smelters, Pyrite Ore, and Others), By Application (Fertilizers, Chemical Manufacturing, Metal Processing, Petroleum Refining, Textile Industry, Automotive, Pulp and Paper, and Others), and South Korea Sulphuric Acid Market Insights, Industry Trends, Forecasts to 2035

Industry: Chemicals & MaterialsSouth Korea Sulphuric Acid Market Insights Forecasts to 2035

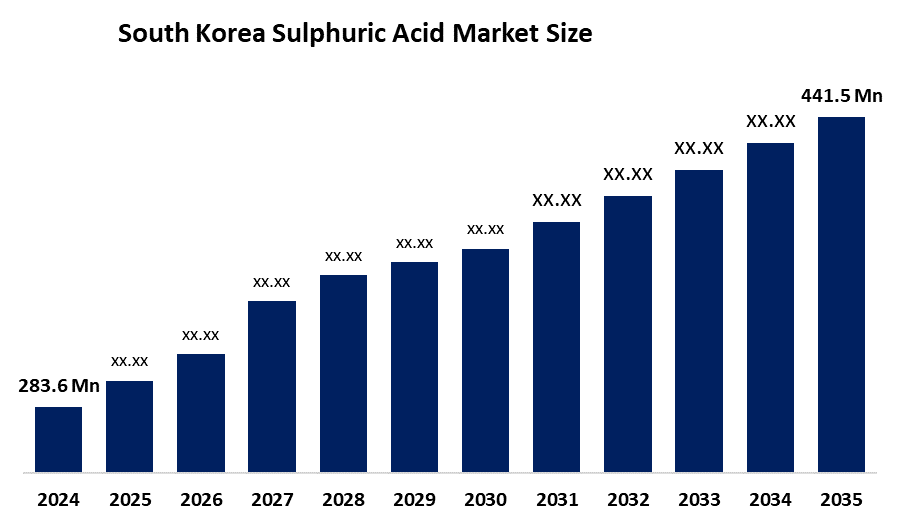

- South Korea Sulphuric Acid Market Size 2024: USD 283.6 Million

- South Korea Sulphuric Acid Market CAGR (2025 to 2035): 4.11 Percent

- South Korea Sulphuric Acid Market Size 2035: USD 441.5 Million

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the South Korea sulphuric acid market is projected to reach USD 441.5 million by 2035, growing at a CAGR of 4.11 percent from 2025 to 2035. Market growth is driven by strong demand from semiconductor manufacturing, metal processing, petrochemicals, battery production, and fertilizer industries. Ongoing industrialization, technological advancement, and increased investments in high-purity chemicals and advanced manufacturing facilities further support market expansion.

Market Overview

The South Korea sulphuric acid market includes the production, distribution, and consumption of sulphuric acid, which is a critical industrial chemical. Sulphuric acid is widely used in semiconductor fabrication, battery manufacturing, metal processing, petroleum refining, fertilizer production, and chemical synthesis.

High-purity sulphuric acid plays a vital role in electronics and semiconductor manufacturing, while industrial-grade sulphuric acid supports heavy industries, power generation, and wastewater treatment operations across South Korea.

Government Support and Industry Development

The South Korean government supports the chemical sector through financial incentives, subsidies, and industrial development programs. The Ministry of Trade, Industry, and Energy has provided funding worth KRW 143.8 billion to promote domestic chemical investments and regional industrial growth.

Additionally, the petrochemical sector benefits from policy financing of approximately KRW 3 trillion, along with tax benefits and regulatory support. These initiatives indirectly strengthen sulphuric acid production by supporting downstream chemical and industrial activities.

Market Expansion and Sustainability Trends

South Korean manufacturers are investing in ultra-high-purity sulphuric acid facilities to meet growing demand from semiconductor and electronics industries. Companies are also developing closed-loop sulphuric acid recycling systems for battery recycling plants.

The integration of carbon capture technologies, efficient logistics, and environmentally sustainable petrochemical facilities is improving long-term sustainability. Future market growth will be driven by domestic high-purity manufacturing expansion and circular acid usage, supporting South Korea’s high-technology and environmentally responsible industrial development goals.

Report Coverage

This report categorizes the South Korea sulphuric acid market by key segments and provides revenue forecasts and trend analysis for each submarket. It examines growth drivers, opportunities, and challenges influencing the market.

The report also includes recent developments such as expansions, product launches, partnerships, mergers, and acquisitions. Key market players are profiled with analysis of their strategies, market positioning, and core competencies across each segment.

South Korea Sulphuric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 283.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.11% |

| 2035 Value Projection: | USD 441.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Namhae Chemical Corporation, Korea Zinc Company Ltd, LS Nikko Copper, Miwon Commercial Co Ltd, FarmHannong, LG Chem Ltd, OCI Company Ltd, Hyosung Chemical Corporation, and Others Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korea sulphuric acid market is primarily driven by strong demand from semiconductor, electronics, and battery manufacturing industries, which require high-purity sulphuric acid for critical production processes.

Additional growth drivers include expansion of metal processing, petrochemical production, and chemical manufacturing activities. Government support for industrial development, increased investment in advanced manufacturing technologies, and rising demand for fertilizers and industrial chemicals further contribute to market growth.

Restraining Factors

Market growth is constrained by high production and operational costs, strict environmental and safety regulations, limited availability of high-purity raw materials, and strong competition from imported sulphuric acid products.

Market Segmentation

The South Korea sulphuric acid market is segmented by raw material and application.

By Raw Material

The market is segmented into elemental sulfur, base metal smelters, pyrite ore, and others.

The elemental sulfur segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is attributed to South Korea’s strong petrochemical and chemical industries, which rely on elemental sulfur due to its high purity, consistent quality, cost efficiency, and suitability for advanced industrial applications, particularly in electronics and semiconductor manufacturing.

By Application

The market is segmented into fertilizers, chemical manufacturing, metal processing, petroleum refining, textile industry, automotive, pulp and paper, and others.

The chemical manufacturing segment held the largest market share in 2024 and is projected to grow at a strong CAGR during the forecast period. This growth is driven by South Korea’s global leadership in semiconductor, battery, and electronics manufacturing, which requires ultra-high-purity sulphuric acid for etching, cleaning, and chemical processing. Continuous expansion of high-technology industries and export-oriented manufacturing supports sustained demand.

Competitive Analysis

The report provides an in-depth analysis of major companies operating in the South Korea sulphuric acid market. The evaluation is based on product portfolios, business overview, geographic presence, corporate strategies, market share, and SWOT analysis.

It also covers recent developments including product innovations, joint ventures, partnerships, mergers, acquisitions, and strategic alliances, offering a comprehensive view of market competition.

Key Companies in the South Korea Sulphuric Acid Market

- Namhae Chemical Corporation

- Korea Zinc Company Ltd

- LS Nikko Copper

- Miwon Commercial Co Ltd

- FarmHannong

- LG Chem Ltd

- OCI Company Ltd

- Hyosung Chemical Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End Users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value Added Resellers

Recent Developments

In August 2025, South Korea’s petrochemical sector, including sulphuric acid producers linked to smelters and chemical complexes, initiated restructuring and capacity reductions to improve efficiency and competitiveness amid global oversupply. The government provided financial and regulatory support to participating companies.

Market Scope

This study forecasts revenue at the South Korea, regional, and country levels from 2020 to 2035. The market is segmented as follows.

South Korea Sulphuric Acid Market by Raw Material

- Elemental Sulfur

- Base Metal Smelters

- Pyrite Ore

- Others

South Korea Sulphuric Acid Market by Application

- Fertilizers

- Chemical Manufacturing

- Metal Processing

- Petroleum Refining

- Textile Industry

- Automotive

- Pulp and Paper

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the South Korea sulphuric acid market size?A: South Korea sulphuric acid market size is expected to grow from USD 283.6 million in 2024 to USD 441.5 million by 2035, growing at a CAGR of 4.11% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by strong demand from the semiconductor, electronics, and battery manufacturing industries, which use high-purity acid for their essential operations. The industry needs more resources because metal processing, petrochemical, and chemical production activities are expanding.

-

Q: What factors restrain the South Korea Sulphuric Acid market?A: Constraints include the high production and operational costs, and its strict environmental and safety regulations limited supply of high-purity feedstock and its strong competition from imported chemicals.

-

Q: How is the market segmented by application?A: The market is segmented into fertilizers, chemical manufacturing, metal processing, petroleum refining, textile industry, automotive, pulp & paper, and others.

-

Q: Who are the key players in the South Korea sulphuric acid market?A: Key companies include Namhae Chemical Corporation, Korea Zinc Company Ltd., LS‑Nikko Copper, Miwon Commercial Co., Ltd., FarmHannong, LG Chem Ltd., OCI Company Ltd., Hyosung Chemical Corporation, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?