South Korea Project Portfolio Management Market Size, Share, By Component (Software, Services, Integration and Deployment, Support and Consulting, Training and Education), By Deployment (On-Premises, Cloud), By Enterprise (Large Enterprises, SMEs), By Application (BFSI, Engineering & Construction, Healthcare, IT & Telecom, Manufacturing, Others), South Korea Project Portfolio Management Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologySouth Korea Project Portfolio Management Market Insights Forecasts to 2035

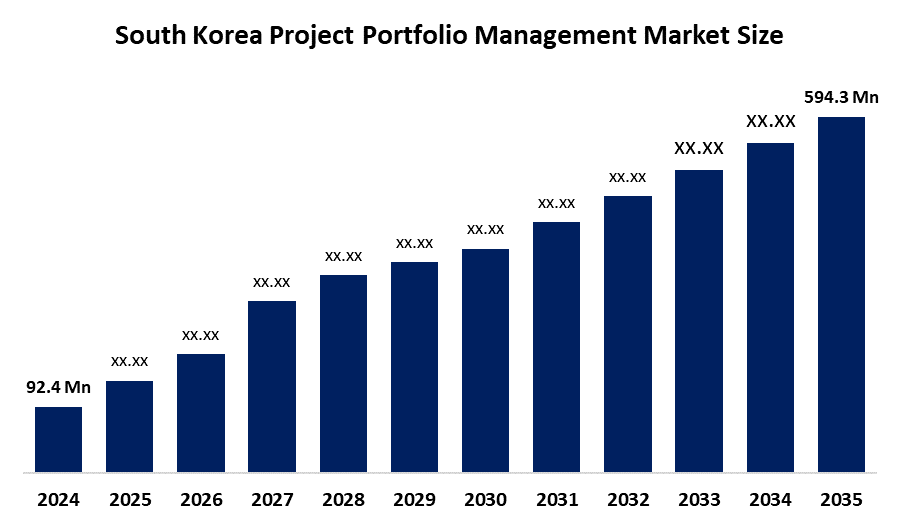

- South Korea Project Portfolio Management Market Size 2024: USD 92.4 Mn

- South Korea Project Portfolio Management Market Size 2035: USD 594.3 Mn

- South Korea Project Portfolio Management Market CAGR 2024: 18.4%

- South Korea Project Portfolio Management Market Segments: By Component, By Deployment, By Enterprise, By Application

Get more details on this report -

Project portfolio management (PPM) is basically a term that combines controls and services which assist organizations in planning, prioritizing, monitoring and managing multiple projects for achieving strategic goals. PPM software enables organizations to manage the allocation of resources, control risks, optimize workflows, and measure performances across different industries such as IT, telecom, construction, manufacturing, and government programs. The market expansion is mainly attributed to the digital transformation programs, rising utilization levels of cloud, based platforms, and the demand for real, time collaboration along with integrated analytics as a way of guaranteeing project success. Moreover, the complex nature of multi, project environments and the increasing strategic alignment of private and public sector enterprises have significantly affected the demand.

Advancements in technology such as AI, machine learning, and predictive analytics are helping portfolios forecast more accurately, flow of work become automated, and decision, making become more effective. South Korean government is facilitating the digital transformation at various levels including the national AI strategy, digital new deal, and the public cloud adoption program that, among other things, help cement a robust IT infrastructure, thus allowing enterprises to effectively adopt advanced project management solutions. The ones that are to come, may be, AI, powered project management, cloud, based solutions for SMEs, and PPM tools' integration in smart city, 5G, and digital infrastructure projects, will not only set the market up for sustainable growth but also for more extensive adoption by enterprises.

South Korea Project Portfolio Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 92.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 18.4% |

| 2035 Value Projection: | USD 594.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Component ,By Deployment |

| Companies covered:: | Broadcom, Hexagon AB, HP Development Company, L.P., Microsoft Corporation, Oracle Corporation, Planisware, Planview, Inc., SAP SE, ServiceNow, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysi |

Get more details on this report -

Market Dynamics of the South Korea Project Portfolio Management Market:

The South Korea Project Portfolio Management Market Size is driven by the rapid digital transformation of enterprises, rising project complexity, and a high demand for more efficient resource utilization, and operational effectiveness. A combination of major digital initiatives, smart manufacturing schemes, and IT modernization projects are compelling organizations to resort to structured portfolio planning and obtaining governance through respective tools. Moreover, the quick migration to the cloud and SaaS platforms, the increasing use of agile methodologies, and the focus on data, driven decision, making are some of the factors that are raising the demand for PPM solutions in the sectors of IT, telecom, manufacturing, and new product development.

The South Korea Project Portfolio Management Market Size is restrained by high implementation and integration costs, data security and privacy issues, and the challenges of integrating PPM platforms with legacy systems. Locally there is an issue of resistance to organizational changes, limited project management maturity in traditional enterprises, and lack of professionals who are capable of working advanced PPM tools which hampers the adoption rate. Moreover, complications with customization and longer implementation periods are making the operational burden for medium, sized businesses even heavier.

The South Korea Project Portfolio Management Market Size, in the long run, holds a bright future with prospects coming from the widening of digital government programs, the initiation of major infrastructural projects, and the adoption of enterprise automation. The increased use of AI, based analytics, predictive planning, real, time portfolio dashboards, and risk management tools will contribute to the enhancement of decision quality and the acceleration of execution.

Market Segmentation

The South Korea Project Portfolio Management Market share is classified into component, deployment, enterprise, application.

By Component:

The South Korea project portf

olio management market is divided by component into software, integration and deployment, support and consulting, and training and education. Among these, the software segment dominated the market share in 2024 and is anticipated to grow at a strong pace during the forecast period. The leading segment of software has been a focus of high adoption by enterprises of centralized portfolio platforms for project prioritization, checking progress in real time, resource planning, and performance monitoring. The surge in digital transformation initiatives, intricate multi, project environments, and the need for data, driven decision, making tools are some of the factors that have impacted the software usage trend in big organizations.

By Deployment:

The South Korea Project Portfolio Management Market Size is divided by deployment into on-premises and cloud. Among these, the cloud segment dominated the market share in 2024 and is anticipated to grow at a strong pace during the forecast period. There are several reasons why the cloud segment is the leader, including faster implementation timelines, scalability, remote access capabilities, and lower infrastructure burden. Enterprises choose cloud, based ppm platforms to facilitate hybrid work models, agile project execution, and multi, location teams, especially in it, telecom, and manufacturing sectors.

By Enterprise:

The South Korea Project Portfolio Management Market Size is divided by enterprise into large enterprises and SMEs. Among these, the large enterprises segment dominated the market share in 2024 and is anticipated to grow at a steady pace during the forecast period. Large enterprises dominate the market because they handle multiple high, value projects in various departments, thus, they need to have structured portfolio governance, risk control, and resource optimization in place. They also have higher technology budgets and more mature project management frameworks that allow them to keep consistent ppm adoption.

By Application:

The South Korea Project Portfolio Management Market Size is divided by application into BFSI, engineering & construction, healthcare, it & telecom, manufacturing, and others. Among these, the IT & telecom segment dominated the market share in 2024 and is anticipated to grow at a strong pace during the forecast period. The core of this dominance is formed by the continuous digital infrastructure upgrades, network expansion projects, software development programs, and technology modernization initiatives that need very tight project coordination and portfolio visibility.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the South Korea Project Portfolio Management Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in South Korea Project Portfolio Management Market:

- Broadcom

- Hexagon AB

- HP Development Company, L.P.

- Microsoft Corporation

- Oracle Corporation

- Planisware

- Planview, Inc.

- SAP SE

- ServiceNow

Recent Developments in South Korea Project Portfolio Management Market:

December 2025, OnePlan unveiled OnePlan NextGen PPM, a cutting, edge project portfolio management solution built to support smooth transitions from old systems. The solution significantly enhances automation, enterprise, grade planning, and AI, powered workflow orchestration, thus helping businesses to quicken their ppm modernization journey, lower the risk of changes, and increase portfolio visibility for quicker and more efficient project delivery.

March 2025, SAP SE has launched an upgraded SAP S/4HANA Cloud Private Edition 2023 FPS03 that includes more advanced AI, automation, and enterprise portfolio and project management capabilities. These changes enhance the functionalities for project cost overview, work breakdown structure controls, and predictive planning, thereby helping Japanese companies to make smarter decisions and have more advanced portfolio governance.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the South Korea, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the South Korea Project Portfolio Management Market Size based on the below-mentioned segments:

South Korea Project Portfolio Management Market, By Component

- Software

- Services

- Integration and Deployment

- Support and Consulting

- Training and Education

South Korea Project Portfolio Management Market, By Deployment

- On-premises

- Cloud

South Korea Project Portfolio Management Market, By Enterprise

- Large Enterprises

- SMEs

South Korea Project Portfolio Management Market, By Application

- BFSI

- Engineering & Construction

- Healthcare

- IT & Telecom

- Manufacturing

- Others

Frequently Asked Questions (FAQ)

-

What is the South Korea project portfolio management market size?South Korea project portfolio management market is expected to grow from USD 92.4 million in 2024 to USD 594.3 million by 2035, growing at a CAGR of 18.4% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the rapid digital transformation of enterprises, rising project complexity, and a high demand for more efficient resource utilization, and operational effectiveness. A combination of major digital initiatives, smart manufacturing schemes, and IT modernization projects are compelling organizations to resort to structured portfolio planning and obtaining governance through respective tools.

-

What factors restrain the South Korea project portfolio management market?South Korea project portfolio management market is restrained by high implementation and integration costs, data security and privacy issues, and the challenges of integrating PPM platforms with legacy systems. Locally there is an issue of resistance to organizational changes, limited project management maturity in traditional enterprises, and lack of professionals who are capable of working advanced PPM tools which hampers the adoption rate.

-

How is the market segmented by enterprise?The market is segmented into large enterprises and SMEs.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?