South Korea Pen Needles for Diabetes Care Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Standard Pen Needles, Safety Pen Needles), By Needle Length (4mm, 5mm, 6mm, 8mm, 10mm, 12mm), and South Korea Pen Needles for Diabetes Care Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Pen Needles for Diabetes Care Market Insights Forecasts to 2035

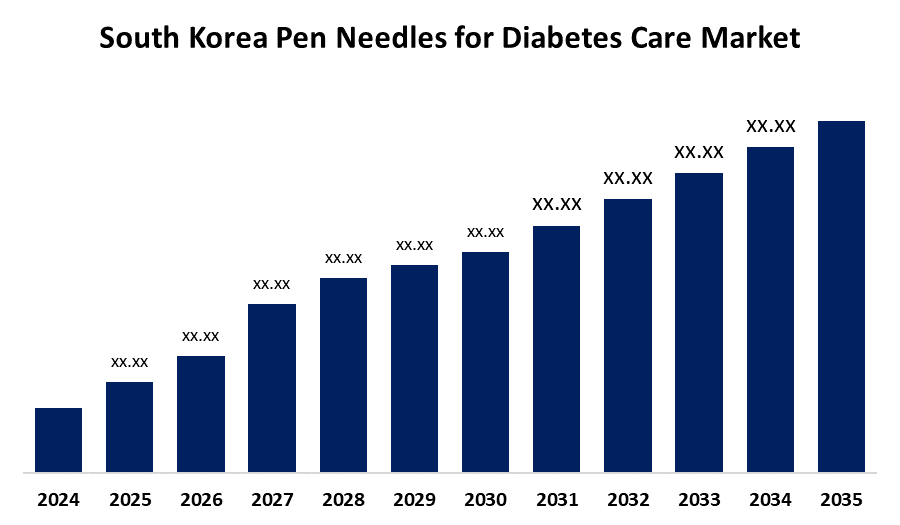

- The South Korea Pen Needles for Diabetes Care Market size is Expected to Grow at a CAGR of around 6.2% from 2025 to 2035

- The South Korea Pen Needles for Diabetes Care Market size is Expected to hold a significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Pen Needles for Diabetes Care Market Size is anticipated to grow at a CAGR of 6.2% from 2025 to 2035. The market is driven by rising prevalence of diabetes, coupled with increasing insulin-dependent patients requiring frequent and safe injections. Advancements in needle technology for improved comfort and reduced pain further accelerate adoption.

Market Overview

South Korea's market for pen needles for diabetes care is defined as the market for disposable needles designed for use with insulin pens to manage blood glucose levels in diabetic patients. Pen needles are popular because they are easy to use, provide precise dosing, and are less painful than traditional syringes. As diabetes prevalence continues to rise (especially Type 2 diabetes), we can expect growth to continue, as well as an increasing aging population and desire by patients for convenient ways to deliver insulin. Newer designs in safety needles, ultra-thin gauges, and compatibility with a variety of insulin pens, have also increased the use of pen needles. Considering that hospitals, clinics, and homecare settings are encouraging insulin pen therapy, there is a clear pathway for sustained growth into 2035.

Report Coverage

This research report categorizes the market for the South Korea pen needles for diabetes care market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea pen needles for diabetes care market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea pen needles for diabetes care market.

South Korea Pen Needles for Diabetes Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Product Type, By Needle Length |

| Companies covered:: | Becton, Dickinson and Company (BD), Novo Nordisk A S, Ypsomed Holding AG, Owen Mumford Ltd, HTL STREFA S.A., Terumo Corporation, B. Braun Melsungen AG, MedExel Co., Ltd., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korea pen needles for diabetes care market is driven by rising diabetes prevalence, increasing insulin acceptance, and growing demand for safer methods for, and less painful options to, inject insulin. The development of improvements to a pen needle that are shorter, thinner and have safety engineered designs enhance patient comfort which can ensure better adherence. And, expanding trends to home healthcare usage and government support for diabetes care also contribute to the growth of this market.

Restraining Factors

The development of the market is restrained by the high cost of devices, lack of reimbursement from payors in certain areas, and competition from alternative insulin delivery devices. They also face regulatory compliance and safety issues that impact adoption.

Market Segmentation

The South Korea pen needles for diabetes care market share is classified into product type and needle length.

- The standard pen needles segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea pen needles for diabetes care market is segmented by product type into standard pen needles and safety pen needles. Among these, the standard pen needles segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is the result of the cost effectiveness, extensive availability, and ease of use of safety pen needles, with products that include protective mechanisms to avoid accidental needle-stick injuries. It is expected that safety pen needles will develop rapidly as awareness of infection prevention and occupational safety standards rises in healthcare.

- The 4mm segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea pen needles for diabetes care market is segmented by needle length into 4mm, 5mm, 6mm, 8mm, 10mm, and 12mm. Among these, the 4mm segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The reason is patients prefer less painful options, more comfort, and greater usability across ages, including children, adults, and the elderly. Longer needle lengths (8mm and 12mm) are still used in patients with higher BMI or unique clinical situations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea pen needles for diabetes care market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Becton, Dickinson and Company (BD)

- Novo Nordisk AS

- Ypsomed Holding AG

- Owen Mumford Ltd

- HTL STREFA S.A.

- Terumo Corporation

- B. Braun Melsungen AG

- MedExel Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea pen needles for diabetes care market based on the below-mentioned segments:

South Korea Pen Needles for Diabetes Care Market, By Product Type

- Standard Pen Needles

- Safety Pen Needles

South Korea Pen Needles for Diabetes Care Market, By Needle Length

- 4mm

- 5mm

- 6mm

- 8mm

- 10mm

- 12mm

Frequently Asked Questions (FAQ)

-

1. What is the South Korea Pen Needles for Diabetes Care Market?The South Korea Pen Needles for Diabetes Care Market refers to the market for disposable needles designed for insulin pens, used by diabetic patients for blood glucose management. These needles offer precise dosing, ease of use, and reduced pain compared to syringes.

-

2. What is the growth outlook of the market?The South Korea Pen Needles for Diabetes Care Market is expected to grow at a CAGR of 6.2% from 2025 to 2035, driven by rising diabetes prevalence, technological advancements, and increasing insulin adoption.

-

3. Which product type dominates the market?The standard pen needles segment held the largest share in 2024 due to their cost-effectiveness, wide availability, and ease of use. However, safety pen needles are expected to grow significantly as awareness of infection prevention rises.

-

4. Which needle length is most preferred by patients?The 4mm needle length segment dominated the market in 2024, preferred for its less painful injections, greater comfort, and usability across all age groups, including children, adults, and the elderly.

-

5. What are the key factors driving the market?The market is driven by the rising prevalence of diabetes, increasing insulin-dependent patients, adoption of home healthcare, government support for diabetes care, and technological improvements in pen needles for enhanced comfort and safety.

-

6. What are the main challenges faced by the market?The market faces restraints such as the high cost of devices, lack of reimbursement in certain areas, competition from alternative insulin delivery methods, and regulatory compliance challenges.

-

7. Who are the major players in the South Korea Pen Needles for Diabetes Care Market?Key companies active in South Korea include Becton, Dickinson and Company (BD), Novo Nordisk A/S, Ypsomed Holding AG, Owen Mumford Ltd, HTL-STREFA S.A., Terumo Corporation, B. Braun Melsungen AG, and MedExel Co., Ltd.

Need help to buy this report?