South Korea Packaging Market Size, Share, and COVID-19 Impact Analysis, By Material (Plastic, Paper & Paperboard, Metal, Glass, Wood, and Others), By End-use Industry (Food & Beverages, Cosmetics & Personal Care, Chemicals & Lubricants, Healthcare, Consumer Products, Building & Construction, Electronics, Automotive, and Others), and South Korea Packaging Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsSouth Korea Packaging Market Size Insights Forecasts to 2035

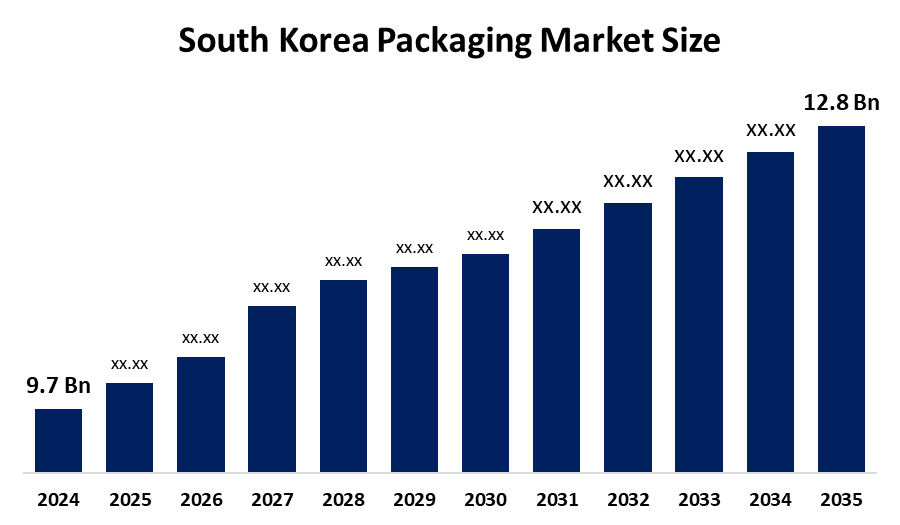

- The South Korea Packaging Market Size Was Estimated at USD 9.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 2.5% from 2025 to 2035

- The South Korea Packaging Market Size is Expected to Reach USD 12.8 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The South Korea Packaging Market Size is anticipated to reach USD 12.8 Billion by 2035, Growing at a CAGR of 2.5% from 2025 to 2035. The South Korea Packaging Market Size is driven by rising demand from the food & beverage industry, rapid growth of e-commerce, increasing consumer preference for convenient and sustainable packaging, and strong government initiatives promoting eco-friendly materials.

Market Overview

The South Korean Packaging Market Size refers to the production and distribution of packaging materials used in various industries for product protection, storage, transportation, and marketing. In sectors such as food and drink, electronics, pharmaceuticals, cosmetics, and e-commerce, the industry includes both rigid and flexible packaging forms. Urbanization, lifestyle changes, technical improvements, sustainability rules, and the increased acceptance of online shopping, ready-to-eat foods, and export production are the key driving forces of the packaging sector.

The packaging sector in South Korea is going through some significant changes that are projected to have an impact on its future expansion. There is a growing drift towards sustainable and recyclable packaging, which is being driven by government objectives to limit plastic waste and adopt a circular economy. Flexible packaging is growing popular because of its light weight, cost-effectiveness, and longer shelf life of food goods. Smart and intelligent packaging technologies, such as QR codes, freshness markers, and digital labelling, are being widely implemented to increase product traceability and safety.

Due to its strict recycling laws and environmental policies, which promote the use of environmentally friendly packaging materials, the South Korean government has played a major role in the growth of the economy's packaging sector. The market's dynamics are evolving as a result of policies that aim to minimize the use of plastics and boost the use of paper and biodegradable packaging. Packaging is becoming more effective, reducing waste, and guaranteeing product safety through technological advancements, including automation, artificial intelligence in quality control, smart packaging, and innovative materials.

Report Coverage

This research report categorizes the market for the South Korea Packaging Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea Packaging Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea Packaging Market Size.

South Korea Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 2.5% |

| 2035 Value Projection: | USD 12.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material, By End-use Industry |

| Companies covered:: | Amcor Korea, Tetea Pak, Berry Global, Sealed Air Korea, ePac Seol, Ltd., Dongwon Systems, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapidly expanding food and beverage sector, rising consumer demand for ready-to-eat goods, and expanding online shopping and home delivery services are the primary drivers of the Packaging Market Size in South Korea. The market is expanding as a result of growing customer concerns about product safety, hygiene, and shelf life. Additionally, the usage of contemporary packaging technology is being pushed by government funding for eco-friendly packaging materials, sustainable packaging development, and advances in technology.

Restraining Factors

The market is affected by factors such as high costs associated with sustainable and biodegradable materials, which may hamper adoption by small-scale manufacturers. Environmental regulations, costs of compliance, and price fluctuations of raw materials also cause challenges. In addition, the recycling system for multi-layer packaging also hampers growth.

Market Segmentation

The South Korea Packaging Market Size share is classified into material and end-use industry.

- The plastic segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea Packaging Market Size is segmented by material into plastic, paper & paperboard, metal, glass, wood, and others. Among these, the plastic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of its outstanding barrier properties against moisture, air, and pollutants, plastic dominates the market. It is ideal for use in the packaging of consumer goods, food, drinks, and medications. The plastic material is incredibly adaptable, making it perfect for use in flexible designs and packaging. Also, it is extremely light, which reduces shipping costs, a significant consideration for big manufacturers and e-commerce companies.

- The food & beverages segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use industries, the South Korea Packaging Market Size is bifurcated into food & beverages, cosmetics & personal care, chemicals & lubricants, healthcare, consumer products, building & construction, electronics, automotive, and others. Among these, the food & beverages segment accounted for the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The food & beverages category is at the top of the market because of the high consumption of packaged and processed food in South Korea. Urbanization, busy lifestyles, and the growing demand for convenience and ready-to-eat foods have led to a rise in the demand for packaging. Food safety regulations and the rise in online food delivery and exports have also contributed to this category being the largest revenue generator.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea Packaging Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amcor Korea

- Tetea Pak

- Berry Global

- Sealed Air Korea

- ePac Seol, Ltd.

- Dongwon Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In March 2025, APP Group has launched its debut into the paper packaging business in South Korea in response to the rising demand for environmentally friendly alternatives in recent years

In May 2024, a leading South Korean packaging manufacturer launched eco-friendly paper-based and biodegradable packaging solutions to meet increasing regulatory requirements and consumer demand for sustainable packaging.

Market Segment

This study forecasts revenue at the South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea Packaging Market Size based on the below-mentioned segments:

South Korea Packaging Market Size, By Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Wood

- Others

South Korea Packaging Market Size, By End-use Industry

- Food & Beverages

- Cosmetics & Personal Care

- Chemicals & Lubricants

- Healthcare

- Consumer Products

- Building & Construction

- Electronics

- Automotive

- Others

Frequently Asked Questions (FAQ)

-

1. What is the South Korea Packaging Market Size?The South Korea Packaging Market Size includes the production and distribution of packaging materials and solutions used across various industries.

-

2. What is the South Korea Packaging Market Size?South Korea Packaging Market Size is expected to grow from USD 9.7 billion in 2024 to USD 12.8 billion by 2035, growing at a CAGR of 2.5% during the forecast period 2025-2035.

-

3. What are the key drivers of the South Korea Packaging Market Size?The market is driven by growth in food & beverages, e-commerce expansion, sustainability initiatives, and technological advancements.

-

4. Which material dominate the South Korea Packaging Market Size?Plastic currently dominates, though paper-based and sustainable materials are gaining traction.

-

5. How is the South Korea Packaging Market Size segmented by end-use industries?The market is segmented into tankers, containers, bulk carriers, general cargo, and other vessels, with tankers being the largest consumers.

-

6. What are the major trends in the South Korea Packaging Market Size?Key trends include sustainable packaging, smart packaging, and growth in flexible packaging.

-

7. Who are the key companies operating in the South Korea Packaging Market Size?Major players include Amcor Korea, Tetea Pak, Berry Global, Sealed Air Korea, ePac Seol, Ltd., Dongwon Systems

-

8. What is the future outlook for the South Korea Packaging Market Size?The market is expected to grow steadily, driven by sustainability, e-commerce growth, and innovation.

Need help to buy this report?