South Korea NOR Flash Market Size, Share, By Type (Serial, Parallel), By Density (2 Megabit and Less NOR, and Other), By Voltage (3V Class, 1.8V Class, and Other), By End-User Application (Consumer Electronics, Communication, and Other), By Process Technology Node (90 Nm and Older, 65 Nm, and Other), By Packaging Type (WLCSP/CSP, QFN/SOIC, and Other), South Korea NOR Flash Market Insights, Industry Trend, Forecasts to 2035.

Industry: Semiconductors & ElectronicsSouth Korea NOR Flash Market Insights Forecasts to 2035

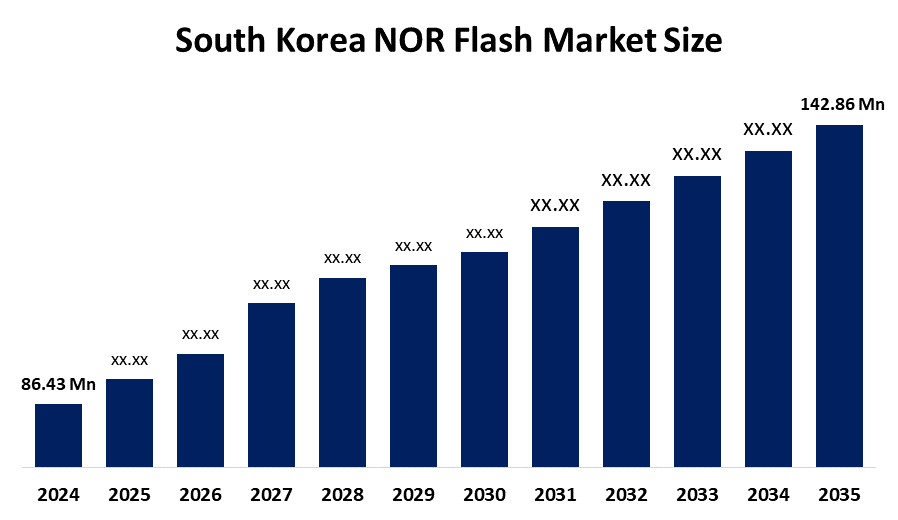

- South Korea NOR Flash Market Size 2024: USD 86.43 Mn

- South Korea NOR Flash Market Size 2035: USD 142.86 Mn

- South Korea NOR Flash Market CAGR 2024: 4.67%

- South Korea NOR Flash Market Segments: Type, Density, Voltage, End-User Application, Process Technology Node, Packaging Type

Get more details on this report -

The South Korea NOR flash market consists of non, volatile memory chips that store firmware and run code in devices that do not have power. NOR Flash allows quick read speeds, a high level of reliability, and direct code execution, which is why it is used in smartphones, automotive electronics, IoT devices, networking equipment, and industrial machinery. The market expansion is caused by the increasing use of connected devices, 5G deployment, AI, enabled applications, and the consumer electronics complexity, which requires fast and reliable memory solutions.

New technologies such as smaller process nodes, high, density packaging, low, voltage operation, and embedded error correction are improving NOR Flash performance while power consumption is being lowered. The South Korean government is supporting the industry by the Semiconductor Industry Innovation Strategy and the Ministry of Trade, Industry and Energy, (MOTIE) initiatives, which encourage domestic chip production, process upgrades, and R&D investments. In the future, there will be a lot of opportunities in AI, driven edge devices, automotive memory solutions, industrial IoT, and 5G networking infrastructure, where there will be continuous innovation and government, supported programs to speed up adoption and reinforce domestic manufacturing capabilities.

Market Dynamics of the South Korea NOR Flash Market

The market for NOR flash in South Korea is driven by the increased requirement for high-speed and reliable non-volatile memory in the market. Smartphones, industrial-use devices, automotive electronics, and 5G networking are creating an increased demand for high-speed memory with low latency in the market. Improved process technology, low-voltage operation, and package size have also driven the market with increased efficiency in the market. Support measures in the South Korean market include support in innovation strategies in the semiconductor sector of the country.

The market is restrained by the high costs of manufacturing, complex manufacturing processes, and strong competition from NAND and other memory options. Production capacities may be limited due to global supply chains.

The future of the NOR Flash market in South Korea is promising with the advent of opportunities in the fields of artificial intelligence edge devices, car electronics, industrial IoT, and 5G networking. Technological innovation, government incentives, and the demand for high-performance memory in the global market are poised to fuel market growth.

South Korea NOR Flash Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 86.43 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.67% |

| 2035 Value Projection: | USD 142.86 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application |

| Companies covered:: | SK Hynix System IC, Infineon Technologies AG, Giga Device Semiconductor Inc., Macronix International Co. Ltd, Winbond Electronics Corporation, Integrated Silicon Solution Inc., Microchip Technology Inc., Renesas Electronics Corporation, Giantec Semiconductor Corporation, Puya Semiconductor (Shanghai) Co., Ltd, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The South Korea NOR flash market share is classified into type, density, voltage, end-user application, process technology node, and packaging type.

By Type:

The South Korea NOR flash market is divided by type into serial and parallel NOR. Among these, the serial NOR segment dominated the share in 2024 and is anticipated to grow at a significant rate during the forecast period. The reason for the rise in the serial NOR flash market is its cost-effectiveness, as it occupies less space on a chip, which suits applications related to consumer electronics, automobiles, and communication devices that have fast read access time requirements.

By Density:

The South Korea NOR flash market is divided by density into 2 Megabit and less NOR, and more than 2 Megabit NOR. Among these the higher density segment dominated the market in 2024 and is anticipated to grow at a significant rate during the forecast period. The growth driver for the company is the increasing demand for storage capacity in smartphones, tablets, automotive electronics, and IoT devices that demand high-density, low-latency memory.

By Voltage:

The South Korea NOR flash market is divided into 3V class, 1.8V class, and others. Among these, the 1.8V class segment held the largest share in 2024 and is anticipated to grow at a significant rate during the forecast period. The reason for its growth is its low power consumption, mobility/IoT device compatibility, and the need for energy-efficient memories with extended battery life and faster data processing speeds

By End-User Application:

The South Korea NOR flash market is classified by end-user application into consumer electronics, communication, and others. Among these, Consumer electronics dominated the market in 2024 and is anticipated to grow at a significant rate during the forecast period. The increasing adoption of smartphones, smart home devices, wearable electronics, and other intelligent gadgets has driven the market for non-volatile memory.

By Process Technology Node:

The South Korea NOR flash market is segmented into 90 nm and older, 65 nm, and other advanced nodes. Among these, the 65 nm segment led the market in 2024 and is anticipated to grow at a significant rate during the forecast period. The reasons for its growth can be attributed to the development of smaller memory chips with high performance characteristics that use lower power consumption and ensure reliability and performance characteristics required by newer technologies.

By Packaging Type:

The South Korea NOR flash market is divided into WLCSP/CSP, QFN/SOIC, and others. Among these the WLCSP/CSP packaging dominated in 2024 and is anticipated to grow at a significant rate during the forecast period. Its development is stimulated by compact, low-cost designs scalable for mobile, IoT, and other applications, with a focus on advanced electronics’ improved heat management, reliability, and flexibility of integration.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the South Korea NOR flash, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in South Korea NOR Flash Market:

- SK Hynix System IC

- Infineon Technologies AG

- Giga Device Semiconductor Inc.

- Macronix International Co. Ltd

- Winbond Electronics Corporation

- Integrated Silicon Solution Inc.

- Microchip Technology Inc.

- Renesas Electronics Corporation

- Giantec Semiconductor Corporation

- Puya Semiconductor (Shanghai) Co., Ltd

Recent Developments in South Korea NOR Flash Market:

In May 2025, Infineon Technologies AGs SEMPER NOR family received ASIL-D functional-safety certification, which validates its automotive memory solutions for ADAS systems and opens up Level 3+ design-wins in a move that will significantly enhance the safety compliance of Infineon, preparing the company for high-value NOR Flash applications in automotive electronics.

In April 2025, The South Korean government announced a USD 23.25 billion support package for semiconductor infrastructure and R&D loans, while the country strategizes to strengthen chip production domestically, reduces the capital intensity of process node transitions, and enhances the competitiveness of memory and NOR Flash production within the country.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the South Korea, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the South Korea NOR flash market based on the below-mentioned segments:

South Korea NOR Flash Market, By Type

- Serial

- Parallel

South Korea NOR Flash Market, By Density

- 2 Megabit and Less NOR

- More than 2 Megabit NOR

South Korea NOR Flash Market, By Voltage

- 3V Class

- 1.8V Class

- Other

South Korea NOR Flash Market, By End-User Application

- Consumer Electronics

- Communication

- Others

South Korea NOR Flash Market, By Process Technology Node

- 90 Nm and Older

- 65 Nm

- Other

South Korea NOR Flash Market, By Packaging Type

- WLCSP/CSP

- QFN/SOIC

- Others

Frequently Asked Questions (FAQ)

-

Q:What is the South Korea NOR flash market size?A:South Korea NOR flash market is expected to grow from USD 86.43 million in 2024 to USD 142.86 million by 2035, at a CAGR of 4.67% during the forecast period 2025-2035.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by rising demand for high-speed, reliable non-volatile memory in smartphones, automotive electronics, industrial IoT, and 5G networking. Innovations such as smaller process nodes, high-density packaging, low-voltage operation, and embedded error correction further fuel market expansion.

-

Q:What factors restrain the South Korea NOR flash market?A:Constraints include high manufacturing costs, complex production processes, limited global supply chain capacities, and competition from NAND and other memory technologies, which may slow adoption and increase production expenses.

-

Q:What are the key end-user applications of NOR flash in South Korea?A:Consumer Electronics, Communication, and Others. Consumer electronics dominate due to the proliferation of smartphones, wearable devices, smart home solutions, and IoT gadgets requiring fast, reliable memory.

-

Q:What recent developments have impacted the market?A:In May 2025, Infineon Technologies AG’s SEMPER NOR family received ASIL-D functional-safety certification, enabling Level 3+ ADAS design-wins in automotive applications. In April 2025, the South Korean government announced a USD 23.25 billion support package for semiconductor infrastructure and R&D loans to strengthen domestic chip production and NOR Flash competitiveness.

-

Q:Who is the target audience for this market report?A:Market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?