South Korea Neuropathy Screening Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Electromyography Devices, Nerve Conduction Velocity Devices, Quantitative Sensory Testing Devices, and Others), By Application (Diabetic Neuropathy, Chemotherapy-Induced Peripheral Neuropathy, and Others), and South Korea Neuropathy Screening Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Neuropathy Screening Devices Market Insights Forecasts to 2035

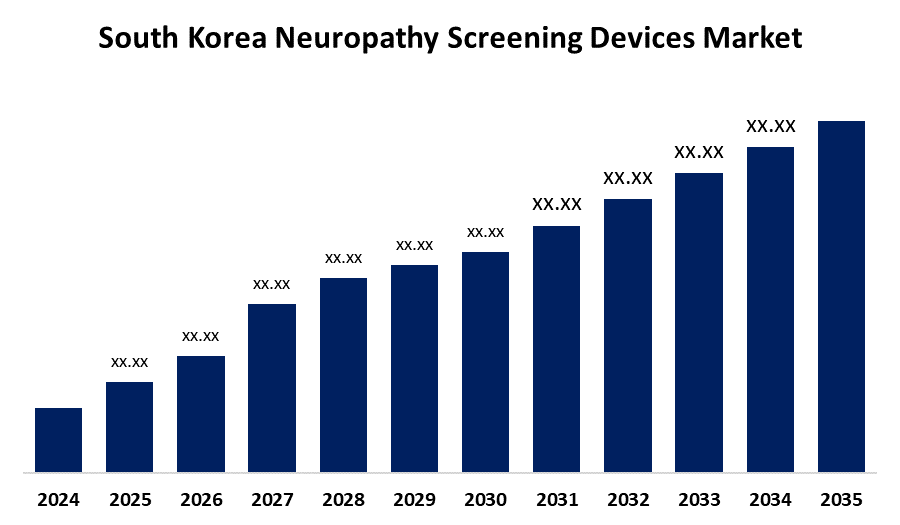

- The South Korea Neuropathy Screening Devices Market Size is Expected to Grow at a CAGR of around 5.7% from 2025 to 2035

- The South Korea Neuropathy Screening Devices Market Size is Expected to hold a significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Neuropathy Screening Devices Market Size is anticipated to grow at a CAGR of 5.7% from 2025 to 2035. The market is driven by rising prevalence of diabetes and metabolic syndrome, earlier detection in primary care, and technology advances in vibration, nerve conduction, and sudomotor testing that enable faster, less-painful screening at the point of care.

Market Overview

The South Korea neuropathy screening devices market is described as the sub-set of the health care marketplace that describes medical devices utilized in order to view, diagnose, and screen peripheral neuropathy that is commonly found as a complication of diabetes or multiple other chronic issues. The South Korea neuropathy screening devices market has steady growth due to factors such as the growing prevalence of diabetes, increased awareness of the importance of earlier detection of neuropathy in the disease trajectory of patients and the rising availability of non-invasive screening devices. An aging population and sided lifestyle-related disorders in South Korea are creating demand for credible screening devices for assessment of neuropathy. Hospitals, clinics and diagnostic laboratories are recognizing the importance of credible screening and are adopting biothesiometers, electromyography and skin conductance systems to ensure the timely and accurate diagnosis of patients. Moreover, the growing implementation of government healthcare strategies, health services investment and focus on managing diabetic complications with responsible screening provides unique opportunities for the growth of the South Korea neuropathy screening devices market.

Report Coverage

This research report categorizes the market for the South Korea neuropathy screening devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea neuropathy screening devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea neuropathy screening devices market.

South Korea Neuropathy Screening Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.7% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Medtronic, Abbott Laboratories, Natus Medical Incorporated, NeuroMetrix, Inc., Boston Scientific Corporation, Hoffmann-La Roche Ltd, Siemens Healthineers, GE Healthcare, Philips Healthcare, Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korea neuropathy screening devices market is driven by the growing prevalence of diabetes and related complications, rising awareness about the importance of early detection of neuropathy, and increasing demand for cutting-edge diagnostic tools. In addition, an older population and rise in lifestyle disorders contributes to an increase in usage and improvements in neuropathy screening devices. Advances in technology with non-invasive devices and government support of chronic disease management assists and strengthens market growth.

Restraining Factors

The South Korea neuropathy screening devices market is restrained by high pricing of advanced and technical screening devices, reimbursement coverage for these devices is only limited in some cases, and many people in more rural parts of the population are unaware of this technology. The limited number of trained professionals also contributes to the utilization and adoption barriers associated with the lack of a timely diagnosis.

Market Segmentation

The South Korea neuropathy screening devices market share is classified into product type and application.

- The electromyography devices segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea neuropathy screening devices market is segmented by product type into electromyography devices, nerve conduction velocity devices, quantitative sensory testing devices, and others. Among these, the electromyography devices segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed in part to their increasing usage for detecting neuromuscular disorders and reliability in clinical diagnosis. Devices for nerve conduction velocity and quantitative sensory testing have increased demand for specific neuropathy assessments; as well as others that represent new technologies for screening.

- The diabetic neuropathy segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea neuropathy screening devices market is segmented by application into diabetic neuropathy, chemotherapy-induced peripheral neuropathy, and others. Among these, the diabetic neuropathy segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is a result of a growing prevalence of diabetes and the necessity for early detection devices. Likewise, chemotherapy-induced neuropathy and other applications have had consistent growth as screening technologies evolve.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea neuropathy screening devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic

- Abbott Laboratories

- Natus Medical Incorporated

- NeuroMetrix, Inc.

- Boston Scientific Corporation

- Hoffmann-La Roche Ltd

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea neuropathy screening devices market based on the below-mentioned segments:

South Korea Neuropathy Screening Devices Market, By Product Type

- Electromyography Devices

- Nerve Conduction Velocity Devices

- Quantitative Sensory Testing Devices

- Others

South Korea Neuropathy Screening Devices Market, By Application

- Diabetic Neuropathy

- Chemotherapy-Induced Peripheral Neuropathy

- Others

Frequently Asked Questions (FAQ)

-

Q1. What is the South Korea Neuropathy Screening Devices Market?The South Korea neuropathy screening devices market refers to the healthcare segment focused on devices used to diagnose and screen peripheral neuropathy, particularly linked to diabetes and other chronic conditions, using tools such as electromyography, nerve conduction velocity, and sensory testing devices.

-

Q2. What is the growth outlook for this market?The South Korea neuropathy screening devices market is expected to grow at a CAGR of 5.7% during the forecast period 2025–2035, driven by the increasing prevalence of diabetes, aging demographics, and adoption of non-invasive diagnostic technologies.

-

Q3. What are the key product segments in this market?The market is segmented by product type into electromyography devices, nerve conduction velocity devices, quantitative sensory testing devices, and others. Electromyography devices held the largest market share in 2024 and are expected to maintain strong growth.

-

Q4. Which applications dominate the South Korea neuropathy screening devices market?The market is segmented by application into diabetic neuropathy, chemotherapy-induced peripheral neuropathy, and others. Among these, diabetic neuropathy held the dominant share in 2024 due to rising diabetes prevalence and demand for early detection.

-

Q5. What are the major factors driving this market?Key drivers include the rising burden of diabetes and related complications, technological advancements in non-invasive screening, increased awareness of early detection, and government support for managing chronic diseases in South Korea.

-

Q6. Who are the leading players in the South Korea Neuropathy Screening Devices Market?Major players include Medtronic, Abbott Laboratories, Natus Medical Incorporated, NeuroMetrix, Boston Scientific Corporation, Hoffmann-La Roche Ltd, Siemens Healthineers, GE Healthcare, and Philips Healthcare, and others.

Need help to buy this report?