South Korea Liquid Dietary Supplements Market Size, Share, By Ingredients (Vitamin, Botanicals, Minerals, Proteins & Amino Acids, Fibers & Specialty Carbohydrates, Omega Fatty Acids, Probiotics, Prebiotics & Postbiotics, Others), By Type (OTC, Prescribed), By Application (Bone & Joint Health, Gastrointestinal Health, Immunity, Cardiac Health, Diabetes, Anti-cancer, Lungs Detox/Cleanse, Skin/ Hair/ Nails, Sexual Health, Brain/Mental Health, Insomnia, Menopause, Anti-aging, Prenatal Health, Others), By End Use (Adults, Geriatric, Children, Infants), and By Distribution Channel (Offline, Online), South Korea Liquid Dietary Supplements Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Liquid Dietary Supplements Market Insights Forecasts to 2035

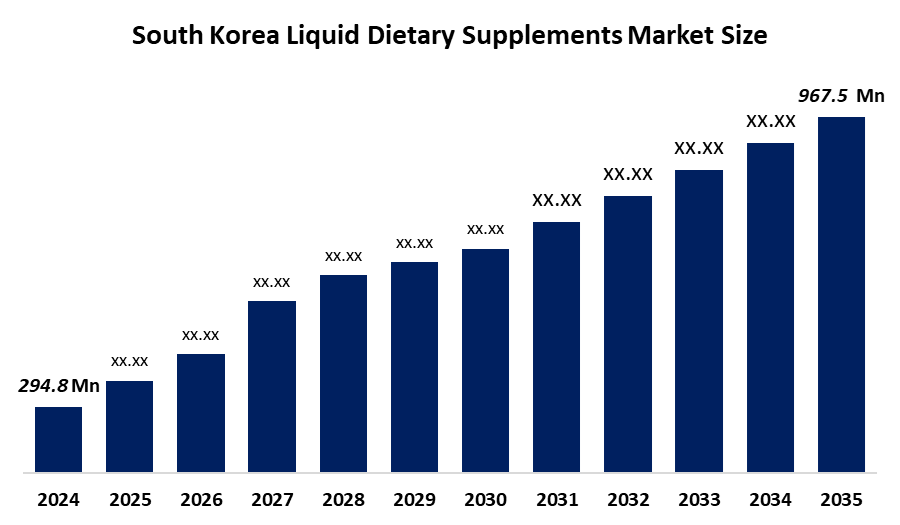

- South Korea Liquid Dietary Supplements Market Size 2024: USD 294.8 Mn

- South Korea Liquid Dietary Supplements Market Size 2035: USD 967.5 Mn

- South Korea Liquid Dietary Supplements Market CAGR 2024: 11.41%

- South Korea Liquid Dietary Supplements Market Segments: Phase Type and Service

Get more details on this report -

The South Korea liquid dietary supplements market comprises liquid forms of vitamins, minerals, botanic compounds, amino acids, and other functional nutrients in the form of shots, syrups, sachets, and bottles to be taken orally. They have different uses like immunity, digestive, energizing, prenatal, and general health benefits. They have the advantage of being taken instantly and being convenient, unlike the traditional capsule or tablet forms of supplements. Imports of functional nutrients in South Korea also fuel the diversification and development of the market for liquid supplements.

There are technological breakthroughs in the area of masking, multi-nutrient formulas, and convenient dosages. The South Korean government provides support with initiatives such as the health functional food act, action against deceptive nutrients, stricter food labelling laws, the pilot plan allowing individual resale of functional foods, and mandatory origin country labelling of supplements for the elderly. The bright outlook includes e-commerce platforms, customized liquid formulas based on regional health requirements, and expanded exports to other regions, which will prepare the market for widespread adoption.

Market Dynamics of the South Korea Liquid Dietary Supplements Market:

The South Korea liquid dietary supplements market is driven by factors such as rising health consciousness, an aging population requiring easy to swallow options, and the K- beauty trend which is linking inner wellness with the outer appearance. Demand for immunity boosters, probiotics, and personalized nutrition coupled with on-the-go liquid formats and well, established e- commerce and influencer marketing go hand, in, hand with adoption. Market growth is further enhanced by the inclusion of vitamins, ginseng, acai, and noni as functional ingredients.

Growth is restrained by the imposition of stringent government regulations such as the health functional foods act, which raise the level of difficulty and cost of approvals. High prices of products, consumers' doubts about exaggerated claims, dissatisfaction with taste and texture, as well as logistics, related problems such as short shelf, life and the need for refrigeration, are some of the factors that prevent the wider adoption and thus also the market growth.

The future is crowded with a plethora of opportunities such as personalized and targeted formulas for sleep, gut health, and beauty, cognitive and stress support liquids, and high, bioavailability formulations such as liposomal vitamin C. Meeting busy lifestyles with single, serve, convenient packaging and the ever, increasing trend of "beauty from within" supplements offer great potential for innovation and expansion of the market.

South Korea Liquid Dietary Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 294.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 11.41% |

| 2035 Value Projection: | USD 967.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application |

| Companies covered:: | Bone & Joint Health, Gastrointestinal Health, Immunity, Cardiac Health, Diabetes, Anti-cancer, Lungs Detox/Cleanse, Skin/ Hair/ Nails, Sexual Health, Brain/Mental Health, Insomnia, Menopause, Anti-aging, Prenatal Health, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The South Korea liquid dietary supplements market share is classified ingredients, type, application, end use, and distribution channel.

By Ingredients:

The South Korea liquid dietary supplements market is divided by ingredients into vitamin, botanicals, minerals, proteins & amino acids, fibers & specialty carbohydrates, omega fatty acids, probiotics, prebiotics & postbiotics, and others. Among these, the probiotics segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Probiotics lead the segment as a result of consumers becoming aware of their gut health, immune system support, and the demand for functional beverages that aid digestion and overall wellness in handy liquid forms.

By Type:

The South Korea liquid dietary supplements market is divided by type into OTC and prescribed. Among these, the OTC segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Over the counter (OTC) liquids lead the way as they provide the daily self, care immunity, energy, and beauty solutions that people need without a doctor's visit in a very simple and convenient manner.

By Application:

The South Korea liquid dietary supplements market is divided by application into bone & joint health, gastrointestinal health, immunity, cardiac health, diabetes, anti-cancer, lungs detox/cleanse, skin/hair/nails, sexual health, brain/mental health, insomnia, menopause, anti-aging, prenatal health, and others. Among these, the immunity segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Liquids with an immunity focus are leading the market as people have become more aware of the need for preventive health after the pandemic. Moreover, they are fast in getting absorbed and adults and elderly populations are preferring the products that support their overall wellness.

By End Use:

The South Korea liquid dietary supplements market is divided by end use into adults, geriatric, children, and infants. Among these, the adults segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Adults have become the main users as they have busy lifestyles, not eating a balanced diet, and also being inclined towards preventive health, thus, the use of liquid supplements for daily nutrition, beauty, and overall wellness in their lives has increased.

By Distribution Channel:

The South Korea liquid dietary supplements market is divided by distribution channel into offline and online. Among these, the online segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The online channels lead the distribution front as they provide convenience, home delivery, e, commerce promotions, influencer marketing, and easier access to personalized, functional liquid supplements for urban consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the South Korea liquid dietary supplements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in South Korea Liquid Dietary Supplements Market:

- Amway International Inc

- Nestlé

- Herbalife.

- Abbott.

- Bayer AG

Recent Developments in South Korea Liquid Dietary Supplements Market:

In July 2025, Convenience store chain CU launched health supplements sales in more than 6000 stores, including 11 new products in partnership with Chong Kun Dang and Dongwha Pharm. The move made functional liquid supplements more accessible to urban consumers, facilitated impulse purchases, and helped spread the use of liquid nutritional products throughout the country at a faster pace.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the South Korea liquid dietary supplements market based on the below-mentioned segments:

South Korea Liquid Dietary Supplements Market, By Ingredients

- Vitamin

- Botanicals

- Minerals

- Proteins & Amino Acids

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Probiotics

- Prebiotics & Postbiotics

- Others

South Korea Liquid Dietary Supplements Market, Type

- OTC

- Prescribed

South Korea Liquid Dietary Supplements Market, Application

- Bone & Joint Health

- Gastrointestinal Health

- Immunity

- Cardiac Health

- Diabetes

- Anti-cancer

- Lungs Detox/Cleanse

- Skin/ Hair/ Nails

- Sexual Health

- Brain/Mental Health

- Insomnia

- Menopause

- Anti-aging

- Prenatal Health

- Others

South Korea Liquid Dietary Supplements Market, End Use

- Adults

- Geriatric

- Children

- Infants

South Korea Liquid Dietary Supplements Market, Distribution Channel

- Offline

- Online

Frequently Asked Questions (FAQ)

-

What is the South Korea liquid dietary supplements market size?South Korea liquid dietary supplements market is expected to grow from USD 294.8 million in 2024 to USD 967.5 million by 2035, growing at a CAGR of 11.41% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the rise in pharmaceutical and biotechnology R&D activities, the increase in the number of chronic and factors such as rising health consciousness, an aging population requiring easy to swallow options, and the K beauty trend which is linking inner wellness with the outer appearance.

-

What factors restrain the South Korea liquid dietary supplements market?: South Korea liquid dietary supplements market is restrained the imposition of stringent government regulations such as the health functional foods act, which raise the level of difficulty and cost of approvals. High prices of products, consumers' doubts about exaggerated claims, dissatisfaction with taste and texture, as well as logistics, related problems such as short shelf, life and the need for refrigeration, are some of the factors that prevent the wider adoption and thus also the market growth.

-

How is the market segmented by application?The market is segmented application into bone & joint health, gastrointestinal health, immunity, cardiac health, diabetes, anti-cancer, lungs detox/cleanse, skin/hair/nails, sexual health, brain/mental health, insomnia, menopause, anti-aging, prenatal health, and others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?