South Korea Dog Food Market Size, Share, and COVID-19 Impact Analysis, By Type (Wet Food, Dry Food, and Snacks/Treats), By Distribution Channel (Supermarkets & Hypermarkets, Speciality Stores, Online, Other Distribution Channels), and South Korea Dog Food Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesSouth Korea Dog Food Market Insights Forecasts to 2035

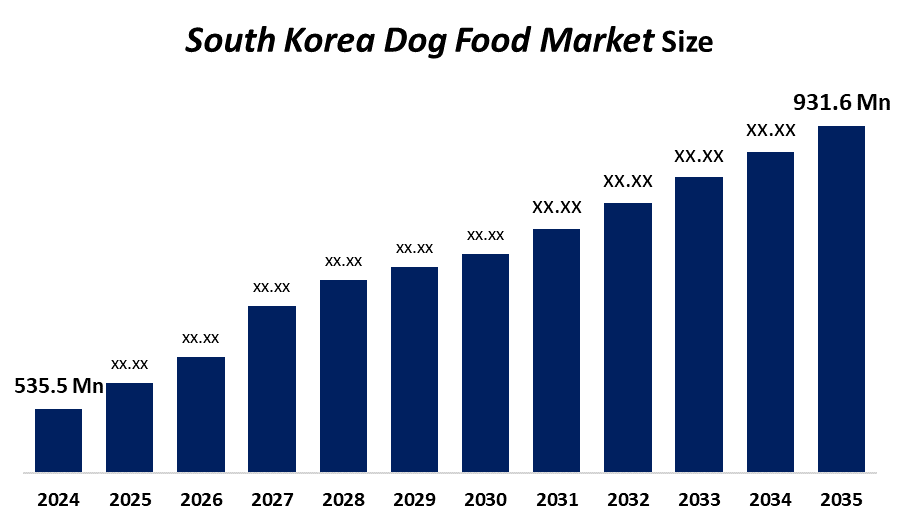

- The South Korea Dog Food Market Size Was Estimated at USD 535.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.16 % from 2025 to 2035

- The South Korea Dog Food Market Size is Expected to Reach USD 931.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea dog food Market Size is anticipated to reach USD 931.6 Million by 2035, growing at a CAGR of 5.16 % from 2025 to 2035. The South Korean dog food market is driven by rising pet ownership, increasing disposable income, humanization of pets, growing demand for premium and organic food, and awareness of pet health and nutrition.

Market Overview

The South Korean Dog Food Market Size focuses on the production, distribution, and sale of food designed for dogs to meet their nutritional needs. Dog food is available in various forms, including dry kibble, wet or tinned food, treats, and customised formulations, depending on age, breed, and health status. In South Korea, increased pet ownership four out of ten people get their dogs from acquaintances reflects socioeconomic shifts such as delayed marriages, low birth rates, and single-person residences. This pet humanization movement increases demand for high-quality, organic, grain-free, and functional dog food that promotes pet nutrition, digestion, joint health, and general well-being. The rising demand for organic, functional, and human-grade dog food presents a prominent opportunity for innovation in premium segments.

Report Coverage

This research report categorizes the market for the south Korea dog food market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the south Korea dog food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the south Korea dog food market.

South Korea Dog Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 535.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.16 % |

| 2035 Value Projection: | USD 931.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | Product Type, Grade, Distribution Channel |

| Companies covered:: | CJ CheilJedang Corporation Nongshim Co., Ltd. (Spoon) Lotte Co., Ltd. Nestle Purina PetCare Company Mars, Incorporated (Royal Canin, Pedigree) Hill’s Pet Nutrition, Inc. Wellpet LLC K9 Natural Ltd. Amano Foods Co., Ltd. and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising number of pet ownership is one of the major contributors to this market. Pet owners are becoming more aware of the health of their pet, which creates the demand for products with functional foods such as digestive health and joint support. The rising demand for organic and grain-free formulations also drives the market growth. The rise in disposable income encourages pet owners to buy high-quality dog food products. Additionally, the expansion and influence of global brands play an important role in market growth.

Restraining Factors

The premium dog food products are expensive, which further limits the adoption among price-sensitive consumers. Additionally, strict government regulations and lengthy product approval hinder market growth.

Market Segmentation

The South Korea dog food market share is classified into type and distribution channel.

- The dry food segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The south Korea dog food market is segmented by type into wet food, dry food, and snacks/treats. Among these, the dry food segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is attributed to its convenience, cost-effectiveness, and ease of storage. Furthermore, high-quality dry goods are developed to give a balanced diet with all of the nutrients, vitamins, and minerals required for a dog's health and well-being.

- The specialty stores segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The south Korea dog food market is segmented by distribution channel into supermarkets & hypermarkets, speciality stores, online, other distribution channels. Among these, the specialty stores segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their wide product selection. Additionally, they give quality assurance and convenience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations or companies involved within the South Korea dog food market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CJ CheilJedang Corporation

- Nongshim Co., Ltd. (Spoon)

- Lotte Co., Ltd.

- Nestle Purina PetCare Company

- Mars, Incorporated (Royal Canin, Pedigree)

- Hill's Pet Nutrition, Inc.

- Wellpet LLC

- K9 Natural Ltd.

- Amano Foods Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the south Korea dog food market based on the below-mentioned segments:

South Korea Dog Food Market, By Type

- Wet Food

- Dry Food

- Snacks or Treats

South Korea Dog Food Market, By Distribution Channels

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Other Distribution Channels

Frequently Asked Questions (FAQ)

-

1)How big is the South Korean dog food market?The South Korean dog food were valued at USD 535.5 million in 2024 and are anticipated to reach USD 931.6 million in 2035

-

2)What is the CAGR of the South Korea dog food market over the forecast period?The South Korea dog food market is projected to expand at a CAGR of 5.16% during the forecast period

-

3)Who are the key players in the South Korea Dog Food Market?Some key players operating South Korea Dog Food Market are CJ CheilJedang Corporation, Nongshim Co., Ltd. (Spoon), Lotte Co., Ltd., Nestle Purina PetCare Company, Mars, Incorporated (Royal Canin, Pedigree), Hill's Pet Nutrition, Inc., Wellpet LLC, K9 Natural Ltd., and Amano Foods Co., Ltd.

-

4)What factors are driving the growth of the South Korea Dog Food Market?The rising number of pet ownership, demand for organic and grain-free formulations, increase in disposable incomes, and influence of global brands are driving growth in South Korea’s skin boosters’ market.

-

5)What are the main challenges restricting wider adoption of the dog food?High costs of premium products, strict government regulations, and lengthy product approval restrict the wider adoption of dog food in the South Korean market

Need help to buy this report?