South Korea Dental Services Organization Market Size, Share, By Service Type (Clinical Services and Non-Clinical Services), By End Use (Dental Surgeons, Endodontists, General Dentists, and Others), and South Korea Dental Services Organization Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareSouth Korea Dental Services Organization Market Insights Forecasts to 2035

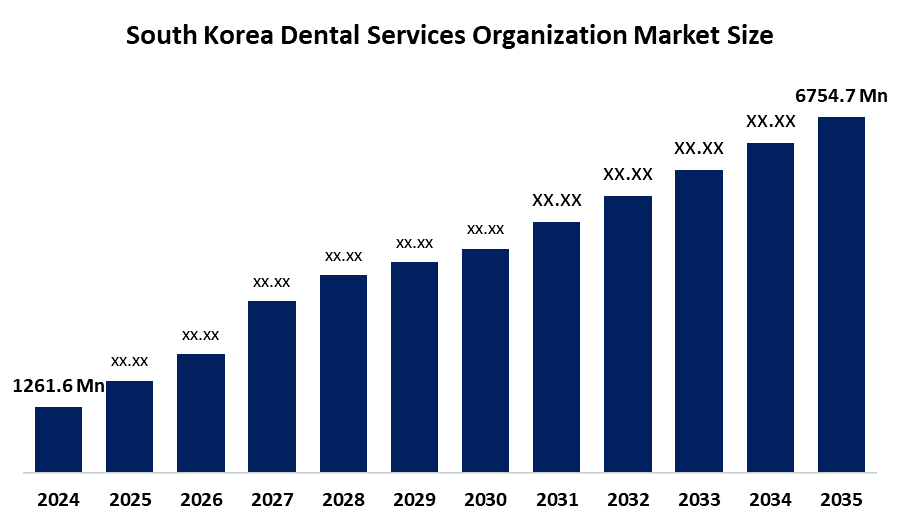

- South Korea Dental Services Organization Market Size 2024: USD 1261.6 Mn

- South Korea Dental Services Organization Market Size 2035: USD 6754.7 Mn

- South Korea Dental Services Organization Market CAGR: 16.48%

- South Korea Dental Services Organization Market Segments: Service Type and End Use

Get more details on this report -

Dental services organization market involves businesses that offer dental practices non-clinical administrative, operational, and management support services. These services, which improve operational efficiency and scalability while allowing dentists to concentrate solely on patient care, usually include billing, staffing, marketing, procurement, IT, and regulatory compliance. The nation's sophisticated healthcare system, high level of oral health awareness, and rising demand for preventive and cosmetic dental procedures are the main factors driving the South Korean Dental Services Organization (DSO) market. Organized dental service networks and multi-clinic dental chains have expanded throughout urban and semi-urban areas due to a rapidly aging population and strong interest in orthodontics, implants, and aesthetic dentistry.

South Korea's universal health insurance program facilitates access to basic dental treatments and preventive care. While guaranteeing quality and uniformity of care, government programs encouraging routine dental examinations, oral health education, and early disease detection indirectly increase demand for organized dental service providers.

With the increased use of digital dentistry technologies, including CAD/CAM systems, 3D imaging, AI-assisted diagnostics, and tele-dentistry platforms, technological developments are essential to market expansion. These developments assist the growth of DSOs in South Korea by enhancing treatment precision, operational effectiveness, and patient satisfaction.

South Korea Dental Services Organization Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1261.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 16.48% |

| 2035 Value Projection: | USD 6754.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 156 |

| Segments covered: | By Service Type,By End Use |

| Companies covered:: | BehnMoe, Seoul National University Dental Hospital, Siamon Technologies, MediTech, Dental Art, Dentium, OralB, MediForte & Hana Dental, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the South Korea Dental Services Organization Market:

The market for dental services organizations (DSOs) in South Korea is fueled by a rapidly aging population that needs continuous dental care, growing demand for cosmetic and restorative dental operations, and growing awareness of oral health. The growing popularity of preventative dentistry and insurance-covered basic treatments, along with the emergence of organized dental chains, all contribute to the market's expansion. Patients are drawn to DSO-based clinics by improvements in efficiency and service quality brought forth by advancements in digital dentistry and standardized clinical procedures.

However, the market is constrained by factors like high upfront costs for cutting-edge dental technologies, stringent healthcare laws, and insurance coverage restrictions for high-end cosmetic procedures. Rapid expansion may also be hampered by patient price sensitivity and competition from independent dental clinics.

The integration of AI-driven diagnostics, tele-dentistry, and digital patient management systems presents substantial prospects despite these obstacles. Strong growth potential for DSOs in South Korea are presented by the rising demand for cosmetic dentistry, dental tourism, and expansion into underserved areas.

Market Segmentation

The South Korea dental services organization market share is classified into service type and end use.

By Service Type:

The South Korea dental services organization market is categorized by service type into clinical services and non-clinical services. Among these, the non-clinical segment held the majority market share in 2024 and is predicted to grow at a remarkable rate during the predicted period. The growing need for both routine and sophisticated dental treatments, such as orthodontics, cosmetic dentistry, restorative operations, and preventative care, is what propels the clinical services segment's domination. The increasing prevalence of dental problems in all age groups, better access to dental care, and increased awareness of oral health all contribute to sector growth.

By End Use:

Based on end use, the South Korea dental services organization market is divided into dental surgeons, endodontists, general dentists, and others. Among these, the general dentists segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. The enormous amount of standard dental procedures, which are primarily performed by general dentists, including exams, fillings, cleanings, and preventative care, is the reason for dominance. Their extensive presence among DSO-affiliated clinics and robust patient intake are anticipated to sustain a notable CAGR over the anticipated time frame.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the South Korea dental services organization market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the South Korea Dental Services Organization Market:

- BehnMoe

- Seoul National University Dental Hospital

- Siamon Technologies

- MediTech

- Dental Art

- Dentium

- OralB

- MediForte & Hana Dental

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korean dental services organization market based on the following segments:

South Korea Dental Services Organization Market, By Service Type

- Clinical Services

- Non-clinical Services

South Korea Dental Services Organization Market, By End Use

- Dental Surgeons

- Endodontists

- General Dentists

- Others

Frequently Asked Questions (FAQ)

-

1. What is the South Korea dental services organization market size and growth forecast?The market was valued at USD 1,261.6 million in 2024 and is projected to reach USD 6,754.7 million by 2035, growing at a CAGR of 16.48% during 2025–2035.

-

2. What is the South Korea dental services organization market size and growth forecast?The market was valued at USD 1,261.6 million in 2024 and is projected to reach USD 6,754.7 million by 2035, growing at a CAGR of 16.48% during 2025–2035.

-

3. Which service segment holds the largest market share of the South Korea dental services organization market?Medical supplies procurement dominated in 2024, as DSOs leverage bulk purchasing and standardized procurement to reduce costs and ensure uniform quality.

-

4. Which end-use segment holds the largest market share of the South Korea dental services organization?The general dentists segment accounted for the largest share in 2024 due to high volumes of routine dental procedures.

Need help to buy this report?