South Korea Colonoscopy Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Colonoscope, Visualization Systems, Other Accessories), By Application (Diagnostic, Therapeutic), and South Korea Colonoscopy Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Colonoscopy Devices Market Insights Forecasts to 2035

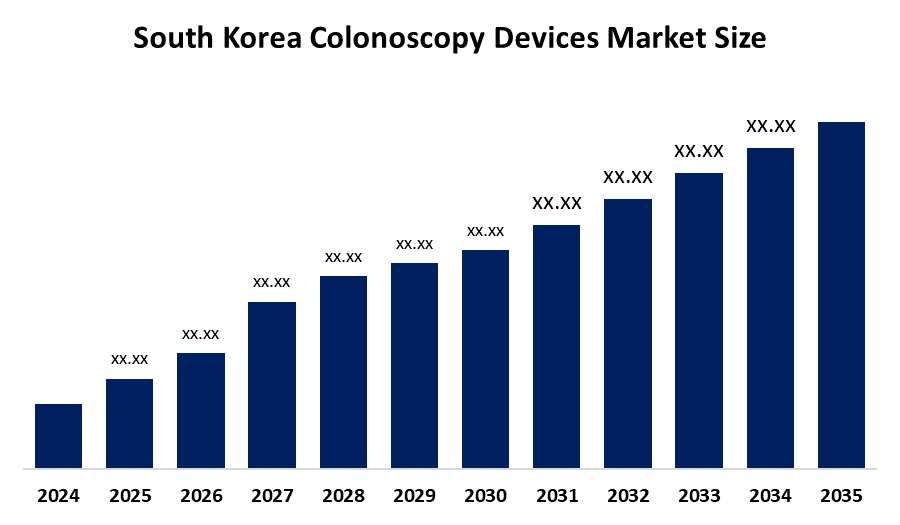

- The South Korea Colonoscopy Devices Market size is Expected to Grow at a CAGR of around 5.4% from 2025 to 2035

- The South Korea Colonoscopy Devices Market size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the South Korea Colonoscopy Devices Market Size is Anticipated to Grow at a CAGR of 5.4% from 2025 to 2035. The market is driven by rising colorectal cancer screening programs, growing prevalence of gastrointestinal disorders, and an ageing population that increases demand for colonoscopy procedures. Also driven by technological advancements such as HD/4K imaging, AI-assisted detection, and adoption of single-use scopes enhancing accuracy, safety, and infection control.

Market Overview

The South Korea colonoscopy devices market is the segment of medical devices that are used for the diagnosis and treatment of colorectal diseases such as colonoscopes, imaging systems, insufflators, and other accessories. The market is currently seeing an uptick in growth in South Korea as the prevalence of colorectal cancer is increasing, which is a major cause of cancer fatalities overall in the country. Increased availability of screening programs by the government and the increased public awareness of the importance of early detection of colorectal cancer are further leading to the overall increased adoption and uptake of colonoscopy procedures. The hospital and specialized endoscopy clinic markets are investing heavily in enhanced technologies and capabilities such as high definition imaging, AI supported and enhanced detection of lesions, and disposable colonoscopes with features focused on accuracy and patient safety. The overall ageing population may be responsible for a higher incidence of gastrointestinal disease thereby increasing the patient pool too. The overlapping factors are all contributing to consistent market growth in enhanced and developed endoscopy facilities.

Report Coverage

This research report categorizes the market for the South Korea colonoscopy devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea colonoscopy devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea colonoscopy devices market.

South Korea Colonoscopy Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.4% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Product Type, By Application. |

| Companies covered:: | Olympus Corporation, Fujifilm Holdings Corporation, Hoya Corporation, Boston Scientific Corporation, Medtronic plc, Stryker Corporation, Smith & Nephew plc and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Market is driven by the rise in colorectal cancer rates and heightened awareness about preventive screenings and early detection. Ongoing innovations in colonoscopy devices in the form of high-definition imaging, AI-supported diagnostic tools, and minimally invasive alternatives are helping providers become more efficient with procedures and providing better outcomes for patients. All these developments further benefit from government advocacy for routine screening, an increased elderly population, and advances in healthcare infrastructure.

Restraining Factors

The South Korea colonoscopy devices market is restrained by high procedural costs, limited reimbursement policies, procedure invasiveness, and unnecessary discomfort to patients. The current market trend whereby there is not enough trained endoscopists and regulatory delays also contribute to slow adoption.

Market Segmentation

The South Korea colonoscopy devices market share is classified into product type and application.

- The colonoscope segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea colonoscopy devices market is segmented by product type into colonoscope, visualization systems, and other accessories. Among these, the colonoscope segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its common utilization in diagnostic and therapeutic applications. The visualization systems and accessories are gaining momentum with advancements in imaging and minimally invasive procedures.

- The diagnostic segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea colonoscopy devices market is segmented by application into diagnostic and therapeutic. Among these, the diagnostic segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to increasing prevalence of colorectal cancer and pathological screening programs. There has also been a slow but steady increase in therapeutic applications using both polyp removal and resection, with advancements in technology, increased awareness, and uptake in hospitals and clinics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea colonoscopy devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Olympus Corporation

- Fujifilm Holdings Corporation

- Hoya Corporation

- Boston Scientific Corporation

- Medtronic plc

- Stryker Corporation

- Smith & Nephew plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea colonoscopy devices market based on the below-mentioned segments:

South Korea Colonoscopy Devices Market, By Product Type

- Colonoscope

- Visualization Systems

- Other Accessories

South Korea Colonoscopy Devices Market, By Application

- Diagnostic

- Therapeutic

Frequently Asked Questions (FAQ)

-

1. What is the projected growth rate of the South Korea Colonoscopy Devices Market?The market is expected to grow at a CAGR of 5.4% during the forecast period 2025–2035.

-

2. What are the main factors driving the market growth?The market is driven by rising colorectal cancer screening programs, growing prevalence of gastrointestinal disorders, an ageing population, and technological advancements such as HD/4K imaging, AI-assisted detection, and single-use scopes.

-

3. What are the key restraints faced by this market?Restraints include high procedural costs, limited reimbursement policies, invasiveness of procedures, patient discomfort, shortage of trained endoscopists, and regulatory delays.

-

4. Which product type holds the largest market share?The colonoscope segment held the largest share in 2024 and is expected to grow significantly due to its widespread use in both diagnostic and therapeutic procedures.

-

5. Which application segment dominates the market?The diagnostic segment dominated the market in 2024 and is projected to continue leading, driven by increasing prevalence of colorectal cancer and government-backed screening programs.

-

6. Who are the major players in the South Korea Colonoscopy Devices Market?Key companies include Olympus Corporation, Fujifilm Holdings Corporation, Hoya Corporation, Boston Scientific Corporation, Medtronic plc, Stryker Corporation, and Smith & Nephew plc., and Others.

Need help to buy this report?