South Korea Anti-Obesity Prescription Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Type (Appetite Suppressants, Lipase Inhibitors, Serotonin-Norepinephrine Reuptake Inhibitors, and Others), By Application (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others), and South Korea Anti-Obesity Prescription Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSouth Korea Anti-Obesity Prescription Drugs Market Insights Forecasts to 2035

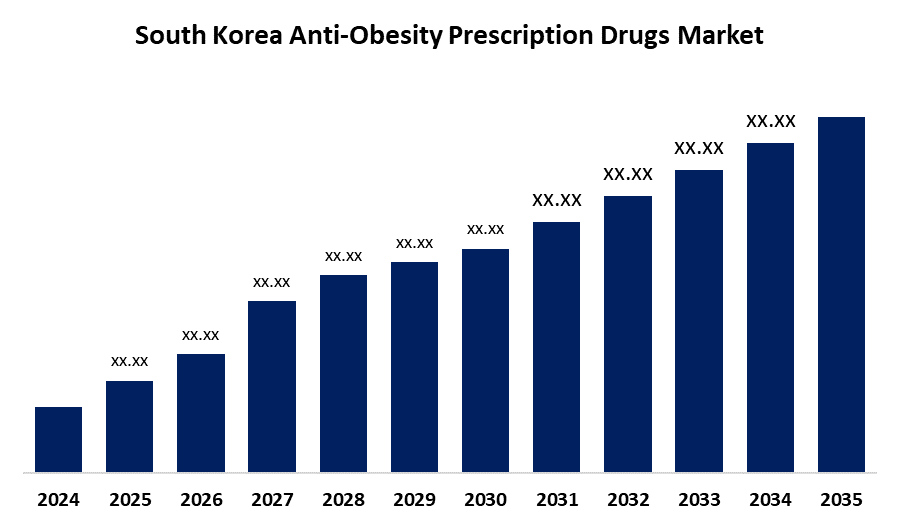

- The Market Size is Expected to Grow at a CAGR of around 18.5% from 2025 to 2035

- The South Korea Anti-Obesity Prescription Drugs Market Size Is Expected To Hold A Significant Share By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South Korea Anti-Obesity Prescription Drugs Market Size is anticipated to grow at a CAGR of 18.5% from 2025 to 2035. The market is growing awareness of obesity as a chronic illness, rising obesity rates and the health risks they pose, and government programs promoting public health.

Market Overview

Anti-obesity prescription includes the prescribed pharmacotherapy to support weight management by reducing appetite, changing fat absorption by reducing appetite in the drugs market, which is used with diet and lifestyle modifications. In South Korea, demand is reduced by increasing priority of overweight/obesity, urban sedentary lifestyle, and medically supervised weight-loss programs. Hospitals and special clinics initiate and monitor, while retail and online pharmacies expand access and adherence through a refill feature. Awareness campaign, guidelines-based care, and digital equipment are improving patient engagement and perseverance. Physician comfort with combination therapy and stepwise treatment algorithms, as well as growing indications (such as cardiometabolic risk reduction messaging), further support market growth.

Report Coverage

This research report categorizes the market for the South Korea anti-obesity prescription drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea anti-obesity prescription drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea anti-obesity prescription drugs market.

South Korea Anti-Obesity Prescription Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 18.5% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Drug Type, By Application |

| Companies covered:: | AstraZeneca plc, Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, Sanofi S.A., GlaxoSmithKline plc, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The main causes are increased physician use of pharmacotherapy in structured care pathways, rising rates of obesity and metabolic comorbidities, and easier access through retail and internet pharmacies. Further speeding up adoption are digital adherence tools and patients' increasing preference for medically supervised options.

Restraining Factors

Wider adoption is restricted by cost and reimbursement limitations, safety/tolerability monitoring, and the stigma associated with pharmacologic weight loss. Results are also tempered by lifestyle dependency and variable long-term adherence.

Market Segmentation

The South Korea Anti-Obesity Prescription Drugs Market share is classified by drug type and application.

- The appetite suppressants segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea anti-obesity prescription drugs market is segmented by drug type into appetite suppressants, lipase inhibitors, serotonin-norepinephrine reuptake inhibitors, and others. Among these, the appetite suppressants segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion can be attributed to their ability to lower caloric intake and hunger. These medications work by changing the chemistry of the brain to reduce appetite, which helps people lose weight. The primary factor driving the demand for appetite suppressants is their rapid weight loss results, which makes them a popular option for both patients and healthcare professionals.

- The hospital pharmacies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South Korea anti-obesity prescription drugs market is segmented by application into hospital pharmacies, retail pharmacies, online pharmacies, and others. Among these, the Hospital pharmacies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The main location where prescription drugs are distributed after consultations and treatment plans are created by medical specialists. Hospital pharmacies are a preferred option for patients looking for anti-obesity medications because of their reputation for reliability and assurance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea anti-obesity prescription drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AstraZeneca plc

- Pfizer Inc.

- Merck & Co., Inc.

- Johnson & Johnson

- Sanofi S.A.

- GlaxoSmithKline plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Korea anti-obesity prescription drugs market based on the below-mentioned segments:

South Korea Anti-Obesity Prescription Drugs Market, By Drug Type

- Appetite Suppressants

- Lipase Inhibitors

- Serotonin-Norepinephrine Reuptake Inhibitors

- Others

South Korea Anti-Obesity Prescription Drugs Market, By Application

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Frequently Asked Questions (FAQ)

-

What is the forecasted CAGR of the South Korea anti-obesity prescription drugs market from 2024 to 2035?The market is expected to grow at a CAGR of around 18.5% during the period 2024–2035.

-

Can you provide company profiles for the South Korea anti-obesity prescription drugs market?Yes. For example, AstraZeneca plc, Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, Sanofi S.A., and GlaxoSmithKline plc.

-

What are the main drivers of growth in the South Korea anti-obesity prescription drugs market?Rising obesity prevalence linked to sedentary lifestyles, greater physician acceptance of pharmacotherapy in structured weight-management programs, and growing access through retail and online pharmacies are key drivers. Increasing patient awareness, digital health integration, and expanding treatment guidelines also support market growth.

-

What challenges are limiting the adoption of anti-obesity prescription drugs in market?High treatment costs, reimbursement restrictions, safety and tolerability concerns, and social stigma around long-term drug use limit wider adoption. Variable patient adherence and reliance on lifestyle modification further restrain sustained uptake.

-

Which segment dominated the market?The appetite suppressants segment dominated the market

Need help to buy this report?