South America Sulphuric Acid Market Size, Share, and COVID-19 Impact Analysis, By Product Form (Anhydrous Ammonia, Aqueous Ammonia, Ammonium Compounds), By Application (Fertilizer Manufacturing, Chemical Intermediates, Refrigeration and Cold Chain Systems, Energy and Fuel Applications, and Others), By End User (Agriculture, Chemical & Petrochemical, Food & Beverage, Mining & Metallurgy, Energy & Utilities and Others), and South America Sulphuric Acid Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsSouth America Sulphuric Acid Market Size Insights Forecasts to 2035

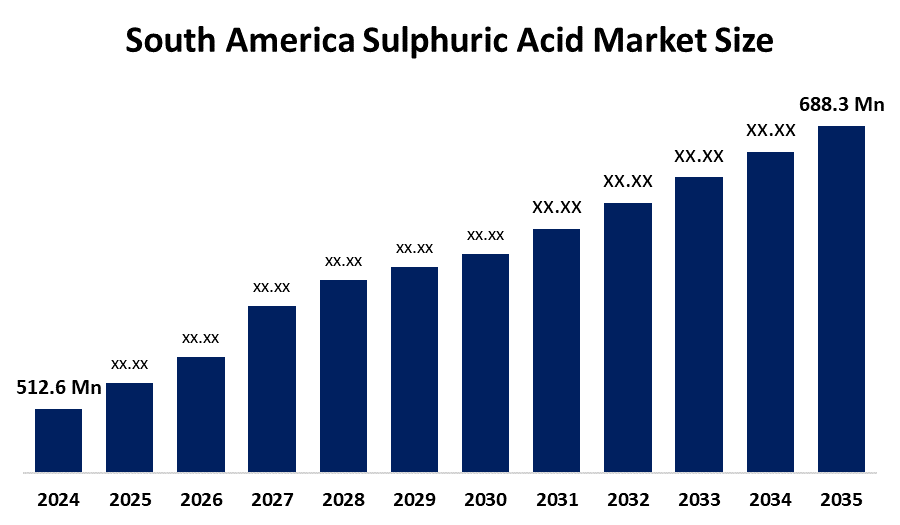

- The South America Sulphuric Acid Market Size Was Estimated at USD 512.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 2.72% from 2025 to 2035

- The South America Sulphuric Acid Market Size is Expected to Reach USD 688.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South America Sulphuric Acid Market Size Is Anticipated To Reach USD 688.3 Million By 2035, Growing At A CAGR Of 2.72% From 2025 To 2035. The market is driven by the rising demand for nitrogen-based fertilizers across agriculture. Increasing industrial uses such as chemical intermediates, refrigeration and cold-chain infrastructure are boosting ammonia consumption.

Market Overview

Fertilizer production uses ammonia as a vital ingredient, which manufacturers create through the Haber-Bosch process that converts nitrogen and hydrogen into ammonia. Ammonia essential chemical compound, exists for multiple applications which extend beyond its use in fertilizer production. The refrigeration and air-conditioning industry uses ammonia as its primary refrigerant due to its high efficiency in maintaining food safety through preservation and food processing operations. The textile industry uses ammonia for two main purposes, which include tanning processes and dyeing operations that produce colored fabrics and synthetic materials. Its versatile nature extends to cleaning products, where it is used in detergent formulations.

Copenhagen Infrastructure Partners (CIP) started construction of its large facility project through Helax in January 2025. The facility will produce 900000 tons of renewable ammonia each year starting in 2028 by using 3.7 GW of solar and wind energy.

Green ammonia is anticipated to make up over 40% of total green ammonia production. The green ammonia market produced revenue of approximately 16.8 million U.S. dollars in 2021 and was projected to attain approximately 4.8 billion dollars by 2030. Ammonia transport and storage, export infrastructure development will support the international trade of fuel and energy-grade ammonia. Industrial users in sectors such as steel manufacturing, shipping, power generation and chemicals production will use ammonia as both feedstock and energy carrier.

The federal government of Brazil, in partnership with private companies, has made efforts to attract international investments and partnerships that will strengthen the domestic ammonia supply chain. Brazil ranks as the leading country in the ammonia market because its agricultural industry operates at high efficiency with extensive farmland resources.

Report Coverage

This research report categorizes the market for the South America sulphuric acid market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South America sulphuric acid market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South America sulphuric acid market.

South America Sulphuric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 512.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.72% |

| 2035 Value Projection: | USD 688.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Form, By Application, By End User |

| Companies covered:: | Yara International, Nutrien Ltd, Proman, Pt Lisas Nitrogen, Koch Industries, Inc., CF Industries Holdings Inc., Enaex Energy, Quimica Industrial, Amino Quimica, Natrio, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sulphuric acid market in South America is driven by increasing demand for nitrogen fertilisers and thus ammonia. Ammonia-based fertilisers enable governments to achieve their food supply self-sufficiency targets while using the fertilisers to enhance crop production. The chemical and petrochemical, mining and manufacturing sectors in South America experience industrial growth which creates increased demand for ammonia feedstock. Ammonia serves as a crucial component for producing urea, nitric acid, plastics, synthetic fibres, explosives and mining chemicals. The combination of investment incentives, regulatory frameworks and infrastructure development for low-carbon ammonia creates stronger market demand.

Restraining Factors

The sulphuric acid market in South America is hindered by risks from supply disruptions and geopolitical tensions, gas price spikes and energy market volatility. The combination of environmental regulations, carbon pricing, emissions limits and public pressure demands businesses to adopt cleaner production methods. The implementation of stricter standards requires financial resources to support CCUS and renewable hydrogen and green ammonia initiatives.

Market Segmentation

The South America sulphuric acid market share is categorised into product form, application, and end user.

- The anhydrous ammonia segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South America sulphuric acid market is segmented by product form into anhydrous ammonia, aqueous ammonia, ammonium compounds. Among these, the anhydrous ammonia segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by NH3-based nitrogenous fertilizers deliver yield improvements through their ability to safeguard crops and extend production periods. The agricultural industry implements anhydrous fertilizer due to it contains 82% nitrogen as its main component. The product demonstrates better performance in warm climates compared to its effectiveness in cold weather conditions. Anhydrous ammonia serves as a refrigerant and solvent because of its powerful smell and high energy requirement for vaporization.

- The fertilizer manufacturing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the South America sulphuric acid market is segmented into fertilizer manufacturing, chemical intermediates, refrigeration and cold chain systems, energy and fuel applications, and others. Among these, the fertilizer manufacturing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the production of several liquid fertilizer mixtures that include urea, aqueous ammonia, and ammonium salts. Ammonia serves as an agricultural tool because it reacts rapidly with soil moisture, free hydrogen ions, organic matter, and silty clay materials. The agricultural sector benefits from ammonium through its enhanced operational properties, which include infiltration rate, land quality, architectural design and specific procedures.

- The agriculture segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South America sulphuric acid market is segmented by end user into agriculture, chemical & petrochemical, food & beverage, mining & metallurgy, energy & utilities and others. Among these, the agriculture segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the agricultural industry, which depends on nitrogen-based fertilizers to achieve better crop production results. Brazil and Argentina are powerhouses in agricultural exports. Ammonia functions as a crucial component because it enables manufacturers to achieve their requirements for continuous, effective, and extensive production processes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South America sulphuric acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yara International

- Nutrien Ltd

- Proman

- Pt Lisas Nitrogen

- Koch Industries, Inc.

- CF Industries Holdings Inc.

- Enaex Energy

- Quimica Industrial

- Amino Quimica

- Natrio

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In June 2025, GE Vernova and IHI launched a test hub to enable 100% Ammonia combustion in F-class gas turbines by 2030. The facility will accelerate full-scale prototype testing starting in summer 2025,

Market Segment

This study forecasts revenue at the South America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South America Sulphuric Acid Market based on the below-mentioned segments:

South America Sulphuric Acid Market, By Product Form

- Anhydrous Ammonia

- Aqueous Ammonia

- Ammonium Compounds

South America Sulphuric Acid Market, By Application

- Fertilizer Manufacturing

- Chemical Intermediates

- Refrigeration and Cold Chain Systems

- Energy and Fuel Applications

- Others

South America Sulphuric Acid Market, By End User

- Agriculture

- Chemical & Petrochemical

- Food & Beverage

- Mining & Metallurgy

- Energy & Utilities

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the South America sulphuric acid market size?A: The South America Sulphuric Acid Market size is expected to grow from USD 1.38 billion in 2024 to USD 1.95 billion by 2035, growing at a CAGR of 3.19% during the forecast period 2025-2035.

-

Q: What is sulphuric acid, and its primary use?A: Sulfuric acid, also referred to as oil of vitriol, functions as a highly corrosive acid that exists in a colorless and odorless form with viscous properties. The contact process, which requires sulfide oxidation to produce sulfuric acid, functions as the main method for manufacturing sulfuric acid because it combines sulfur dioxide with sulfur and air.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the strong corrosive properties of sulfuric acid, which lead to severe health and environmental dangers because it creates acid rain and contaminates groundwater.

-

Q: What factors restrain the South America sulphuric acid market?A: The market is restrained by the production of copper in Chile and Peru, which depends on sulfuric acid because it is essential to heap leaching and ore processing. Mining operations need more capacity, so they continue to invest in their existing operations.

-

Q: How is the market segmented by raw material type?A: The market is segmented into elemental sulfur, pyrite ore, and others.

-

Q: Who are the key players in the South America sulphuric acid market?A: Key companies include The Mosaic Company, Vale Fertilizantes S.A., BASF SE, Nutrien Ltd, Aurubis AG, Chemtrade Logistics Inc., Carbonor S.A., Usiquimica do Brasil, SulGesso Agro, and Macler.

Need help to buy this report?