South America Pulp and Paper Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Type (Binders, Bleaching Agents, Fillers, Pulping Chemicals, Sizing Agents, and Others), By Application (Newsprint, Packaging and Industrial Papers, Printing and Writing Papers, Pulp Mills and Water Treatment, and Others), and South America Pulp and Paper Chemicals Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsSouth America Pulp and Paper Chemicals Market Insights Forecasts to 2035

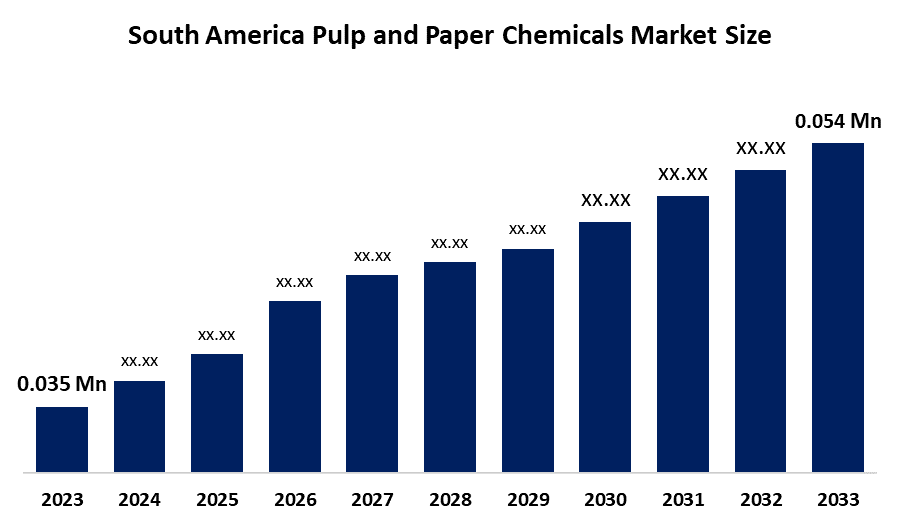

- The South America Pulp and Paper Chemicals Market Size Was Estimated at 0.035 Million Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.02% from 2025 to 2035

- The South America Pulp and Paper Chemicals Market Size is Expected to Reach 0.054 Million Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South America Pulp And Paper Chemicals Market Size Is Anticipated To Reach 0.054 Million Tonnes By 2035, Growing At A CAGR Of 4.02% From 2025 To 2035. The market is driven by the increasing demand for specialty papers, particularly in sectors such as packaging, printing, and writing. This trend is fuelled by advancements in technology that enable the production of high-performance and sustainable speciality papers.

Market Overview

The South America pulp and paper chemicals market is referred to as a specialized market that delivers chemical reagents needed to extract cellulose fibres from wood and to change paper properties. The market consists of chemical substances used at various stages of paper production, from initial pulping to final coating, to enhance performance, appearance, and durability. The ultimate paper product brightness and purity receive enhancement through the application of bleaching chemicals.

Susanoo Ventures provides Biform Technologies with up to US 5 million in funding which will support the development of their bio-based plastic alternatives. The investment provides up to US 5 million towards the company’s seed round which will enable it to accelerate the development of its novel bio-based plastic alternatives.

US President Donald Trump declared in July 2025 that he would establish a 50% import tariff from Brazil, with the new policy set to begin operations in August 2025. The export restrictions from South America, which mainly affect Brazilian paper and chemical industries, are causing exporters to search for new markets, resulting in intensified price competition between Argentina and Peru.

Report Coverage

This research report categorises the South America pulp and paper chemicals market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South America pulp and paper chemicals market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South America pulp and paper chemicals market.

South America Pulp and Paper Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 0.035 Million Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.02% |

| 2035 Value Projection: | 0.054 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Type, By Application |

| Companies covered:: | BASF SE Ashland Kemora Evenki Industries AG Beckman Laboratories International, Inc. MWV Riesa CMPC MASISA Kalvin Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The pulp and paper chemicals market in South America is driven by the increasing environmental awareness, with the enforceable plastic regulations forcing companies to switch their packaging materials from plastic to recyclable paper products. The paper industry requires specialty chemicals for its applications because paper needs to be treated with barrier coatings, which provide water and grease protection. The agricultural programs of Brazil and the clean production programs of Chile provide financial support to businesses that implement environmentally friendly methods and sustainable production technologies. The Brazilian climate which supports rapid eucalyptus growth, creates a cost benefit for the region that establishes it as a leading global eucalyptus exporter while attracting substantial foreign investment.

Restraining Factors

The pulp and paper chemicals market in South America is restrained by the supply chain operation, which faces interruptions from three main factors, including geopolitical issues, currency fluctuations and port disruptions. The chemical industry fails to adopt new technologies because there is insufficient workforce training for process engineering and digital transformation.

Market Segmentation

The South America pulp and paper chemicals market share is categorised into type and application.

- The bleaching agents segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South America pulp and paper chemicals market is segmented by type into binders, bleaching agents, fillers, pulping chemicals, sizing agents, and others. Among these, the bleaching agents segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by research showing that brightness targets require permanent solutions. Currently, they use chlorine dioxide, hydrogen peroxide and oxygen-based methods. The shift has gained strength because regulations limit AOX, and consumers examine products for chlorinated content. Suppliers develop stabilized peroxide products together with high-performance activators and chemical dispersants, which decrease overall chemical oxygen demand.

- The packaging and industrial papers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the South America pulp and paper chemicals market is segmented into newsprint, packaging and industrial papers, printing and writing papers, pulp mills and water treatment, and others. Among these, the packaging and industrial papers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the corrugated and containerboard mills, which consume high amounts of starch adhesives, retention polymers and barrier coatings, enabling them to produce lighter board grades that maintain their compressive strength.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South America pulp and paper chemicals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Ashland

- Kemora

- Evenki Industries AG

- Beckman Laboratories International, Inc.

- MWV Riesa

- CMPC

- MASISA

- Kalvin

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In August 2025, Nouryon expanded its South America industry-leading sodium chlorate capacity by 20% in support of the new Arauco pulp mill and the growing Brazilian pulp industry

In February 2024, Kemira accelerates the switch to renewable solutions by launching biomass-balanced wet strength resins for the paper industry. These paper surface treatment chemicals enhance durability and recyclability in packaging and tissue paper applications.

Market Segment

This study forecasts revenue at the South America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South America Pulp and Paper Chemicals Market based on the below-mentioned segments:

South America Pulp and Paper Chemicals Market, By Type

- Binders

- Bleaching Agents

- Fillers

- Pulping Chemicals

- Sizing Agents

- Others

South America Pulp and Paper Chemicals Market, By Application

- Newsprint

- Packaging and Industrial Papers

- Printing and Writing Papers

- Pulp Mills and Water Treatment

- Others

Frequently Asked Questions (FAQ)

-

What is the South America pulp and paper chemicals market size?The South America pulp and paper chemicals market size is expected to grow from 0.035 million tonnes in 2024 to 0.054 million tonnes by 2035, growing at a CAGR of 4.02% during the forecast period 2025-2035

-

What are pulp and paper chemicals, and their primary use?The South American pulp and paper chemicals market functions as a specialized market that delivers chemical reagents needed to extract cellulose fibers from wood and to change paper properties. The market consists of chemical substances used at various stages of paper production, from initial pulping to final coating, to enhance performance, appearance, and durability

-

What are the key growth drivers of the market?Market growth is driven by the increasing environmental awareness, with the enforceable plastic regulations forcing companies to switch their packaging materials from plastic to recyclable paper products

-

What factors restrain the South America pulp and paper chemicals market?The market is restrained by the supply chain operation, which faces interruptions from three main factors, including geopolitical issues, currency fluctuations and port disruptions.

-

How is the market segmented by type?The market is segmented into binders, bleaching agents, fillers, pulping chemicals, sizing agents, and others

-

Who are the key players in the South America pulp and paper chemicals market?Key companies include BASF SE, Ashland, Kemira, Evonik Industries AG, Buckman Laboratories International, Inc., MWV Rigesa, CMPC, MASISA, and Klabin.

Need help to buy this report?