South America Polyvinyl Chloride Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Rigid PVC, Flexible PVC, Low-Smoke PVC, and Chlorinated PVC), By Application (Pipes and Fittings, Films and Sheets, Wires and Cables, and More), and South America Polyvinyl Chloride Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsSouth America Polyvinyl Chloride Market Insights Forecasts to 2035

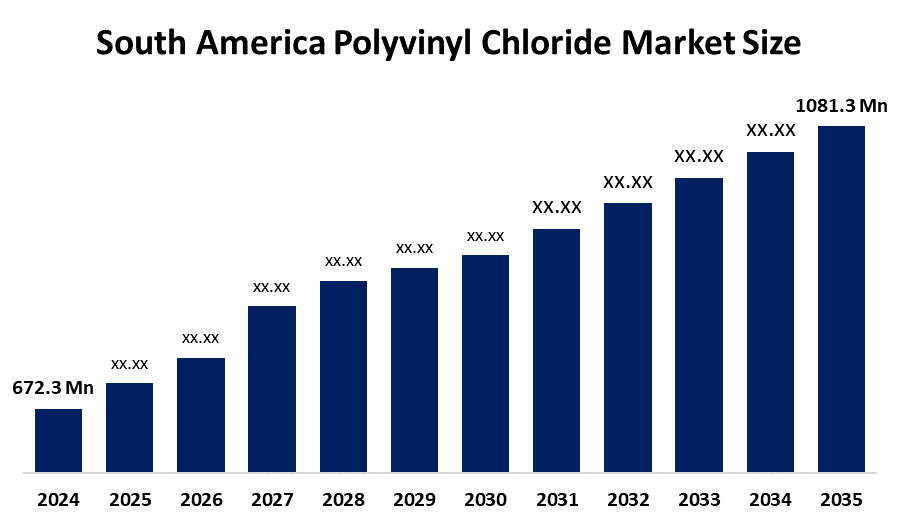

- The South America Polyvinyl Chloride Market Size Was Estimated at USD 672.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.41% from 2025 to 2035

- The South America Polyvinyl Chloride Market Size is Expected to Reach USD 1081.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South America Polyvinyl Chloride Market size is anticipated to reach USD 1081.3 Million by 2035, growing at a CAGR of 4.41% from 2025 to 2035. The market is driven by the increasing need for materials that offer both durability and flexibility to produce consumer products, with the growing trend of people buying personal vehicles.

Market Overview

Polyvinyl chloride (PVC) is a synthetic plastic polymer that contains 57% salt and 43% oil or gas as its main components. The material polyvinyl chloride (PVC) functions as a common plastic that exists in both its rigid and flexible resin forms. Rigid PVC serves as a material for pipes and accessories that people use in construction and agriculture for window and door profiles, conduits and automotive parts. PVC pipes have been used in building and construction for over 60 years because they provide energy-efficient production, affordable distribution and permanent maintenance-free operation.

The government of Brazil launched the Infrastructure Concessions Program to invest in infrastructure for roads, airports, ports, and energy in the country. In this program, the government announced an investment of USD 14.4 billion in transport, energy, and sanitation projects. Brazil's construction sector business confidence indicator (ICEI) showed an improvement during the first five months of 2022, when it reached 56.2 in May 2022 after starting at 55.5 in April and 55.3 in March 2022.

Brazilian petrochemical firm Braskem will invest R614mn ($100mn) to expand its current domestic production capacity in PE and PVC. Brazil and Argentina are working to improve their local manufacturing capabilities for ethylene dichloride (EDC), which will help them establish steady supplies and boost their market competitiveness.

Report Coverage

This research report categorizes the market for the South America polyvinyl chloride market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South America polyvinyl chloride market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South America polyvinyl chloride market.

South America Polyvinyl Chloride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.41% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Braskem S.A., Unipar Carbocloro, Orbia, PVC Evolution SRL, Corr Plastik, Perin Plasticos, Plastiferro Tubos SA, Novoplast, Koplast Industrial, VICK Solucoes, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The polyvinyl chloride market in South America is driven by the demand for PVC pipes and fittings reaches high levels because governments in Brazil and Peru have made substantial financial commitments to their infrastructure and water supply, sewage and irrigation systems. The automotive industry reduces vehicle weight to improve fuel efficiency, which leads to increased usage of lightweight PVC components. A major emerging trend is the shift towards sustainable practices, including the use of calcium-zinc stabilizers instead of lead-based ones and the adoption of PVC recycling technologies.

Restraining Factors

The polyvinyl chloride market in South America is hindered by the hazardous impacts on humans and the environment from PVC production and disposal remain a significant challenge leading to both increased regulatory measures and public monitoring of the industry. The production costs and manufacturer profits experience fluctuations because raw material prices for ethylene and chlorine undergo changes.

Market Segmentation

The South America polyvinyl chloride market share is categorised into product type and application.

- The rigid PVC segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South America polyvinyl chloride market is segmented by product type form into rigid PVC, flexible PVC, low-smoke PVC, and chlorinated PVC. Among these, the rigid PVC segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The market for the region experienced its largest share through rigid PVC, which reached 56.75% of total volume, due to building projects and our drinking water systems needed materials that could withstand extreme pressure. The material serves as an excellent electrical insulator, which makes it suitable for use in electrical systems and cable insulation work. The construction industry uses this material for various purposes, including pipes and fittings, window frames, siding, roofing membranes and cable insulation.

- The pipes and fittings segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the South America polyvinyl chloride market is segmented into pipes and fittings, films and sheets, wires and cables, and others. Among these, the pipes and fittings segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Pipes and Fittings captured 45.89% of South America polyvinyl chloride market share in 2025, and their absolute volume growth will remain highest until 2031 because Brazil, Colombia and Peru will develop their utility-scale water systems. The handling and transportation of PVC pipes becomes easier because their design facilitates installation, which results in decreased labor and transportation expenses. The smooth internal surface of PVC pipes decreases friction, which enables fluids to flow through the pipes with maximum efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South America polyvinyl chloride market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Braskem S.A.

- Unipar Carbocloro

- Orbia

- PVC Evolution SRL

- Corr Plastik

- Perin Plasticos

- Plastiferro Tubos SA

- Novoplast

- Koplast Industrial

- VICK Solucoes

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In November 2025, Olin Corporation announced a strategic partnership with Braskem, one of the largest petrochemical companies in the Americas and the leading producer of polyvinyl chloride (PVC) in South America.

Market Segment

This study forecasts revenue at the South America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South America Polyvinyl Chloride Market based on the below-mentioned segments:

South America Polyvinyl Chloride Market, By Product Type

- Rigid PVC

- Flexible PVC

- Low-Smoke PVC

- Chlorinated PVC

South America Polyvinyl Chloride Market, By Application

- Pipes and Fittings

- Films and Sheets

- Wires and Cables

- More

Frequently Asked Questions (FAQ)

-

Q: What is the South America polyvinyl chloride market size?A: The South America Polyvinyl Chloride Market size is expected to grow from USD 672.3 million in 2024 to USD 1081.3 million by 2035, growing at a CAGR of 4.41% during the forecast period 2025-2035.

-

Q: What is polyvinyl chloride, and its primary use?A: Polyvinyl chloride (PVC) is a synthetic plastic polymer that contains 57% salt and 43% oil or gas as its main components. The material polyvinyl chloride (PVC) functions as a common plastic that exists in both its rigid and flexible resin forms.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the demand for PVC pipes and fittings, which reaches high levels because governments in Brazil and Peru have made substantial financial commitments to their infrastructure and water supply, sewage and irrigation systems.

-

Q: What factors restrain the South America polyvinyl chloride market?A: The market is restrained by the hazardous impacts on humans and the environment from PVC production and disposal, which remain a significant challenge, leading to both increased regulatory measures and public monitoring of the industry.

-

Q: How is the market segmented by application?A: The market is segmented into pipes and fittings, films and sheets, wires and cables, and others.

-

Q: Who are the key players in the South America polyvinyl chloride market?A: Key companies include Braskem S.A., Unipar Carbocloro, Orbia, PVC Evolution SRL, Corr Plastik, Perin Plasticos, Plastiferro Tubos SA, Novoplast, Koplast Industrial, and VICK Solucoes.

Need help to buy this report?