South America Plastic Recycling Market Size, Share, and COVID-19 Impact Analysis, By Material (PET, PP, HDPE, LDPE, PS, PVC and Others), By Application (Packaging, Automotive, Construction, Textiles, and Others), and South America Plastic Recycling Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsSouth America Plastic Recycling Market Insights Forecasts to 2035

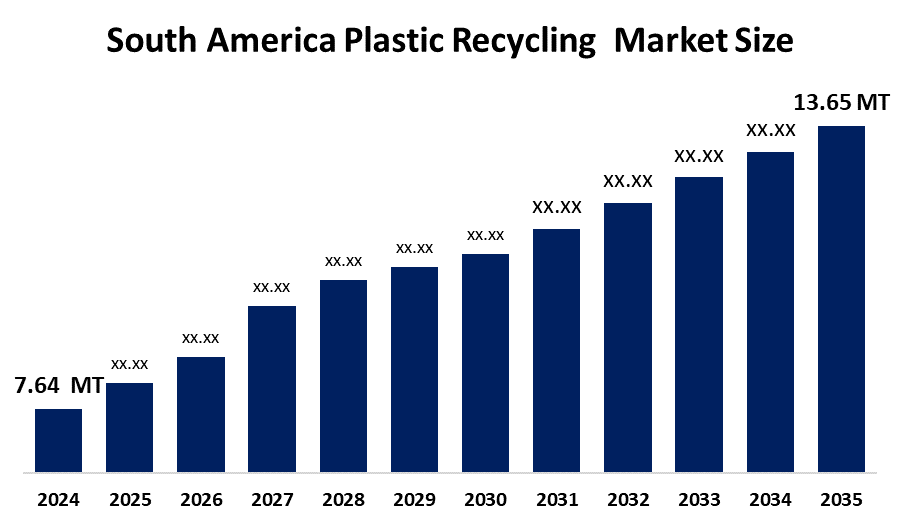

- The South America Plastic Recycling Market Size Was Estimated at 7.64 Million Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.42% from 2025 to 2035

- The South America Plastic Recycling Market Size is Expected to Reach 13.65 Million Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South America Plastic Recycling Market size is anticipated to reach 13.65 million tonnes by 2035, growing at a CAGR of 5.42% from 2025 to 2035. The market is driven by the growing environmental awareness among customers and organizations, rigid regulations encouraging recycling, rising demand for sustainable packaging, and a switch towards circular economy practices.

Market Overview

The South American plastic recycling market describes an industrial process that transforms waste plastic into reusable products and raw materials that replace the need for new resources. The process of creating lower grade products from post-consumer waste starts with physical waste treatment of used bottles, which involves shredding, washing, and pelletizing to produce garbage bags and construction materials. The two main segments of the market are polyethene PE and polyethene terephthalate PET, but PET shows the most rapid expansion in its use for food-grade products.

ALPLA establishes sustainable plastic packaging production resources in January 2025 to meet South American market demands. ALPLArecycling acquires a controlling interest in its joint venture with Brazilian HDPE recycling company Clean Bottle.

Delterra, which operates from Washington, has established a strategic partnership with three major consumer packaged goods companies to combat plastic waste in developing countries, starting their efforts in Argentina, Brazil and Indonesia. Brazil and Mexico export recycled PET flakes and pellets to global beverage and textile markets, generating foreign revenue. South America exhibits high recycling activity, which centers around major urban areas such as Sao Paulo, Buenos Aires and Santiago.

Report Coverage

This research report categorises the South America plastic recycling market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South America plastic recycling market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub segment of the South America plastic recycling market.

South America Plastic Recycling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 7.64 Million Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.42% |

| 2035 Value Projection: | 13.65 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Material ,By Application |

| Companies covered:: | Valgroup,Ambipar,ALPLA,Biocirculo,Braskem And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The plastic recycling market in South America is driven by the programs that governments and non governmental organizations support to establish and enhance these cooperatives, which are building stronger recycling supply chains that create positive social effects and enable material recovery. The surge in online shopping in Brazil, Argentina, and Colombia has created a greater need for protective plastic packaging, which demands recycled materials to handle the subsequent waste. The cost of recycled resins has turned more competitive with virgin materials because crude oil prices create fluctuations in virgin plastic costs.

Restraining Factors

The plastic recycling market in South America is restrained by the system for collecting, sorting, and processing materials, which suffers from serious deficiencies that block progress in developing regions. The combination of expensive recycling technologies and high energy needs makes recycled plastic less competitive against virgin plastics.

Market Segmentation

The South America plastic recycling market share is categorised into material and application.

- The PET segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South America plastic recycling market is segmented by material into PET, PP, HDPE, LDPE, PS, PVC and others. Among these, the PET segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the growing understanding of recycled plastic benefits among consumers, which will drive sustainable packaging demand, resulting in market growth throughout the entire forecast period. The public demand for environmentally friendly solutions will lead to increased usage of biodegradable materials in food grade packaging.

- The packaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the South America plastic recycling market is segmented into packaging, automotive, construction, textiles, and others. Among these, the packaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the material, which serves multiple industrial applications, ranging from the production of clothing to the manufacturing of carpets and automotive parts, as well as building materials and food packaging systems. PET stands as the most recycled plastic worldwide because its recycling process requires minimal effort.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South America plastic recycling market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Valgroup

- Reciclar S.A.

- Ambipar

- ALPLA

- Biocirculo

- Omnigreen

- Braskem

- Berry Global Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In November 2024, Dow and Ambipar, a Brazilian multinational and global leader in environmental solutions, announced the signing of a Memorandum of Understanding (MoU) to explore innovative business opportunities that leverage the value of post-consumer plastic waste, transforming it into new products in the Latin American region.

Market Segment

This study forecasts revenue at the South America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South America plastic recycling market based on the below-mentioned segments:

South America Plastic Recycling Market, By Material

- PET

- PP

- HDPE

- LDPE

- PS

- PVC

- Others

South America Plastic Recycling Market, By Application

- Packaging

- Automotive

- Construction

- Textiles

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the South America plastic recycling market size?A: The South America plastic recycling market size is expected to grow from 7.64 million tonnes in 2024 to 13.65 million tonnes by 2035, growing at a CAGR of 5.42% during the forecast period 2025-2035.

-

Q: What is plastic recycling, and its primary use?A: The South American plastic recycling market describes an industrial process that transforms waste plastic into reusable products and raw materials that replace the need for new resources. The process of creating lower-grade products from post-consumer waste starts with the physical waste treatment of used bottles

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the programs that governments and non-governmental organizations support to establish and enhance these cooperatives, which are building stronger recycling supply chains that create positive social effects and enable material recovery

-

Q: What factors restrain the South America plastic recycling market?A: The market is restrained by the system for collecting, sorting, and processing materials, which suffers from serious deficiencies that block progress in developing regions.

-

Q: How is the market segmented by material?A: The market is segmented into PET, PP, HDPE, LDPE, PS, PVC and others

-

Q: Who are the key players in the South America plastic recycling market?A: Key companies include Valgroup, Reciclar S.A., Ambipar, ALPLA, Alpek S.A.B. de C.V., Biocirculo, Veolia Latin America, Omnigreen, Braskem, and Berry Global Inc.

Need help to buy this report?