South America Ethylene Vinyl Acetate Market Size, Share, and COVID-19 Impact Analysis, By Grade (Low Density, Medium Density and High Density), By Application (Films, Adhesives, Foams, Solar Cell Encapsulation and Others), and South America Ethylene Vinyl Acetate Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsSouth America Ethylene Vinyl Acetate Market Insights Forecasts to 2035

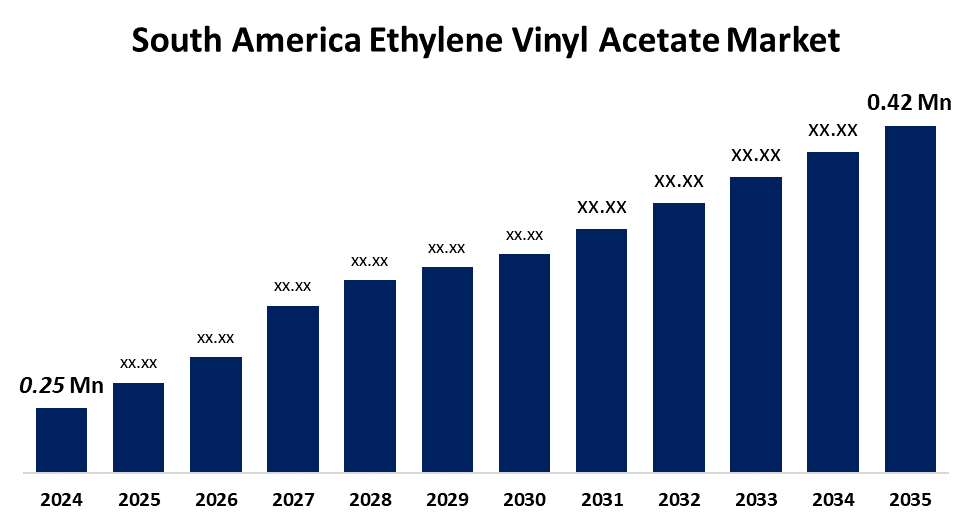

- The South America Ethylene Vinyl Acetate Market Size Was Estimated at USD 0.25 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.83% from 2025 to 2035

- The South America Ethylene Vinyl Acetate Market Size is Expected to Reach USD 0.42 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South America Ethylene Vinyl Acetate Market size is anticipated to reach USD 0.42 million by 2035, growing at a CAGR of 4.83% from 2025 to 2035. The market is driven by increasing investment in solar projects, which drives demand for EVA, which is crucial for encapsulating solar cells and enhancing their durability.

Market Overview

The material known as ethylene vinyl acetate functions as a flexible thermoplastic copolymer that consists of ethylene and vinyl acetate. The compound vinyl acetate finds diverse applications, which include footwear manufacturing, packaging film production, sporting goods creation, hot-melt adhesive development and medical device manufacturing and drug delivery system construction.

Mitsui & Dow Polychemicals will begin to sell biomass ethylene vinyl acetate copolymer (EVA) and biomass low-density polyethene (LDPE) products, which they produce through the mass balance method, starting on September 1 2024.

Braskem, the largest polyolefins producer in the Americas as well as a market-leading biopolymer producer that developed biopolymers for industrial use, announced its plan to supply extra quantities of its proprietary I'm green TM carbon-negative EVA biopolymer. The company will use this material to increase its production of Welli Bins T, sustainable storage bins, which will begin in May 2022.

The government has implemented a dual VAT system (IBS + CBS), which will streamline tax regulations for industrial materials. Chile's Deregulation: The new government expects to achieve 4% annual economic growth through its planned regulations simplification and corporate tax reductions, which will benefit companies that consume large quantities of polymers.

Report Coverage

This research report categorises the South America ethylene vinyl acetate market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South America ethylene vinyl acetate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South America ethylene vinyl acetate market.

South America Ethylene Vinyl Acetate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.25 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.83% |

| 2035 Value Projection: | USD 0.42 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 337 |

| Segments covered: | By Grade, By Application |

| Companies covered:: | Braskem S.A., ExxonMobil Corporation, Dow Chemical Company, Formosa Plastics Corporation, LyondellBasell Industries N.V., Celanese Corporation, Hanwha Solutions, Arkema S.A., and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The ethylene vinyl acetate market in South America is driven by EVA, which serves as the primary material for shoe soles because it provides both lightweight construction and comfortable shock-absorbing capabilities. Increasing solar power investment drives higher demand for EVA as a photovoltaic module encapsulant, which needs ultraviolet protection and durable performance. The growing demand for EVA now extends to interior components, adhesives, sealants and insulation materials.

Restraining Factors

The ethylene vinyl acetate market in South America is restrained by the material EVA which comes from petroleum sources and does not decompose in nature creates major problems for waste disposal operations and environmental preservation. The government has implemented multiple new environmental regulations, which now exist as binding requirements.

Market Segmentation

The South America ethylene vinyl acetate market share is categorised into grade and application.

- The high-density segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South America ethylene vinyl acetate market is segmented by grade into low density, medium density and high density. Among these, the high-density segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the material, which exhibits superior strength with increased stiffness and better thermal stability. The material serves as the optimal choice for solar PV encapsulants and durable foams, multilayer packaging, and high-performance industrial components. The solar photovoltaic sector is the largest demand center for high-density EVA because it provides strong cross-linking ability, UV protection, and extended module lamination durability.

- The foams segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the South America ethylene vinyl acetate market is segmented into films, adhesives, foams, solar cell encapsulation and others. Among these, the foams segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the demand for lightweight materials that provide cushioning and insulation performance has increased across the footwear, automotive, and packaging sectors. EVA foam provides outstanding thermal insulation and energy absorption capabilities together with high durability, which makes it suitable for products that need to deliver comfortable and protective performance throughout extended use.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South America ethylene vinyl acetate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Braskem S.A.

- ExxonMobil Corporation

- Dow Chemical Company

- Formosa Plastics Corporation

- LyondellBasell Industries N.V.

- Celanese Corporation

- Hanwha Solutions

- Arkema S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the South America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South America ethylene vinyl acetate market based on the below-mentioned segments:

South America Ethylene Vinyl Acetate Market, By Grade

- Low Density

- Medium Density

- High Density

South America Ethylene Vinyl Acetate Market, By Application

- Films

- Adhesives

- Foams

- Solar Cell Encapsulation

- Others

Frequently Asked Questions (FAQ)

-

What is the South America ethylene vinyl acetate market size?The South America ethylene vinyl acetate market size is expected to grow from USD 0.25 million in 2024 to USD 0.42 million by 2035, growing at a CAGR of 4.83% during the forecast period 2025-2035

-

What is a ethylene vinyl acetate, and its primary use?The material known as ethylene vinyl acetate (EVA) functions as a flexible thermoplastic copolymer that consists of ethylene and vinyl acetate. The compound VA finds diverse applications, which include footwear manufacturing, packaging film production, sporting goods creation, hot-melt adhesive development and medical device manufacturing and drug delivery system construction

-

What are the key growth drivers of the market?Market growth is driven by EVA, which serves as the primary material for shoe soles because it provides both lightweight construction and comfortable shock-absorbing capabilities.

-

What factors restrain the South America Ethylene Vinyl Acetate market?The market is restrained by the material EVA, which comes from petroleum sources and does not decompose in nature, creating major problems for waste disposal operations and environmental preservation.

-

How is the market segmented by grade?The market is segmented into low density, medium density and high density

-

Who are the key players in the South America ethylene vinyl acetate market?Key companies include Braskem S.A., ExxonMobil Corporation, Dow Chemical Company, Formosa Plastics Corporation, LyondellBasell Industries N.V., Celanese Corporation, Hanwha Solutions, and Arkema S.A.

Need help to buy this report?