South America Ethanol Derivative Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Ethyl Acetate, Ethylamines, Ethylene, Ethyl Ether, Ethyl Chloride, Other), By End User (Pharmaceuticals, Paints & Coatings, Food & Beverages, Personal Care & Cosmetics, Agrochemicals, Plastics & Resins, Other), and South America Ethanol Derivative Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsSouth America Ethanol Derivative Market Insights Forecasts to 2035

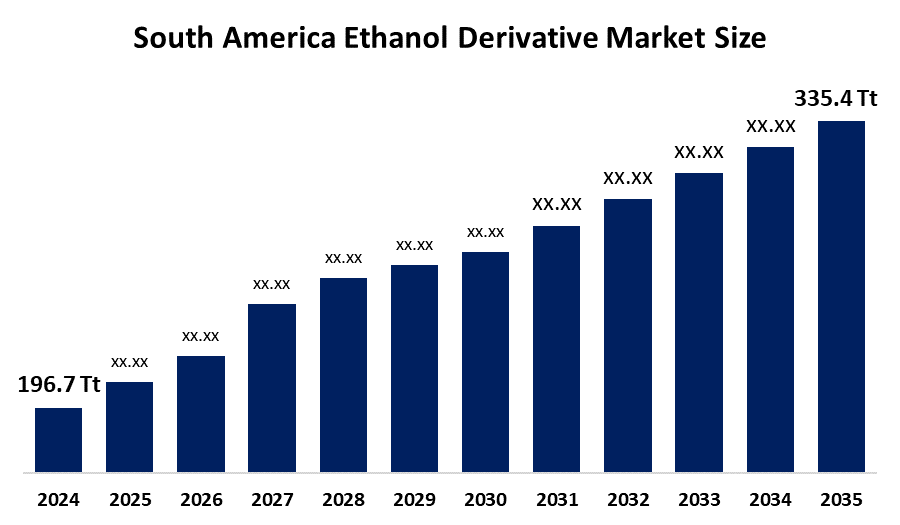

- The South America Ethanol Derivative Market Size Was Estimated at 196.7 Thousand Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.97% from 2025 to 2035

- The South America Ethanol Derivative Market Size is Expected to Reach 335.4 Thousand Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South America Ethanol Derivative Market size is anticipated to reach 335.4 thousand tonnes by 2035, growing at a CAGR of 4.97% from 2025 to 2035. The market is driven by increasing adoption of ethanol as an alternative fuel and the growing use of ethanol derivatives in various industries, such as automotive, pharmaceuticals, and personal care, which are significant contributors.

Market Overview

The manufacture, distribution, and consumption of chemical compounds from ethanol create a monopolistic business sector that functions as the ethanol derivatives market. Ethanol derivatives exist as a collection of various chemical compounds that industrial facilities create through the conversion of ethanol, which originates from biomass fermentation and ethylene hydration processes. Ethanol derivatives exist as chemical compounds that industrial facilities create through alcohol dehydration, oxidation, and esterification processes to produce sustainable feedstock alternatives that replace petroleum based materials.

Multiple nations have established renewable energy policies that include tax incentives and subsidies, and mandatory biofuel blending requirements. Brazilian Ambassador Kenneth Felix Haczynski da Nobrega on Tuesday welcomed the idea of ethanol exports from India, saying it would be great news if India has surplus to export.

Report Coverage

This research report categorises the South America ethanol derivative market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South America ethanol derivative market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South America ethanol derivative market.

South America Ethanol Derivative Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 196.7 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.97% |

| 2035 Value Projection: | 335.4 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type,By End User |

| Companies covered:: | Raizen,Inpasa,Copersucar,Cargill And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ethanol derivative market in South America is driven by the increasing public awareness about environmental issues, which is leading to the adoption of bio-based solvents and cleaning products that have lower carbon emissions than conventional chemical products. The South American governments are increasing their required ethanol blending percentages that must be mixed with gasoline. The Brazilian government raised its biofuel requirement to which will take effect in August 2025, and this change will create a substantial rise in domestic anhydrous ethanol demand.

Restraining Factors

The ethanol derivative market in South America is restrained by the agricultural feedstock market becomes vulnerable to price changes and weather related yield variations because it depends on sugarcane and corn for its raw materials. The production costs of certain derivatives exceed those of less expensive petrochemical based products.

Market Segmentation

The South America ethanol derivative market share is categorised into product type and end user.

- The ethylamines segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South America ethanol derivative market is segmented by product type into ethyl acetate, ethylamines, ethylene, ethyl ether, ethyl chloride, other. Among these, the ethylamines segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the extensive application of ethyl acetate as a versatile solvent across multiple industrial sectors, including paints and coatings, adhesives, pharmaceuticals, and food processing operations, which has proved to be the main driver behind its adoption. The substance gained more popularity because of its beneficial traits, which include safe use, effective solvent capacity and its suitability for environmental protection.

- The paints & coatings segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the South America ethanol derivative market is segmented into pharmaceuticals, paints coatings, food beverages, personal care cosmetics, agrochemicals, plastics resins, other. Among these, the paints coatings segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the demand for high-performance coating products, which require ethanol based materials for their formulation and application processes drives the market for paints and coatings in the construction, automotive and industrial sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations companies involved within the South America ethanol derivative market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Raizen S.A.

- Inpasa

- Sao Marthinho

- Copersucar

- Archer Daniels Midland

- Cargill

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the South America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South America ethanol derivative market based on the below-mentioned segments:

South America Ethanol Derivative Market, By Product Type

- Ethyl Acetate

- Ethylamines

- Ethylene

- Ethyl Ether

- Ethyl Chloride

- Other

South America Ethanol Derivative Market, By End User

- Pharmaceuticals

- Paints & Coatings

- Food & Beverages

- Personal Care & Cosmetics

- Agrochemicals

- Plastics & Resins

- Other

Frequently Asked Questions (FAQ)

-

Q: What is the South America ethanol derivative market size?A: The South America ethanol derivative market size is expected to grow from 196.7 thousand tonnes in 2024 to 335.4 thousand tonnes by 2035, growing at a CAGR of 4.97% during the forecast period 2025-2035

-

Q: What is ethanol derivative, and its primary use?A: The manufacture, distribution, and consumption of chemical compounds from ethanol create a monopolistic business sector that functions as the ethanol derivatives market. Ethanol derivatives exist as a collection of various chemical compounds that industrial facilities create through the conversion of ethanol, which originates from biomass fermentation and ethylene hydration processes.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing public awareness about environmental issues is leading to the adoption of bio-based solvents and cleaning products that have lower carbon emissions than conventional chemical products.

-

Q: What factors restrain the South America ethanol derivative market?A: The market is restrained by the agricultural feedstock market becomes vulnerable to price changes and weather-related yield variations because it depends on sugarcane and corn for its raw materials

-

Q: How is the market segmented by product type?A: The market is segmented into ethyl acetate, ethylamines, ethylene, ethyl ether, ethyl chloride, other

-

Q: Who are the key players in the South America ethanol derivative market?A: Key companies include Raizen S.A., Inpasa, Petrobras Biocombustiveis, BP Bunge Bioenergia, Sao Marthinho, Copersucar, Archer Daniels Midland, Cargill, and Tereos Maintain Substantial

Need help to buy this report?