South America Biodiesel Market Size, Share, and COVID-19 Impact Analysis, By Feedstock (Vegetable Oils, Animal fats, and Others), By Application (Fuel, Power Generation and Others), By Production Technology (Conventional Alcohol Trans-Esterification, Pyrolysis, and Hydro Heating), and South America Biodiesel Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsSouth America Biodiesel Market Insights Forecasts to 2035

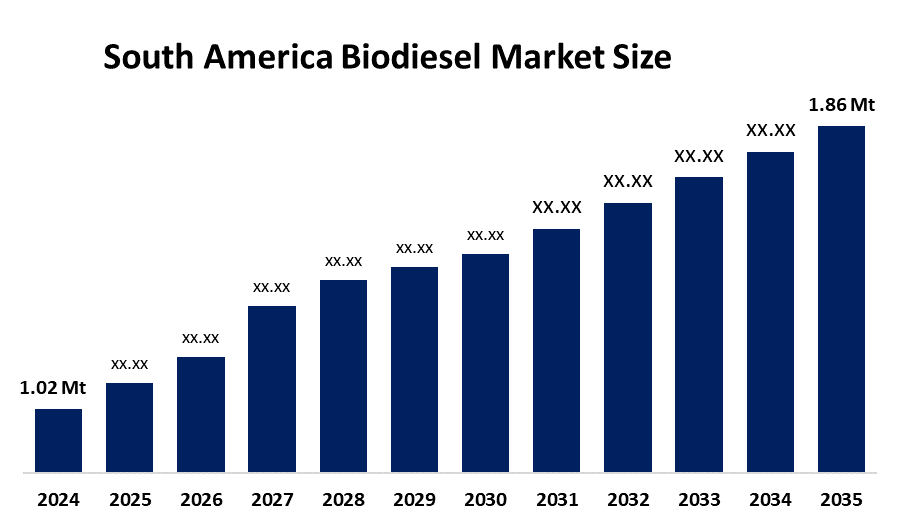

- The South America Biodiesel Market Size Was Estimated at 1.02 Million Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.61% from 2025 to 2035

- The South America Biodiesel Market Size is Expected to Reach 1.86 Million Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The South America Biodiesel Market Size is anticipated to reach 1.86 Million Tonnes by 2035, Growing at a CAGR of 5.61% from 2025 to 2035. The market is driven by the strong government mandates for renewable energy use, growing environmental awareness, and increasing demand for sustainable fuels in transportation.

Market Overview

The biodiesel market experiences growth through rising domestic demand, and the adoption of advanced biodiesel blends helps achieve decarbonization goals. Biodiesel is a renewable fuel that becomes biodegradable through its production from vegetable oils, animal fats and recycled restaurant grease. The fuel operates as a power source for stationary diesel generators, which function in remote locations that lack access to electrical grids due to its capacity to generate high heat while producing fewer emissions. The heavy-duty sector now adopts the technology for shipping and locomotive operations to achieve international carbon reduction goals.

Be8 is a Brazilian company that produces biodiesel and announced in April that it received certification from the California Air Resources Board for its biodiesel production method, which uses animal fats as feedstock.

In September 2023, Monjasa launched biofuel supply in Latin America. Monjasa has focused its recent work activities on the Latin American region, which includes the Colombian port of Cartagena. In 2020, Gunvor Group completed the establishment of a new US 540 million borrowing base facility to support the Company's biodiesel trading operations.

The Brazilian National Energy Policy Council (CNPE) will increase the country's biodiesel mandate to 15% starting in August, from the current blend of 14%, the council announced on Wednesday, June 25. The new regulations will raise the anhydrous ethanol gasoline blend from its existing 27% level to a new 30% standard.

Report Coverage

This research report categorises the South America biodiesel market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South America biodiesel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South America biodiesel market.

South America Biodiesel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 1.02 Million Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.61% |

| 2035 Value Projection: | 1.86 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Feedstock, By Application |

| Companies covered:: | Petrobras, Raizen S.A., Be8, BP Bunge Bioenergia, Grupo Potencial, Archer Daniels Midland, Cargill, Olfar Group, Avalon BioEnergy, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The biodiesel market in South America is driven by Brazil, which has established a plan that will boost its biodiesel blend from the current 14% to 15% in March 2025 and will achieve a 1% annual increase until the country reaches 20% by 2030. Bolivia and Brazil plan to reduce their foreign fossil fuel import costs by developing domestic energy resources, including soybean and animal fat supplies. The process of expanding production capacity guarantees that biodiesel, which serves as a renewable alternative to fossil fuels, will be produced in steady and uninterrupted quantities.

Restraining Factors

The biodiesel market in South America is restrained by the process of implementing higher blends, which exceed B15 requirements needs multiple technical feasibility studies and engine compatibility tests that require extensive time for completion. The current high cost of soybean oil has caused a decline in producer profit margins, which has resulted in some areas experiencing plant shutdowns.

Market Segmentation

The South America biodiesel market share is categorised into feedstock, application, and production technology.

- The vegetable oils segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South America biodiesel market is segmented by feedstock into vegetable oils, animal fats, and others. Among these, the vegetable oils segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the regional area that produces large amounts of feedstock materials include soybean, palm and sunflower oils. The United States leads all nations in biodiesel production, while Brazil ranks second as the largest producer of biodiesel in Latin America because the country uses soybean oil to produce more than 65% of its biodiesel output.

- The fuel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the South America biodiesel market is segmented into fuel, power generation and others. Among these, the fuel segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the established three key initiatives that work together with its strong regional policies and its efforts to develop cleaner energy sources. Brazil serves as the primary biodiesel producer and consumer in the region through its National Program for the Production and Use of Biodiesel, which has established higher mandatory biodiesel blending requirements.

- The conventional alcohol trans-esterification segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South America biodiesel market is segmented by production technology into conventional alcohol trans-esterification, pyrolysis, and hydro heating. Among these, the conventional alcohol trans-esterification segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the established method for producing biodiesel from vegetable oils and animal fats has become a standard procedure. The production method uses alcohol to react with oils for creating both glycerol and biodiesel, which remains the most widely used and economical production method throughout the area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South America biodiesel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Petrobras

- Raizen S.A.

- Be8

- BP Bunge Bioenergia

- Grupo Potencial

- Archer Daniels Midland

- Cargill

- Olfar Group

- Avalon BioEnergy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2024, Avalon BioEnergy Uruguay S.A., a subsidiary of U.S.-based Avalon Energy Group LLC, announced the launch of its first fully integrated Agriculture-Sustainable Aviation Fuel (SAF) biorefinery in Uruguay

Market Segment

This study forecasts revenue at the South America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South America biodiesel market based on the below-mentioned segments:

South America Biodiesel Market, By Feedstock

- Vegetable Oils

- Animal fats

- Others

South America Biodiesel Market, By Application

- Fuel

- Power Generation

- Others

South America Biodiesel Market, By Production Technology

- Conventional Alcohol Trans-Esterification

- Pyrolysis

- Hydro Heating

Frequently Asked Questions (FAQ)

-

Q: What is the South America biodiesel market size?A: South America biodiesel market size is expected to grow from 1.02 million tonnes in 2024 to 1.86 million tonnes by 2035, growing at a CAGR of 5.61% during the forecast period 2025-2035

-

Q: What is biodiesel, and its primary use?A: The biodiesel market experiences growth through rising domestic demand, and the adoption of advanced biodiesel blends helps achieve decarbonization goals. Biodiesel is a renewable fuel that becomes biodegradable through its production from vegetable oils, animal fats and recycled restaurant grease.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by Brazil, which has established a plan that will boost its biodiesel blend from the current 14% to 15% in March 2025 and will achieve a 1% annual increase until the country reaches 20% by 2030.

-

Q: What factors restrain the South America biodiesel market?A: The market is restrained by the process of implementing higher blends, which exceed B15 requirements needs multiple technical feasibility studies and engine compatibility tests that require extensive time for completion.

-

Q: How is the market segmented by feedstock?A: The market is segmented into vegetable oils, animal fats, and others.

-

Q: Who are the key players in the South America biodiesel market?A: Key companies include Petrobras, Raizen S.A., Be8, BP Bunge Bioenergia, Grupo Potencial, Archer Daniels Midland, Cargill, Olfar Group, and Avalon BioEnergy.

Need help to buy this report?