South America Biodegradable Polymers Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Polylactic Acid, Polyhydroxyalkanoates, Starch Blends, Polybutylene Succinate, Polyhydroxyurethanes, Others), By Application (Packaging, Agriculture, Medical, Consumer Goods, Textile, Others), and South America Biodegradable Polymers Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsSouth America Biodegradable Polymers Market Insights Forecasts to 2035

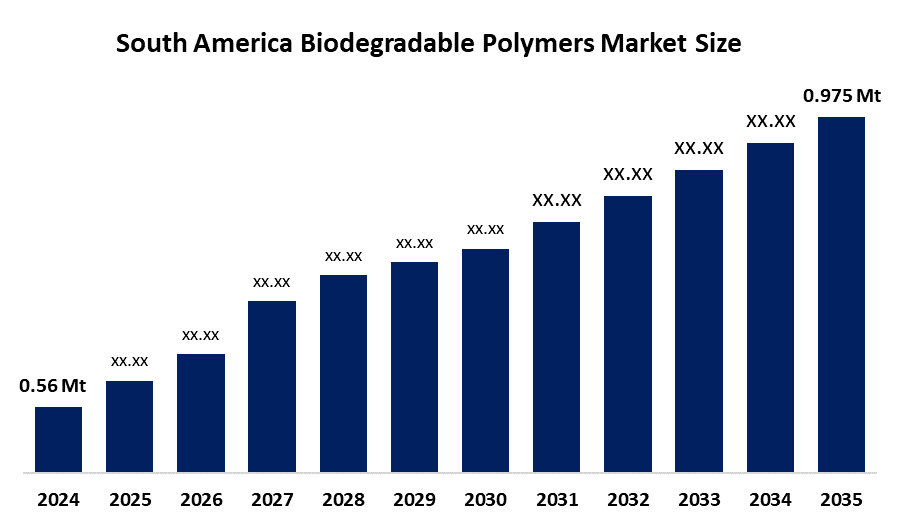

- The South America Biodegradable Polymers Market Size Was Estimated at 0.56 Million Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.17% from 2025 to 2035

- The South America Biodegradable Polymers Market Size is Expected to Reach 0.975 Million Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the South America Biodegradable Polymers Market Size is anticipated to reach 0.975 Million Tonnes by 2035, growing at a CAGR of 5.17% from 2025 to 2035.

Market Overview

The South American biodegradable polymers market is a growing sector which environmental regulations and agricultural raw material availability. Biodegradable polymers are materials that can be broken down into water, carbon dioxide, and possibly biomass by microorganisms like bacteria, fungi, etc. The agriculture industry uses the product to create mulch films, seed coatings, and plant pots, which help minimize plastic waste that ends up in soil. Consumer goods include disposable cutlery, electronics casings and personal hygiene products, which include diapers.

In October 2024, the Brazilian beauty company Natura formed a partnership with Nestlé to recycle aluminum from used Nespresso coffee capsules. The recycled aluminium will be used to produce packaging for the Ekos Castanha hand moisturizers, which are the most popular product of the Natura Ekos brand.

The government published the Draft National Waste Management Strategy 2026 in December 2025 to establish waste reduction as its primary objective while enhancing the Extended Producer Responsibility system. The SADA Group announced its plan to invest R$1.1 billion in corn ethanol facilities on Monday (15), which represents a major step forward for Brazil's energy diversification efforts.

Report Coverage

This research report categorises the South America biodegradable polymers market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South America biodegradable polymers market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South America biodegradable polymers market.

South America Biodegradable Polymers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 0.56 Million Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.17% |

| 2035 Value Projection: | 0.975 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Connectivity |

| Companies covered:: | Braskem, Unibaio, Entec Polymers Argentina, MYA Estetica Salud y Moda SPA, Saudi Basic Industries Corp., Cardia Bioplastics Australia Pty Ltd, Ecovita, Kekhren, EkoPolimeros, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The biodegradable polymers market in South America is driven by the growing need for plastic bans throughout South American cities, which serves as the main force driving market development in the region. Consumers are now choosing environmentally friendly products that do not contain harmful substances because of their increased knowledge about plastic waste. Researchers are conducting studies to enhance biopolymer materials through their research work, which will enable stronger performance in automotive and medical applications.

Restraining Factors

The biodegradable polymers market in South America is restrained by the agricultural commodity price fluctuations, which affect corn and sugarcane prices, determining both production costs and profit margins. The South American communities do not have access to this specialized infrastructure. This lack of infrastructure results in improper waste disposal, which creates potential environmental damage.

Market Segmentation

The South America biodegradable polymers market share is categorised into material type and application.

- The polylactic acid segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The South America biodegradable polymers market is segmented by material type into polylactic acid, polyhydroxyalkanoates, starch blends, polybutylene succinate, polyhydroxyurethanes, others. Among these, the polylactic acid segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by sustainable packaging solutions due to their biodegradable and compostable properties. The increasing need for environmentally friendly packaging options to replace standard plastic materials in the food and beverage industry has played a major role in making PLA the leading market choice.

- The packaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the South America biodegradable polymers market is segmented into packaging, agriculture, medical, consumer goods, textile, others. Among these, the packaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the rising demand for sustainable packaging solutions, which results from two factors: consumer preferences and new environmental regulations. These biodegradable polymers find their main use in packaging materials, which include food containers, wrappers, and bottles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South America biodegradable polymers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Braskem

- Unibaio

- Entec Polymers Argentina

- MYA Estetica Salud y Moda SPA

- Saudi Basic Industries Corp.

- Cardia Bioplastics Australia Pty Ltd

- Ecovita

- Kekhren

- EkoPolimeros

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the South America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South America biodegradable polymers market based on the below-mentioned segments:

South America Biodegradable Polymers Market, By Material Type

- Polylactic Acid

- Polyhydroxyalkanoates

- Starch Blends

- Polybutylene Succinate

- Polyhydroxyurethanes

- Others

South America Biodegradable Polymers Market, By Application

- Packaging

- Agriculture

- Medical

- Consumer Goods

- Textile

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the South America biodegradable polymers market size?A: The South America biodegradable polymers Market size is expected to grow from 0.56 million tonnes in 2024 to 0.975 million tonnes by 2035, growing at a CAGR of 5.17% during the forecast period 2025-2035.

-

Q: What are biodegradable polymers, and their primary use?A: The South American biodegradable polymers market is a growing sector which environmental regulations and agricultural raw material availability. Biodegradable polymers are materials that can be broken down into water, carbon dioxide, and possibly biomass by microorganisms like bacteria, fungi, etc.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growing need for plastic bans throughout South American cities, which serves as the main force driving market development in the region.

-

Q: What factors restrain the South America biodegradable polymers market?A: The market is restrained by the agricultural commodity price fluctuations, which directly affect corn and sugarcane prices, directly determining both production costs and profit margins.

-

Q: How is the market segmented by material type?A: The market is segmented into polylactic acid, polyhydroxyalkanoates, starch blends, polybutylene succinate, polyhydroxyurethanes, and others.

-

Q: Who are the key players in the South America biodegradable polymers market?A: Key companies include Braskem, Unibaio, Entec Polymers Argentina, MYA Estetica Salud y Moda SPA, Saudi Basic Industries Corp., Cardia Bioplastics Australia Pty Ltd, Ecovita, Kekhren, and EkoPolimeros.

Need help to buy this report?