South Africa Biodegradable Polymers Market Size, Share, and COVID-19 Impact Analysis, By Process (Starch Blends and Polylactic Acid), By End Use (Packaging, Agriculture, Textiles, and Consumer Goods), and United States Biodegradable Polymers Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsSouth Africa Biodegradable Polymers Market Insights Forecasts to 2035

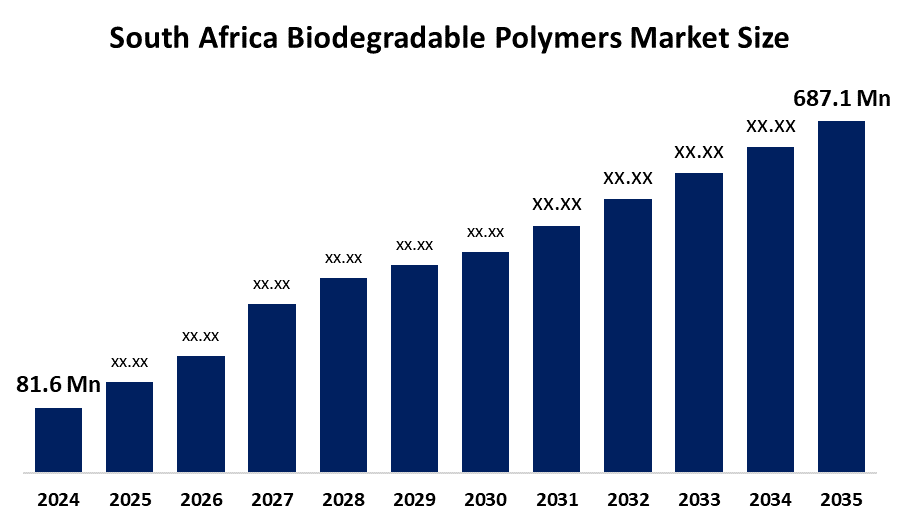

- South Africa Biodegradable Polymers Market Size 2024: USD 81.6 Million

- South Africa Biodegradable Polymers Market Size 2035: USD 687.1 Million

- South Africa Biodegradable Polymers Market CAGR 2024: 21.37%

- South Africa Biodegradable Polymers Market Segments: Process and End Use

Get more details on this report -

The South Africa Biodegradable Polymers Market Refers To The Production And Use Of Eco-Friendly Polymer Materials That Naturally Decompose, Driven By Rising Environmental Awareness, Plastic Waste Regulations, And Demand From Packaging, Agriculture, And Consumer Goods Industries.

Fortis X biodegradable plant-based packaging launch. A Cape Town-based company introduced Africa’s first fully biodegradable and recyclable plant-based bottles made from sugarcane-derived biopolymers. These bottles biodegrade within 1–3 months under composting conditions and are being adopted by local brands for beverages and other products.

Circular Economy Demonstration Fund support for bioplastic trials – The Department of Science, Technology and Innovation (DSTI) funds projects like CSIR’s biodegradable mulch film trials via the South African Circular Economy Demonstration Fund. These government-backed initiatives demonstrate the use of biodegradable polymers in agriculture and support the scaling of sustainable alternatives.

Growing bans on single-use plastics, rising demand for sustainable packaging, agricultural films, and government support for circular economy initiatives create strong growth opportunities for biodegradable polymers in South Africa.

South Africa Biodegradable Polymers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 81.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 21.37% |

| 2035 Value Projection: | USD 687.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Process, By End Use |

| Companies covered:: | Sasol Ltd., Safripol, Basf Holdings South Africa, Biodegradable Future, Mpact Ltd., Polyoak Packaging, Alpla Packaging Sa, Transpaco Ltd., Masterbatch South Africa, Ncs South Africa (Pty) Ltd., Apex Cordset Technologies, Others. |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Market Dynamics of the South Africa Biodegradable Polymers Market:

The South Africa biodegradable polymers market is driven by the growing environmental awareness, strict government regulations on plastic usage, increasing demand from packaging, agriculture, and consumer goods industries, and rising adoption of sustainable and eco-friendly polymer alternatives across multiple sectors.

The South Africa biodegradable polymers market is restrained by the high production costs, limited raw material availability, lack of widespread consumer awareness, and competition from conventional plastics that remain cheaper and more established.

The future of South Africa biodegradable polymers market is bright and promising, with the expansion of government initiatives, growing circular economy adoption, and increasing innovation in biodegradable polymer applications across packaging, agriculture, and industrial sectors, driving sustainable growth.

Market Segmentation

The South Africa biodegradable polymers market share is classified into process and end use.

By Process:

The South Africa biodegradable polymers market is divided by process into starch blends and polylactic acid. Among these, the starch blends segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to lower cost, easy availability, and versatility in packaging and disposable products, it widely adopted across industries in South Africa

By End Use:

The South Africa biodegradable polymers market is divided by end use into packaging, agriculture, textiles, and consumer goods. Among these, the packaging segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because of the rising demand for sustainable, single-use, and food-grade biodegradable materials, driven by environmental regulations and consumer preference for eco-friendly packaging solutions

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the South Africa biodegradable polymers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in South Africa Biodegradable Polymers Market:

- Sasol Ltd.

- Safripol

- Basf Holdings South Africa

- Biodegradable Future

- Mpact Ltd.

- Polyoak Packaging

- Alpla Packaging Sa

- Transpaco Ltd.

- Masterbatch South Africa

- Ncs South Africa (Pty) Ltd.

- Apex Cordset Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End Users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the South Africa, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Africa biodegradable polymers market based on the below-mentioned segments:

South Africa Biodegradable Polymers Market, By Process

- Starch Blends

- Polylactic Acid

South Africa Biodegradable Polymers Market, By End Use

- Packaging

- Agriculture

- Textiles

- Consumer Goods

Frequently Asked Questions (FAQ)

-

Q: What is the South Africa biodegradable polymers market size?A: South Africa biodegradable polymers market is expected to grow from USD 81.6 million in 2024 to USD 687.1 million by 2035, growing at a CAGR of 21.37% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growing environmental awareness, strict government regulations on plastic usage, increasing demand from packaging, agriculture, and consumer goods industries, and rising adoption of sustainable and eco-friendly polymer alternatives across multiple sectors.

-

Q: What factors restrain the South Africa biodegradable polymers market?A: Constraints include the high production costs, limited raw material availability, lack of widespread consumer awareness, and competition from conventional plastics that remain cheaper and more established

-

Q: Who are the key players in the South Africa biodegradable polymers market?A: Key companies include Sasol Ltd., Safripol, BASF Holdings South Africa, Biodegradable Future, Mpact Ltd., Polyoak Packaging, Alpla Packaging SA, Transpaco Ltd., Masterbatch South Africa, NCS South Africa (Pty) Ltd., Apex Cordset Technologies, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, End Users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?