South Africa Ammonia Market Size, Share, By Sales Channel (Direct Sales and Indirect Sales), By End-Use (Agriculture & Fertilizers, Textiles & Pharmaceuticals, Explosives, Refrigeration, and Others), South Africa Ammonia Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsSouth Africa Ammonia Market Insights Forecasts to 2035

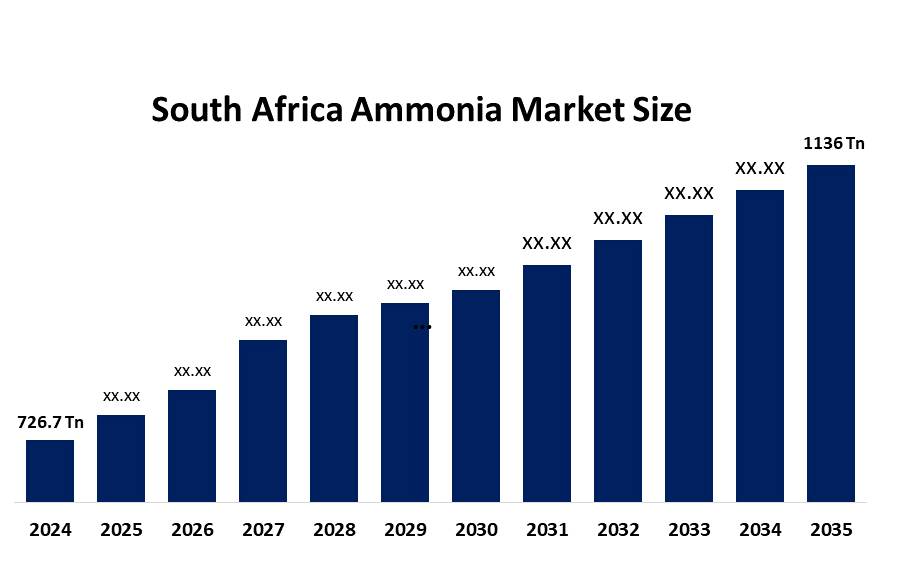

- South Africa Ammonia Market Size 2024: USD 726.4Thousand Tones

- South Africa Ammonia Market Size 2035: USD 1136Thousand Tones

- South Africa Ammonia Market CAGR 2024: 4.15%

- South Africa Ammonia Market Segments: Sales Channel and End-Use

Get more details on this report -

The South Africa ammonia market encompasses the complete process of producing, distributing and using ammonia, which supports applications in fertilisers, chemicals and mining, refrigeration and emerging clean energy industries.

Yara International announced plans to develop a major ammonia plant in South Africa, with the integration of CCUS technology for reducing carbon intensity.

The South African government, together with domestic and foreign partners, established the SA-H2 blended finance facility to support funding for large-scale green hydrogen and ammonia projects. The fund has dedicated multiple times ten thousand tones dollars to support the development of the Hive Hydrogen Coega Green Ammonia Project, which represents South Africa's first industrial green ammonia facility that combines renewable energy sources to prepare the nation for worldwide green ammonia trade.

The ammonia market in South Africa creates multiple business opportunities because of its green ammonia production capabilities and increasing fertilizer demand, mining activities and its capacity to export products, which will be powered by renewable energy growth and hydrogen economy development.

Market Dynamics of the South Africa Ammonia Market:

The South Africa ammonia market is driven by the increase in agricultural fertilizer requirements, mining and explosives needs, growth and chemical manufacturing, and government backing for green ammonia development through hydrogen economy and renewable energy transition programs.

The South Africa ammonia market is restrained by the high production expenses, the requirement to import natural gas, existing infrastructure constraints, market price fluctuations and the gradual implementation of green ammonia technology, which requires substantial financial resources and faces regulatory obstacles.

The future of South Africa ammonia market is bright and promising, with green ammonia projects and available renewable energy, increasing fertilizer demand and export possibilities, and governmental assistance for hydrogen development and decarbonization programs drive market expansion.

South Africa Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 726.4 Thousand Tons |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.15% |

| 2035 Value Projection: | USD 1136 Thousand Tons |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Sales Channel, By End-Use |

| Companies covered:: | Sasol, Omnia Holdings (Omnia Fertilizer), AECI, Foskor, African Oxygen (Afrox), Built Africa, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The South Africa ammonia market share is classified into sales channel and end-use.

By Sales Channel:

The South Africa ammonia market is divided by sales channel into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because large fertilizer, mining, and industrial users prefer bulk purchasing, long-term contracts, stable pricing, reliable supply, and direct relationships with ammonia producers.

By End-Use:

The South Africa ammonia market is divided by end-use into agriculture & fertilizers, textiles & pharmaceuticals, explosives, refrigeration, and others. Among these, the agriculture & fertilizers segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because South Africa needs to produce more crops and uses fertilizers extensively while the government supports agricultural development which results in constant ammonia demand and market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the South Africa ammonia market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in South Africa Ammonia Market:

- Sasol

- Omnia Holdings (Omnia Fertilizer)

- AECI

- Foskor

- African Oxygen (Afrox)

- Built Africa

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the South Africa, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the South Africa ammonia market based on the below-mentioned segments:

South Africa Ammonia Market, By Sales Channel

- Direct Sales

- Indirect Sales

South Africa Ammonia Market, By End-Use

- Agriculture & Fertilizers

- Textiles & Pharmaceuticals

- Explosives

- Refrigeration

- Others

Frequently Asked Questions (FAQ)

-

Q:What is the South Africa ammonia market size?A:South Africa ammonia market is expected to grow from USD 726.4 thousand tonnes in 2024 to USD 1136 thousand tonnes by 2035, growing at a CAGR of 4.15% during the forecast period 2025-2035.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by the increase in agricultural fertilizer requirements, mining and explosives needs, growth and chemical manufacturing, and government backing for green ammonia development through hydrogen economy and renewable energy transition programs.

-

Q:What factors restrain the South Africa ammonia market?A:Constraints include the high production expenses, the requirement to import natural gas, existing infrastructure constraints, market price fluctuations and the gradual implementation of green ammonia technology, which requires substantial financial resources and faces regulatory obstacles.

-

Q:How is the market segmented by sales channel?A:The market is segmented into direct sales and indirect sales.

-

Q:Who are the key players in the South Africa ammonia market?A:Key companies include Sasol, Omnia Holdings (Omnia Fertilizer), AECI, Foskor, African Oxygen (Afrox), Built Africa, and Others.

-

Q:Who are the target audiences for this market report?A:The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?