Global Soup Market Size, Share, and COVID-19 Impact Analysis, By Packaging Type (Canned, Metal Cans, Aluminum Cans, Composite Cans, Non-canned, Tetra Pak, Pouches, Cartons, Bowls, Cups), By Product Type (Vegetable Soup, Chicken Soup, Beef Soup, Seafood Soup, Tomato Soup, Creamy Soup, Specialty Soups), By Distribution Channels ( Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, On-the-Go Channels, Vending Machines, Petrol Stations), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Industry: Food & BeveragesGlobal Soup Market Insights Forecasts to 2033

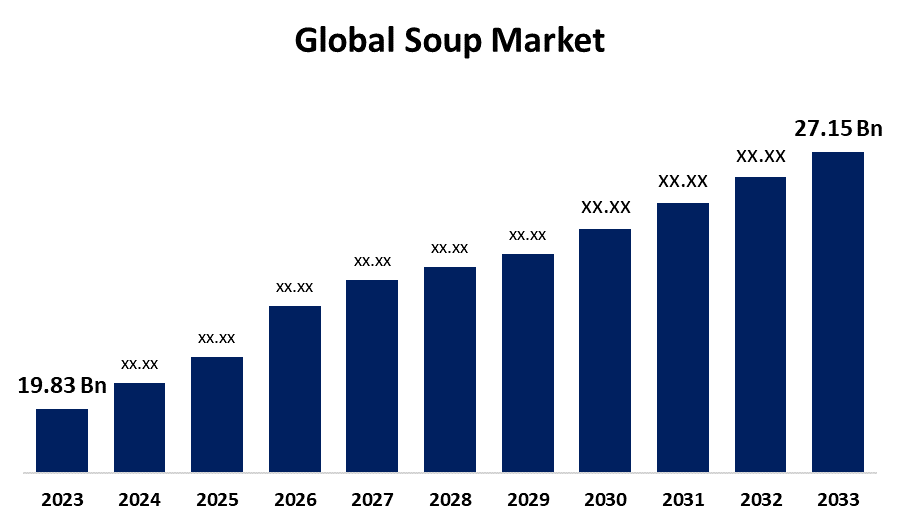

- The Global Soup Market Size was Valued at USD 19.83 Billion in 2023

- The Market Size is Growing at a CAGR of 3.19% from 2023 to 2033

- The Worldwide Soup Market Size is Expected to Reach USD 27.15 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Soup Market Size is Anticipated to Exceed USD 27.15 Billion by 2033, Growing at a CAGR of 3.19% from 2023 to 2033.

Market Overview

Soup is generally a liquid meal that is produced by mixing components such as vegetables and meat with water, milk, or other liquids. It is typically served warm or hot. Boiling solid ingredients in liquids inside a pot until their flavors are extracted and a broth is formed. Soups are also commonly consumed during illness because they provide numerous health benefits. They can help with digestion, improve heart function, aid in weight loss, and strengthen bones. Furthermore, increased product variety, consumption of wellness and health products, and active advertising by competitors are all expected to help the soup market grow. Furthermore, as demand for convenience food grows, companies are developing more convenient packaging formats for consumption and disposal. For example, Campbell sells soups in microwavable mugs, which is a better packing format than powdered soup in ordinary packets. In addition, various companies operating in the segment are launching new products and expanding their offerings. For example, Pacific Foods introduced new organic canned ready-to-eat soups and chilis in infinitely recyclable non-BPA lined packaging in September 2022.

Report Coverage

This research report categorizes the market for the global soup market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global soup market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global soup market.

Global Soup Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.83 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.19% |

| 2033 Value Projection: | USD 27.15 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Packaging Type, By Product Type, By Distribution Channels, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | The Kraft Heinz Company, Campbell Soup Company, General Mills Inc., Unilever PLC, Tideford Organics, B&G Foods, Inc., Conagra Brands Inc., Baxters Food Group, Nestlé S.A., Associated British Foods Plc, The Hain Celestial Group, Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing vegan population has a significant impact on the consumption of plant-based soups in both developed and developing nations. To meet growing public demand, major vendors are producing vegan soups in a variety of containers. Except for vegans, most consumers prefer healthy vegetable soups over non-vegetarian soups. Consumer acceptance of these broths is increasing, which benefits the global soup market. Furthermore, several producers are involved in creating an appealing package, and even fewer are developing new flavors. This indicates the availability of different varieties based on consumer preferences. Additionally, there has been a significant increase in demand for soups with specific certifications and health claims, particularly among consumers following a specific diet. Consumers are willing to pay more for such health-related products, potentially supplementing the studied market. The trend has significantly increased sales of soups labeled as organic, made-with-natural ingredients, or free-from claims. Furthermore, there has been a significant increase in convenience food products, particularly among middle- to upper-income consumers. The surge can be attributed to the growing female workforce and their global demand for quick and time-saving meal options. This is expected to drive the global soup market growth over the forecast period.

Restraining Factors

A variety of soups have a lot of sodium, especially the canned or processed kinds. To improve taste and lengthen shelf life, sodium is frequently added to packaged soups as a preservative and flavor enhancer. Excessive intake of salt has been connected to several health issues, such as cardiovascular disorders and hypertension. Consumers are paying more attention to how much sodium they consume as they get more health-conscious. This might result in a drop in the global soup market's growth and demand for certain products.

Market Segmentation

The global soup market share is classified into packaging type, product type, and distribution channel.

- The non-canned segment is expected to hold the largest share of the global soup market during the forecast period.

Based on the packaging type, the global soup market is divided into canned (metal cans, aluminum cans, composite cans), and non-canned (tetra pack, pouches, cartons, bowls, cups). Among these, the non-canned segment is expected to hold the largest share of the global soup market during the forecast period. Non-canned packaging, which is frequently used for soups that are ready to eat and simple to make, has become more and more popular since it has several benefits. Customers with hectic schedules will find soup pouches or cups to be a useful option because they are simple to handle, store, and prepare. Direct heating is frequently possible due to the packaging such as microwaveable pouches, cups, and bowls, which streamlines preparation and eliminates the need for extra cooking tools. In addition, pouches' small size and light weight make them perfect for traveling, business lunches, camping, and on-the-go drinking.

- The chicken soup segment is expected to grow at the fastest CAGR in the global soup market during the forecast period.

Based on the product type, the global soup market is divided into vegetable soup, chicken soup, beef soup, seafood soup, tomato soup, creamy soup, and specialty soups. Among these, the chicken soup segment is expected to grow at the fastest CAGR in the global soup market during the forecast period. Chicken soup's distinct flavors and high nutritious content contribute significantly to the market's growth. Compared to vegetarian soup options, Chicken soup has a richer, flavorful flavor. They are also a great source of protein and other necessary elements, which makes them a filling and nutritious option for individuals looking for a tasty and visually appealing dinner.

- The online retail segment is expected to grow at the fastest CAGR in the global soup market during the forecast period.

Based on the distribution channel, the global soup market is divided into supermarkets/hypermarkets, convenience stores, online retail, specialty stores, on-the-go channels, vending machines, petrol stations. Among these, the online retail segment is expected to grow at the fastest CAGR in the global soup market during the forecast period. This is because more restaurants have entered the online market to expand their product offerings and give customers easier access to them. It is anticipated that the majority of countries will acquire imported beverages and processed food items through online retail, which will boost the segment growth in the global soup market.

Regional Segment Analysis of the Global Soup Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global soup market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global soup market over the predicted timeframe. Classic favorites including clam chowder, tomato soup, and chicken noodle soup have evolved into legendary recipes in North American cooking. This shared cultural love of soup generates steady demand and propels regional market expansion. Furthermore, the North American consumer base is diverse and constantly changing, with a preference for convenience, health-conscious options, and a wide range of flavors. The introduction of premium, clean-label, and innovative tastes, together with consumers' growing inclination for soups as a quick lunch and their evolving perception as a healthier food option, are anticipated to fuel the market's expansion in the North American area. Consumer's preference for ready-to-go meals due to their increasingly hectic lifestyles in nations like the US and Canada is the main driver behind the expansion of the soup market in North America. Sales in these nations are also being driven by manufacturers' inventiveness in creating soup products that follow the prevailing snacking habits and provide the correct variety of soups for their clientele. For instance, Upton's Naturals of the United States released three new tasty vegan Ready-to-Eat soups in July 2022 that can be microwaved or prepared on the stovetop. Due to the increased number of foreigners living in Canada, there is also a need for soups with various ethnic flavors.

Europe is expected to grow at the fastest pace in the global soup market during the forecast period. The United Kingdom and Russia are the top soup consumers in Europe because of their rapidly expanding populations. Compared to other countries in the region, these countries consume a comparably large amount of processed food. The region's consumption of dehydrated soups is anticipated to increase due to the ongoing product introductions that address customer preferences and purchase patterns. In addition, as more women become economically independent, there is a growing need for processed and quick food items in the area. It is anticipated that this will support the growth of the soup market expansion in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global soup market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Kraft Heinz Company

- Campbell Soup Company

- General Mills Inc.

- Unilever PLC

- Tideford Organics

- B&G Foods, Inc.

- Conagra Brands Inc.

- Baxters Food Group

- Nestlé S.A.

- Associated British Foods Plc

- The Hain Celestial Group, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2022, the plant-based, vegan, and gluten-free soup brand in the UK, Tideford Organics, increased its retail distribution from the previous year and introduced a variety of new soup flavors and better recipes. Indian Cauliflower Masala, Lebanese Lentil + Kale, and Malaysian Coconut + Noodle soups were introduced by its Inspired brand. Additionally, it offers Butternut + Sage from their favorite assortment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global soup market based on the below-mentioned segments:

Global Soup Market, By Packaging Type

- Canned

- Metal Cans

- Aluminum Cans

- Composite Cans

- Non-canned

- Tetra Pak

- Pouches

- Cartons

- Bowls

- Cups

Global Soup Market, By Product Type

- Vegetable Soup

- Chicken Soup

- Beef Soup

- Seafood Soup

- Tomato Soup

- Creamy Soup

- Specialty Soups

Global Soup Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- On-the-Go Channels

- Vending Machines

- Petrol Stations

Global Soup Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?The Kraft Heinz Company, Campbell Soup Company, General Mills Inc., Unilever PLC, Tideford Organics, B&G Foods, Inc., Conagra Brands Inc., Baxters Food Group, Nestlé S.A., Associated British Foods Plc, The Hain Celestial Group, Inc., and Others.

-

2. What is the size of the global soup market?The Global Soup Market is expected to grow from USD 19.83 Billion in 2023 to USD 27.15 Billion by 2033, at a CAGR of 3.19% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global soup market over the predicted timeframe.

Need help to buy this report?