Global Sorbic Acid Market Size, Share, and COVID-19 Impact Analysis, By Form (Powder and Liquid), By Application (Food and Beverage, Pharmaceuticals, Nutraceuticals, Cosmetics & Personal Care, Pet Food, and Animal Feed), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Sorbic Acid Market Size Insights Forecasts to 2035

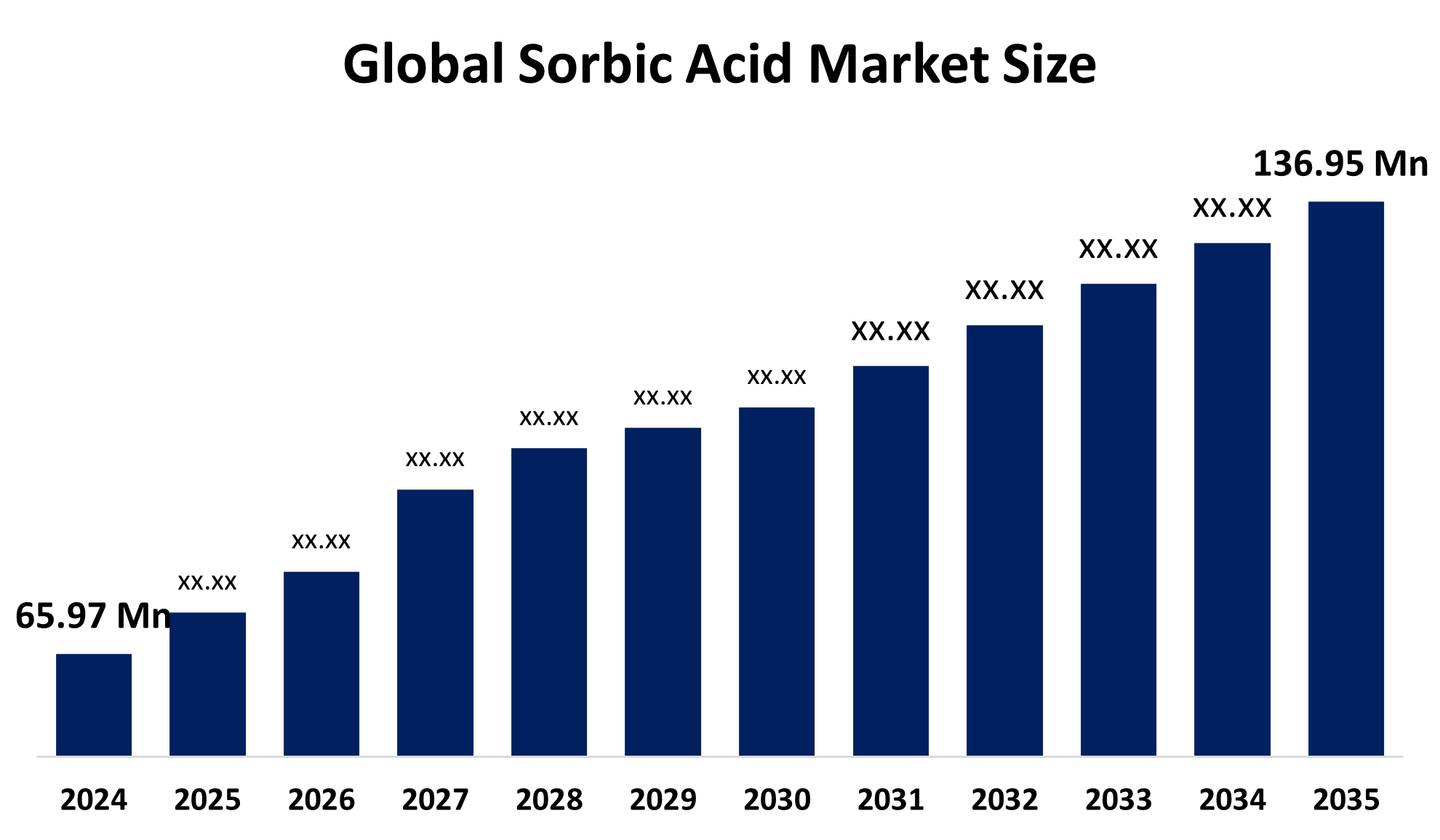

- The Global Sorbic Acid Market Size Was Estimated at USD 65.97 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.87% from 2025 to 2035

- The Worldwide Sorbic Acid Market Size is Expected to Reach USD 136.95 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

Market Overview

Sorbic acid exists as a naturally occurring unsaturated fatty acid, which is widely used in its acid form and potassium salt form as a powerful antibacterial preservative that protects food, beverages, cosmetics and pharmaceuticals from mould, yeast and fungal contamination. The product provides value because it enables manufacturers to extend product shelf life while maintaining original taste and smell characteristics. The market shows growth because people now demand more processed foods, and they want safe food products, and manufacturers use clean-label preservatives.

The European Union approved Commission Regulation (EU) 2025/2060 in October 2025, which allows the combined usage of sorbic acid (E 200) and potassium sorbate (E 202) in non-heat-treated plant-based mousses. The update establishes safety boundaries that enable new applications while preserving existing applications of preservatives. The pharmaceutical industry and animal feed industry provide emerging chances to protect nutritional content. The market identifies chances to use environmentally friendly production methods, which create sustainable bio-based products as alternatives to standard chemical manufacturing processes. The market operates through major multinational companies, which include Celanese Corporation, Wanglong Tech Co., Daicel Corporation, WEGO Chemical Group, and Eastman Chemical Company.

Report Coverage

This research report categorizes the Global Sorbic Acid Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the sorbic acid market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the sorbic acid market.

Global Sorbic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 65.97 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.87% |

| 2035 Value Projection: | USD 136.95 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Form, By Application |

| Companies covered:: | Wanglong Tech Co., Ltd., Eastman Chemical Company, Celanese Corporation, Daicel Corporation, WEGO Chemical Group, Shandong Hongda Group, Prinova Group LLC, PT Halim Sakti Pratama, KIC Chemicals Inc., Seidler Chemical Co. Inc., AVATAR CORPORATION, QINGDAO KAISON CHEMICALS CO., Ltd, Continental Chemical USA, Nantong Acetic Acid Chemical Co., Ltd. and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The Global Sorbic Acid Market Size is primarily driven by the rising demand for effective preservatives in the food and beverage industry, which needs preservatives that can stop mold and yeast growth in dairy products, bakery items and processed foods. Urbanization leads to increased packaged food consumption, which creates demand for packaged products. Market growth is driven by consumer demand for clean-label products and natural identical preservatives, which the FDA has recognized as safe. The market expands because sustainable production technologies increase their use in food and pharmaceutical products, personal care items and animal feed.

Restraining Factors

The Global Sorbic Acid Market Size is restrained by the increasing consumer preference for natural/clean-label preservatives over synthetic alternatives. Growth is hindered by three factors, which include high production costs and raw material price changes for petrochemicals and the need to follow different regulations in multiple regions. The market faces constraints because cheaper alternative preservatives create strong competition.

Market Segmentation

The sorbic acid market share is classified into form and application.

- The powder segment dominated the market in 2024, approximately 45% and is projected to grow at a substantial CAGR during the forecast period.

Based on the form, the Global Sorbic Acid Market Size is divided into powder and liquid. Among these, the powder segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The powder segment emerged as the leading segment in the sorbic acid market because it enables easy handling, provides precise dosing, longer shelf life and multiple uses in bakery and dairy, meat and beverage products. The stable product form enables manufacturers to use it in their products, which delivers product preservation and meets clean-label requirements, and drives market expansion because consumers prefer to purchase safe and high-quality food additives.

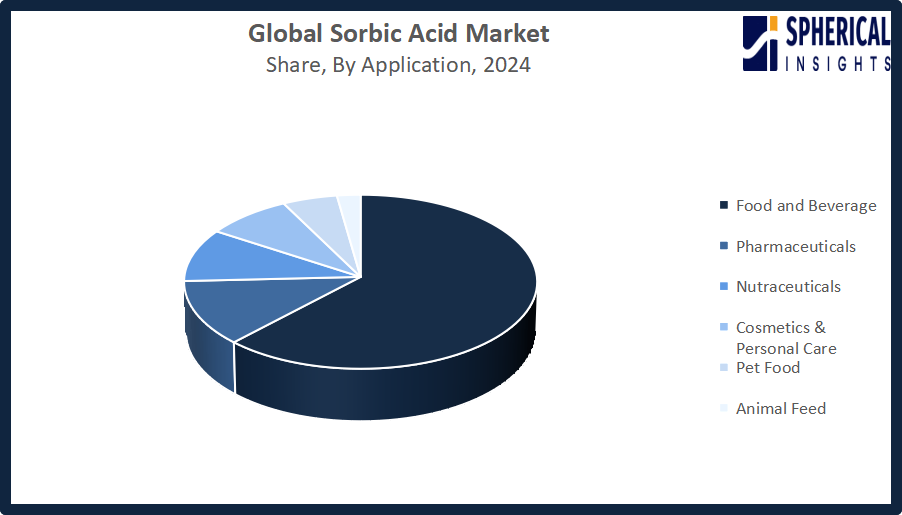

- The food and beverage segment accounted for the highest market revenue in 2024, approximately 62% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Global Sorbic Acid Market Size is divided into food and beverage, pharmaceuticals, nutraceuticals, cosmetics & personal care, pet food, and animal feed. Among these, the food and beverage segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The food and beverage sector emerged as the main driver of sorbic acid market expansion because it uses sorbic acid extensively in bakery, dairy and processed meat and beverage products to prevent microbial spoilage and extend product shelf life. The rising consumer demand for products that feature clean-label methods, natural ingredients and high-quality standards has driven manufacturers to develop sustainable food-grade bio-based sorbic acid products.

Get more details on this report -

Regional Segment Analysis of the Sorbic Acid Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the sorbic acid market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the Global Sorbic Acid Market Size over the predicted timeframe. The sorbic acid market will experience its 38% market share in North America because of its established food and beverage sector, its strict food safety standards and its consumers who understand the importance of food quality and shelf life. The United States drives demand through extensive bakery, dairy, processed meat, and beverage production, while Canada contributes with growing organic and clean-label product trends. The region experiences continuous growth because of its advanced supply chain network, combined with its common use of preservatives and its demand for high-purity food-grade sorbic acid. The U.S. FDA and EFSA established potassium sorbate as safe to use in multiple food categories when they designated it GRAS in December 2025.

Asia Pacific is expected to grow at a rapid CAGR in the Global Sorbic Acid Market Size during the forecast period. The sorbic acid market in the Asia Pacific will experience a 30% share growth because urbanization rates continue to rise, while people achieve higher disposable income levels, and the food and beverage sector expands. The demand for processed foods, packaged items and foods with extended shelf life drives growth in China and India. The market grows because people now understand food safety better and choose clean-label products, and businesses invest in advanced food processing equipment. Chinas National Health Commission recognized sorbic acid and potassium sorbate as food additives, which will enable better regulatory processes and wider product approvals throughout the Chinese food industry.

Europe’s sorbic acid market develops because food safety regulations become more stringent, consumers prefer clean-label products and organic items, and the processed food sector maintains strong growth. The bakery industry and dairy business, and the beverage sector in Germany, France and the UK generate the highest demand. The region maintains growth through its dedication to high-quality foods that undergo minimal processing and sustainable preservative solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Global Sorbic Acid Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wanglong Tech Co., Ltd.

- Eastman Chemical Company

- Celanese Corporation

- Daicel Corporation

- WEGO Chemical Group

- Shandong Hongda Group

- Prinova Group LLC

- PT Halim Sakti Pratama

- KIC Chemicals Inc.

- Seidler Chemical Co. Inc.

- AVATAR CORPORATION

- QINGDAO KAISON CHEMICALS CO., Ltd

- Continental Chemical USA

- Nantong Acetic Acid Chemical Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, Celanese Corporation introduced a sustainable, bio-based production process for sorbic acid, minimizing environmental impact. The initiative aligns with global trends favoring eco-friendly preservatives, supporting cleaner manufacturing practices and meeting growing demand for sustainable solutions in the food, beverage, and pharmaceutical industries.

- In September 2024, Evident Ingredients launched Evicide Potassium Sorbate Eco, a 100% natural, cassava-derived preservative for personal care products. Offering strong antimicrobial protection for shampoos, conditioners, and wet wipes, it supports certified natural cosmetics and sustainable formulations, reflecting the industry’s push toward green chemistry and clean-label innovation in cosmetic preservation.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Global Sorbic Acid Market Size based on the below-mentioned segments:

Global Sorbic Acid Market, By Form

- Powder

- Liquid

Global Sorbic Acid Market, By Application

- Food and Beverage

- Pharmaceuticals

- Nutraceuticals

- Cosmetics & Personal Care

- Pet Food

- Animal Feed

Global Sorbic Acid Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the sorbic acid market over the forecast period?The global sorbic acid market is projected to expand at a CAGR of 6.87% during the forecast period.

-

2.What is the global sorbic acid market?The global sorbic acid market refers to the production and sale of sorbic acid, a preservative used in food, beverages, and pharmaceuticals.

-

3.What is the market size of the sorbic acid market?The global sorbic acid market size is expected to grow from USD 65.97 million in 2024 to USD 136.95 million by 2035, at a CAGR of 6.87% during the forecast period 2025-2035.

-

4.Which region holds the largest share of the sorbic acid market?North America is anticipated to hold the largest share of the sorbic acid market over the predicted timeframe.

-

5.Who are the top 10 companies operating in the global sorbic acid market?Wanglong Tech Co., Ltd., Eastman Chemical Company, Celanese Corporation, Daicel Corporation, WEGO Chemical Group, Shandong Hongda Group, Prinova Group LLC, PT Halim Sakti Pratama, KIC Chemicals Inc., Seidler Chemical Co., Inc., and Others.

-

6.What factors are driving the growth of the sorbic acid market?The drivers include rising demand for food preservation/extended shelf life, growing popularity of clean-label products, expanding convenience food industry, and increasing applications in cosmetics, pharmaceuticals, and animal feed sectors.

-

7.What are the market trends in the sorbic acid market?Key trends include rising clean-label demand, increased usage in pharmaceuticals/cosmetics, shift toward natural preservatives, and sustainable bio-based production techniques.

-

8.What are the main challenges restricting wider adoption of the sorbic acid market?The challenges restricting the sorbic acid market include rising consumer demand for natural alternatives over synthetic preservatives, high raw material price volatility, stringent regulatory compliance, and competition from cheaper alternatives.

Need help to buy this report?