Global Solid Welding Wires Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Steel, Copper, Aluminum & Aluminum Alloys, and Others), By Application (Automotive, Building & Construction, Heavy Engineering, Railway & Shipbuilding, and Others), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Solid Welding Wires Market Insights Forecasts to 2035

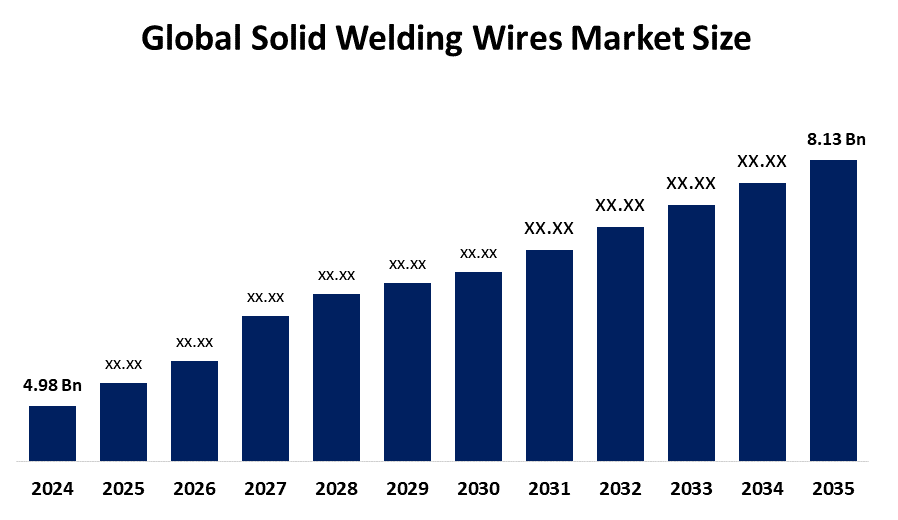

- The Global Solid Welding Wires Market Size Was Estimated at USD 4.98 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.56 % from 2025 to 2035

- The Worldwide Solid Welding Wires Market Size is Expected to Reach USD 8.13 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Solid Welding Wires Market Size was worth around USD 4.98 Billion in 2024 and is predicted to Grow to around USD 8.13 Billion by 2035 with a compound annual growth rate (CAGR) of 4.56% from 2025 to 2035. Future opportunities in the solid welding wires market include advancements in alloy development, increased automation, growing construction and automotive demand, expansion in emerging economies, and focus on high-strength, corrosion-resistant welding solutions.

Market Overview

The solid welding wires market refers to consumable metal wires used primarily in MIG and automated welding to permanently join metals across construction, automotive, shipbuilding, energy, and heavy engineering industries. Market growth is driven by rapid infrastructure expansion, rising vehicle production, increasing use of robotic and automated welding systems, and demand for high-strength, defect-free welds. Government initiatives promoting industrialization, smart manufacturing, renewable energy projects, and large-scale infrastructure development in regions such as Asia Pacific and the Middle East further support demand. Statistically, solid wires account for nearly half of global welding wire consumption, with automation-based welding showing strong adoption rates. Recent developments include innovations in low-fume wires, high-strength alloy formulations, and robot-compatible packaging to enhance efficiency and workplace safety.

Report Coverage

This research report categorizes the solid welding wires market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the solid welding wires market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the solid welding wires market.

Global Solid Welding Wires Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.98 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.56% |

| 2035 Value Projection: | USD 8.13 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Material Type, By Application |

| Companies covered:: | Lincoln Electric, ESAB, Voestalpine Böhler Welding, KOBE Steel Ltd., Ador Welding Ltd., Kiswel Ltd., Chosun Welding Co., Ltd., Gedik Welding, Capilla Welding Materials GmbH, FSH Welding Group, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is propelled by strong industrial demand, especially from automotive and construction sectors, where welding consumables like solid wires accounted for over 45% of total welding wire use globally. Automation adoption is rising as robotic welding represents ~30% of total wire consumption, improving quality and throughput. Rapid infrastructure development and manufacturing growth in Asia Pacific (approx. 34.4% regional share in 2024) further fuel demand. Additionally, aerospace, renewable energy, and heavy engineering industries seek high-performance, reliable welding solutions.

Restraining Factors

High raw material price volatility, competition from flux-cored wires, strict environmental regulations, skilled labor shortages, and high automation costs restrain solid welding wires market growth.

Market Segmentation

The solid welding wires market share is classified into material type and application.

The steel segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material type, the solid welding wires market is divided into steel, copper, aluminum & aluminum alloys, and others. Among these, the steel segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Due to its extensive use across automotive, construction, heavy engineering, and industrial applications. Steel solid wires remain preferred for their versatility, cost-effectiveness, availability, and broad applicability in structural and manufacturing welding processes.

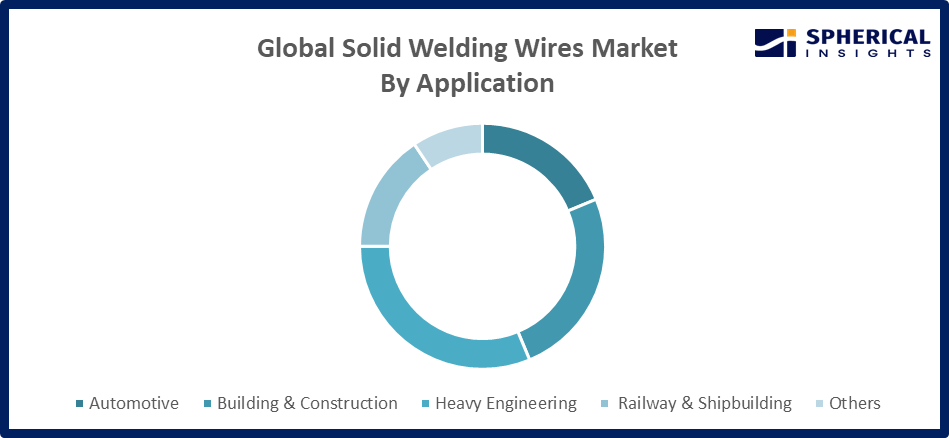

- The heavy engineering segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the solid welding wires market is divided into automotive, building & construction, heavy engineering, railway & shipbuilding, and others. Among these, the heavy engineering segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because heavy engineering involves extensive welding in the manufacture of heavy machinery, mining and agricultural equipment, and industrial fabrication projects, driving strong demand for solid welding wires in structural and high-strength applications.

Get more details on this report -

Regional Segment Analysis of the Solid Welding Wires Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the solid welding wires market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the solid welding wires market over the predicted timeframe. Asia Pacific dominated the global market in 2024 with around one-third of total revenue, driven by rapid industrialization, infrastructure development, and strong demand from key end-use sectors such as automotive and construction in countries like China, India, and Japan. The region is also projected to sustain significant growth due to continued investment in manufacturing capabilities and adoption of automated welding technologies.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the solid welding wires market during the forecast period. North America is expected to grow at a rapid CAGR due to increasing investments in infrastructure modernization, rising automotive and aerospace manufacturing, and growing adoption of robotic and automated welding systems. Additionally, strict quality standards, demand for high-strength welds, and expansion of renewable energy, oil & gas, and shipbuilding projects further accelerate solid welding wires consumption across the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the solid welding wires market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lincoln Electric

- ESAB

- Voestalpine Böhler Welding

- KOBE Steel Ltd.

- Ador Welding Ltd.

- Kiswel Ltd.

- Chosun Welding Co., Ltd.

- Gedik Welding

- Capilla Welding Materials GmbH

- FSH Welding Group

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the solid welding wires market based on the below-mentioned segments:

Global Solid Welding Wires Market, By Material Type

- Steel

- Copper

- Aluminum & Aluminum Alloys

- Others

Global Solid Welding Wires Market, By Application

- Automotive

- Building & Construction

- Heavy Engineering

- Railway & Shipbuilding

- Others

Global Solid Welding Wires Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the solid welding wires market over the forecast period?The global solid welding wires market is projected to expand at a CAGR of 4.56% during the forecast period.

-

2.What is the market size of the solid welding wires market?The global solid welding wires market size is expected to grow from USD 4.98 billion in 2024 to USD 8.13 billion by 2035, at a CAGR of 4.56 % during the forecast period 2025-2035.

-

3.Which region holds the largest share of the solid welding wires market?Asia Pacific is anticipated to hold the largest share of the solid welding wires market over the predicted timeframe.

-

4.Who are the top 10 companies operating in the global solid welding wires market?Lincoln Electric, ESAB, Voestalpine Böhler Welding, KOBE Steel Ltd., Ador Welding Ltd., Kiswel Ltd., Chosun Welding Co., Ltd., Gedik Welding, Capilla Welding Materials GmbH, and FSH Welding Group.

-

5.What factors are driving the growth of the solid welding wires market?Rising infrastructure development, automotive manufacturing growth, increased industrial automation, expanding heavy engineering projects, and demand for high-strength, reliable welding solutions drive growth.

-

6.What are the market trends in the solid welding wires market?Growing adoption of automated/robotic welding, demand for high-strength alloys, eco-friendly low-fume wires, and expansion in automotive, construction, and industrial sectors.

-

7.What are the main challenges restricting the wider adoption of the solid welding wires market?Volatile raw material prices, competition from flux-cored wires, skilled labor shortages, strict environmental regulations, and high automation investment costs limit adoption.

Need help to buy this report?