Solar Mobile Light Tower Market Size, Share, and COVID-19 Impact Analysis, By Lighting (Metal Halide, LED, Electric, and Others), By Technology (Manual Lifting and Hydraulic Lifting), By Application (Construction, Infrastructure & Development, Oil & Gas, Mining, Military & Defense, Emergency & Disaster Relief, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Energy & PowerGlobal Solar Mobile Light Tower Market Insights Forecasts to 2035

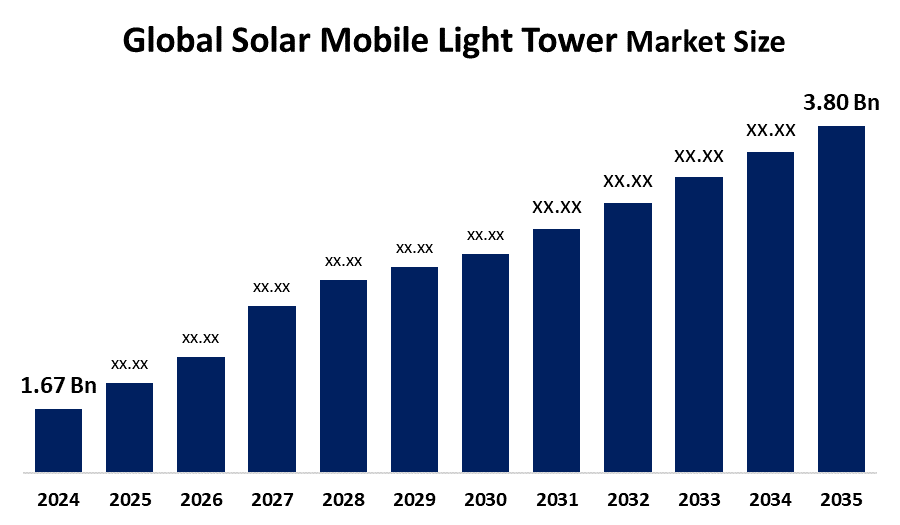

- The Global Solar Mobile Light Tower Market Size Was Estimated at USD 1.67 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.76% from 2025 to 2035

- The Worldwide Solar Mobile Light Tower Market Size is Expected to Reach USD 3.80 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global solar mobile light tower market size was worth around USD 1.67 billion in 2024 and is predicted to grow to around USD 3.80 billion by 2035 with a compound annual growth rate (CAGR) of 7.76% from 2025 to 2035. The demand for solar mobile light towers is growing due to increased awareness, stringent emission regulations, rising fuel costs and the demand for cost-effective, eco-friendly lighting options in construction, mining and event industries. Advances in battery technology and smart control systems also enhance efficiency and appeal.

Market Overview

The worldwide solar-powered mobile light tower industry refers to lighting units powered by energy sources outfitted with panels, battery storage and LED bulbs aimed at delivering dependable lighting in remote or off-grid areas. These towers find application in construction zones, mining sites, oil and gas fields, emergency response missions, military installations and outdoor gatherings. The market expansion is propelled by increasing demand for eco-lighting options, stricter environmental policies and a transition away from diesel-fueled light towers due to fuel expenses and emission concerns. Chances are growing because of progress in solar panel technology, lithium-ion batteries and intelligent monitoring systems, which allow for efficiency and extended operating durations. Additionally, the rise in infrastructure developments in emerging countries further boosts usage. Prominent firms, such as Atlas Copco, Generac Mobile, Wacker Neuson Trime S.p.A. and Progress Solar Solutions keep producing models tailored to industry requirements, fostering global market growth. In September 2025, India's distributed solar sector experienced growth stimulated by policies, lower costs and increasing consumer demand. As per MNRE, off-grid solar capacity increased to 5,399.51 MW while rooftop solar attained 21,522.75 MW, boosting distributed energy production and reducing transmission losses across the country.

Report Coverage

This research report categorizes the solar mobile light tower market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the solar mobile light tower market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the solar mobile light tower market.

Driving Factors

The worldwide market for solar mobile light towers is mainly propelled by the increasing need for eco, energy-efficient lighting in construction areas, mining activities, outdoor gatherings and emergency scenarios. Growing environmental awareness and strict government policies encouraging the use of energy options support the transition from diesel-powered towers to solar-based solutions. Improvements in solar panel technology, LED illumination and energy storage boost performance, longevity and adaptability. Moreover, the minimal operational and upkeep expenses, along with portability and straightforward installation in off-grid areas, further propel market expansion by encouraging utilization across different sectors.

Restraining Factors

Key restraining factors for the global solar mobile light tower market include the high initial investment required for advanced solar equipment and energy storage systems. Limited energy generation during cloudy or low-sunlight conditions, dependence on battery capacity, and lower performance in extreme climates also hinder adoption. Additionally, diesel alternatives remain more familiar in certain regions.

Market Segmentation

The solar mobile light tower market share is classified into lighting, technology, and application.

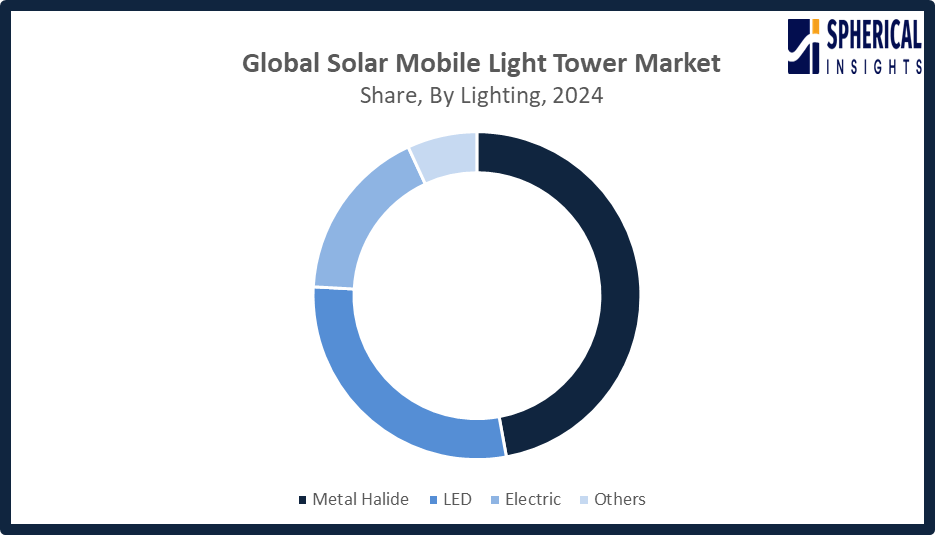

- The metal halide segment dominated the market in 2024, approximately 47% and is projected to grow at a substantial CAGR during the forecast period.

Based on the lighting, the solar mobile light tower market is divided into metal halide, LED, electric, and others. Among these, the metal halide segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Metal halide lamps lead the market because of their brightness, extensive coverage and demonstrated effectiveness in large outdoor settings. With the increasing use of LEDs, it continues to be favored for spaces needing extensive illumination and elevated lumen levels. Its dependability in weather conditions and appropriateness for extended use further consolidate its standing in the market.

Get more details on this report -

- The manual lifting segment accounted for the largest share in 2024, approximately 58% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the solar mobile light tower market is divided into manual lifting and hydraulic lifting. Among these, the manual lifting segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Manual lifting mechanisms are widely favored due to their affordability, straightforward setup and minimal upkeep needs. Preferred in harsh settings, they emphasize easy use and mechanical dependability rather than automated features. Their robustness and reduced upfront costs render them perfect for construction and industrial users seeking elevation control without intricate machinery.

- The construction segment accounted for the highest market revenue in 2024, approximately 41% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the solar mobile light tower market is divided into construction, infrastructure & development, oil & gas, mining, military & defense, emergency & disaster relief, and others. Among these, the construction segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment is growing due to rising demand for reliable, mobile, and eco-friendly lighting in large-scale construction and infrastructure projects. Solar mobile light towers extend working hours, enhance site safety, and support environmental compliance. Their portability and quick deployment make them ideal for dynamic construction layouts and adapting to evolving project requirements.

Regional Segment Analysis of the Solar Mobile Light Tower Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the solar mobile light tower market over the predicted timeframe.

North America is anticipated to hold the largest share of the solar mobile light tower market over the predicted timeframe. North America is expected to have a 34% market share of the mobile light tower market due to its infrastructure, extensive use of renewable energy, and rigorous environmental regulations. The U.S. drives this growth, supported by industries such as construction, mining and government backing for energy programs. Investments in infrastructure and disaster readiness elevate the demand for off-grid lighting options. Advances in panel and LED technology further encourage usage. In April 2025, U.S. Tariffs on imported components increased costs for businesses on imports but encouraged domestic production and partnerships aligned with policies favoring locally made solar equipment.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the solar mobile light tower market during the forecast period. The solar mobile light tower market in the Asia Pacific area is expected to have a 27% market share is grow due to expanding infrastructure projects, construction activities, mining and the rising adoption of energy sources. China, India and Japan lead this growth, supported by government incentives, urbanization and the demand for off-grid lighting solutions. Increased project numbers and heightened environmental awareness also drive market adoption. In February 2024, India launched the Pradhan Mantri Surya Ghar Muft Bijli Yojana, providing support and free electricity for solar installations, boosting residential solar adoption and strengthening the region's renewable energy framework.

The demand for solar-powered mobile light towers in Europe is growing due to regulations, extensive adoption of renewable energy and rising infrastructure projects. Germany, the UK and France lead the market, supported by government incentives and the requirement for eco-lighting options. Increasing awareness about methods further drives the increased adoption. In 2024, the EU updated its Renewable Energy Directive, raising the 2030 target to 45%, offering subsidies for off-grid solar solutions, and prioritizing low-emission equipment in public tenders, boosting usage across construction, events, and remote projects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the solar mobile light tower market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Atlas Copco AB

- Caterpillar Inc.

- Wacker Neuson Trime S.p.A.

- Progress Solar Solutions

- Generac Power Systems

- Sunbelt Rentals

- Doosan Portable Power

- Terex Corporation

- Vermac

- Greensky Mobile Power & Light

- Colorado Standby

- Biglux Innovation

- Wanco

- Larson Electronics

- Herc Rentals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Atlas Copco launched the second-generation solar light towers, HiLight MS 4 and MS 5, offering versatile lighting solutions. The company emphasized the launch as a major step in environmentally conscious innovation, promoting sustainable, efficient, and reliable lighting across various applications.

- In November 2021, Doosan Portable Power launched the LVL 50 Hz portable light tower for MEA markets. Designed for durability and mobility, it suits the rental market with a compact footprint, cost-effective transport, and reliable on-site performance.

- In October 2021, Generac Mobile introduced the MLTB, the industry’s first high-intensity, DOT-certified battery light tower using Green Lithium Battery technology. Offering low-noise, zero-emission, and cable-free operation, the MLTB provides versatile lighting solutions for indoor jobsites, entertainment venues, and other diverse applications.

- In June 2021, Atlas Copco Power and Flow launched the HiLight S2+ solar-powered LED light tower. The user-friendly system reduces CO2 emissions by up to six tonnes, provides efficient high-performance lighting, enhances worker visibility, and helps sites comply with zero-emission and low-noise sustainability regulations.

- In February 2019, Larson Electronics LLC launched the SPLT-1.06K-LM20 solar-powered LED surveillance tower. Featuring two IP cameras, eight LED lights, a 1,000aH battery bank, and a telescoping mast, the portable system is trailer-mounted, ideal for remote and rugged outdoor locations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the solar mobile light tower market based on the below-mentioned segments:

Global Solar Mobile Light Tower Market, By Lighting

- Metal Halide

- LED

- Electric

- Others

Global Solar Mobile Light Tower Market, By Technology

- Manual Lifting

- Hydraulic Lifting

Global Solar Mobile Light Tower Market, By Application

- Construction

- Infrastructure & Development

- Oil & Gas

- Mining

- Military & Defense

- Emergency & Disaster Relief

- Others

Global Solar Mobile Light Tower Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the solar mobile light tower market over the forecast period?The global solar mobile light tower market is projected to expand at a CAGR of 7.76% during the forecast period.

-

2. What is the market size of the solar mobile light tower market?The global solar mobile light tower market size is expected to grow from USD 1.67 billion in 2024 to USD 3.80 billion by 2035, at a CAGR of 7.76% during the forecast period 2025-2035

-

3. What is the solar mobile light tower market?The solar mobile light tower market involves portable, solar-powered lighting solutions used in construction, events, and off-grid outdoor applications

-

4. Which region holds the largest share of the solar mobile light tower market?North America is anticipated to hold the largest share of the solar mobile light tower market over the predicted timeframe

-

5. Who are the top 10 companies operating in the global solar mobile light tower market?Atlas Copco AB, Caterpillar Inc., Wacker Neuson Trime S.p.A., Progress Solar Solutions, Generac Power Systems, Sunbelt Rentals, Doosan Portable Power, Terex Corporation, Vermac, Greensky Mobile Power & Light, and Others

-

6. What factors are driving the growth of the solar mobile light tower market?The solar mobile light tower market is driven by rising infrastructure projects, demand for eco-friendly lighting, off-grid power needs, government incentives, cost-effective operation, and increasing adoption of renewable energy solutions.

-

7. What are the market trends in the solar mobile light tower market?Key trends include rising adoption of eco‑friendly lighting, advanced solar‑battery technologies, portable off‑grid solutions, and integration of smart monitoring systems for enhanced efficiency and reliability.

-

8. What are the main challenges restricting wider adoption of the solar mobile light tower market?The main challenges restricting the wider adoption of solar mobile light towers are high initial costs, performance limitations in certain weather conditions, and a lack of robust support services.

Need help to buy this report?