Global Sodium Propionate Market Size, Share, and COVID-19 Impact Analysis, By Form (Powder and Liquid), By Function (Preservatives, pH Regulators, Flavor Enhancers, Mold Inhibitors, Antimicrobial Agents, and Others), By End-use (Pharmaceuticals, Food and Beverages, Agriculture, Cosmetics and Personal Care, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Sodium Propionate Market Insights Forecasts to 2035

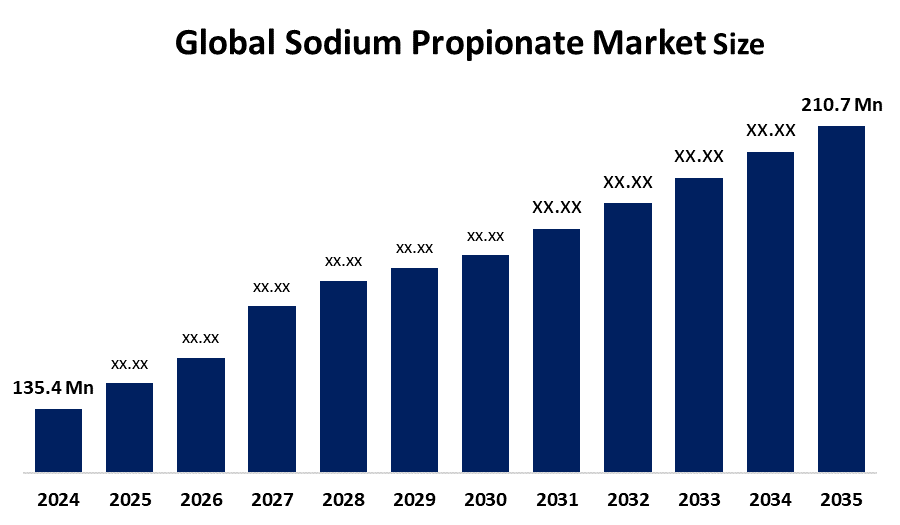

- The Global Sodium Propionate Market Size Was Estimated at USD 135.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.1% from 2025 to 2035

- The Worldwide Sodium Propionate Market Size is Expected to Reach USD 210.7 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report published by Spherical Insights and Consulting, The Global Sodium Propionate Market Size was worth around USD 135.4 Million in 2024 and is predicted to Grow to around USD 210.7 Million by 2035 with a compound annual Growth rate (CAGR) of 4.1% from 2025 to 2035. The factors contributing to the market expansion of the sodium propionate market are the growing use of food preservatives, rising consumption of bakery products, processed food, shelf-life extension, and its use in inhibiting mold and bacteria in food and animal feeds.

Market Overview

The international sodium propionate market refers to the manufacturing, trading, and consumption of sodium propionate, the sodium salt of propionic acid. It finds applications in the bakery products industry as a preservative since the compound can effectively prevent the development of mold and bacterial action. It also finds uses in the dairy products industry and the pharmaceutical industry. However, newer applications in the pharmaceutical industry and the increase in the utilization of the compound in industrial chemicals increase its scope. But the major factors propelling the market forward are the rapidly developing demand for shelf-life extension in various food products and the increase in urbanization and the convenience food industry.

In August 2024, sodium propionate was reaffirmed as a substance authorized for use in animal nutrition as a feed additive for all terrestrial animals by the EFSA. This will ensure the continued safe use in animal nutrition in the EU. Opportunities lie in the development of natural preservatives or natural combinations of preservatives. Other opportunities also lie in developing the utilization of the product in the animal feed industry. The top players in the market are Corbion, Jungbunzlauer, Shandong Luhua, Anhui Jin’ao, and COFCO Biochemical, who concentrate on innovation, cooperation, and geographic developments in order to satisfy the continued demand for the additive.

Report Coverage

This research report categorizes the sodium propionate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the sodium propionate market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the sodium propionate market.

Global Sodium Propionate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 135.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.1% |

| 2035 Value Projection: | USD 210.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Niacet Corporation, Shandong Luhua, Corbion, Anhui Jin’ao, COFCO Biochemical, Macco Organiques Inc., Jainex Specialty Chemicals, Prathista Industries Ltd., Titan Biotech Ltd, Dr. Paul Lohmann GmbH KG, Fine Organic Industries Pvt. Ltd., Tengzhou Zhongzheng Chemical Co., Ltd., Foodchem International Corporation, Others, and Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The major driver of the international market for sodium propionate is its widespread applications as a food preservative, especially in bakery products, dairy products, and processed foods, due to its successful inhibitory action against mold and bacteria. The increasing consumer desire to have a longer shelf life, along with healthy preservation methods, is a major factor accelerating the growth of the market. Additionally, the rise in the bakery segment along with the convenience. The animal feed and pharmaceutical industries using sodium propionate are other major growth opportunities for the industry. Technological improvements in manufacturing processes and increasing awareness about food safety and quality are also factors responsible for the growth in the global sodium propionate market.

Restraining Factors

The sodium propionate market worldwide is hampered by restraints such as fluctuating raw material prices, food safety regulations, and an ever-growing demand for a more normal food additive, among other restraints. High manufacturing costs, low knowledge among new market entrants, and other competitors to the food additive contribute to restraints to growth within the market.

Market Segmentation

The sodium propionate market share is classified into form, function, and end-use.

- The powder segment dominated the market in 2024, approximately 82% and is projected to grow at a substantial CAGR during the forecast period.

Based on the form, the sodium propionate market is divided into powder and liquid. Among these, the powder segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The powder form of sodium propionate is the predominantly used form due to enhanced solubility, longer shelf life, and ease of mixing. Improved mixability, handling, storage, and transportation, along with the increasing demand for packing and processing of foods, which need a moisture-resistant preservative, are major reasons for the continued steady growth of the market.

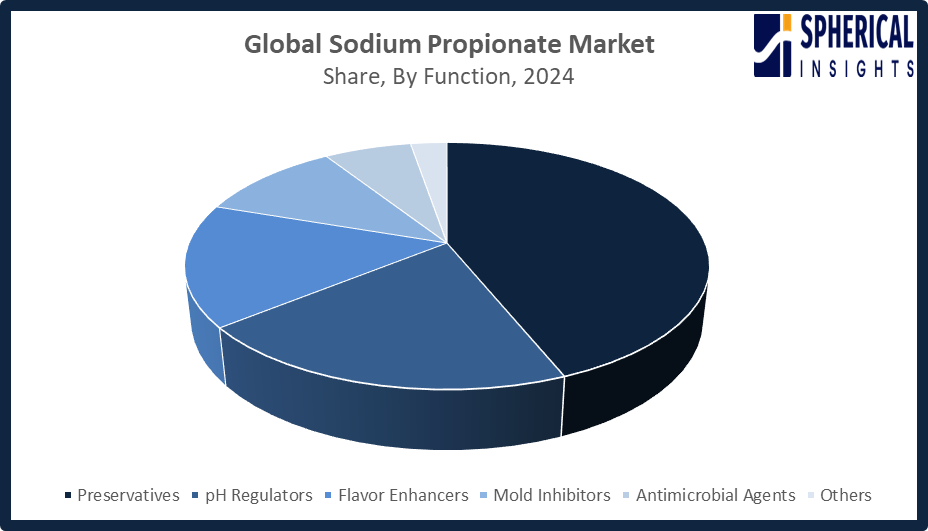

- The preservatives segment accounted for the largest share in 2024, approximately 44% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the function, the sodium propionate market is divided into preservatives, pH regulators, flavor enhancers, mold inhibitors, antimicrobial agents, and others. Among these, the preservatives segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Preservatives growth within the market due to sodium propionates’ proven ability to prevent mold and bacterial development. However, due to increasing demand for packaged and ready-to-eat foods, as well as more stringent food safety standards, it has become a widely accepted option and is currently the leading choice for manufacturers.

Get more details on this report -

- The food and beverages segment accounted for the highest market revenue in 2024, approximately 56% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the sodium propionate market is divided into pharmaceuticals, food and beverages, agriculture, cosmetics and personal care, and others. Among these, the food and beverages segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The food and beverages industry led in terms of market growth owing to the rise in demand for packaged, processed, and ready-to-eat foods. The increased number of urbanized people and active lifestyles, as well as stricter food regulations, have led to increased demand for stable preservatives such as sodium propionate, which secures food storage life by ensuring food safety.

Regional Segment Analysis of the Sodium Propionate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the sodium propionate market over the predicted timeframe.

North America is anticipated to hold the largest share of the sodium propionate market over the predicted timeframe. The market for sodium propionate is projected to have a 38% market share in North America, driven by the prominence of the food and beverage industry. The high demand for processed foods and the rigid norms of the FDA for enhanced food safety have ensured that the market registers growth. The U.S. leads the market, driven by the development of the food processing industry and the elevated concerns for shelf life and enhanced food security. The growth of the market has been increased by the use of the product for animal feed and pharmaceuticals. In April 2025, the U.S. Health and Human Services and the FDA decided to reduce the use of petroleum-based dyes. The decision is to ensure cleaner labels and not affect the use of other preservatives such as sodium propionate.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the sodium propionate market during the forecast period. The Asia Pacific is expected to have 21% market share of the sodium propionate market due to increasing urbanization and rising disposable incomes in countries in the region, and growing demand for packaged and processed food products. China is leading in the Asia Pacific region with its large food processing industry and increasing demand for convenience food products. India is contributed to by rapid industrialization, expansion in animal feed and food preservative demand, and firm legislation on food safety. Rising pharmaceutical and agricultural applications further support growth. In March 2025, China's National Health Commission approved sodium propionate as a food additive, allowing regulatory compliance for wider diffusion in food applications.

The European market is expected to continue growing at a consistent rate, driven by high demand for food preservatives and stringent food safety regulations. The main countries driving the sodium propionate market are Germany, due to its well-developed food processing sector and stringent quality parameters, followed by countries such as France and Italy, due to their high bakery products, dairy products, and processed food outputs. In October 2025, the European Commission extended the approved use of sodium propionate and propionates as feed additives for all terrestrial animals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the sodium propionate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Niacet Corporation

- Shandong Luhua

- Corbion

- Anhui Jin’ao

- COFCO Biochemical

- Macco Organiques Inc.

- Jainex Specialty Chemicals

- Prathista Industries Ltd.

- Titan Biotech Ltd

- Dr. Paul Lohmann GmbH KG

- Fine Organic Industries Pvt. Ltd.

- Tengzhou Zhongzheng Chemical Co., Ltd.

- Foodchem International Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, the European Food Safety Authority approved sodium propionate as a preservative for a broader range of food products, including bread, pastries, cakes, and other baked goods, enhancing food safety and extending shelf life across the industry.

- In January 2022, Niacet Corporation, a leading sodium propionate producer, announced a 25% production capacity increase to meet rising demand from the food and pharmaceutical industries, supporting global supply for preservation and antimicrobial applications.

- In June 2021, Kerry Group PLC agreed to acquire Niacet Corp. from SK Capital Partners and others for €853 million ($1.016 billion). Niacet, based in Niagara Falls, NY, is a leader in baking and pharmaceutical preservation technologies, offering products like calcium and sodium propionate and low-sodium preservation solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the sodium propionate market based on the below-mentioned segments:

Global Sodium Propionate Market, By Form

- Powder

- Liquid

Global Sodium Propionate Market, By Function

- Preservatives

- pH Regulators

- Flavor Enhancers

- Mold Inhibitors

- Antimicrobial Agents

- Others

Global Sodium Propionate Market, By End-use

- Pharmaceuticals

- Food and Beverages

- Agriculture

- Cosmetics and Personal Care

- Others

Global Sodium Propionate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the sodium propionate market over the forecast period?The global sodium propionate market is projected to expand at a CAGR of 4.1% during the forecast period.

-

2.What is the sodium propionate market?The sodium propionate market refers to the global trade and demand for sodium propionate, a preservative and mold inhibitor.

-

3.What is the market size of the sodium propionate market?The global sodium propionate market size is expected to grow from USD 135.4 million in 2024 to USD 210.7 million by 2035, at a CAGR of 4.1% during the forecast period 2025-2035.

-

4.Which region holds the largest share of the sodium propionate market?North America is anticipated to hold the largest share of the sodium propionate market over the predicted timeframe.

-

5.Who are the top 10 companies operating in the global sodium propionate market?Niacet Corporation, Shandong Luhua, Corbion, Anhui Jin’ao, COFCO Biochemical, Macco Organiques Inc., Jainex Specialty Chemicals, Prathista Industries Ltd., Titan Biotech Ltd, Dr Paul Lohmann GmbH KG, and Others.

-

6.What factors are driving the growth of the sodium propionate market?The sodium propionate market is driven by rising processed food and bakery demand, food safety regulations, meat and dairy preservation needs, and growing animal feed and pharmaceutical applications globally.

-

7.What are the market trends in the sodium propionate market?Growing demand for processed and packaged foods, rising emphasis on food safety and shelf‑life extension, and innovation in preservation technologies are shaping market trends.

-

8.What are the main challenges restricting wider adoption of the sodium propionate market?The main challenges restricting the wider adoption of the sodium propionate market include rising consumer demand for clean-label or natural products, competition from alternative preservatives, price volatility of raw materials, and strict regulatory compliance costs.

Need help to buy this report?