Global Sodium Bisulfite Market Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial Grade, Food Grade, and Pharmaceutical Grade), By End-Use (Water Treatment, Pulp & Paper, Food & Beverages, Textiles, Pharmaceuticals, and Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Sodium Bisulfite Market Size Insights Forecasts to 2035

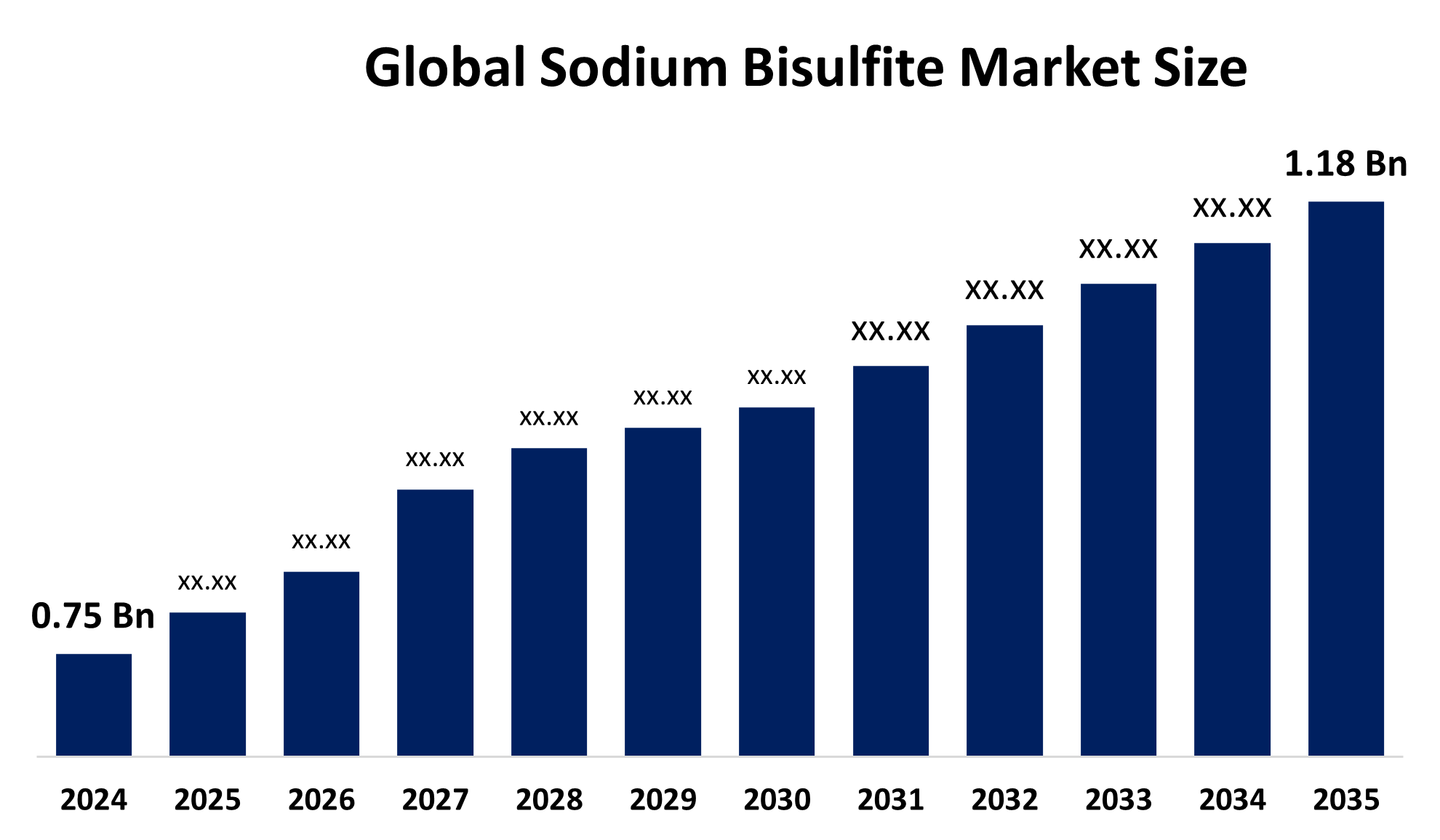

- The Global Sodium Bisulfite Market Size Was Estimated at USD 0.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.21% from 2025 to 2035

- The Worldwide Sodium Bisulfite Market Size is Expected to Reach USD 1.18 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Sodium Bisulfite Market Size was worth around USD 0.75 Billion in 2024 and is Predicted to Grow to around USD 1.18 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 4.21% from 2025 to 2035. The global market for sodium bisulfite is expanding due to the increasing water treatment needs, growing food preservation demands and industrial growth in pulp and paper, and textile sectors. The Asia-Pacific region experiences increased demand owing to its industrial growth and environmental control measures.

Market Overview

The global sodium bisulfite or sodium hydrogen sulfite exists as a white crystalline water-soluble inorganic compound, which scientists use to create reducing agents, preservatives and antichlor substances. Its main uses involve dechlorinating wastewater from both municipal and industrial sources, bleaching pulp for paper production, and serving as an antioxidant in food and beverages and pharmaceuticals. The market operates because of environmental regulations that mandate wastewater treatment, together with industrial growth and customers who prefer processed foods with high preservative content.

The European Commission launched its Action Plan for the Chemicals Industry in July 2025 to enhance competitiveness through its chemical industry initiative. The initiative addresses three problems, including high energy costs, unfair competition, and weak demand, by establishing two programs that support sodium bisulfite manufacturers, the Critical Chemical Alliance and the Affordable Energy Action Plan. The adoption of eco-friendly high-purity formulations creates new growth opportunities in developing markets. The market receives strong support because the pulp and paper industry depends on its ability to provide bleaching solutions. The global market is controlled by key companies, which include INEOS Calabrian Corp., BASF SE, Evonik Industries AG, Aditya Birla Chemicals, Solvay S.A., Esseco USA LLC and Grillo-Werke AG, with Asia-Pacific countries leading in both production and consumption.

Report Coverage

This research report categorizes the Global Sodium Bisulfite Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the sodium bisulfite market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Global Sodium Bisulfite Market Size.

Global Sodium Bisulfite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.75 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.21% |

| 2035 Value Projection: | USD 1.18 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Grade, By End-Use |

| Companies covered:: | INEOS Group Ltd, Evonik Industries AG, BASF SE, Chemtrade Logistics, Aditya Birla Chemicals, Solvay S.A., Esseco USA LLC, Hawkins Inc., LANXESS AG, Grillo-Werke AG, Hydrite Chemical, Merck KGaA, Adisseo France S.A.S., Southern Ionics Inc. and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The Global Sodium Bisulfite Market Size exists because industries need sodium bisulfite to function as a reducing agent, which they use for industrial water treatment. The Asian Pacific region currently experiences a surge in industrial development, which increases demand for bleaching and dye reduction products used in textile, leather, pulp and paper operations. The market experiences growth because processed food producers need food preservatives that increase shelf life, and pharmaceutical companies use antioxidants in their product development. The market develops because companies embrace sustainable chemical production methods, and technological innovations improve product stability.

Restraining Factors

Health risks from exposure, which cause respiratory irritation, together with people using alternative water treatment technologies, which include UV and RO filtration systems, prevent the global sodium bisulfite market from growing. The market faces limitations due to strict environmental regulations and supply chain issues, and the presence of sodium metabisulfite as a substitute for sodium bisulfite creates obstacles to growth.

Market Segmentation

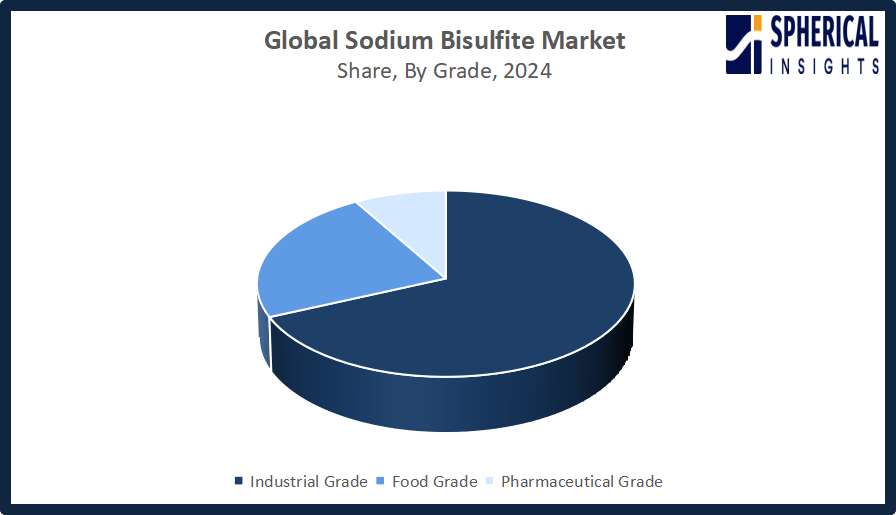

The sodium bisulfite market share is classified into grade and end-use.

- The industrial grade segment dominated the market in 2024, approximately 68% and is projected to grow at a substantial CAGR during the forecast period.

Based on the grade, the Global Sodium Bisulfite Market Size is divided into industrial grade, food grade, and pharmaceutical grade. Among these, the industrial grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The industrial segment of sodium bisulfite covers high-volume applications in water treatment, chemical processing, pulp and paper and textile industries. The company leads the market because customers widely choose its product, which combines technical purity with cost-effective features. The formulations deliver dependable results through their dechlorination, oxygen scavenging, bleaching and reduction capabilities, which provide cost-effective bulk procurement solutions to large-scale operations.

Get more details on this report -

- The water treatment segment accounted for the highest market revenue in 2024, approximately 42% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the Global Sodium Bisulfite Market Size is divided into water treatment, pulp & paper, food & beverages, textiles, pharmaceuticals, and other. Among these, the water treatment segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The water treatment segment dominates the sodium bisulfite market because sodium bisulfite functions as an essential component in municipal dechlorination and industrial wastewater treatment and boiler water conditioning throughout the world. The market leadership of the company depends on three factors, which include the development of municipal infrastructure, the implementation of stricter discharge regulations and the increasing industrial adoption of zero liquid discharge systems that require reliable chemical treatment solutions.

Regional Segment Analysis of the Sodium Bisulfite Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the sodium bisulfite market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the Global Sodium Bisulfite Market Size over the predicted timeframe. The sodium bisulfite market will be 45% share in the Asia Pacific region due to its industrial growth and municipal water treatment system development, and its rising sodium bisulfite requirements in pulp and paper, textile and chemical manufacturing. The two countries that consume most of the product are China and India, whose urbanization and industrial development and dechlorination needs for wastewater treatment drive their consumption. The Southeast Asian nations also participate through their government-backed water management programs and their commitment to environmentally sustainable industrial operations. The Chandrawal water treatment plant in Delhi will start operations in February 2026 to serve more than 3 million people while using sodium bisulfite for dechlorination, which demonstrates both infrastructure development and chemical supply requirements.

North America is expected to grow at a rapid CAGR in the Global Sodium Bisulfite Market Size during the forecast period. The sodium bisulfite market in North America will experience a 28% share of rapid growth owing to strict environmental regulations, wastewater treatment requirements, municipal water treatment facilities and industrial facilities that are now implementing zero liquid discharge systems. The United States leads regional demand because its chemical, pulp and paper and food processing sectors drive market needs. The consumption increases because of infrastructure upgrades and Clean Water Act compliance requirements. The U.S. EPA announced in March 2025 its intention to update 2024 wastewater regulations, which will apply to coal-fired power plants while establishing affordable, reliable electricity standards and Clean Water Act discharge limit reassessments.

Europe's sodium bisulfite market experiences continuous expansion because of growing environmental regulations and increasing needs from water treatment operations, pulp and paper manufacturing, and textile production. The three leading countries for sodium bisulfite consumption in Europe are Germany, France and the UK, which benefit from sewage treatment plant upgrades and efforts to decrease industrial wastewater discharge. The EU's 'One Substance One Assessment' regulations, which will begin on 1 January 2026, establish standardized chemical assessment procedures that enhance transparency and deliver consistent results, which will affect market entry and regulatory compliance for industrial chemicals, sodium bisulfite included, that are used in dechlorination, bleaching, and chemical processing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Global Sodium Bisulfite Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- INEOS Group Ltd

- Evonik Industries AG

- BASF SE

- Chemtrade Logistics

- Aditya Birla Chemicals

- Solvay S.A.

- Esseco USA LLC

- Hawkins Inc.

- LANXESS AG

- Grillo-Werke AG

- Hydrite Chemical

- Merck KGaA

- Adisseo France S.A.S.

- Southern Ionics Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, Solvay partnered with ENOWA to develop the world’s first carbon-neutral soda ash facility in NEOM, Saudi Arabia. Pending feasibility studies and approvals, operations are planned by 2030. The plant will support ENOWA’s Water Sustainability Strategy and NEOM’s zero-liquid discharge water management goals.

- In September 2025, Southern Ionics announced a $34 million expansion in Tuscaloosa, Alabama, boosting sodium bisulfite production, adding infrastructure, and introducing sodium metabisulfite. Operational since 1994, the facility serves water treatment, food, chemicals, and pharmaceuticals. Construction began in Q4 2025 to enhance supply for dechlorination and industrial applications.

- In January 2025, the EU’s Urban Waste Water Treatment Directive (Recast 2024/3019) took effect, introducing stricter requirements for micropollutant removal and advanced treatment in municipal wastewater plants. Member states must update national laws by mid-2027, driving adoption of enhanced treatment and dechlorination solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Global Sodium Bisulfite Market Size based on the below-mentioned segments:

Global Sodium Bisulfite Market, By Grade

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

Global Sodium Bisulfite Market, By End-Use

- Water Treatment

- Pulp & Paper

- Food & Beverages

- Textiles

- Pharmaceuticals

- Other

Global Sodium Bisulfite Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the sodium bisulfite market over the forecast period?The global sodium bisulfite market is projected to expand at a CAGR of 4.21% during the forecast period.

-

2.What is the global sodium bisulfite market?The global sodium bisulfite market involves the production and sale of sodium bisulfite used in water treatment, chemicals, and industries.

-

3.What is the market size of the sodium bisulfite market?The global sodium bisulfite market size is expected to grow from USD 0.75 billion in 2024 to USD 1.18 billion by 2035, at a CAGR of 4.21% during the forecast period 2025-2035.

-

4.Which region holds the largest share of the sodium bisulfite market?Asia Pacific is anticipated to hold the largest share of the sodium bisulfite market over the predicted timeframe.

-

5.Who are the top 10 companies operating in the global sodium bisulfite market?INEOS Group Ltd, Evonik Industries AG, BASF SE, Chemtrade Logistics, Aditya Birla Chemicals, Solvay S.A., Esseco USA LLC, Hawkins Inc., LANXESS AG, Grillo-Werke AG, and Others.

-

6.What factors are driving the growth of the sodium bisulfite market?The drivers include increasing water treatment (dechlorination) demands, food preservation needs, textile industry bleaching, pharmaceutical applications, and rapid industrialization, specifically within the Asia-Pacific region.

-

7.What are the market trends in the sodium bisulfite market?Market trends include increasing water treatment demand, strict discharge regulations, industrial growth, zero liquid discharge adoption, and expanding chemical applications globally.

-

8.What are the main challenges restricting wider adoption of the sodium bisulfite market?Key challenges restricting sodium bisulfite market adoption include health-related exposure risks (respiratory/skin issues), strict environmental regulations, competition from UV/RO water treatment technologies, and supply chain disruptions affecting raw material availability.

Need help to buy this report?