Global SMO254 Market Size, Share, and COVID-19 Impact Analysis, By Sales Channel (Direct Sale and Indirect Sale), By End User (Oil & Gas, Saltwater Treatment, Flue Gas Desulfurization (FGD) Systems, Chemical Processing, Pulp & Paper, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Advanced MaterialsGlobal SMO254 Market Size Insights Forecasts to 2035

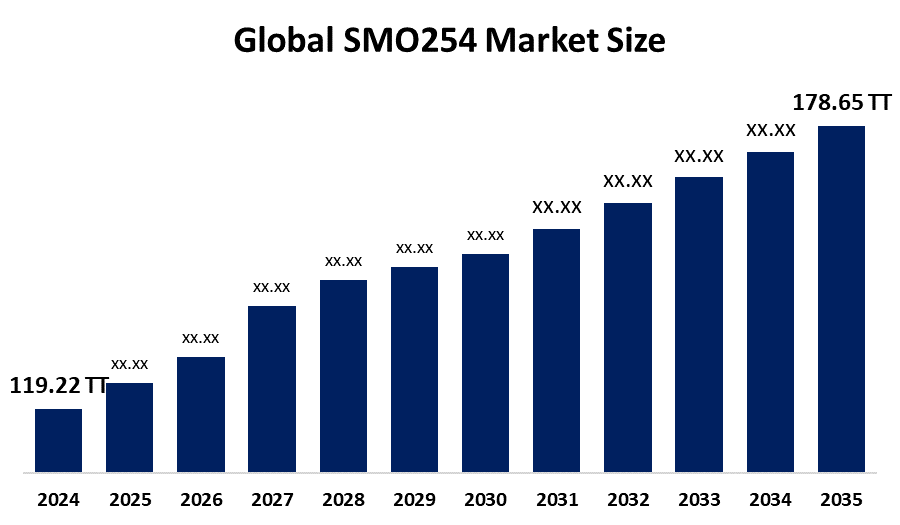

- The Global SMO254 Market Size Was Valued at USD 119.22 Thousand Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.75 % from 2025 to 2035

- The Worldwide SMO254 Market Size is Expected to Reach USD 178.65 Thousand Tonnes by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global SMO254 Market Size was worth around USD 119.22 Thousand Tonnes in 2024 and is predicted to Grow to around USD 178.65 Thousand Tonnes by 2035 with a compound annual growth rate (CAGR) of 3.75 % from 2025 to 2035. Analyzing linguistic patterns, automating communication, strengthening computational models, advancing NLP applications, facilitating accurate syntax processing, and assisting AI-driven language research are some of the potential opportunities presented by the SMO254 market

Market Overview

The global commerce, manufacturing, and use of 254 SMO (UNS S31254), a super-austenitic stainless steel alloy known for its remarkable resistance to pitting, crevice corrosion, and chloride-induced stress cracking, are all included in the SMO254 market. It performs exceptionally well in harsh situations such as offshore oil and gas, chemical processing, desalination facilities, and pulp and paper industries due to its high molybdenum (6%), nitrogen, and chromium content. It also offers better mechanical strength and weldability than standard grades. According to India’s Ministry of Steel launched the third PLI 1.2 scheme on November 4, 2025, aiming to attract RS.44,000 crore in specialty steel investments, including high-alloy 254 SMO, boosting domestic production. The desalination and offshore oil and gas industries, which require materials that can endure extreme seawater exposure without degrading, are the primary drivers of the market.

Report Coverage

This research report categorizes the SMO254 market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the SMO254 market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the SMO254 market.

Global SMO254 Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 119.22 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.75% |

| 2035 Value Projection: | USD 178.65 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Sales Channel, By End User and COVID-19 Impact Analysis |

| Companies covered:: | JN Special Alloy Technology Co., Ltd., Outokumpu, Dhanwant Metal Corporation, Metallica Metals India, Sandvik AB, Sanyo Special Steel Co., Ltd., Aperam S.A., Sagar Steel Corporation, Taashvi Special Alloys, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The alloy's remarkable resistance to stress corrosion cracking caused by chloride, increasing global investment in seawater desalination infrastructure, is a key growth driver for the SMO254 market. The increasing need for high-performance specialty steels, such as SMO254, in sectors including chemical processing, marine engineering, and aerospace, promotes accurate modeling and optimization using formal languages. The need to increase domestic output and decrease imports encourages the use of sophisticated modeling for investment planning and supply chain efficiency. Additionally, developments in data analytics, machine learning, and artificial intelligence improve the marketability of formal language applications.

Restraining Factors

The SMO254 specialty steel market's expansion is restricted by high production costs, scarce raw materials, complicated manufacturing procedures, a shortage of skilled labor, regulatory obstacles, and a sluggish adoption of formal language-based market modeling.

Market Segmentation

The SMO254 market share is classified into sales channel and end user.

- The direct sale segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the sales channel, the SMO254 market is divided into direct sale and indirect sale. Among these, the direct sale segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Direct sales enable suppliers to forge closer ties with important sectors, including chemical processing, oil and gas, maritime, and flue gas desulfurization systems, all of which need high-alloy specialty steels like 254 SMO.

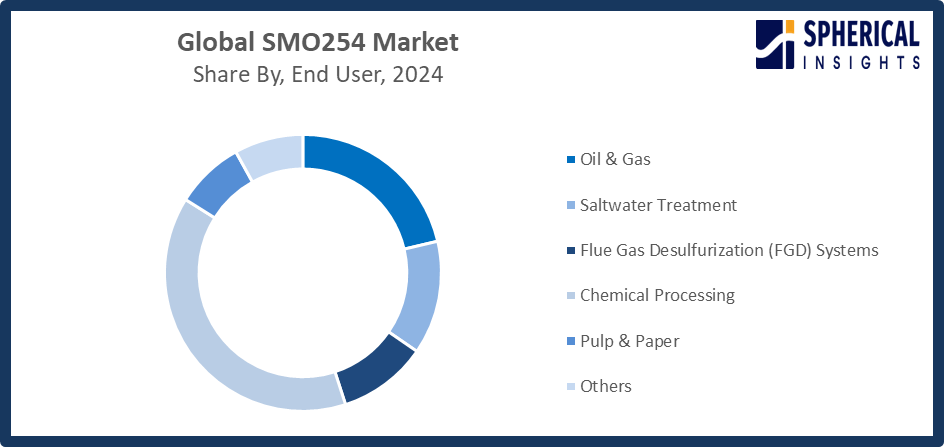

- The chemical processing segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the SMO254 market is divided into oil & gas, saltwater treatment, flue gas desulfurization (FGD) systems, chemical processing, pulp & paper, and others. Among these, the chemical processing segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The strong demand for corrosion-resistant, high-alloy steels like 254 SMO, which are necessary for managing harsh chemicals, acids, and high-temperature procedures, is the reason for the chemical processing industry.

Get more details on this report -

Regional Segment Analysis of the SMO254 Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the SMO254 market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the SMO254 market over the predicted timeframe. High-performance, corrosion-resistant alloys like 254 SMO are needed in the chemical processing, petrochemical, maritime, and aerospace industries, which are the main drivers of the region's dominance. Market expansion is also supported by the growing number of industrial facilities and government programs to increase domestic steel production. According to China's strategy, which places a strong emphasis on market-driven capacity increases, regional output is predicted to increase by 15% by 2027, and SMO254 demand rises in offshore wind and desalination projects. Duty protections and other import reduction measures implemented by India from August 1, 2025, have encouraged local investments in specialty steel factories totaling more than RS.10,000 crore.

North America is expected to grow at a rapid CAGR in the SMO254 market during the forecast period. The use of formal language-based computational modeling to optimize production, supply chain management, and market analysis is growing as a result of industrial automation and digitalization projects. Precise scenario simulations and predictive analytics are made possible by the structured representation of market factors, investment planning, and risk assessment made possible by formal languages. In order to protect American production of sophisticated alloys like SMO254 and to align with the USD 1.2 trillion pipeline of the Infrastructure Investment and Jobs Act, the U.S. Department of Commerce strengthened Section 232 tariffs in early 2025, placing 25% levies on some imports.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the SMO254 market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- JN Special Alloy Technology Co., Ltd.

- Outokumpu

- Dhanwant Metal Corporation

- Metallica Metals India

- Sandvik AB

- Sanyo Special Steel Co., Ltd.

- Aperam S.A.

- Sagar Steel Corporation

- Taashvi Special Alloys

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, Aperam S.A. launched its acquisition of Universal Stainless & Alloy Products, strengthening SMO254 production capabilities and global supply, enhancing aerospace, industrial, and energy sector solutions through combined expertise and distribution.

- In December 2024, Nippon Yakin Kogyo launched its upgraded Kawasaki cold rolling mill, boosting SMO254 and other high-alloy steel production, improving quality, efficiency, and meeting growing chemical and environmental sector demand.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the SMO254 market based on the below-mentioned segments:

Global SMO254 Market, By Sales Channel

- Direct Sale

- Indirect Sale

Global SMO254 Market, By End User

- Oil & Gas

- Saltwater Treatment

- Flue Gas Desulfurization (FGD) Systems

- Chemical Processing

- Pulp & Paper

- Others

Global SMO254 Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the SMO254 market over the forecast period?The global SMO254 market is projected to expand at a CAGR of 3.75% during the forecast period.

-

2. What is the market size of the SMO254 market?The global SMO254 market size is expected to grow from USD 119.22 thousand tonnes in 2024 to USD 178.65 thousand tonnes by 2035, at a CAGR of 3.75 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the SMO254 market?Asia Pacific is anticipated to hold the largest share of the SMO254 market over the predicted timeframe.

-

4. Who are the top companies operating in the global SMO254 market?JN Special Alloy Technology Co., Ltd., Outokumpu, Dhanwant Metal Corporation, Metallica Metals India, Sandvik AB, Sanyo Special Steel Co., Ltd., Aperam S.A., Sagar Steel Corporation, Taashvi Special Alloys, and Others.

-

5. What factors are driving the growth of the SMO254 market?Rising demand in chemical, marine, and aerospace industries, government initiatives, automation, digitalization, AI-based predictive analytics, quality standards, and supply chain optimization drive SMO254 market growth.

-

6. What are the market trends in the SMO254 market?Increasing adoption of high-alloy specialty steels, investment in domestic production, digitalized manufacturing, AI-driven modeling, eco-friendly production, and focus on reducing imports are key trends shaping the SMO254 market.

-

7. What are the main challenges restricting the wider adoption of the SMO254 market?Wider SMO254 usage is hampered by high production costs, scarce raw materials, complicated manufacturing procedures, a lack of specialized workforce, regulatory obstacles, and a sluggish acceptance of formal language-based market modeling.

Need help to buy this report?