Global SMD LEDs Market Size, Share, and COVID-19 Impact Analysis, By Type (Standard SMD LEDs, High-Power SMD LEDs, and Ultra-High Power SMD LEDs), By Color (Red SMD LEDs, Green SMD LEDs, Blue SMD LEDs, White SMD LEDs, and RGB SMD LEDs), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Semiconductors & ElectronicsGlobal SMD LEDs Market Insights Forecasts To 2035

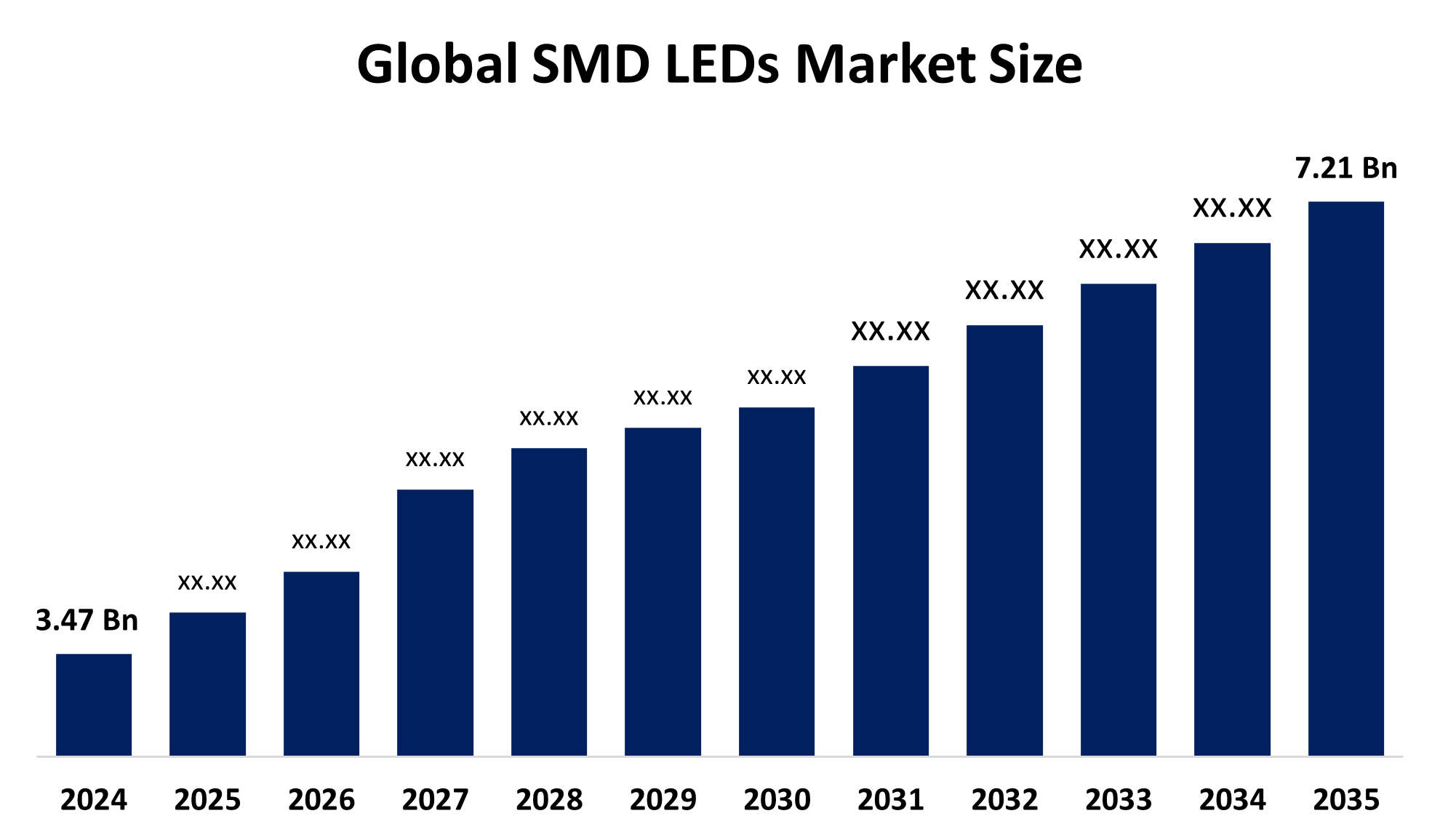

- The Global SMD LEDs Market Size Was Estimated at USD 3.47 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.87% from 2025 to 2035

- The Worldwide SMD LEDs Market Size is Expected to Reach USD 7.21 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global SMD LEDs Market Size was worth around USD 3.47 Billion in 2024 and is Predicted To Grow to around USD 7.21 Billion by 2035 with a compound annual growth rate (CAGR) of 6.87% from 2025 to 2035. The widespread adoption of energy-efficient lighting solutions, developments in LED technology, and rising demand across a range of application categories are the main drivers of this strong growth. SMD LEDs are increasingly being chosen because of their small size, high efficiency, and extended operating life as both consumers and businesses gradually move towards sustainable and energy-efficient solutions.

Market Overview

The global SMD LEDs market refers to the surface-mounted light-emitting diodes that are utilised in electronics, automotive, signage, and lighting applications, providing a compact form, great brightness, energy economy, and varied functionality across multiple industries. The market for SMD LEDs is expanding rapidly on a global scale because of their high performance, applicability across industries, and versatility. Consumer electronics, vehicle lighting, architectural illumination, and healthcare applications all make extensive use of these surface-mounted LEDs. Technological developments are making SMD LEDs acceptable for small, high-performance devices by improving colour rendering, thermal management, and miniaturisation. Particularly in smart city and urban planning projects, the combination of smart lighting technologies with IoT is a major development driver since it enables remote control, improved energy efficiency, and increased convenience.

Innovations like the NSSM237B Full-Colour RGB SMD LED with Lens, which is designed for big outdoor displays, were introduced by Nichia. The novel lens design improves downhill dispersion while reducing upward light pollution. It overcomes the size and weight constraints of conventional through-hole LEDs and offers excellent brightness and low power consumption. SMD LEDs enhance visual quality in displays and backlighting in consumer electronics, while they also improve safety and aesthetics in the automotive industry. Their contribution to diagnostic instruments and medical lighting assists the healthcare sector. The market for SMD LEDs is expected to increase significantly on a global scale due to the growing need for energy-efficient, multipurpose, and compact lighting solutions, as well as prospects in developing nations driven by the construction of infrastructure.

A top-tier SMD LED in the 1,040–1,900 nm short-wavelength infrared (SWIR) band was introduced by DOWA (Japan) in 2025. Available in a 5 mm square shape, with a 3 mm version in development, it offers 36% more radiant power at 1,460 nm and 46% more at 1,300 nm.

Report Coverage

This research report categorizes the SMD LEDs market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the SMD LEDs market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the SMD LEDs market.

Driving Factors

Rising demands for energy efficiency-driven by tighter governmental constraints and sustainability commitments-continues to spur the SMD LED market. The growth of automotive applications, around electric vehicles-increases usage in headlights and interiors. Smart city initiatives are accelerating rollouts of connected LED streetlights. Meanwhile, the changing consumer electronics and entertainment sectors provide a rise in demand for advanced display technologies. Lower manufacturing prices are enabling price-sensitive sectors, like general lighting, to purchase LEDs. Additionally, IoT integration and industrial automation provide opportunities for sensor and machine vision, while also growing environmental awareness supports consumers and businesses in adopting eco-friendly practices.

Restraining Factors

The SMD LED market faces a multitude of challenges, such as intense price competition, rapid obsolescence of technology, and quality control issues that impact reliability. Geopolitical uncertainty and a complex global supply chain can cause disruption in sourcing, while integration issues hinder retrofit adoption. The additional burden of compliance with numerous regulatory requirements creates additional costs and delays, and makes it especially difficult for small companies to compete in a changing market.

Market Segmentation

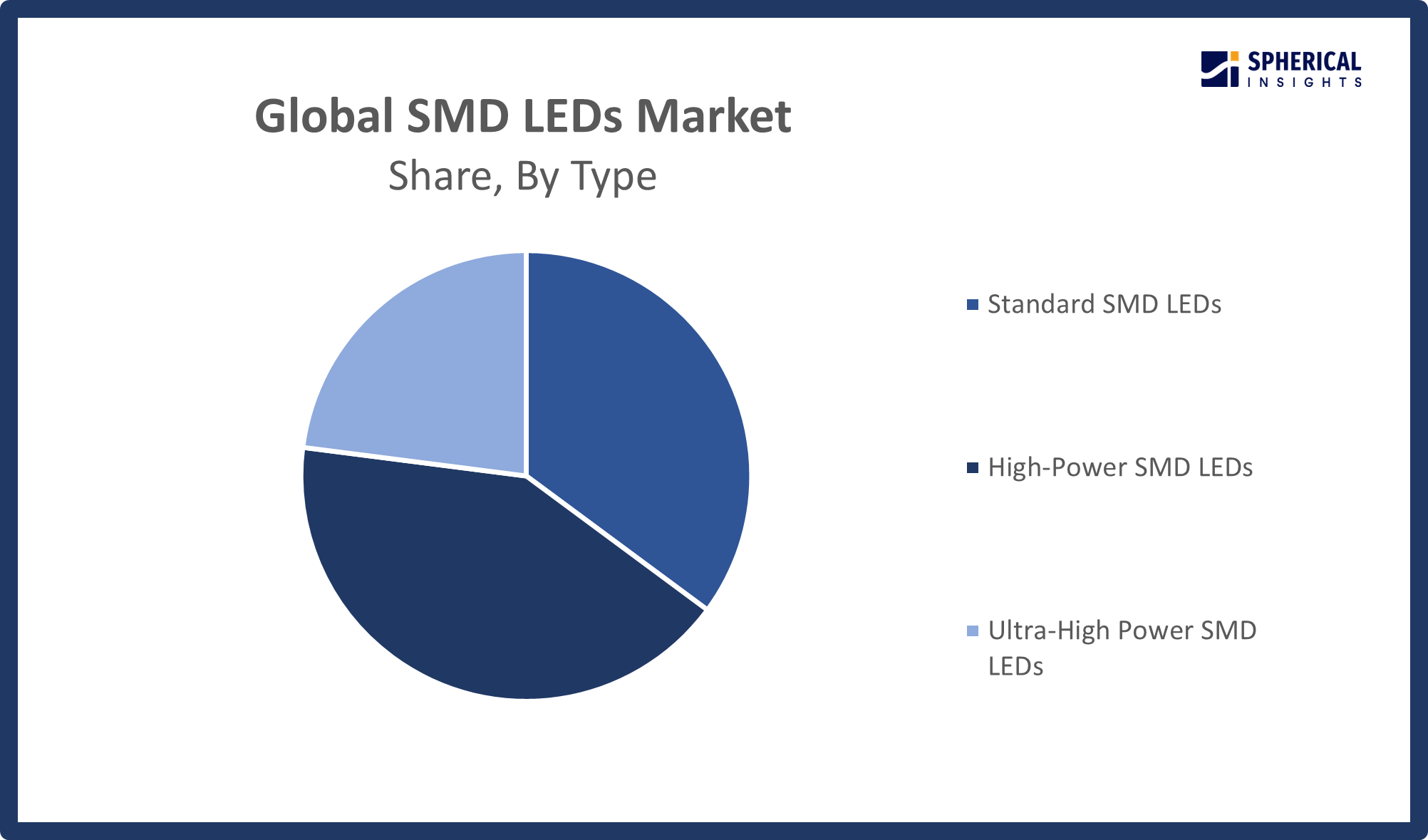

The SMD LEDs market share is classified into type and color.

- The high-power SMD LEDs segment dominated the market in 2024 with approximately 40.5% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the SMD LEDs market is divided into standard SMD LEDs, high-power SMD LEDs, and ultra-high-power SMD LEDs. Among these, the high-power SMD LEDs segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Applications including street lighting, vehicle illumination, and large-scale display systems that demand greater brightness and efficiency are better served by high-power SMD LEDs. Their dominant position in the industry is a result of their capacity to execute exceptionally well under pressure.

Get more details on this report -

- The white SMD LEDs segment accounted for the largest share in 2024, approximately 60% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the color, the SMD LEDs market is divided into red SMD LEDs, green SMD LEDs, blue SMD LEDs, white SMD LEDs, and RGB SMD LEDs. Among these, the white SMD LEDs segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The primary factor for their supremacy is their widespread application in backlighting applications, automotive lighting, and general lighting. White LEDs are utilized in several lighting applications because of their high brightness, energy efficiency, and flexibility. Thus, it is anticipated that the white SMD LEDs market will continue to grow due to rising demand for energy-saving lighting options and advances in LED technology.

Regional Segment Analysis of the SMD LEDs Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share with approximately 41% of the SMD LEDs market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the SMD LEDs market over the predicted timeframe. The Asia Pacific region is anticipated to dominate the worldwide SMD LEDs market due to its strong manufacturing infrastructure, technical developments, and rising demand across important applications, including general lighting, consumer electronics, and automotive. With the help of government programs encouraging energy-efficient lighting and smart city initiatives, nations like China, Japan, South Korea, and India are spearheading this trend. The region's market dominance and growth prospects are being further reinforced by rising industrialisation, urbanisation, and the adoption of cutting-edge display technology.

North America is expected to grow market share with approximately 21.8% at a rapid CAGR in the SMD LEDs market during the forecast period. Benefits from strict energy regulations and a strong emphasis on sustainability, which are incentivising the adoption of LED lighting solutions. The market in North America is driven by the growing demand for energy-efficient lighting in commercial and residential spaces, as well as the automotive sector's shift towards electric and autonomous vehicles.

Europe is expected to grow at a rapid CAGR in the SMD LEDs market during the forecast period. Increasing demand for smart lighting systems and energy efficient lighting alternatives for commercial, industrial, and residential applications. The increasing application of SMD LEDs in automotive displays, along with government initiatives advocating for sustainability, is accelerating market growth. The strong potential for market development in Europe is also proactively driven from growing urbanisation and advances in technology.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the SMD LEDs market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bridgelux

- Inc EVERLIGHT

- ITW Group

- Sun Top Electronics

- Philips Lighting

- Nichia

- SAMSUNG

- EPISTAR

- Cree

- Osram

- LG Innotek

- Toyoda Gosei

- Semileds

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, Okeli Lighting introduced deep anti-glare downlights, trimless adjustable tiny spotlights, and incredibly thin SMD panel lights. High-end commercial and residential lighting with improved aesthetics and energy-saving features is the target market for these products.

- In May 2025, A short-wavelength infrared (SWIR) SMD LED with a wavelength range of 1,040–1,900 nm was introduced by DOWA (Japan) and provides up to 46% more radiant power for semiconductor wafer inspection applications.

- In January 2024, Nichia, the world’s largest LED manufacturer and inventor of high-brightness blue and white LEDs, is launching a full-colour RGB SMD LED with a lens aimed at contributing to a more environmentally friendly society.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the SMD LEDs market based on the below-mentioned segments:

Global SMD LEDs Market, By Type

- Standard SMD LEDs

- High-Power SMD LEDs

- Ultra-High Power SMD LEDs

Global SMD LEDs Market, By Color

- Red SMD LEDs

- Green SMD LEDs

- Blue SMD LEDs

- White SMD LEDs

- RGB SMD LEDs

Global SMD LEDs Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the SMD LEDs market over the forecast period?The global SMD LEDs market is projected to expand at a CAGR of 6.87% during the forecast period.

-

2. What is the market size of the SMD LEDs market?The global SMD LEDs market size is expected to grow from USD 3.47 Billion in 2024 to USD 7.21 Billion by 2035, at a CAGR of 6.87% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the SMD LEDs market?Asia Pacific is anticipated to hold the largest share of the SMD LEDs market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global SMD LEDs market?Bridgelux, Inc EVERLIGHT, ITW Group, Sun Top Electronics, Philips Lighting, Nichia, SAMSUNG, EPISTAR, Cree, and Osram, and Others.

-

5. What factors are driving the growth of the SMD LEDs market?Rising energy efficiency requirements, growing automotive applications, developing smart lighting infrastructure, and developments in display technologies are the main factors propelling the SMD LEDs market. Significant market expansion is also being supported by rising industrial automation, falling production costs, and more environmental consciousness, all of which are promoting adoption in the commercial, industrial, and residential sectors.

-

6. What are the market trends in the SMD LEDs market?The integration of smart technologies (IoT/AI), energy efficiency, miniaturisation with high brightness, government incentives encouraging use, and quick growth in emerging regions are some of the market trends for SMD LEDs. All of these elements work together to spur innovation and the global adoption of SMD LEDs.

-

7. What are the main challenges restricting wider adoption of the SMD LEDs market?The market for SMD LEDs is hampered by a number of factors, including fierce price rivalry, quick technological obsolescence, problems with quality control, intricate supply chains, technical integration, and strict regulatory compliance.

Need help to buy this report?