Global Smart Payments Market Size, Share, and COVID-19 Impact Analysis, By Type (Internet Payment, Mobile Payment), By End-user (Retail, Transportation, Hospital, Media and Entertainment, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Electronics, ICT & MediaGlobal Smart Payments Market Insights Forecasts to 2032

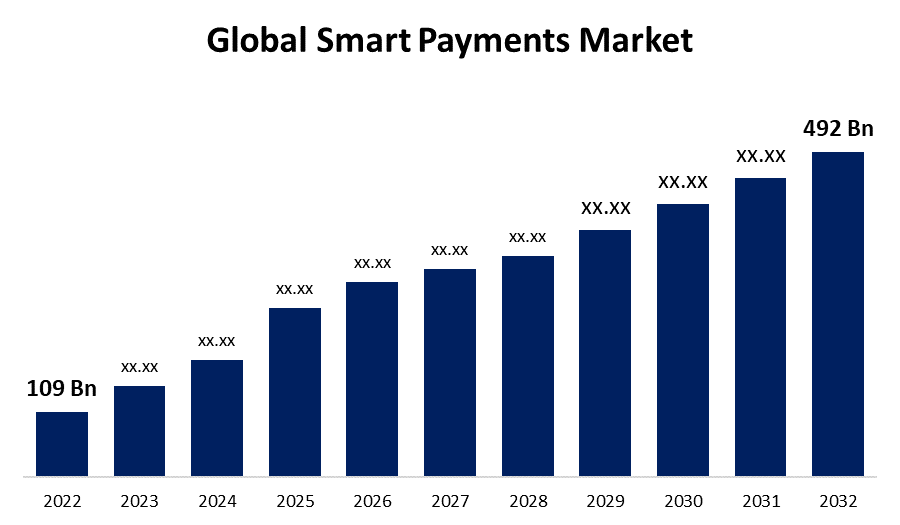

- The Global Smart Payments Market Size was Valued at USD 109 Billion in 2022.

- The Market Size is Growing at a CAGR of 16.27% from 2022 to 2032

- The Worldwide Smart Payments Market Size is Expected to Reach USD 492 Billion by 2032

- North America is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Smart Payments Market Size is Anticipated to Exceed USD 492 Billion by 2032, Growing at a CAGR of 16.27% from 2022 to 2032.

Market Overview

Smart payments are those that are completed automatically by using contemporary technology like machine learning algorithms and artificial intelligence. Instead of using conventional ways, it enables clients to complete payments via smart platforms. To improve the effectiveness, security, and convenience of financial transactions, smart payments employ a variety of safe, data-driven digital payment methods. In the dynamic world of modern finance, they play a crucial role in benefiting people, businesses, and entire economies. Convenience, security, technology breakthroughs, shifting consumer behavior, and changing corporate practices are driving the demand for smart payments. The adoption of smart payment systems is expected to increase as these elements change, transforming the way financial transactions are carried out on a worldwide scale. Using smartphones or wearables as payment instruments is one of the most crucial components of smart payments. With mobile payment apps, customers may perform transactions by tapping, scanning, or using biometric authentication, all while keeping their payment information secure. This makes making payments simpler and more comfortable because you won't need to carry a physical wallet or credit card.

Report Coverage

This research report categorizes the market for the global smart payments market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global smart payments market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global smart payments market.

Global Smart Payments Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 109 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 16.27% |

| 2032 Value Projection: | USD 492 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-user, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | American Express Company, Apple Inc., Google LLC, MasterCard, One Communication Limited, PayPal Holdings Inc., Samsung, Amazon.com, Inc., Square. Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The marketplace is expanding because to government measures supporting digital transactions, the expansion of e-commerce, and the growing demand for smartphones and internet connectivity. The industry for smart payments has been greatly impacted by technological advancements. This includes advancements in safe authentication techniques, tokenization, and encryption that improve the security of online transactions. Furthermore, the advancement of distributed ledger technology and blockchain has made it possible for transactions to be more transparent and safer, making cryptocurrencies like Ethereum and Bitcoin acceptable forms of payment.

Restraining Factors

Smart payments are subject to technical problems or outages, just like any other program that depends on technology. Even though tech maintenance tasks are planned ahead of time and frequently take place at night, online shoppers may occasionally find them annoying. High bounce rates are a problem for many organizations, especially when it happens suddenly. Smart Payments might not spread as quickly in places with slow internet or inadequate network coverage. Security plays a major role in smart payments because users need to feel secure knowing that their financial information is protected. The potential for security breaches or fraud occurrences to erode consumer confidence could impede the adoption of smart payment.

Market Segmentation

The Global Smart Payments Market share is classified into type and end-user.

- The mobile payment segment is expected to hold the largest share of the global smart Payments market during the forecast period.

Based on type, the global smart payment market is bifurcated into internet payment, mobile payment. Among these, the mobile payment segment accounted for the largest market share and is expected to continue this pattern over the forecast period. The world's network infrastructure has advanced dramatically, and the use of smartphones is growing. Due to high-speed internet connectivity, a variety of shops may provide their customers with mobile-based payment alternatives. The fact that everyone in the current situation has a phone on which they can conveniently use smart payment and protect their privacy is the other reason.

- The retail segment is expected to hold the largest share of the global smart payments market during the forecast period.

Based on the end-user, the global smart payments market is divided into retail, transportation, hospital, media and entertainment, and others. Among these, the retail segment is expected to hold the largest share of the global smart payments market during the forecast period. The growth of the mobile market, which enables consumers to make payments online, is the cause of this. This promoted digital transactions, and consumers are now adopting intelligent payment systems for regular bill payments and product purchases. Customers are encouraged to use smart payments on a regular basis by the many benefits of digital payments, which include the elimination of cash transactions, ease of use, special offers, security from theft, and many more.

Regional Segment Analysis of the Global Smart Payments Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

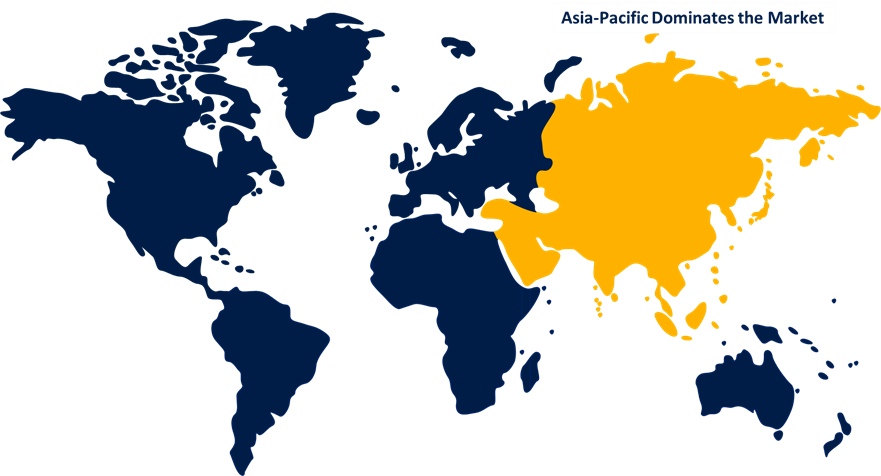

Asia-Pacific is anticipated to hold the largest share of the global Smart Payments market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is projected to hold the largest share of the global smart payments market over the predicted years. Regional market expansion is expected to be driven by changing lifestyles, evolving online purchasing habits, and increasing smartphone penetration over the forecast period. The increasing number of government initiatives in the Asia Pacific region to implement cashless payment systems is expected to create opportunities for local market growth. The growing uptake of mobile technology in emerging economies has given fintech companies and banks a new way to reach underserved and unbanked customers in rural areas with mobile banking products. The Bharat Interface for Money (BHIM) app and the Unified Payments Interface (UPI) are only two of the policies and initiatives the Indian government has put in place to increase the accessibility and usability of digital payments.

North America is expected to grow at the fastest pace in the global smart payments market during the forecast period. This is because the region adopted cutting-edge technologies at an early stage. The increase in unmanned retail locations in the US is another factor driving the acceptance of smart payments. Due to the growth of the e-commerce industry, mobile payment systems are widely used in North America.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global smart payments along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- American Express Company

- Apple Inc.

- Google LLC

- MasterCard

- One Communication Limited

- PayPal Holdings Inc.

- Samsung

- Amazon.com, Inc.

- Square. Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, Verizon Business looked into collaborating with Mastercard and First National Bank of Omaha (FNBO) to launch a credit card that would benefit small business owners. Businesses with less than 100 connections and an online account can apply for the Verizon Business Mastercard. When using the card, each completed transaction will result in the accumulation of reward points.

- In December 2021, The Mi Smart Band 6, a cutting-edge device created in partnership with MasterCard and including the vital capability to conduct contactless payments at terminals that enable MasterCard transactions, was formally unveiled by Xiaomi.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Smart Payments Market based on the below-mentioned segments:

Global Smart Payments Market, By Type

- Internet Payment

- Mobile Payment

Global Smart Payments Market, By End User

- Retail

- Transportation

- Hospital

- Media and Entertainment

- Others

Global Smart Payments Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within market?American Express Company, Apple Inc., Google LLC, MasterCard, One Communication Limited, PayPal Holdings Inc., Samsung, Amazon.com, Inc., Square. Inc., and others.

-

2. Which region is holding the largest share of market?Asia-Pacific is anticipated to hold the largest share of the global smart payments market over the predicted timeframe.

Need help to buy this report?