Global Smart Building Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution and Service), By Solution (Energy Management, Network Management, Safety & Security Management, Building Infrastructure Management, and Integrated Workplace Management System), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Construction & ManufacturingGlobal Smart Building Market Insights Forecasts to 2035

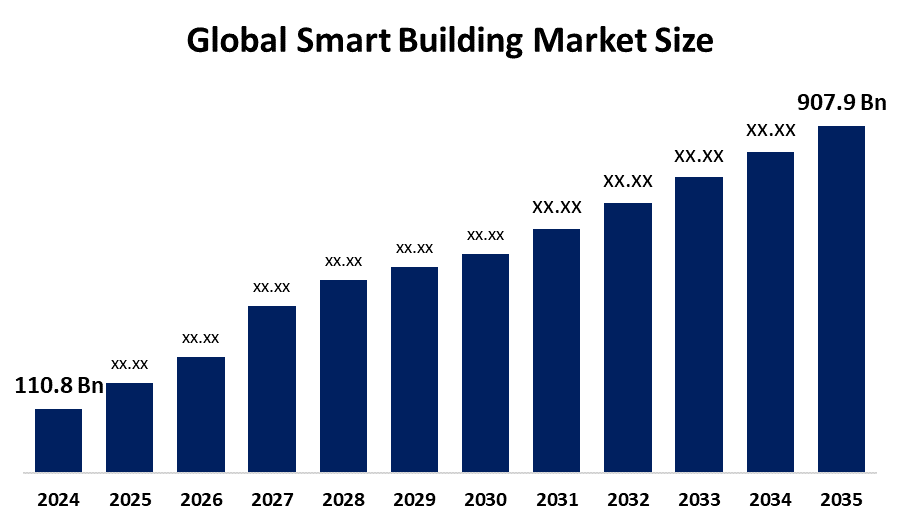

- The Global Smart Building Market Size Was Estimated at USD 110.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 21.07% from 2025 to 2035

- The Worldwide Smart Building Market Size is Expected to Reach USD 907.9 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Smart Building Market Size was worth around USD 110.8 Billion in 2024 and is predicted to grow to around USD 907.9 Billion by 2035 with a compound annual growth rate (CAGR) of 21.07% from 2025 and 2035. The market for smart building has a number of opportunities to grow due to growing demand for sustainability and energy efficiency as a result of government incentives and tougher building regulations. Furthermore, real time monitoring, automation, and predictive maintenance are made possible by developments in IoT, AI, sensors, and cloud analytics, which enhance operational security, comfort, and efficiency.

Market Overview

A smart building monitors, controls, and optimizes systems like ventilation, lighting, heating, and security using networked sensors, automation, Internet of Things devices, and data analytics. The intricate control systems utilized by smart buildings consist of sensors, actuators, and microchips for controlling several functions of a building, such as heating, cooling, ventilation, lighting, and more. The industry is being driven by the ability of these buildings to support reduced operating costs, tenant management, security management, and building performance management. Additionally, the growth of 5G technology combined with new initiatives in smart cities will provide very profitable opportunities for the development of the industry. For instance, a new research center was opened up by the Department of the Built Environment at the National University of Singapore in December 2021 to support the development of 5G technologies, promote training in 5 G-enabled smart facilities management, and expand the digital capacity of Singapore’s construction industry. The utilization of smart building technologies can be found in many homes and buildings to reduce energy usage. For example, ABB assisted in the construction of the New Development Bank in Shanghai by implementing a smart building control system that included management of over 8000 control circuits to regulate the management of windows, electric curtains, and interior lighting. Creating connected buildings is the first step in the development of smart city initiatives, principally because once installed, the New Development Bank saved 15% or more energy than conventional systems.

Governments throughout the world are launching a number of initiatives to expand the market for smart buildings. For instance, India's Smart Cities Mission provides funding for smart solutions, infrastructure improvements, and area-based retrofitting to promote sustainable urban growth. Through optional star ratings and labeling for both residential and commercial structures, the National Policy Roadmap for home Automation Technologies from India's Bureau of Energy Efficiency, on the other hand, encourages energy efficient building and house designs.

Report Coverage

This research report categorizes the smart building market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the smart building market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the smart building market.

Global Smart Building Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 110.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 21.07% |

| 2035 Value Projection: | USD 907.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Component and By Region |

| Companies covered:: | Siemens AG, Honeywell International Inc., Johnson Controls, Schneider Electric, ABB Ltd., IBM Corporation, Cisco Systems, Inc., Legrand SA, Hitachi, Ltd., United Technologies Corporation, Verdigris Technologies, BuildingIQ, Delta Controls, Bosch Security Systems, Huawei Technologies Co. Ltd, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The smart building market is driven by the increasingly concerning global energy consumption is expected to fuel the growth of smarter, more energy efficient equipment. For example, according to a 2019 study by IBM Corporation on IoT and smart buildings, business and residential buildings use half of the world's energy and water. The analysis concludes that by the end of 2025, buildings will reach their maximum energy consumption. Likewise, as stated in the Schneider Electric Whitepaper, buildings account for 36% of carbon emissions, an overconsumption and waste of efficiency leads to significantly higher operational and maintenance costs.

Restraining Factors

The smart building market is restricted by factors like the increasing frequency of cyberattacks. Each piece of equipment and system in the building is equipped with smart technology at times; it could instead be a disclosure of confidential and sensitive information being hacked.

Market Segmentation

The smart building market share is classified into components and solutions.

- The solution segment dominated the market in 2024, accounting for approximately 76% and is projected to grow at a substantial CAGR during the forecast period.

Based on the component, the smart building market is divided into solution and service. Among these, the solution segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven as this product category refers to advanced technologies whose primary focus is concerning preventing threats and occupant safety, biometric systems, video management, emergency communications, access control with AI-enabled benefits, and cybersecurity. The market is driven by mobile based credentialing preferences, the ongoing convergence of life safety and operational systems, the increasing use of IoT and AI for predictive operations and building management, and stricter life-safety and sustainability measures in pre design and construction.

- The safety & security management segment accounted for the largest share in 2024, accounting for approximately 20% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the solution, the smart building market is divided into energy management, network management, safety & security management, building infrastructure management, and an integrated workplace management system. Among these, the safety & security management segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to this category includes technologies where danger mitigation and occupant safety are critical, like biometric systems, video surveillance, emergency communication, AI enhanced access control, and cybersecurity solutions. Drivers include the growing demand for integrated systems that integrate safety, security, and emergency response, the use of AI and IoT for predictive security intelligence, the development of mobile credentials for seamless access, and the increased regulatory emphasis on building safety requirements.

Regional Segment Analysis of the Smart Building Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 34% of the smart building market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share, representing nearly 34% of the smart building market over the predicted timeframe. In the North American market, the market is rising due to the increased private and public funding, as well as the rapid adoption of digitalization in business, industrial, and residential occupancies. Additional enhancements in building systems regionally, in the areas of automation, energy efficiency, and security systems, are occurring through heightened integration of IoT technology and Internet based advances in digital infrastructure.

The U.S. smart building industry led the way in 2024 largely due to large government investments in digital infrastructure intended to speed up the country's transition to a digital economy. In order to ensure service transparency and enhance citizen experiences, the U.S. government is working hard to digitize commercial buildings. In order to benefit from advanced technologies for energy efficiency and operational excellence, several industries are converting their conventional offices into smart buildings.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 33% in the smart building market during the forecast period. The Asia Pacific area has a thriving market for smart buildings due to increased internet access, rapid urbanization, and a growing demand for IoT enabled remote building management services. Structural changes in government investment in smart building infrastructure are providing widespread adoption of the Internet of Things within both residential and commercial occupancies. An additional regional driver of stabilization is the shift in consumer focus to modernizing older assets to smart-enabled technologies.

The key drivers driving the Chinese smart building market are the expanding digitization of building systems, the widespread rollout of 5G-powered IoT networks, and the strong government backing for smart and environmentally friendly infrastructure initiatives. Tech giants such as ZTE and Huawei are advancing cloud integrated building management systems that enhance energy optimization, predictive maintenance, and occupant comfort.

Japan's market for smart buildings is growing quickly due to the nation's stringent building regulations and emphasis on disaster resilient infrastructure, which increases demand for cutting edge smart building solutions. Remote monitoring and real time data exchange are made possible by the growing rollout of 5G networks

Europe is growing due to the increased use of Industry 4.0 technologies and the creation of new building operations with the use of big data analytics, IoT, AI, and ML technology. All levels of government are prioritizing digitalization projects to improve sustainability, operational efficiencies, and customer safety in building management systems.

The German smart building industry is expected to grow significantly over the coming years as a result of building owners and operators being forced to adopt creative cost cutting and efficiency enhancing solutions in response to the growing need to reduce energy use in the face of rising energy costs. Advanced energy management systems are used in German smart buildings to optimize lighting, air conditioning, heating, ventilation, and other electrical operations.

The growing popularity of smart building technologies is driving the UK's smart building market's rapid expansion, which is attracting international industry companies to set up shop there. At the Smart Buildings Show UK in London in July 2025, for example, Coster Group debuted WebGarage, its next generation smart building platform, which provides unified control over energy systems, HVAC, lighting, and alarms across numerous buildings, real-time monitoring, and comprehensive analytics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the smart building market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens AG

- Honeywell International Inc.

- Johnson Controls

- Schneider Electric

- ABB Ltd.

- IBM Corporation

- Cisco Systems, Inc.

- Legrand SA

- Hitachi, Ltd.

- United Technologies Corporation

- Verdigris Technologies

- BuildingIQ

- Delta Controls

- Bosch Security Systems

- Huawei Technologies Co. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Johnson Controls completed the sale of its residential and light commercial HVAC business, focusing its transformation on becoming a pure play innovative building solutions provider.

- In July 2025, Honeywell International, Inc. acquired Li-ion Tamer. This company produces off gas detection solutions for lithium-ion batteries that improve fire safety for energy storage and data centers. This acquisition bolstered Honeywell’s fire safety technology portfolio under its Building Automation business.

- In May 2025, ABB Ltd. launched ABB Smart EMS, a smart energy management solution aimed at allowing homeowners better control over their energy use.

- In February 2025, ASHB launched its 2025 Smart Buildings Trends & Technology Adoption Research initiative, backed by Honeywell and Siemens.

- In June 2025, Cisco Canada, in partnership with Sentiom, launched a new smart building solution to mitigate water and fire damage in multi-residential buildings.

- In January 2025, ABB unveiled the ABB Cyclon smart building management system at Light Middle East 2023. Its latest offerings provide customers with real time data, operational analytics, and comprehensive solutions for smarter, more efficient buildings.

- In January 2025, Wipro Limited announced the launch of its latest solution, Smart i building, which runs on the Microsoft Azure platform. This solution reduces the impact of office buildings on their sustainability footprint through efficient use of corporate space, reduced energy consumption, and increased operational efficiency.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the smart building market based on the below-mentioned segments:

Global Smart Building Market, By Component

- Solution

- Service

Global Smart Building Market, By Solution

- Energy Management

- Network Management

- Safety & Security Management

- Building Infrastructure Management

- Integrated Workplace Management System

Global Smart Building Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the smart building market over the forecast period?The global smart building market is projected to expand at a CAGR of 21.07% during the forecast period.

-

2. What is the market size of the smart building market?The global smart building market size is expected to grow from USD 110.8 billion in 2024 to USD 907.9 billion by 2035, at a CAGR of 21.07% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the smart building market?North America is anticipated to hold the largest share of the smart building uilding market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global smart building market?Siemens AG, Honeywell International Inc., Johnson Controls, Schneider Electric, ABB Ltd., IBM Corporation, Cisco Systems, Inc., Legrand SA, Hitachi, Ltd., United Technologies Corporation, Verdigris Technologie, BuildingIQ, Delta Controls, Bosch Security Systems, Huawei Technologies Co., Ltd, and Others.

-

5. What factors are driving the growth of the smart building market?The smart building market growth is driven because of increased demand for energy efficiency, lower operating costs, and more stringent government policies regarding carbon emissions and sustainability. Predictive maintenance, better HVAC, lighting, and security systems are made possible by the growth of IoT, AI, sensors, and real-time data analytics, which enhances occupant safety and comfort.

-

6. What are market trends in the smart building market?The smart building market trends include AI & machine learning driven automation, cloud native & edge computing architectures, focus on energy efficiency, sustainability & green building, enhanced connectivity, and health, wellness, indoor air quality & occupant experience.

-

7. What are the main challenges restricting wider adoption of the smart building market?The smart building market trends include high upfront expenditures and unclear return on investment. Implementation is hampered by difficulties with integration and incompatibility between devices and legacy systems. The hazards to cybersecurity and data privacy posed by interconnected systems are grave.

Need help to buy this report?