Global Small-Scale LNG Market Size By Type (Liquefaction Terminal, Regasification Terminal), Mode of Supply (Trucks, Shipment and Bunkering, Rail Tanks, Pipeline, Others), By Application (Transportation, Heavy-Duty Vehicles, Industrial and Power, Others), By Region, And Segment Forecasts, By Geographic Scope And Forecasts 2032

Industry: Energy & PowerGlobal Small-Scale LNG Market Insights Forecasts to 2032

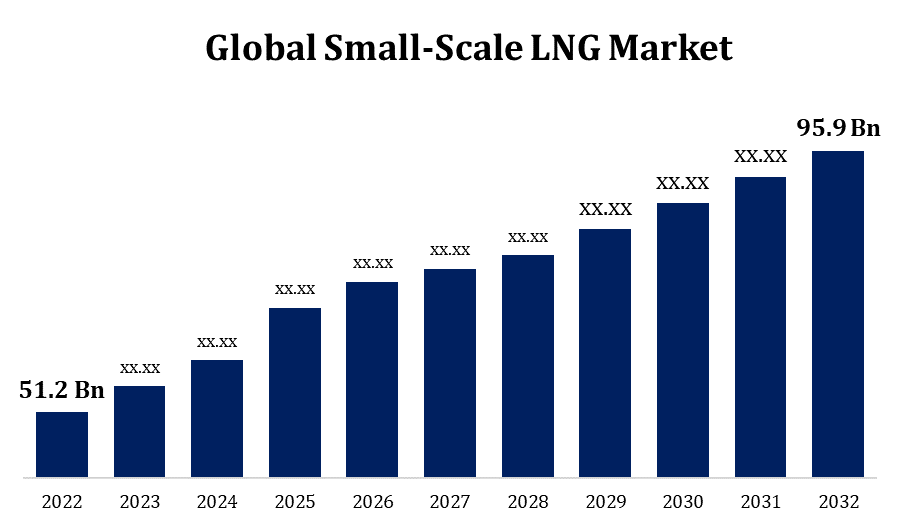

- The Small-Scale LNG Market Size was valued at USD 51.2 Billion in 2022.

- The Market Size is Growing at a CAGR of 15.1% from 2022 to 2032

- The Worldwide Small-Scale LNG Market Size is Expected to Reach USD 95.9 Billion by 2032

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Small-Scale LNG Market Size is Expected to Reach USD 95.9 Billion by 2032, at a CAGR of 15.1% during the forecast period 2022 to 2032.

In recent years, the smallscale LNG business has grown in popularity. It generally entails producing, storing, and distributing liquefied natural gas on a smaller scale, making it more accessible and feasible for places that may lack the infrastructure required for large-scale LNG operations. This creates new opportunities for businesses such as transportation, electricity generation, and even remote locations that were previously off the grid. Small-scale LNG solutions are appealing for a variety of applications due to their flexibility and scalability. It's similar to promoting the benefits of LNG to a larger audience. The market appears to be expanding as technology and infrastructure catch up, from cleaner energy sources for transportation to providing power to remote regions.

Global Small-Scale LNG Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 51.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 15.1% |

| 2032 Value Projection: | USD 95.9 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region. |

| Companies covered:: | Gazprom (Russia), Engie (France), Honeywell International Inc. (U.S.), Wärtsilä (Finland), Linde plc (Germany), Gasum Ltd., (Norway), IHI Corporation (Japan), Excelerate Energy L.P (U.S), Prometheus Fuels (U.S), Cryostar (U.S.), General Electric (U.S.), Novatek (Russia), Engie (France), NYK Line (Japan), Mitsui O.S.K.Lines (Japan), Teekay Corporation (Bermuda), Hyundai Heavy Industries Co., Ltd., (South Korea), HANJIN HEAVY INDUSTRIES & CONSTRUCTION HOLDINGS CO., LTD. (South Korea), Kawasaki Heavy Industries, Ltd., (Japan), and Others |

| Growth Drivers: | High Demand For Small-Scale Liquefied Natural Gas (LNG) |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Small-Scale LNG Market Value Chain Analysis

The extraction and production of natural gas is the first step in the process. Exploration, drilling, and extraction of natural gas from wells are all part of this process. After extraction, the natural gas is treated to eliminate contaminants and processed to fulfil the liquefaction criteria. The processed natural gas is then cooled to extremely low temperatures so that it can be converted into liquefied natural gas (LNG). Cryogenic technology and specialised equipment are used in this liquefaction process. The LNG is stored in tanks or containers intended to keep it at a low temperature. It is then transported to its final destination via specialised LNG carriers, vehicles, or containers. An LNG terminal with regasification facilities is located at the receiving end. The LNG is heated to return it to a gaseous condition for further distribution.

Small-Scale LNG Market Opportunity Analysis

Small-scale LNG offers a tremendous opportunity to provide clean, dependable energy to rural and off-grid locations. Because these places may not have access to traditional energy sources, small-scale LNG can be a feasible alternative. LNG is being investigated as a cleaner fuel alternative by the maritime industry. Small-scale LNG can meet the needs of smaller vessels, ferries, and coastal shipping, lowering emissions in the transportation sector. Small-scale LNG can help industries without pipeline connections or with unpredictable energy demands. It provides a versatile solution for a wide range of industrial activities, including manufacturing and power generation. Scalability is enabled by the modular architecture of small-scale LNG facilities.

Market Dynamics

Small-Scale LNG Market Dynamics

High Demand For Small-Scale Liquefied Natural Gas (LNG)

Natural gas, which is considered a somewhat cleaner alternative to traditional fossil fuels, is in high demand as the world transitions towards cleaner energy sources. Small-scale LNG is an easy approach to distribute and use natural gas in a more sustainable way. Small-scale LNG enables decentralised energy solutions for regions or sectors that do not have access to large-scale pipeline infrastructure. This adaptability makes it appealing for rural or off-grid settings. The transportation industry, particularly maritime and heavy-duty road transportation, is increasingly using LNG as a fuel. Small-scale LNG is a stable and flexible energy source for industries with changing energy demands or those located in areas without simple access to pipelines. It provides a more environmentally friendly alternative for industrial activities.

Restraints & Challenges

The initial expenditures of establishing small-scale LNG infrastructure are high. Construction of liquefaction, storage, and regasification facilities, as well as transportation infrastructure, can be costly for some projects. Accessing markets with enough demand for small-scale LNG might be difficult. Demand unpredictability in specific locations or industries may provide difficulties for project developers seeking long-term commitments. Other energy sources, such as renewable energy and alternative fuels, compete with small-scale LNG. The volatile nature of the energy market, as well as shifting preferences, might have an impact on LNG demand. The use of cutting-edge liquefaction, storage, and regasification technologies is fraught with danger. Technical hurdles and the need for continuous improvement may have an impact on the dependability and efficiency of small-scale LNG operations.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Small-Scale LNG Market from 2023 to 2032. In North America, there is a developing demand for small-scale LNG, driven by factors such as the need for cleaner energy sources, a greater emphasis on decreasing carbon emissions, and the expansion of LNG applications in various industries. North America's transport sector has been a primary driver of small-scale LNG demand. Because of its environmental benefits and cost-effectiveness, the use of LNG as a fuel for vehicles, buses, and marine vessels is gaining support. Small-scale LNG infrastructure is being built to offer regional LNG distribution. This is especially critical in areas with inadequate pipeline infrastructure, and small-scale LNG can help reach isolated or off-grid sites.The North American marine industry is increasingly utilising small-scale LNG for vessel fueling.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The Asia-Pacific small-scale LNG market is expanding rapidly. This expansion is due to rising demand for cleaner energy sources, economic development, and regional attempts to reduce emissions. Small-scale LNG is being used to generate electricity in distant and off-grid regions around the Asia-Pacific region. It offers a dependable and cleaner alternative to traditional energy sources, particularly in areas with limited access to centralised power infrastructure. Asia-Pacific industries are embracing small-scale LNG for a variety of applications, including industrial processes and heating. Small-scale LNG infrastructure's flexibility and scalability meet the diversified energy needs of various sectors.

Segmentation Analysis

Insights by Type

Liquefaction Terminal segment accounted for the largest market share over the forecast period 2023 to 2032. As the need for LNG develops, particularly in applications such as transportation, industrial processes, and power production, so does the demand for liquefaction terminals. Liquefaction is a vital process that allows liquefied natural gas to be transported and stored. Liquefaction terminals are critical for enabling LNG production in remote or off-grid areas. These terminals liquefy natural gas at the source, allowing LNG to be transported to places without direct pipeline connection. The increased use of LNG as a maritime fuel has resulted in the development of LNG bunkering infrastructure, which frequently includes liquefaction stations. These terminals provide the liquefaction procedures required to create LNG for maritime industry bunkering needs.

Insights by Application

Heavy duty vehicles segment accounted for the largest market share over the forecast period 2023 to 2032. An important factor is LNG's economic competitiveness with diesel in heavy-duty vehicles. As small-scale LNG infrastructure becomes more accessible, the economic benefits of using LNG in heavy-duty transportation contribute to market expansion. In comparison to the volatility of fuel prices, LNG prices have been rather stable. This stability provides fleet managers with a measure of certainty, making LNG an appealing alternative for long-term fuel cost management. The integration of LNG supply chains, including liquefaction, transportation, and bunkering infrastructure, helps to provide a holistic ecosystem for heavy-duty LNG vehicles. This integration ensures that fleet operators have a consistent and efficient supply of LNG.

Insights by Mode of Supply

Trucks segment accounted for the largest market share over the forecast period 2023 to 2032. The economic benefits of LNG, such as cost reductions and price stability over diesel, contribute to the increased use of LNG in the truck industry. The expansion of LNG refuelling infrastructure, including truck-friendly LNG stations, is critical to the truck segment's growth. The increased availability of LNG refuelling facilities increases the viability and convenience of using LNG in truck fleets. The worldwide nature of the trucking sector, as well as the capacity to carry LNG across borders, contribute to the segment's growth. Many trucking companies are launching fleet conversion projects to convert their vehicles to LNG. This strategic move is frequently motivated by a combination of economic concerns, regulatory compliance, and a desire to exhibit environmental stewardship.

Recent Market Developments

- In November 2020, FGEN LNG, a subsidiary of First Gen Corporation (FPIP), was looking into the L.N.G. development in the First Philippine Industrial Park.

Competitive Landscape

Major players in the market

- Gazprom (Russia)

- Engie (France)

- Honeywell International Inc. (U.S.)

- Wärtsilä (Finland)

- Linde plc (Germany)

- Gasum Ltd., (Norway)

- IHI Corporation (Japan)

- Excelerate Energy L.P (U.S)

- Prometheus Fuels (U.S)

- Cryostar (U.S.)

- General Electric (U.S.)

- Novatek (Russia)

- Engie (France)

- NYK Line (Japan)

- Mitsui O.S.K.Lines (Japan)

- Teekay Corporation (Bermuda)

- Hyundai Heavy Industries Co., Ltd., (South Korea)

- HANJIN HEAVY INDUSTRIES & CONSTRUCTION HOLDINGS CO., LTD. (South Korea)

- Kawasaki Heavy Industries, Ltd., (Japan)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Small-Scale LNG Market, Type Analysis

- Liquefaction Terminal

- Regasification Terminal

Small-Scale LNG Market, Application Analysis

- Transportation

- Heavy-Duty Vehicles

- Industrial and Power

- Others

Small-Scale LNG Market, Mode of Supply Analysis

- Trucks

- Shipment and Bunkering

- Rail Tanks

- Pipeline

- Others

Small-Scale LNG Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Small-Scale LNG Market?The global Small-Scale LNG Market is expected to grow from USD 51.2 Billion in 2023 to USD 95.9 Billion by 2032, at a CAGR of 15.1% during the forecast period 2023-2032.

-

2. Who are the key market players of the Small-Scale LNG Market?Some of the key market players of market are Gazprom (Russia), Engie (France), Honeywell International Inc. (U.S.), Wärtsilä (Finland), Linde plc (Germany), Gasum Ltd., (Norway), IHI Corporation (Japan), Excelerate Energy L.P (U.S), Prometheus Fuels (U.S), Cryostar (U.S.), General Electric (U.S.), Novatek (Russia), Engie (France), NYK Line (Japan), Mitsui O.S.K.Lines (Japan), Teekay Corporation (Bermuda), Hyundai Heavy Industries Co., Ltd., (South Korea), HANJIN HEAVY INDUSTRIES & CONSTRUCTION HOLDINGS CO., LTD. (South Korea) and Kawasaki Heavy Industries, Ltd., (Japan).

-

3. Which segment holds the largest market share?Trucks segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Small-Scale LNG Market?North America is dominating the Small-Scale LNG Market with the highest market share.

Need help to buy this report?