Global Small Business Project Management Software Market Size, Share, and COVID-19 Impact Analysis, By Deployment Type (Cloud-Based Solutions and On-Premise Solutions), By Application (Activity Scheduling, Project Portfolio Management, Resource Management, Issue Tracking, Document Management, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Small Business Project Management Software Market Size Insights Forecasts to 2035

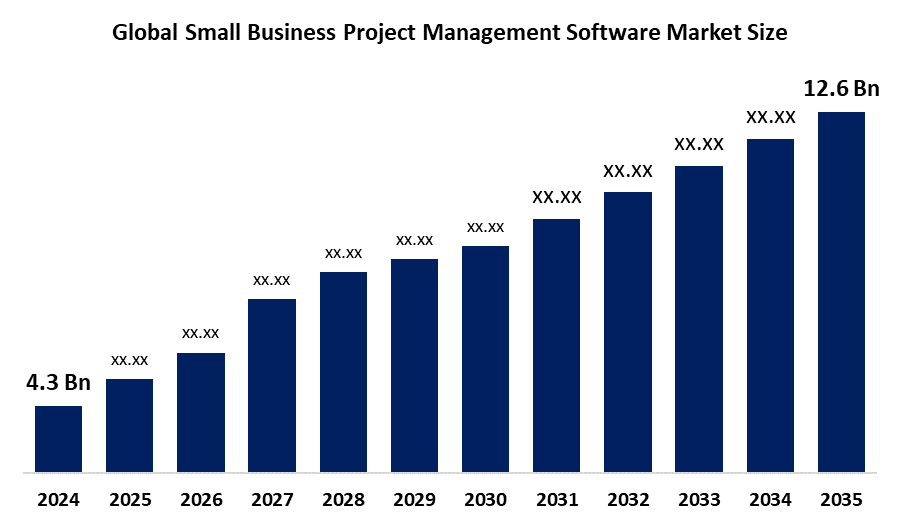

- The Global Small Business Project Management Software Market Size Was Estimated at USD 4.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.27% from 2025 to 2035

- The Worldwide Small Business Project Management Software Market Size is Expected to Reach USD 12.6 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Small Business Project Management Software Market Size was worth around USD 4.3 Billion in 2024 and is predicted to Grow to around USD 12.6 Billion by 2035 with a compound annual growth rate (CAGR) of 10.27% from 2025 to 2035. The primary driver of this significant increase is the increasing use of digital tools to enhance small business collaboration and efficiency. The market's growth is also greatly aided by the spread of cloud computing and the growing demand for remote work options.

Market Overview

The global small business project management software market refers to digital solutions that help SMEs plan, organise, track, and manage projects more efficiently, thereby improving collaboration, resource allocation, work scheduling, and productivity. Growing SME knowledge of the advantages of efficiency, AI/ML integration, and the need for real-time communication in remote work is driving growth in the small business project management software industry. These technologies are accessible because of their affordability, scalability, and flexibility in price; additionally, their adoption is fuelled by free and open-source alternatives. For small businesses, these solutions aid in resource optimisation, productivity gains, and increased competitiveness. By facilitating project planning, scheduling, resource allocation, job management, and collaboration on a single platform, project management software optimises workflows. It guarantees timely work completion, improves communication, gives reminders, and monitors project progress.

By resolving issues with data sharing and communication, this widely used technology facilitates remote and hybrid work models in sectors including construction, IT, BFSI, and telecoms. Since over 60% of SMEs have already adopted such technologies in 2023 to improve performance, their affordability, scalability, and efficiency-boosting capabilities make them indispensable. Leading companies in the industry are launching new products, forming alliances, and completing mergers and acquisitions in order to give clients access to the best project management software available.

For instance, Monday.com and Appfire, a developer of workplace collaboration apps, formed a strategic relationship in February 2023. Appfire will assist Monday.com users in locating apps that can manage their distinct business requirements, such as projects, workflows, and processes, on a single platform as part of the partnership.

Report Coverage

This research report categorizes the small business project management software market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the small business project management software market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the small business project management software market.

Global Small Business Project Management Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.27% |

| 2035 Value Projection: | USD 12.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Deployment Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | ProActive Software, Zoho Sprints, Cascade Strategy, Bitrix24, Confluence, Favro, Teamwork Projects, Saviom, Forecast, HarmonyPSA, Agile CRM, Samepage, NetSuite OpenAir, Workzone, Smartsheet, Projectric, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The main drivers in the small business project management software market are the growing tendency for cloud-based solutions. Cloud computing allows companies access to software in a flexible and remote workforce environment from anywhere. The demand for a more efficient method for tracking resource and employee time has led small businesses to seek project management systems that are focused on cutting through tracking all aspects efficiently. Small business owners are also interested in systems that include artificial intelligence (AI) and machine learning features in particular because those systems have proven to allow more accurate project planning and risk mitigation.

Restraining Factors

The lack of knowledge and comprehension of project management tools among small business owners is a major obstacle. Many consumers might think that these solutions are excessively complicated or unsuited to their particular requirements. These datasets may jeopardize an organization's security and, in turn, its competitiveness. Additionally, it is anticipated that the following issues will be lessened by the growing usage of cutting-edge technologies like artificial intelligence (AI), machine learning (ML), and blockchain technology, as well as increased investments by major companies in addressing the growing cybersecurity difficulties.

Market Segmentation

The small business project management software market share is classified intodeployment type and application.

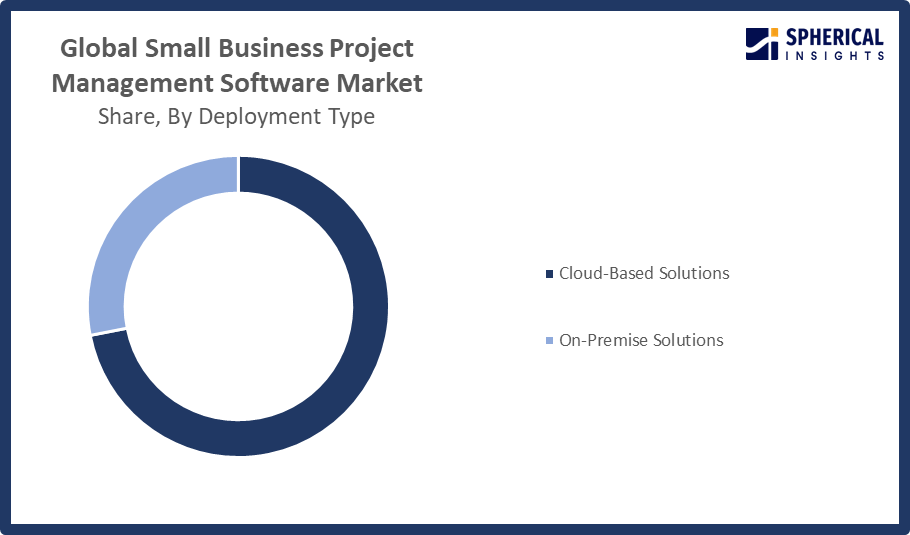

- The cloud-based solutions segment dominated the market in 2024 with approximately 60% and is projected to grow at a substantial CAGR during the forecast period.

Based on the deployment type, the small business project management software market is divided into cloud-based solutions and on-premise solutions. Among these, the cloud-based solutions segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Subscription-based software solutions make up the majority of cloud-based project management software. It enables companies to use cloud-based infrastructure with project management software. Businesses can use and extend their software licenses in accordance with their needs due to this cloud-based project management software. Therefore, during the projected period, the following variables are anticipated to promote the segment's growth.

Get more details on this report -

- The activity scheduling segment accounted for the largest share in 2024, approximately 30% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the small business project management software market is divided into activity scheduling, project portfolio management, resource management, issue tracking, document management, and others. Among these, the activity scheduling segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Effective project management software aids businesses in creating project plans, strategies, budgets, delivery schedules, and deadlines. Additionally, it provides real-time project updates, a simple way to monitor project performance, and a way to compare plans that have been defined with those that have been accomplished. As a result, the following segment is seeing an increase in demand for project management software.

Regional Segment Analysis of the Small Business Project Management Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share with approximately 43.5% of the Small Business Project Management Software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the small business project management software market over the predicted timeframe. The growing need for business software across key end-use industries, including IT and telecom, BFSI, and healthcare, is anticipated to propel market growth in North America, which would benefit the project management software sector. Additionally, the major regional players Microsoft Corporation, Oracle Corporation, LiquidPlanner, Inc., and Smartsheet, Inc. are making some calculated choices to broaden and improve their selection of project management software. The following are the main drivers of market expansion in North America.

Asia Pacific is expected to grow market share with approximately 25% at a rapid CAGR in the small business project management software market during the forecast period. Project management software adoption in the Asia Pacific region is anticipated to be strengthened by the quick uptake of cutting-edge technologies like AI, ML, and IoT in a variety of end-use industries, including manufacturing, healthcare, transportation, logistics, IT and telecom, and the expanding government initiatives towards digitisation, such as the Digital India program. Additionally, by providing them with dependable and reasonably priced tools for handling daily business operations, project management software helps SMEs and individual business organisations in the area. Therefore, the Asia Pacific region's need for project management software solutions is anticipated to be driven by the following causes.

Europe is expected to grow at a rapid CAGR in the small business project management software market during the forecast period. With Germany, the UK, and France in the forefront of adoption, Europe is also a sizable market for small business project management software. The growing demand for effective project management solutions across a range of industries, including manufacturing, healthcare, and construction, is propelling the market expansion in this area. Strong security measures in project management software are required due to the strict data protection laws that define the European market. In this area, vendors who can provide secure and compliant solutions are probably going to have an advantage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the small business project management software market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ProActive Software

- Zoho Sprints

- Cascade Strategy

- Bitrix24

- Confluence

- Favro

- Teamwork Projects

- Saviom

- Forecast

- HarmonyPSA

- Agile CRM

- Samepage

- NetSuite OpenAir

- Workzone

- Smartsheet

- Projectric

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, OutSystems Launches Agent Workbench: OutSystems introduced Agent Workbench, a low-code platform enabling enterprises to implement agentic AI across workflows. This tool facilitates the development and coordination of intelligent agents, streamlining operations and modernizing legacy systems.

- In February 2024, Microsoft announced the integration of its Project management tool with Teams, enhancing collaboration capabilities and providing seamless project communication within the Teams environment.

- In July 2022, Planview offered connected work solutions, including portfolio and work management solutions, and announced a strategic partnership with Tasktop to provide value stream management. Based on the partnership Planview and Tasktop will assist organizations to speed up their time to market, enhance operational efficiency, and provide capabilities that will help customers connect their software delivery business while enabling them to transform their organization quickly and efficiently.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the small business project management software market based on the below-mentioned segments:

Global Small Business Project Management Software Market, By Deployment Type

- Cloud-Based Solutions

- On-Premise Solutions

Global Small Business Project Management Software Market, By Application

- Activity Scheduling

- Project Portfolio Management

- Resource Management

- Issue Tracking

- Document Management

- Others

Global Small Business Project Management Software Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Small Business Project Management Software market over the forecast period?The global Small Business Project Management Software market is projected to expand at a CAGR of 10.27% during the forecast period.

-

2. What is the market size of the Small Business Project Management Software market?The global Small Business Project Management Software market size is expected to grow from USD 4.3 Billion in 2024 to USD 12.6 Billion by 2035, at a CAGR of 10.27% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Small Business Project Management Software market?North America is anticipated to hold the largest share of the Small Business Project Management Software market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Small Business Project Management Software market?ProActive Software, Zoho Sprints, Cascade Strategy, Bitrix24, Confluence, Favro, Teamwork Projects, Saviom, Forecast, and HarmonyPSA.

-

5. What factors are driving the growth of the Small Business Project Management Software market?Growing cloud-based adoption, remote work trends, SMEs' digital transformation, affordable SaaS solutions, the need for workflow automation, collaboration effectiveness, scalability, and government digitalisation initiatives are all factors propelling the market for small business project management software.

-

6. What are the market trends in the Small Business Project Management Software market?Cloud-based SaaS adoption, AI-driven automation, remote and mobile collaboration, integration with other business tools, improved security, scalable pricing, customisable features, and an increasing emphasis on efficiency and real-time analytics are some of the major trends in the small business project management software market.

-

7. What are the main challenges restricting wider adoption of the Small Business Project Management Software market?High upfront costs, a lack of IT know-how in small firms, data security issues, change aversion, trouble integrating with current systems, and ignorance of the advantages of software are the main obstacles preventing adoption.

Need help to buy this report?