Global Single-use Assemblies Market Size, Share, and COVID-19 Impact Analysis, By Product (Bag Assemblies, Filtration Assemblies, Bottle Assemblies, Tubing Assemblies, and Others), By Application (Filtration, Cell Culture & Mixing, Storage, Sampling, Fill-Finish Applications, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Single-use Assemblies Market Size Forecasts to 2035

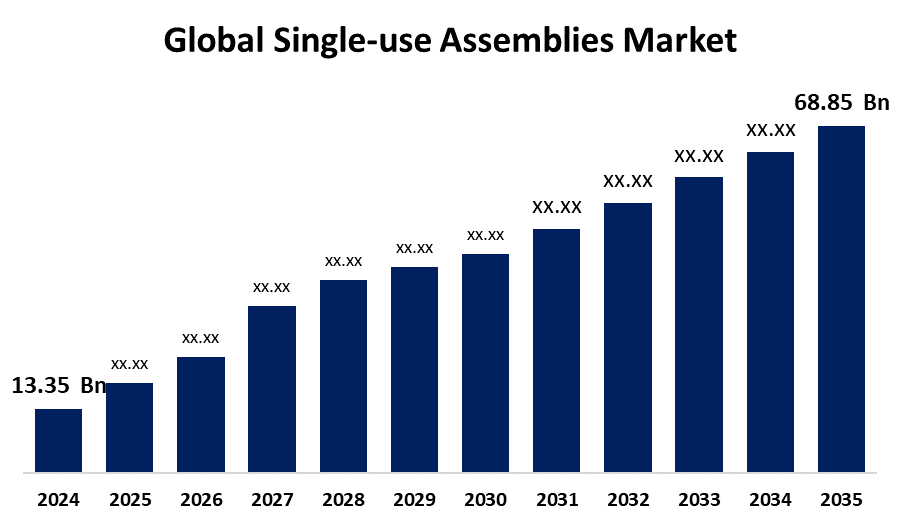

- The Global Single-use Assemblies Market Size Was Estimated at USD 13.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.08% from 2025 to 2035

- The Worldwide Single-use Assemblies Market Size is Expected to Reach USD 68.85 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global single-use assemblies market size was worth around USD 13.35 billion in 2024 and is predicted to grow to around USD 68.85 billion by 2035 with a compound annual growth rate (CAGR) of 16.08% from 2025 to 2035. One of the key factors driving the growth of the single-use assemblies market is the expanding biologics industry, ongoing technological advancements in bioprocessing, rising biopharmaceutical R&D, and the broad acceptance of single-use technology by various CMOS.

Market Overview

The market for pre-assembled, sterile, disposable parts used in the production of biopharmaceuticals is known as the single-use assemblies market. Bag assemblies, filter assemblies, bottle assemblies, and tube assemblies are some of these assemblies. By decreasing contamination hazards, cutting expenses, and increasing production process flexibility, they improve operational efficiency.

High rates of growth in emerging economies and a growing focus on expanding bioprocessing capabilities are anticipated to generate attractive opportunities for the single-use assemblies market. For Instance, in April 2024, SaniSure launched Fill4Sure, a tailored single-use filling assembly designed to improve security, operational efficiency, and process repeatability in drug product filling while shortening the time to market for pharmaceutical products.

The market for single-use assemblies is anticipated to increase significantly in emerging economies as a result of the biopharmaceutical and biotechnology sectors' rapid expansion. The creation of stronger and more effective materials for disposable parts like bags, filters, and connectors is one of the major developments in single-use assemblies market. The expanding adoption of single-use assemblies technologies by CDMOs, SMEs, and startups, as well as the thriving biologics and biosimilars markets, are the main factors driving the single-use assemblies market's growth.

Report Coverage

This research report categorizes the single-use assemblies market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the single-use assemblies market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the single-use assemblies market.

Single-use Assemblies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13.35 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.08% |

| 2035 Value Projection: | USD 68.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Thermo Fisher Scientific, Inc., Intellitech, Inc., Merck KGaA, Corning Incorporated, Antylia Scientific, KUHNER AG, Sartorius AG, Danaher Corporation, Cobetter, Entegris, Avantor, Lonza, Nupore Filtration Systems, Saint-Gobain, and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The single-use assemblies market is anticipated to rise as a result of increased biopharmaceutical R&D, the expanding biologics market, ongoing bioprocessing technology advancements, and the broad use of single-use assemblies by different CMOs. Effective diagnosis and treatment alternatives, including biologics, are necessary for infectious diseases, and this is projected to drive the expansion of the single-use assemblies market.

The need to produce biologics more efficiently, more affordably, and more quickly has fueled the development of single-use assemblies market. Technological developments and sustainability initiatives are driving a major transition in the single-use assembly sector. The use of single-use components in research and academic institutions can be encouraged by growing pharma-academia alliances, which are expected to increase demand and drive the single-use assemblies market.

Restraining Factors

High upfront investment costs, regulatory worries about leachability and extractability, difficulties with waste disposal, and competition from conventional multi-use systems are some of the factors restricting the single-use assemblies market.

Market Segmentation

The single-use assemblies market share is classified into product and application.

- The filtration assemblies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the single-use assemblies market is divided into bag assemblies, filtration assemblies, bottle assemblies, tubing assemblies, and others. Among these, the filtration assemblies segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Filtration assemblies are being used more often for bulk and final fill processes due to increased regulatory opportunities and the need to reduce the risk of contamination. Single-use filtering assemblies remove the need for sterilizing procedures and the associated validation protocols, making them a versatile and effective substitute for stainless steel systems.

- The filtration segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the single-use assemblies market is divided into filtration, cell culture & mixing, storage, sampling, fill-finish applications, and others. Among these, the filtration segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The single-use assemblies have so many advantages their application in filtration is growing quickly. Single-use filtration systems save time in the process due to they are ready to use, unlike conventional filtration systems.

Regional Segment Analysis of the Single-use Assemblies Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the single-use assemblies market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the single-use assemblies market over the predicted timeframe. The development of the pharmaceutical and biotechnology sectors, improvements in products, rising rates of diseases like cancer, and financial support for drug discovery research are all factors contributing to the North American region. The company can satisfy the growing demand for the bioprocessing materials needed to create innovative cancer and other illness treatments and vaccines due to its USD 105 million, 400,000-square-foot facilities.

Asia Pacific is expected to grow at a rapid CAGR in the single-use assemblies market during the forecast period. Asia-Pacific the biopharma infrastructure in China's single-use assembly market is developing quickly due to government incentives, the growth of domestic manufacturing, and the return of foreign talent. The need for single-use assemblies is driven by the transition from generics to biologics, the focus on biopharma self-sufficiency, and the growth of domestic CDMOs. However, regulatory harmonization and pricing sensitivity continue to be important factors.

Europe is predicted to hold a significant share of the single-use assemblies market throughout the estimated period. In Europe, strict regulations, a robust pipeline of biosimilars, and growing automation in biomanufacturing are the main factors driving growth. The adoption of single-use technologies in R&D and commercial contexts is accelerated by the region's dedication to cost-effective and sustainable operations as well as rising investments in modular facilities. Innovation is further encouraged by regional biopharma clusters and multinational partnerships.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the single-use assemblies market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific, Inc.

- Intellitech, Inc.

- Merck KGaA

- Corning Incorporated

- Antylia Scientific

- KUHNER AG

- Sartorius AG

- Danaher Corporation

- Cobetter

- Entegris

- Avantor

- Lonza

- Nupore Filtration Systems

- Saint-Gobain

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, the Supor Prime filters, launched by Cytiva (US), support a high throughput capacity and a viscosity of 30 centipoise, which increases the recovery of the final therapeutic product during manufacture.

- In May 2023, A deal to purchase all of Purity New England, Inc.'s shares was announced by Getinge. When it comes to single-use technology for bioprocessing applications, Purity New England, Inc. leads the market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the single-use assemblies market based on the below-mentioned segments:

Global Single-use Assemblies Market, By Product

- Bag Assemblies

- Filtration Assemblies

- Bottle Assemblies

- Tubing Assemblies

- Others

Global Single-use Assemblies Market, By Application

- Filtration

- Cell Culture & Mixing

- Storage

- Sampling

- Fill-finish Applications

- Others

Global Single-use Assemblies Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the single-use assemblies market over the forecast period?The global single-use assemblies market is projected to expand at a CAGR of 16.08% during the forecast period.

-

2. What is the market size of the single-use assemblies market?The global Single-use Assemblies market size is expected to grow from USD 13.35 Billion in 2024 to USD 68.85 Billion by 2035, at a CAGR of 16.08% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the single-use assemblies market?North America is anticipated to hold the largest share of the single-use assemblies market over the predicted timeframe.

Need help to buy this report?