Singapore Waste Management Market Size, Share, and COVID-19 Impact Analysis, By Source (Residential, Commercial, Industrial, and Others), By Service Type (Collection/Transportation/Sorting & Segregation, Disposal/treatment, and Others), By Waste Type (Municipal Solid, Industrial Hazardous, E-Waste, Plastic Waste, Biomedical Waste, Construction & Demolition Waste, and Others), By Contract Model (Private and Public), and Singapore Waste Management Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSingapore Waste Management Market Insights Forecasts to 2035

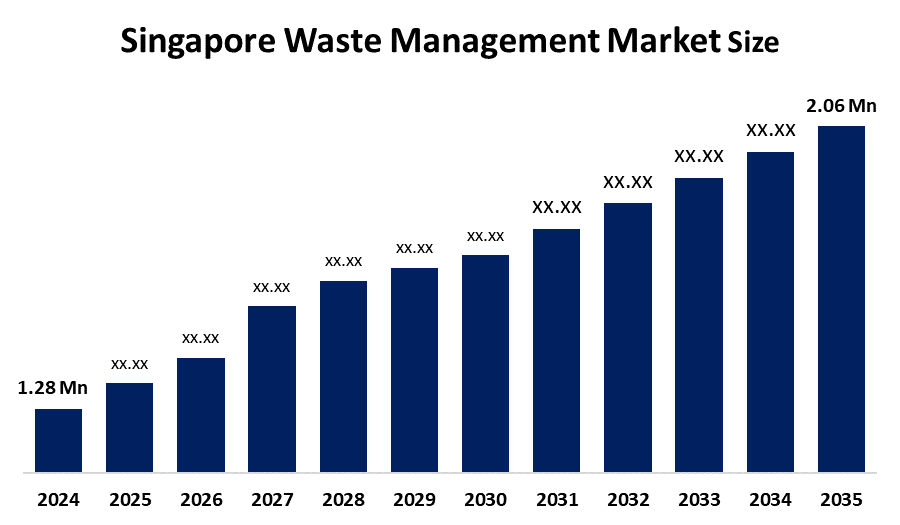

- The Singapore Waste Management Market Size Was Estimated at USD 1.28 Billion in 2024

- The Singapore Waste Management Market Size is Expected to Grow at a CAGR of Around 4.42% from 2025 to 2035

- The Singapore Waste Management Market Size is Expected to Reach USD 2.06 Billion by 2035

Get more details on this report -

According to a Research Report published by Spherical Insights & Consulting, The Singapore waste Management Market Size is anticipated to reach USD 2.06 Billion by 2035, growing at a CAGR of 4.42% from 2025 to 2035. The Singapore waste management market is driven by rapid urbanization and population growth, increasing industrial and municipal waste generation, government initiatives promoting recycling and circular economy practices, and growing adoption of advanced waste-to-energy technologies to reduce landfill dependence and recover resources.

Market Overview

The Singapore waste management market covers activities related to the collection, transport, treatment, recycling, and disposal of municipal, industrial, and hazardous waste in Singapore. The market comprises services and technologies for waste segregation, recycling, incineration, landfill management, and waste-to-energy conversion, with the goals of lessening environmental impact and supporting the sustainable use of resources. It is driven by the rapid urbanization and population growth, the rising volumes of industrial and household waste, the initiatives that facilitate recycling and implementation of the circular economy principles, as well as the use of waste-to-energy technologies that aim at lowering landfill and recovering resources.

Singapore’s waste management market is shaped by its population of approximately 5.9 million and high urban density, which generates around 7.7 million tonnes of waste annually. Municipal solid waste accounts for roughly 3.6 million tonnes, with industrial and construction waste contributing significantly to the total. Rapid urbanization, expanding commercial and industrial activities, and increasing consumption patterns have put pressure on limited landfill space, driving demand for advanced waste collection, recycling, and waste-to-energy solutions. Inefficient waste handling can lead to environmental pollution, higher greenhouse gas emissions, and public health risks, reinforcing the need for sustainable waste management solutions.

The Singapore government actively supports the sector through policies and initiatives under the Sustainable Singapore Blueprint and Zero Waste Masterplan, which aim to increase recycling rates and divert waste from landfills. Investments in waste-to-energy plants, smart recycling technologies, and research programs exceed SGD 1 billion, encouraging innovation in waste processing and resource recovery. Regulatory frameworks, carbon tax policies, and incentives for private investment further promote the adoption of sustainable waste management practices, providing a commercially attractive environment for companies and technology providers operating in Singapore’s waste management market.

Report Coverage

This research report categorizes the market for the Singapore waste management market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore waste management market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore waste management market.

Singapore Waste Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.28 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.42% |

| 2035 Value Projection: | USD 2.06 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Sembcorp Industries, Veolia Environmental Services Singapore, SUEZ Singapore, NEA (National Environment Agency), ST Engineering - Environmental Solutions, CleanTech Environmental Solutions, United Envirotech Ltd., SembWaste, Wilmar Environmental Solutions, Hitachi Zosen Inova Singapore, Keppel Seghers, Singapore Waste Management, Others, and key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore waste management market is driven by a variety of factors, including increasing population and urban density, larger volumes of municipal, industrial, and construction waste, and limited landfill capacity. The market growth is also backed by the implementation of strict government regulations, recycling and circular economy initiatives, the extension of waste-to-energy facilities, and the rising focus on environmental sustainability.

Restraining Factors

The Singapore waste management market is restrained by several challenges. These include high capital and operating costs for advanced treatment and recycling facilities, limited land availability for new waste infrastructure, difficulties in waste segregation at the source, fluctuating recycling economics, and reliance on a single offshore landfill, which can restrict the flexibility of long-term waste disposal planning.

Market Segmentation

The Singapore waste management market share is classified into source, service type, waste type, and contract model.

- The residential segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore waste management market is segmented by source into residential, commercial, industrial, and others. Among these, the residential segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The residential segment is growing because Singapore’s rising population and urban density lead to higher household waste generation. Increased consumption, widespread use of packaged goods, and government-led recycling and waste collection programs in housing estates further support strong demand from the residential sector.

- The collection/transportation/sorting & segregation segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore waste management market is segmented by service type into collection/transportation/sorting & segregation, disposal/treatment, and others. Among these, the collection/transportation/sorting & segregation segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The collection/transportation/sorting & segregation segment is growing because rising waste volumes require frequent and efficient pickup services. Strict regulations on waste separation, expansion of residential and commercial areas, and adoption of smart collection systems increase demand for organized and reliable waste handling services.

- The municipal solid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore waste management market is segmented by waste type into municipal solid, industrial hazardous, e-waste, plastic waste, biomedical waste, construction & demolition waste, and others. Among these, the municipal solid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The municipal solid waste segment is growing because of Singapore’s high population density, increasing household consumption, and expanding commercial activities. Regular waste generation from homes, offices, and public spaces, along with strict government collection and disposal requirements, drives steady demand for municipal solid waste management services.

- The public segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore waste management market is segmented by contract model into private and public. Among these, the public segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The public segment is growing because waste management in Singapore is largely handled through government-led contracts and public agencies to ensure nationwide coverage, regulatory compliance, and environmental protection. Strong public funding, long-term service contracts, and centralized planning support stable and consistent growth in this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore waste management market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sembcorp Industries

- Veolia Environmental Services Singapore

- SUEZ Singapore

- NEA (National Environment Agency)

- ST Engineering – Environmental Solutions

- CleanTech Environmental Solutions

- United Envirotech Ltd.

- SembWaste

- Wilmar Environmental Solutions

- Hitachi Zosen Inova Singapore

- Keppel Seghers

- Singapore Waste Management

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In May 2025, SG Recycle announced it would end its paper recycling program and remove 84 smart collection bins in Singapore due to funding challenges and low paper prices, highlighting financial pressures on recycling efforts within the waste management sector.

- In November 2025, Singapore-headquartered waste solutions firm Blue Planet secured a strategic investment from global investor Novo Holdings to expand its circular waste management and sustainable infrastructure operations across Asia, reinforcing technology-driven recycling and resource recovery efforts.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore waste management market based on the below-mentioned segments:

Singapore Waste Management Market, By Source

- Residential

- Commercial

- Industrial

- Others

Singapore Waste Management Market, By Service Type

- Collection/Transportation/Sorting & Segregation

- Disposal/treatment, and Others

Singapore Waste Management Market, By Waste Type

- Municipal Solid

- Industrial Hazardous

- E-Waste

- Plastic Waste

- Biomedical Waste

- Construction & Demolition Waste

- Others

Singapore Waste Management Market, By Contract Model

- Private

- Public

Frequently Asked Questions (FAQ)

-

1.What is the Singapore waste management market size in 2024?The Singapore waste management market size was estimated at USD 1.28 billion in 2024.

-

2.What is the projected market size of the Singapore waste management market by 2035?The Singapore waste management market size is expected to reach USD 2.06 billion by 2035.

-

3.What is the CAGR of the Singapore waste management market?The Singapore waste management market size is expected to grow at a CAGR of around 4.42% from 2024 to 2035.

-

4.What are the key growth drivers of the Singapore waste management market?The Singapore waste management market is driven by rapid urbanization and population growth, increasing industrial and municipal waste generation, government initiatives promoting recycling and circular economy practices, and growing adoption of advanced waste-to-energy technologies to reduce landfill dependence and recover resources.

-

5.Which service type segment dominated the market in 2024?The collection/transportation/sorting & segregation segment dominated the market in 2024.

-

6.What segments are covered in the Singapore waste management market report?The Singapore waste management market is segmented on the basis of source, service type, waste type, and contract model.

-

7.Who are the key players in the Singapore waste management market?Key companies include Sembcorp Industries, Veolia Environmental Services Singapore, SUEZ Singapore, NEA (National Environment Agency), ST Engineering – Environmental Solutions, CleanTech Environmental Solutions, United Envirotech Ltd., SembWaste, Wilmar Environmental Solutions, Hitachi Zosen Inova Singapore, Keppel Seghers, Singapore Waste Management, and others.

-

8.Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?