Singapore Vinyl Flooring Market Size, Share, and COVID-19 Impact Analysis, By Product (Vinyl Sheets, Luxury Vinyl Tiles, Vinyl Tiles, and Others), By Application (Commercial and Residential), and Singapore Vinyl Flooring Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsSingapore Vinyl Flooring Market Size Insights Forecasts To 2035

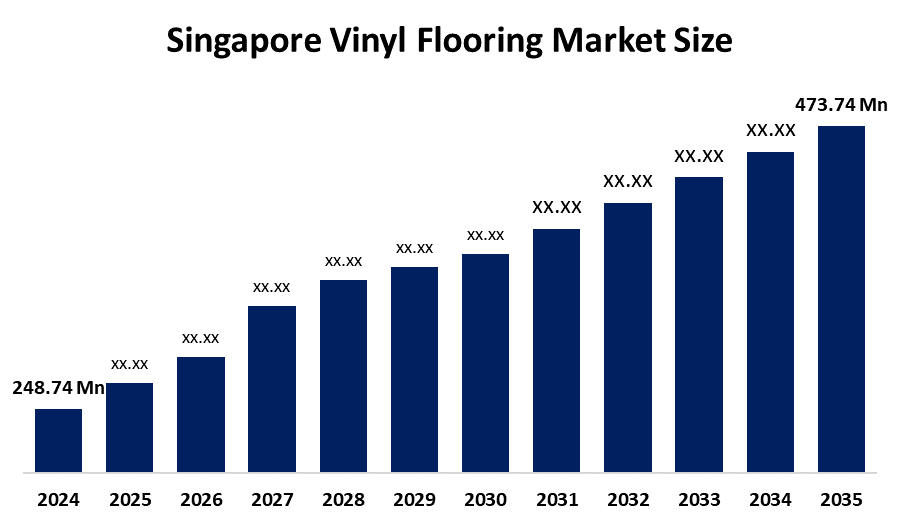

- The Singapore Vinyl Flooring Market Size Was Estimated At USD 248.74 Million In 2024

- The Singapore Vinyl Flooring Market Size Is Expected To Grow At A CAGR Of Around 6.03% From 2025 To 2035

- The Singapore Vinyl Flooring Market Size Is Expected To Reach USD 473.74 Million By 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Singapore Vinyl Flooring Market Size Is Anticipated To Reach USD 473.74 Million By 2035, Growing At A CAGR Of 6.03% From 2025 To 2035. The Singapore vinyl flooring market is driven by rising demand for durable, water-resistant, and low-maintenance flooring in residential and commercial spaces. Rapid urbanization, growth in construction and renovation activities, and the availability of cost-effective, aesthetically versatile vinyl flooring solutions further support market growth.

Market Overview

The Singapore Vinyl Flooring Market Size Encompasses The Production, Import, Distribution, And Application Of Vinyl Flooring Materials Across Residential, Commercial, And Industrial Sectors In Singapore. Vinyl flooring is a synthetic flooring solution made primarily from polyvinyl chloride (PVC) and is available in various forms such as luxury vinyl tiles (LVT), vinyl planks, and vinyl sheets, offering a wide range of designs that replicate natural materials like wood and stone. This market is driven by Singapore’s space-efficient urban infrastructure, high renovation activity, and demand for durable, water-resistant, and low-maintenance flooring solutions.

Singapore’s Adoption Of The Vinyl Flooring Market Size Is Strongly Supported By Its Robust Construction And Renovation Environment, Urban Lifestyle Demands, And Government Policies Promoting Quality Building Materials And Sustainability. With Singapore’s total construction demand projected between SGD 36 billion and SGD 41 billion in 2025, driven by public housing, commercial development, and major infrastructure projects, the demand for versatile finishing materials like vinyl flooring continues to rise.

Population Trends And Housing Dynamics Also Emphasize The Market Size Importance. With Over 90 % Of Singaporeans Living In HDB Flats, Homeowners Increasingly Invest In Upgrades And Renovations, Including Modern And Resilient Floor Coverings. Renovation activities are further encouraged by housing improvements under programmes like the Home Improvement Programme (HIP), where optional upgrades (often including flooring enhancements) are supported, with recent allocations of S$742 million for estate upgrades. Such initiatives, combined with government and industry efforts like the Built Environment Technology and Capability Grant to encourage innovation and productivity in building materials, create a favorable environment for vinyl flooring adoption and innovation.

Report Coverage

This Research Report Categorizes The Market Size For The Singapore Vinyl Flooring Market Based On Various Segments And Regions, And Forecasts Revenue Growth And Analyses Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore vinyl flooring market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore vinyl flooring market.

Singapore Vinyl Flooring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 248.74 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 6.03% |

| 2023 Value Projection: | USD 473.74 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application |

| Companies covered:: | NatureSteps, Unitrio Trading Pte Ltd, CME Corporation (S) Pte Ltd, Big Foot Vinyl Flooring, PVC Master Singapore, U1 Floor Pte Ltd, Floorrich, Goodhill Enterprise (S) Pte Ltd, Evorich Holdings Pte Ltd, Wallhub (vinyl flooring supplier), Floor Xpert, Floor Melody, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore Vinyl Flooring Market Size Is Driven By Rapid Urbanization, High Residential Renovation Activity, And Strong Demand From Commercial Spaces Such As Offices, Retail, And Hospitality. Its durability, water resistance, low maintenance, and cost-effectiveness make vinyl flooring ideal for Singapore’s compact living environments and high-traffic areas, supporting steady market growth.

Restraining Factors

The Singapore Vinyl Flooring Market Size Faces Restraints Such As Concerns Over The Environmental Impact and recyclability of PVC-based products, a rising preference for natural and eco-friendly flooring alternatives, and higher initial costs of premium luxury vinyl tiles. Strict building and sustainability regulations can also limit adoption in certain projects.

Market Segmentation

The Singapore vinyl flooring market share is classified into product and application.

- The luxury vinyl tiles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Vinyl Flooring Market Size Is Segmented By Product Into Vinyl Sheets, Luxury Vinyl Tiles, Vinyl Tiles, And Others. Among these, the luxury vinyl tiles segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The luxury vinyl tiles segment is growing because it offers superior durability, water resistance, and high-end aesthetic appeal that closely replicates natural wood and stone at a lower cost. Easy installation, low maintenance, and strong demand from residential renovations and commercial spaces in Singapore further drive its adoption and revenue growth.

- The residential segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore Vinyl Flooring Market Size Is Segmented By Application Into Commercial And Residential. Among these, the residential segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The residential segment is growing because of rising home renovation and remodeling activities, especially in HDB flats and private apartments across Singapore. Increasing preference for durable, water-resistant, easy-to-maintain flooring, along with the affordability and modern design options of vinyl flooring, continues to drive strong household adoption.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Singapore Vinyl Flooring Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NatureSteps

- Unitrio Trading Pte Ltd

- CME Corporation (S) Pte Ltd

- Big Foot Vinyl Flooring

- PVC Master Singapore

- U1 Floor Pte Ltd

- Floorrich

- Goodhill Enterprise (S) Pte Ltd

- Evorich Holdings Pte Ltd

- Wallhub (vinyl flooring supplier)

- Floor Xpert

- Floor Melody

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2024, Xing Floors in Singapore launched a new range of versatile and stylish vinyl flooring options with diverse designs and waterproof features, catering to both residential and commercial spaces and reflecting growing demand for cost-effective, durable flooring solutions.

- In April 2024, Floorrich Global in Singapore launched its new SPCPlus flooring with synchronized texture technology to mark its 15th anniversary, offering highly realistic, durable, and low-maintenance vinyl flooring for homes and commercial spaces.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore vinyl flooring market based on the below-mentioned segments:

Singapore Vinyl Flooring Market, By Product

- Vinyl Sheets

- Luxury Vinyl Tiles

- Vinyl Tiles

- Others

Singapore Vinyl Flooring Market, By Application

- Commercial

- Residential

Frequently Asked Questions (FAQ)

-

1. What is the Singapore vinyl flooring market size in 2024?The Singapore vinyl flooring market size was estimated at USD 248.74 million in 2024.

-

2. What is the projected market size of the Singapore vinyl flooring market by 2035?The Singapore vinyl flooring market size is expected to reach USD 473.74 million by 2035

-

3. What is the CAGR of the Singapore vinyl flooring market?The Singapore vinyl flooring market size is expected to grow at a CAGR of around 6.03% from 2024 to 2035.

-

4. What are the key growth drivers of the Singapore vinyl flooring market?The Singapore vinyl flooring market is driven by rising demand for durable, water-resistant, and low-maintenance flooring in residential and commercial spaces. Rapid urbanization, growth in construction and renovation activities, and the availability of cost-effective, aesthetically versatile vinyl flooring solutions further support market growth.

-

5. Which application segment dominated the market in 2024?The residential segment dominated the market in 2024.

-

6. What segments are covered in the Singapore vinyl flooring market report?The Singapore vinyl flooring market is segmented on the basis of product and application

-

7. Who are the key players in the Singapore vinyl flooring market?Key companies include NatureSteps, Unitrio Trading Pte Ltd, CME Corporation (S) Pte Ltd, Big Foot Vinyl Flooring, PVC Master Singapore, U1 Floor Pte Ltd, Floorrich, Goodhill Enterprise (S) Pte Ltd, Evorich Holdings Pte Ltd, Wallhub (vinyl flooring supplier), Floor Xpert, Floor Melody, and others.

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?