Singapore Smart Inhalers Market Size, Share, and COVID-19 Impact Analysis, By Type (Dry Powdered Inhalers (DPIs) and Metered Dose Inhalers (MDIs)), By Indication (Asthma and Chronic Obstructive Pulmonary Disease (COPD)), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others), and Singapore Smart Inhalers Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSingapore Smart Inhalers Market Insights Forecasts to 2035

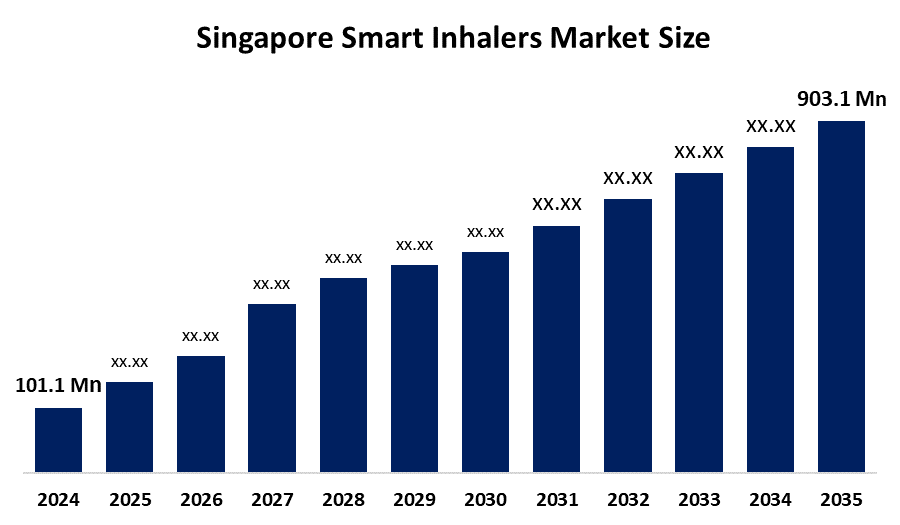

- The Singapore Smart Inhalers Market Size Was Estimated at USD 101.1 Million in 2024

- The Singapore Smart Inhalers Market Size is Expected to Grow at a CAGR of Around 22.03% from 2025 to 2035

- The Singapore Smart Inhalers Market Size is Expected to Reach USD 903.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Singapore Smart Inhalers Market Size Is Anticipated To Reach USD 903.1 Million By 2035, Growing At A CAGR of 22.03% From 2025 to 2035. The Singapore smart inhalers market is driven by the rising prevalence of respiratory diseases such as asthma and COPD, growing awareness of proper inhaler usage, demand for digital health monitoring, and adoption of connected healthcare solutions that improve medication adherence and patient outcomes.

Market Overview

The Singapore Smart Inhalers Market Size is mainly a market for those connected inhalation devices that are equipped with digital sensors and wireless technology that assist in monitoring, tracking, and managing the use of medications for respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD). These devices keep a record of inhaler usage, give reminders to patients about doses, and send data to healthcare providers or mobile apps, thus leading to better adherence, real-time monitoring, and improved disease management.

The market of smart inhalers in Singapore is expanding due to a massive load of respiratory problems. The Singapore Ministry of Health reports that more than 400,000 people are affected by asthma, and around 70,000 adults have COPD; thus, there is a considerable need for improved inhaler adherence and disease management. Besides, factors such as urban pollution, hectic lifestyles, and the growing number of respiratory triggers make it all the more necessary to have connected inhaler technologies that can not only track medication usage but also provide reminders and share real-time data with healthcare providers. The increasing health consciousness and the adoption of digital health among the people in Singapore, as well as the very high smartphone penetration rate (88%), make smart inhalers a suitable option for both preventive and continuous care.

The Singapore government is really making an effort to promote innovations in digital health and MedTech. They have thus created a very friendly environment for the adoption of smart inhalers. The Research, Innovation, and Enterprise Plan initiatives, with a total budget of S$25 billion, are just some of the measures taken to fund healthcare research, integrate digital health, and develop medical technology, thereby indirectly helping smart inhaler R&D and deployment. Programs such as HealthHub and National Electronic Health Record (NEHR) are geared towards enabling data-driven disease management and patient monitoring, which in turn raises the effectiveness of smart inhalers. Singapore is now a leading market for smart respiratory devices, and this is a great chance for device makers to step in and deliver clinical efficacy products, patient adherence support, and digital health expansion solutions.

Report Coverage

This research report categorizes the market for the Singapore Smart Inhalers Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore smart inhalers market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore smart inhalers market.

Singapore Smart Inhalers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 101.1 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 22.03% |

| 2035 Value Projection: | USD 903.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Type, By Indication |

| Companies covered:: | Teva Pharmaceutical Industries Ltd. GlaxoSmithKline plc (GSK) AstraZeneca plc Propeller Health (ResMed) Adherium Ltd. AptarGroup, Inc. / Cohero Health Novartis AG 3M Health Care Boehringer Ingelheim OPKO Health, Inc. FindAir Sp. z o.o. Amiko Digital Health Limited Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore Smart Inhalers Market Size is driven by the increasing incidence of asthma and chronic obstructive pulmonary disease (COPD), more awareness of correct inhaler usage, and the need for better medication compliance. Also, the development of sophisticated connected devices and the integration of digital health facilitate remote monitoring and enhanced disease management, which in turn increases the usage of such devices.

Restraining Factors

The Singapore Smart Inhaler Market Size is restrained by the high price of the devices, narrow reimbursement coverage, and the necessity for patients to be trained on the use of the connected devices effectively. Moreover, worries about data privacy, the challenge of integrating with current healthcare systems, and the resistance of elderly patients to new technologies may also act as brakes on the market development.

Market Segmentation

The Singapore smart inhalers market share is classified into type, indication, and distribution channel.

- The metered dose inhalers (MDIs) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Smart Inhalers Market Size is segmented by type into dry powdered inhalers (DPIs) and metered dose inhalers (MDIs). Among these, the metered dose inhalers (MDIs) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The metered dose inhalers (MDIs) segment is growing because they are widely prescribed for asthma and COPD management, easy to use, compatible with most smart inhaler sensor technologies, and preferred by healthcare providers for accurate dosing and reliable drug delivery.

- The chronic obstructive pulmonary disease (COPD) segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore Smart Inhalers Market Size is segmented by indication into asthma and chronic obstructive pulmonary disease (COPD). Among these, the chronic obstructive pulmonary disease (COPD) segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The chronic obstructive pulmonary disease (COPD) segment is growing because COPD prevalence is rising in Singapore, requiring long-term inhaler therapy, and smart inhalers help monitor adherence, track usage, and improve disease management for better patient outcomes.

- The hospital pharmacies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Smart Inhalers Market Size is segmented by distribution channel into hospital pharmacies, retail pharmacies, online pharmacies, and others. Among these, the hospital pharmacies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hospital pharmacies segment is growing because hospitals provide direct access to patients with chronic respiratory conditions, ensure proper device usage under medical supervision, and integrate smart inhalers with digital health systems for monitoring and adherence management.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore smart inhalers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Teva Pharmaceutical Industries Ltd.

- GlaxoSmithKline plc (GSK)

- AstraZeneca plc

- Propeller Health (ResMed)

- Adherium Ltd.

- AptarGroup, Inc. / Cohero Health

- Novartis AG

- 3M Health Care

- Boehringer Ingelheim

- OPKO Health, Inc.

- FindAir Sp. z o.o.

- Amiko Digital Health Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In April 2024, the Health Sciences Authority (HSA) in Singapore approved a new asthma indication for GSK’s Trelegy Ellipta inhaler, making it the first once-daily single inhaler triple therapy cleared for both asthma and COPD treatment in Singapore.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore smart inhalers market based on the below-mentioned segments:

Singapore Smart Inhalers Market, By Type

- Dry Powdered Inhalers (DPIs)

- Metered Dose Inhalers (MDIs)

Singapore Smart Inhalers Market, By Indication

- Asthma

- Chronic Obstructive Pulmonary Disease (COPD)

Singapore Smart Inhalers Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Frequently Asked Questions (FAQ)

-

1. What is the Singapore smart inhalers market size in 2024?The Singapore smart inhalers market size was estimated at USD 101.1 million in 2024.

-

2. What is the projected market size of the Singapore smart inhalers market by 2035?The Singapore smart inhalers market size is expected to reach USD 903.1 million by 2035.

-

3. What is the CAGR of the Singapore smart inhalers market?The Singapore smart inhalers market size is expected to grow at a CAGR of around 22.03% from 2024 to 2035.

-

4. What are the key growth drivers of the Singapore smart inhalers market?The Singapore smart inhalers market is driven by the rising prevalence of respiratory diseases such as asthma and COPD, growing awareness of proper inhaler usage, demand for digital health monitoring, and adoption of connected healthcare solutions that improve medication adherence and patient outcomes

-

5. Which indication segment dominated the market in 2024?The chronic obstructive pulmonary disease (COPD) segment dominated the market in 2024.

-

6. What segments are covered in the Singapore smart inhalers market report?The Singapore smart inhalers market is segmented on the basis of type, indication, and distribution channel

-

7. Who are the key players in the Singapore smart inhalers market?Key companies include Teva Pharmaceutical Industries Ltd., GlaxoSmithKline plc (GSK), AstraZeneca plc, Propeller Health (ResMed), Adherium Ltd., AptarGroup, Inc./Cohero Health, Novartis AG, 3M Health Care, Boehringer Ingelheim, OPKO Health, Inc., FindAir Sp. z o.o., Amiko Digital Health Limited, and others

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?