Singapore Sealants Market Size, Share, and COVID-19 Impact Analysis, By Resin (Acrylic, Epoxy, Polyurethane, Silicone, and Others), By End-User Industry (Aerospace, Automotive, Building & Construction, Healthcare, and Others), and Singapore Sealants Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsSingapore Sealants Market Insights Forecasts to 2035

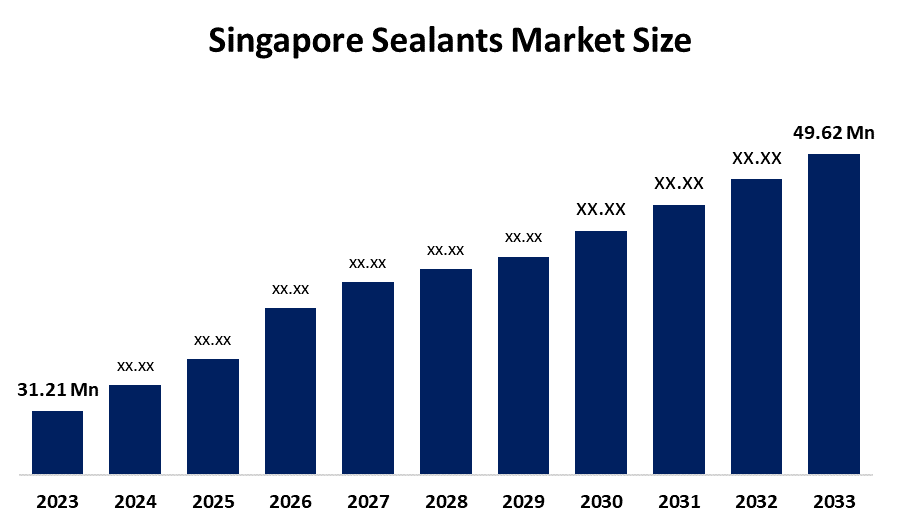

- The Singapore Sealants Market Size Was Estimated at USD 31.21 Million in 2024

- The Singapore Sealants Market Size is Expected to Grow at a CAGR of Around 4.31% from 2025 to 2035

- The Singapore Sealants Market Size is Expected to Reach USD 49.62 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Singapore sealants market size is anticipated to reach USD 49.62 million by 2035, growing at a CAGR of 4.31% from 2025 to 2035. The Singapore sealants market is driven by growing construction and infrastructure development, increasing demand for building and industrial maintenance, rising awareness of energy-efficient and weatherproofing solutions, and advancements in silicone, polyurethane, and hybrid sealant technologies.

Market Overview

The Singapore sealants market is the industry that involves the production and sale of materials that are used to seal joints, fill gaps, and protect surfaces in buildings, infrastructure, and industrial applications. The market comprises products such as silicone, polyurethane, acrylic, epoxy, and hybrid sealants that offer waterproofing, weatherproofing, insulation, and durability. The market caters to different sectors like residential and commercial construction, infrastructure projects, automotive, and industrial maintenance. The market expansion is attributed to the continuous construction and infrastructure development, growing demand for energy, efficient and durable building materials, technological advancements in sealant formulations, and maintenance or refurbishment of existing structures, which help in protecting them against environmental and structural damage.

The market in France is largely influenced by the rising demand for new constructions and infrastructures, as well as the refurbishment of old buildings and the increasing emphasis on energy efficiency and sustainability. On top of that, the application of the market in renewable energy, electric vehicles, and advanced industrial equipment is opening up new growth avenues. In addition, the adoption of the market is very much supported by the government through initiatives like France 2030, which commits €54 billion in investments, and regulations such as RE2020 that encourage the construction of energy-efficient and low-carbon buildings. There is a strong indication that this market will expand from USD 31.21 million in 2024 to nearly USD 49.62 million by 2035, highlighting its increasing importance in the France industrial and construction sectors.

Report Coverage

This research report categorizes the market for the Singapore sealants market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore sealants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore sealants market

Driving Factors

The Singapore sealants market is driven by the rapid expansion of the construction and infrastructure sectors. The demand for building maintenance and renovation has also significantly contributed to the market growth. Moreover, the energy efficiency and weatherproofing requirements for both residential and commercial buildings have become major factors attracting the market. The technological innovations in silicone, polyurethane, and hybrid sealants provide improved durability, flexibility, and performance. Furthermore, the market growth is being backed by the increase in industrial applications in the automotive, electronics, and packaging sectors.

Restraining Factors

The Singapore sealants market is restrained by the expensive raw materials and environmental regulations. The market is also affected by the fluctuations in construction activity, challenges in adopting new technologies, and intensified competition among manufacturers.

Market Segmentation

The Singapore Sealants market share is classified into resin and end-user industry.

- The silicone segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore sealants market is segmented by resin into acrylic, epoxy, polyurethane, silicone, and others. Among these, the silicone segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The silicone segment is growing because silicone sealants offer excellent durability, flexibility, and resistance to extreme temperatures and weather conditions, making them ideal for construction, industrial, and automotive applications. Increasing demand for energy-efficient and long-lasting sealing solutions also drives its growth.

- The healthcare segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore sealants market is segmented by end-user industry into aerospace, automotive, building & construction, healthcare, and others. Among these, the healthcare segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The healthcare segment is growing because sealants are widely used in medical devices, hospital equipment, and pharmaceutical packaging, where sterility, durability, and chemical resistance are critical. Increasing healthcare infrastructure and demand for high-quality medical products further drive this segment’s growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore sealants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M Singapore Pte Ltd

- Sika Singapore Pte. Ltd.

- Henkel Singapore Pte. Ltd.

- Dow Chemical Pacific (Singapore) Pte Ltd

- Bostik Singapore Pte Ltd

- H.B. Fuller Asia Pacific Pte. Ltd.

- Mapei Singapore

- Tremco Illbruck

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In June 2025, 3M launched its new 3M™ Polyurethane Construction Sealant 525 in Singapore, a durable and flexible sealant designed for expansion joints and various construction materials, enhancing sealing solutions for building and infrastructure projects.

- In July 2025, Trelleborg Group acquire Singapore-based sealing specialist Masterseals, strengthening its sealing solutions presence for energy and industrial applications in Southeast Asia and enhancing local support and technical services.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore sealants market based on the below-mentioned segments:

Singapore Sealants Market, By Resin

- Acrylic

- Epoxy

- Polyurethane

- Silicone

- Others

Singapore Sealants Market, By End User Industry

- Aerospace

- Automotive

- Building & Construction

- Healthcare

- Others

Frequently Asked Questions (FAQ)

-

1. What is the Singapore sealants market size in 2024?The Singapore sealants market size was estimated at USD 31.21 million in 2024.

-

2. What is the projected market size of the Singapore sealants market by 2035?The Singapore sealants market size is expected to reach USD 49.62 million by 2035.

-

3 What is the CAGR of the Singapore sealants market?The Singapore Sealants market size is expected to grow at a CAGR of around 4.31% from 2024 to 2035.

-

4. What are the key growth drivers of the Singapore sealants market?The Singapore Sealants market is driven by growing construction and infrastructure development, increasing demand for building and industrial maintenance, rising awareness of energy-efficient and weatherproofing solutions, and advancements in silicone, polyurethane, and hybrid sealant technologies.

-

5. Which end-user industry segment dominated the market in 2024?The healthcare segment dominated the market in 2024.

-

7. Who are the key players in the Singapore sealants market?Key companies include 3M Singapore Pte Ltd, Sika Singapore Pte. Ltd., Henkel Singapore Pte. Ltd., Dow Chemical Pacific (Singapore) Pte Ltd, Bostik Singapore Pte Ltd, H.B. Fuller Asia Pacific Pte. Ltd., Mapei Singapore, Tremco Illbruck, Fosroc Singapore, PFE Technologies Pte Ltd (Pereseal), Hypercoat Enterprises Pte Ltd, Shin‑Etsu Singapore Pte. Ltd., and others.

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?