Singapore Renewable Energy Market Size, Share, and COVID-19 Impact Analysis, By Source (Wind Energy and Energy Storage Technologies), By Application (Solar and Bioenergy), and Singapore Renewable Energy Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerSingapore Renewable Energy Market Insights Forecasts to 2035

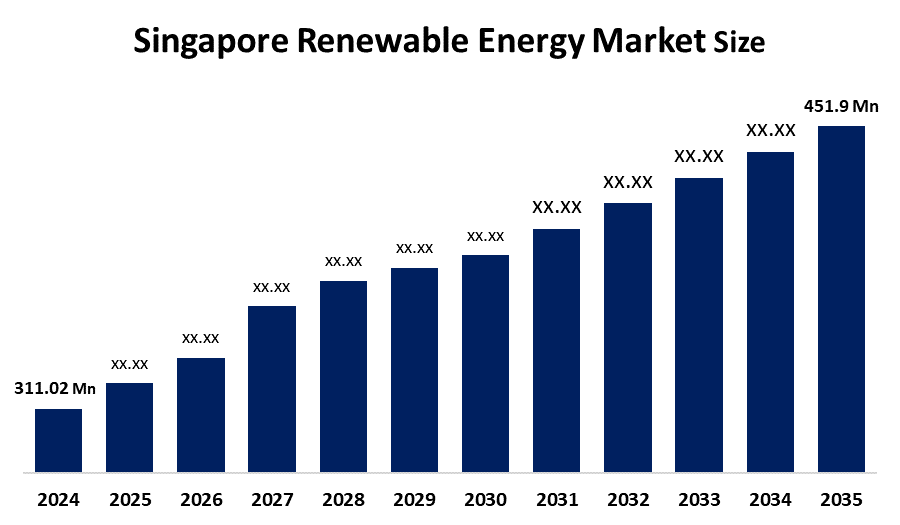

- The Singapore Renewable Energy Market Size Was Estimated at USD 311.02 Million in 2024

- The Singapore Renewable Energy Market Size is Expected to Grow at a CAGR of Around 3.45% from 2025 to 2035

- The Singapore Renewable Energy Market Size is Expected to Reach USD 451.9 Million by 2035

Get more details on this report -

According to a Research Report published by Spherical Insights & Consulting, the Singapore Renewable Energy Market Size is anticipated to reach USD 451.9 Million by 2035, growing at a CAGR of 3.45% from 2025 to 2035. The Singapore renewable energy market is driven by government support for clean energy, high electricity demand, limited fossil fuel resources, and increasing use of solar power and energy storage to reduce carbon emissions.

Market Overview

The Singapore renewable energy market encompasses the various stages of the energy value chain, from the development, production, and distribution to the use of energy generated from renewable sources. These sources include solar power, bioenergy, waste-to-energy, and emerging technologies like energy storage and regional clean energy imports. It aligns with Singapore's move to a cleaner, low-carbon electricity generation mix. The market is propelled by factors such as a strong government climate policy framework, increasing electricity demand, scarce land and fossil fuel resources, growing investments in solar and energy storage, and Singapore's goal of carbon emission reduction and energy security enhancement.

Singapore's renewable energy market is influenced by the country's approximate 5.9 million population, high urban density, and electricity consumption that is steadily increasing and driven by data centers, transport electrification, and digital industries. The city and state import over 95% of their energy, mostly natural gas. Thus, it is vulnerable to fuel price volatility and supply risks. A small land area and no hydro or wind potential have led to aggressive adoption of solar power, waste-to-energy, energy storage, and regional clean energy imports, which are positioning renewables as a strategic solution for both long-term power stability and emissions reduction.

Market adoption is largely accelerated by government support. The government, under the Singapore Green Plan 2030, is targeting at least 2 GWp of solar capacity by 2030, which would be enough to supply around 350,000 households, and net zero emissions by 2050. Public funding through RIE2025 (SGD 25 billion) is allocated to support clean energy R&D, grid optimization, hydrogen, and storage technologies. Additional assistance consists of carbon tax policies, solar rooftop programs for public housing, EMA-led power sector transformation, and incentives for private investment. Together, they form a robust commercial environment for renewable energy developers, technology providers, and investors.

Report Coverage

This research report categorizes the market for the Singapore renewable energy market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore renewable energy market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore renewable energy market.

Singapore Renewable Energy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 311.02 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 3.45% |

| 2035 Value Projection: | USD 451.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Sembcorp Industries, Sunseap Group, Solargy Pte Ltd, REC Solar Holdings AS, SunPro Energies Pte Ltd, Keppel Renewable Energy, Vena Energy, ENGIE Southeast Asia, TotalEnergies Renewables, Asiatic Engineering, Gstar Solar, SP Group, Others, and key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore renewable energy market is driven by increasing electricity demand due to urban growth and data centers. It is also influenced by a heavy dependence on imported fossil fuels and strong government policies under the Singapore Green Plan 2030. Expansion of solar rooftops, implementation of carbon tax, concerns about energy security, and increased investment in energy storage and regional clean energy imports.

Restraining Factors

The Singapore renewable energy market is restrained by several factors, including stringent regulatory requirements, stiff competition from traditional banks and other neobanks, concerns about cybersecurity and data privacy, and a lack of trust, mainly among those users who have been accustomed to banking with established institutions.

Market Segmentation

The Singapore renewable energy market share is classified into source and application.

- The energy storage technologies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore renewable energy market is segmented by source into wind energy and energy storage technologies. Among these, the energy storage technologies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The energy storage technologies segment is growing because Singapore has limited potential for large-scale wind energy due to its geographic and urban constraints, making energy storage systems critical for supporting solar power integration, grid stability, and reliable renewable energy supply. The implementation of a carbon tax, concerns about energy security, and increased investment in energy storage and regional clean energy imports.

- The solar segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore renewable energy market is segmented by application into solar and bioenergy. Among these, the solar segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The solar segment is growing because Singapore has high solar energy potential, strong government support for solar rooftop installations and solar farms, and increasing demand for clean, reliable, and cost-effective electricity, making solar the primary focus of the country’s renewable energy strategy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore renewable energy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sembcorp Industries

- Sunseap Group

- Solargy Pte Ltd

- REC Solar Holdings AS

- SunPro Energies Pte Ltd

- Keppel Renewable Energy

- Vena Energy

- ENGIE Southeast Asia

- TotalEnergies Renewables

- Asiatic Engineering

- Gstar Solar

- SP Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, Sembcorp Industries unveiled major renewable energy projects on Jurong Island, including Singapores largest 118 MWp ground-mounted solar farm and an expanded 326 MWh battery storage system, boosting clean energy production and grid stability.

- In May 2025, Peak Energy acquired a 1 MW solar rooftop project in Singapore and signed a long-term virtual power purchase agreement with Arkema to generate about 1 GWh of clean energy annually, supporting industrial decarbonization goals.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore renewable energy market based on the below-mentioned segments:

Singapore Renewable Energy Market, By Source

- Wind Energy

- Energy Storage Technologies

Singapore Renewable Energy Market, By Application

- Solar

- Bioenergy

Frequently Asked Questions (FAQ)

-

1.What is the Singapore renewable energy market size in 2024?The Singapore renewable energy market size was estimated at USD 311.02 million in 2024.

-

2.What is the projected market size of the Singapore renewable energy market by 2035?The Singapore renewable energy market size is expected to reach USD 451.9 million by 2035.

-

3.What is the CAGR of the Singapore renewable energy market?The Singapore renewable energy market size is expected to grow at a CAGR of around 3.45% from 2024 to 2035.

-

4.What are the key growth drivers of the Singapore renewable energy market?The Singapore renewable energy market is driven by government support for clean energy, high electricity demand, limited fossil fuel resources, and increasing use of solar power and energy storage to reduce carbon emissions.

-

5.Which application segment dominated the market in 2024?The solar segment dominated the market in 2024.

-

6.What segments are covered in the Singapore renewable energy market report?The Singapore renewable energy market is segmented on the basis of account source and application.

-

7.Who are the key players in the Singapore renewable energy market?Key companies include Sembcorp Industries, Sunseap Group, Solargy Pte Ltd, REC Solar Holdings AS, SunPro Energies Pte Ltd, Keppel Renewable Energy, Vena Energy, ENGIE Southeast Asia, TotalEnergies Renewables, Asiatic Engineering, Gstar Solar, SP Group, and others.

-

8.Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?