Singapore Portable Fire Extinguisher Market Size, Share, and COVID-19 Impact Analysis, By Agent (Dry Chemical, Water, Foam, Carbon Dioxide, and Others), By Fire Type (Class A, Class B, Class D, Class C, Class K, and Others), By Application (Residential and Non-residential), and Singapore Portable Fire Extinguisher Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsSingapore Portable Fire Extinguisher Market Insights Forecasts to 2035

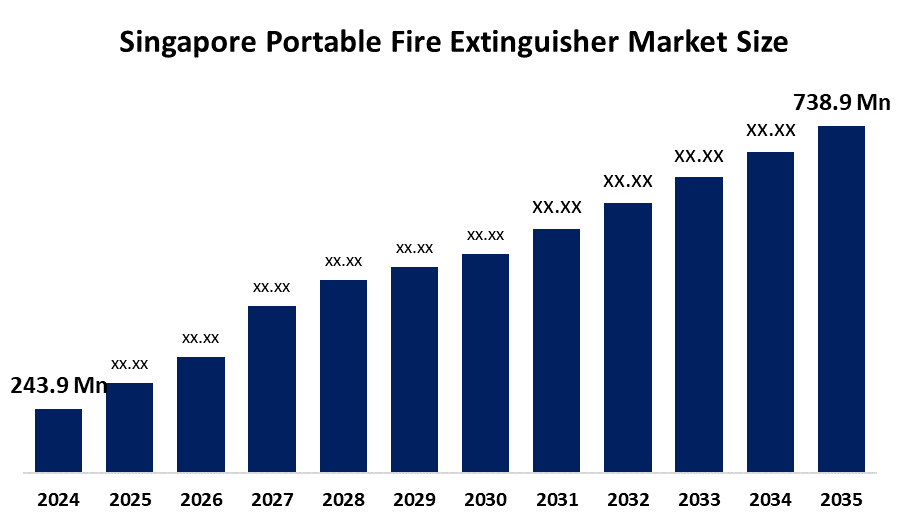

- The Singapore Portable Fire Extinguisher Market Size Was Estimated at USD 243.9 Million in 2024

- The Singapore Portable Fire Extinguisher Market Size is Expected to Grow at a CAGR of Around 10.6% from 2025 to 2035

- The Singapore Portable Fire Extinguisher Market Size is Expected to Reach USD 738.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Singapore portable fire extinguisher market size is anticipated to reach USD 738.9 million by 2035, growing at a CAGR of 10.6 from 2025 to 2035. The Singapore portable fire extinguisher market is driven by strict fire safety regulations, growing construction and industrial activities, increased awareness of fire safety in homes and workplaces, technological advancements in extinguisher types, and compliance requirements from insurance and corporate safety standards.

Market Overview

The Singapore portable fire extinguisher market refers to the segment of the fire safety industry that involves the manufacture, distribution, and sale of handheld fire extinguishers used to control or extinguish small fires in residential, commercial, and industrial settings across Singapore. These extinguishers include types such as water, foam, dry chemical ABC, CO, and wet chemical, designed for different classes of fires. The market encompasses products that comply with Singapore Civil Defence Force SCDF regulations and safety standards, addressing the growing need for fire prevention, workplace safety, and regulatory compliance in buildings, factories, and public spaces.

Singapores adoption of the portable fire extinguisher market is driven by ongoing fire safety challenges and regulatory requirements. In 2024, the Singapore Civil Defence Force SCDF responded to 1,990 fire incidents, nearly half of which occurred in residential settings, with five fatalities and 80 injuries, highlighting persistent fire risks in homes and public spaces. Fires due to electrical faults, unattended cooking, and active mobility devices (AMDs) such as personal mobility devices and e bikes increased, underscoring the need for effective fire prevention and immediate response tools like portable fire extinguishers.

The Singapore government supports stringent fire safety regulations and enforcement, with SCDF conducting over 15,000 fire safety enforcement checks and issuing fire hazard abatement notices to ensure compliance with safety standards. Portable fire extinguishers are mandated across residential, commercial, and industrial premises to meet building codes and reduce fire severity. Public education campaigns on fire prevention and safe practices further encourage adoption, making portable fire extinguishers essential for protecting lives, property, and infrastructure in Singapore’s urban environment.

Report Coverage

This research report categorizes the market for the Singapore portable fire extinguisher market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore portable fire extinguisher market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore portable fire extinguisher market.

Singapore Portable Fire Extinguisher Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 243.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.6% |

| 2035 Value Projection: | USD 738.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Agent, By Fire Type |

| Companies covered:: | Fire Armour Pte Ltd,Asiatic Fire System Pte Ltd,SAFETY FIRST FIRE SG,King Fire Customized Fire Protection Systems, |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore portable fire extinguisher market is driven by strict SCDF fire safety regulations, growing construction and industrial activities, rising awareness of fire hazards, technological advancements in extinguisher types, and compliance with corporate safety and insurance requirements, fueling widespread adoption.

Restraining Factors

The Singapore portable fire extinguisher market is restrained by high initial and maintenance costs, limited awareness and training among users on proper usage, competition from alternative fire suppression systems (like sprinkler systems), and market saturation in commercial and residential sectors. Additionally, frequent replacement and inspection requirements can add ongoing costs, slowing adoption in smaller businesses or low-income residential areas.

Market Segmentation

The Singapore portable fire extinguisher market share is classified into agent, fire type, and application.

- The dry chemical segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore portable fire extinguisher market is segmented by agent into dry chemical, water, foam, carbon dioxide, and others. Among these, the dry chemical segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dry chemical segment is growing because it is highly versatile and effective against multiple types of fires Class A, B, and C making it suitable for residential, commercial, and industrial use. Its reliability, quick extinguishing capability, and wide availability drive strong adoption in Singapore’s fire safety market.

- The Class A segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore portable fire extinguisher market is segmented by fire type into class A, class B, class D, class C, class K, and others. Among these, the class A segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The class A segment is growing because it is designed to extinguish fires involving ordinary combustible materials such as wood, paper, and textiles, which are the most common fire sources in residential, commercial, and industrial settings in Singapore. Its widespread applicability and essential role in fire safety drive strong adoption and market growth.

- The non-residential segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore portable fire extinguisher market is segmented by application into residential and non-residential. Among these, the non-residential segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The non-residential segment is growing because commercial, industrial, and institutional buildings in Singapore are required by SCDF regulations to install fire extinguishers, ensuring safety for employees and visitors. The increasing number of office complexes,

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore portable fire extinguisher market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fire Armour Pte Ltd

- Asiatic Fire System Pte Ltd

- SAFETY FIRST FIRE SG

- King FireCustomized Fire Protection Systems

- Firetronics Private Limited

- National City Corporation

- FALCON - Fire Protection System

- Fire Line Pte Ltd

- FireStore Singapore

- Drako Fire Engineering Pte Ltd

- DSH Fire Systems Pte Ltd

- SAFENET Fire Systems Pte Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In June 2024, Lingjack Engineering Works launched the COMBAT fluorinefree lithium ion battery fire extinguisher in Singapore, offering versatile, eco friendly protection against lithium ion battery fires and multiple fire classes for homes and workplaces.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore portable fire extinguisher market based on the below-mentioned segments:

Singapore Portable Fire Extinguisher Market, By Agent

- Dry Chemical

- Water

- Foam

- Carbon Dioxide

- Others

Singapore Portable Fire Extinguisher Market, By Fire Type

- Class A

- Class B

- Class D

- Class C

- Class K

- Others

Singapore Portable Fire Extinguisher Market, By Application

- Residential

- Non-residential

Frequently Asked Questions (FAQ)

-

1.What is the Singapore portable fire extinguisher market size in 2024?The Singapore portable fire extinguisher market size was estimated at USD 243.9 million in 2024.

-

2.What is the projected market size of the Singapore portable fire extinguisher market by 2035?The Singapore portable fire extinguisher market size is expected to reach USD 738.9 million by 2035.

-

3. What is the CAGR of the Singapore portable fire extinguisher market?The Singapore portable fire extinguisher market size is expected to grow at a CAGR of around 10.6% from 2024 to 2035.

-

4.What are the key growth drivers of the Singapore portable fire extinguisher market?The Singapore portable fire extinguisher market is driven by strict fire safety regulations, growing construction and industrial activities, increased awareness of fire safety in homes and workplaces, technological advancements in extinguisher types, and compliance requirements from insurance and corporate safety standards.

-

5. Which tire-type segment dominated the market in 2024?The Class A segment dominated the market in 2024.

-

6. What segments are covered in the Singapore portable fire extinguisher market report?The Singapore portable fire extinguisher market is segmented on the basis of agent, fire type, and application

-

7. Who are the key players in the Singapore portable fire extinguisher market?Key companies include Fire Armour Pte Ltd, Asiatic Fire System Pte Ltd, SAFETY FIRST (FIRE) SG, King Fire Customised Fire Protection Systems, Firetronics Private Limited, National City Corporation, FALCON Fire Protection System, Fire Line Pte Ltd, FireStore Singapore, Drako Fire Engineering Pte Ltd, DSH Fire Systems Pte Ltd, SAFENET Fire Systems Pte Ltd, and others.

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?