Singapore Pharmaceutical Robots Market Size, Share, and COVID-19 Impact Analysis, By Product (Traditional Robots and Collaborative Robots), By Application (Picking and Packaging, Inspection of Pharmaceutical Drugs, Laboratory Applications, and Others), By End Use (Pharmaceutical Companies and Research Laboratories), and Singapore Pharmaceutical Robots Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSingapore Pharmaceutical Robots Market Insights Forecasts to 2035

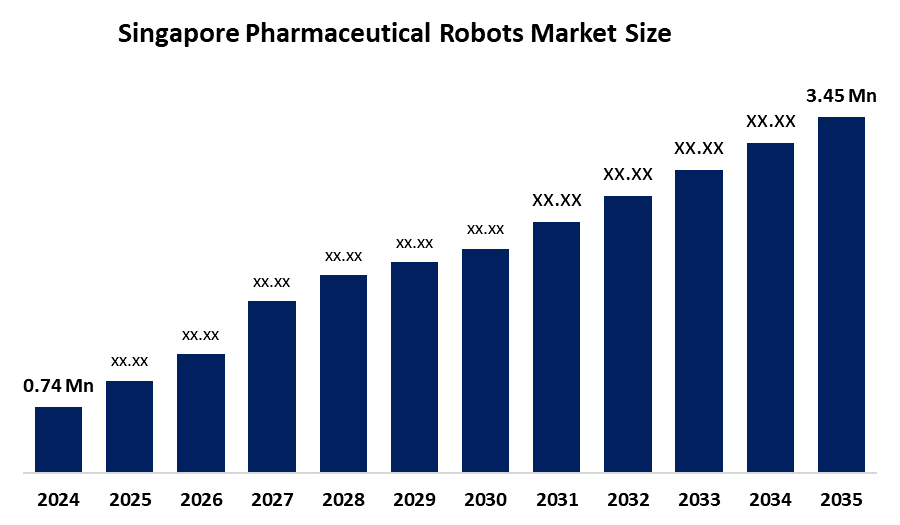

- The Singapore Pharmaceutical Robots Market Size was estimated at USD 0.74 million in 2024.

- The Singapore Pharmaceutical Robots Market Size is expected to grow at a CAGR of around 15.02% from 2025 to 2035.

- The Singapore Pharmaceutical Robots Market Size is expected to reach USD 3.45 million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the Singapore Pharmaceutical Robots Market size is anticipated to reach USD 3.45 million by 2035, growing at a CAGR of 15.02% from 2025 to 2035. The Singapore pharmaceutical robots market is driven by the growing need among hospitals and pharmacies for faster, more accurate, and more efficient methods to handle medicines, reduce errors, save time, and address staff shortages, supported by strong government initiatives promoting advanced technology.

Market Overview

The Singapore pharmaceutical robots market refers to the market for automated robotic systems used in the pharmaceutical industry and healthcare settings to perform tasks such as drug dispensing, packaging, sorting, compounding, and quality control. These robots help improve accuracy, efficiency, and safety, reduce human errors, support high volume operations, and optimize workflow in hospitals, pharmacies, and pharmaceutical manufacturing facilities. The market includes robotic hardware, software, and integrated solutions designed for both clinical and industrial pharmaceutical applications.

Singapore’s pharmaceutical robots market is expanding due to rising demand for automation in hospitals, pharmacies, and drug manufacturing facilities. The market addresses challenges such as high medication volumes, workforce shortages, and the need to reduce human errors, particularly in a country with an aging population and a highly technology driven healthcare system. Robotic systems are increasingly adopted for drug dispensing, packaging, inventory management, and quality control, improving operational efficiency and accuracy. The market was valued at approximately USD 0.74 million in 2024 and is projected to grow at a CAGR of 15.02% during the forecast period, reflecting strong adoption potential.

Government support is a key driver, with initiatives such as the National Robotics Programme receiving USD 45 million in funding to encourage robotics research and development, including healthcare applications. Institutions such as the Centre for Healthcare Assistive and Robotics Technologies, supported by the Ministry of Health and the Singapore Economic Development Board, are developing and testing robotic solutions in clinical settings. These efforts align with national strategies such as Smart Nation and the National AI Strategy 2.0, which allocate USD 743 million for AI and robotics integration in healthcare. Together, these factors highlight the strong demand, government backing, and strategic importance of pharmaceutical robots in Singapore’s healthcare and pharmaceutical sectors.

Report Coverage

This research report categorizes the Singapore pharmaceutical robots market based on various segments and forecasts revenue growth while analyzing trends in each submarket. The report analyzes key growth drivers, opportunities, and challenges influencing the market. Recent market developments and competitive strategies such as expansion, product launches, partnerships, mergers, and acquisitions are included to illustrate the competitive landscape. The report also profiles key market players and analyzes their core competencies across each sub segment.

Singapore Pharmaceutical Robots Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.74 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 15.02% |

| 2035 Value Projection: | USD 3.45 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, Universal Robots A/S (Teradyne), Mitsubishi Electric Corporation, Omron Corporation, Denso Corporation, Seiko Epson Corporation, Staubli International AG, Kawasaki Heavy Industries Ltd., Swisslog Holding AG, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore pharmaceutical robots market is driven by the increasing need for automation, accuracy, and efficiency in hospitals, pharmacies, and pharmaceutical manufacturing, along with workforce shortages, patient safety concerns, advanced healthcare technologies, and strong government support and funding.

Restraining Factors

The market is restrained by high initial investment costs, complex installation and maintenance requirements, limited availability of skilled personnel to operate robotic systems, regulatory compliance challenges, and resistance to adoption among smaller pharmacies and healthcare facilities.

Market Segmentation

The Singapore pharmaceutical robots market share is classified into product, application, and end use.

By Product

The market is segmented into traditional robots and collaborative robots. The traditional robots segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth is attributed to their high speed, precision, and reliability in repetitive pharmaceutical tasks such as drug dispensing, packaging, and quality control. Their ability to handle high volume operations makes them the preferred choice in Singapore.

By Application

The market is segmented into picking and packaging, inspection of pharmaceutical drugs, laboratory applications, and others. The picking and packaging segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. Automation in sorting, labeling, and packaging improves efficiency, reduces errors, lowers operational costs, and supports fast and reliable pharmaceutical logistics.

By End Use

The market is segmented into pharmaceutical companies and research laboratories. The pharmaceutical companies segment dominated the market in 2024 and is expected to grow at a substantial CAGR. This is due to increased adoption of robotic automation for high volume manufacturing, packaging, and quality control to improve efficiency, reduce errors, and meet strict regulatory standards.

Competitive Analysis:

The report provides a comprehensive analysis of key companies operating in the Singapore pharmaceutical robots market, including comparisons based on product offerings, business overview, geographic presence, strategic initiatives, market share, and SWOT analysis. It also examines recent developments such as product innovations, partnerships, joint ventures, mergers, and acquisitions to assess the competitive environment.

List of Key Companies

- ABB Ltd

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corporation

- Universal Robots A/S

- Mitsubishi Electric Corporation

- Omron Corporation

- Denso Corporation

- Seiko Epson Corporation

- Staubli International AG

- Kawasaki Heavy Industries Ltd

- Swisslog Holding AG

- Others

Key Target Audience

- Market Players

- Investors

- End Users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value Added Resellers

Market Segment Forecast

This study forecasts revenue at the Singapore level from 2020 to 2035. The market is segmented as follows:

Singapore Pharmaceutical Robots Market, By Product

- Traditional Robots

- Collaborative Robots

Singapore Pharmaceutical Robots Market, By Application

- Picking and Packaging

- Inspection of Pharmaceutical Drugs

- Laboratory Applications

- Others

Singapore Pharmaceutical Robots Market, By End Use

- Pharmaceutical Companies

- Research Laboratories

Frequently Asked Questions (FAQ)

-

1.What is the Singapore pharmaceutical robots market size in 2024?The Singapore pharmaceutical robots market size was estimated at USD 0.74 million in 2024.

-

2.What is the projected market size of the Singapore pharmaceutical robots market by 2035?The Singapore pharmaceutical robots market size is expected to reach USD 3.45 million by 2035.

-

3.What is the CAGR of the Singapore pharmaceutical robots market?The Singapore pharmaceutical robots market size is expected to grow at a CAGR of around 15.02% from 2024 to 2035.

-

4.What are the key growth drivers of the Singapore pharmaceutical robots market?The Singapore pharmaceutical robots market is driven by growing hospitals’ and pharmacies’ need for faster, more accurate, and more efficient ways to handle medicines, reduce mistakes, save time, and cope with staff shortages, with government support for advanced technology.

-

5.Which application segment dominated the market in 2024?The picking and packaging oral syringe segment dominated the market in 2024.

-

6.What segments are covered in the Singapore pharmaceutical robots market report?The Singapore pharmaceutical robots market is segmented on the basis of product, application, and end use.

-

7.Who are the key players in the Singapore pharmaceutical robots market?Key companies include ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, Universal Robots A/S (Teradyne), Mitsubishi Electric Corporation, Omron Corporation, Denso Corporation, Seiko Epson Corporation, Staubli International AG, Kawasaki Heavy Industries Ltd., Swisslog Holding AG, and others

-

8.Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?