Singapore Payments Market Size, Share, and COVID-19 Impact Analysis, By Mode of Payment (Point-of-Sale and Online), By Transaction Type (Person-to-Person (P2P), Consumer-to-Business (C2B), Business-to-Business (B2B), Remittances & Cross-Border, and Others), By End-User Industry (Retail, Entertainment & Digital Content, Healthcare, Hospitality & Travel, and Others), and Singapore Payments Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSingapore Payments Market Size Insights Forecasts to 2035

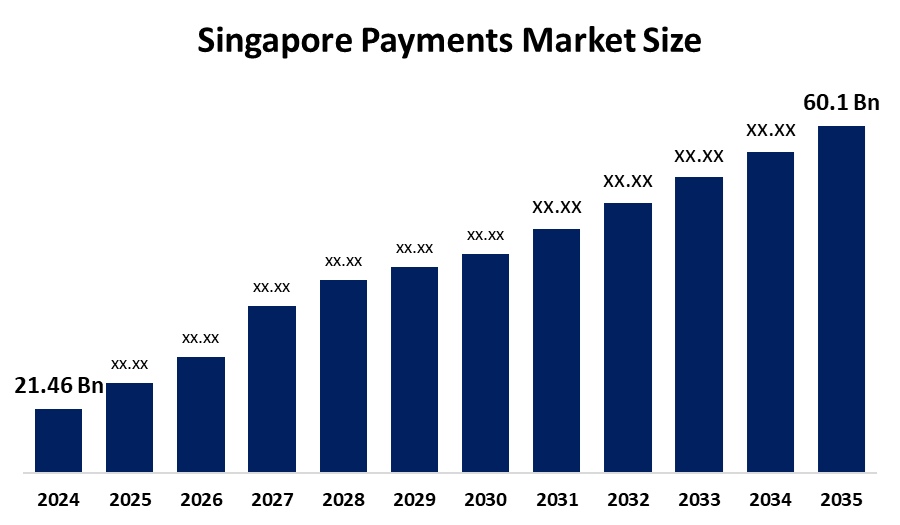

- The Singapore Payments Market Size Was Estimated at USD 21.46 Billion in 2024

- The Singapore Payments Market Size is Expected to Grow at a CAGR of Around 9.81% from 2025 to 2035

- The Singapore Payments Market Size is Expected to Reach USD 60.1 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Singapore Payments Market Size is anticipated to reach USD 60.1 billion by 2035, growing at a CAGR of 9.81% from 2025 to 2035. The payments market in Singapore is driven by strong support for cashless payments, high use of smartphones, growing online shopping, and easy, fast, and secure digital payment options.

Market Overview

The Singapore Payments Market Size covers the full range of digital and conventional payment systems designed to facilitate financial transactions among consumers, businesses, and government entities throughout the country. These are debit and credit cards, mobile and digital wallets, online and mobile banking, real-time payment platforms, QR code-based payments, and cross-border remittance solutions, all supported by a highly developed banking and financial infrastructure.

The market is governed by strong regulatory oversight from the Monetary Authority of Singapore (MAS) and is affected by proactive government initiatives aimed at building a smart, cashless economy. The major factors driving the market are high smartphone and internet penetration, widespread acceptance of contactless and mobile payments, rapid growth in e-commerce and on-demand services, increasing fintech innovation, and rising consumer and merchant demand for secure, fast, and convenient payment experiences.

The Singapore Payments Market Size is central to enabling quick, secure, and convenient transactions that support daily consumer spending, business operations, and digital commerce. Its expansion is powered by efforts to cut down on cash usage, increase efficiency, and enable a digital economy. Prospects of the market include mobile wallets, real-time and cross-border payments, and fintech innovations. The government is actively facilitating this market through Smart Nation initiatives, Pay Now, SGQR, and MAS funding schemes like the Financial Sector Technology and Innovation (FSTI) scheme, with investments exceeding SGD 200 million to encourage research, innovation, and adoption of digital payments on a large scale.

Report Coverage

This research report categorizes the market for the Singapore payments market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore payments market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore payments market.

Singapore Payments Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 21.46 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.81% |

| 2035 Value Projection: | 60.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Mode of Payment, By Transaction Type |

| Companies covered:: | DBS Bank Ltd., OCBC Bank, United Overseas Bank (UOB), NETS, PayPal Holdings, Inc., Stripe, Inc., GrabPay, Fave (Pine Labs), Nium, FOMO Pay, HitPay, Sunrate, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore Payments Market Size is primarily driven by government initiatives aimed at promoting a cashless economy. Additionally, the market benefits from high smartphone and internet penetration rates, a broad usage of mobile wallets, and real-time payment systems such as Pay Now. The rapid growth of e-commerce, the presence of a sophisticated banking infrastructure, and an ever-increasing consumer demand for digital payment methods that are not only fast but also secure and convenient.

Restraining Factors

The Singapore Payments Market Size is restrained by the increasing cybersecurity and fraud risks, and small merchants are experiencing high implementation and compliance costs. In addition, data privacy and regulatory requirements, interoperability challenges between platforms, and consumers' concerns about security and misuse of their personal financial data are some of the other factors.

Market Segmentation

The Singapore Payments Market Size share is classified into mode of payment, transaction type, and end-user industry.

- The point-of-sale segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Payments Market Size is segmented by mode of payment into point-of-sale and online. Among these, the point-of-sale segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The point-of-sale segmental growth is due to the widespread adoption of contactless card payments and mobile wallets, high penetration of smartphones and NFC-enabled devices, easy availability of payment terminals, strong merchant acceptance, and consumer preference for quick, safe, and convenient in-store payments.

- The consumer-to-business (C2B) segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore Payments Market Size is segmented by transaction type into person-to-person (P2P), consumer-to-business (C2B), business-to-business (B2B), remittances & cross-border, and others. Among these, the consumer-to-business (C2B) segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The consumer-to-business (C2B) segmental growth is due to the rapid adoption of digital wallets and QR-based payments, high use of contactless cards, the growth of online shopping, easy QR payments, wide merchant acceptance, and consumer preference for quick and secure payments.

- The retail segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Payments Market Size is segmented by end-user industry into retail, entertainment & digital content, healthcare, hospitality & travel, and others. Among these, the retail segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The retail segmental growth is due to the high volume of daily consumer transactions, widespread acceptance of digital and contactless payments, growth of e-commerce and omnichannel retailing, strong adoption of mobile wallets and QR payments, and consumer demand for fast, convenient, and secure checkout experiences.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore payments market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DBS Bank Ltd.

- OCBC Bank

- United Overseas Bank (UOB)

- NETS

- PayPal Holdings, Inc.

- Stripe, Inc.

- GrabPay

- Fave (Pine Labs)

- Nium

- FOMO Pay

- HitPay

- Sunrate

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, Apple’s Tap to Pay on iPhone launched in Singapore, letting merchants use just an iPhone to accept contactless payments from cards and digital wallets without extra hardware, marking its availability in 50 countries and boosting mobile payment acceptance locally.

- In December 2025, Singapore-based MetaComp and blockchain firm Stable partnered to expand stablecoin-based cross-border payments by integrating Stable’s blockchain network into MetaComp’s regulated StableX platform, enhancing faster, compliant international settlement solutions.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore payments market based on the below-mentioned segments:

Singapore Payments Market, By Mode of Payment

- Point-of-sale

- Online

Singapore Payments Market, By Transaction Type

- Person-to-Person (P2P)

- Consumer-to-Business (C2B)

- Business-to-Business (B2B)

- Remittances & Cross-Border

- Others

Singapore Payments Market, By End-User Industry

- Retail

- Entertainment & Digital Content

- Healthcare

- Hospitality & Travel

- Others

Frequently Asked Questions (FAQ)

-

1. What is the Singapore payments market size in 2024?The Singapore payments market size was estimated at USD 21.46 billion in 2024.

-

2. What is the projected market size of the Singapore payments market by 2035?The Singapore payments market size is expected to reach USD 60.1 billion by 2035.

-

3. What is the CAGR of the Singapore payments market?The Singapore payments market size is expected to grow at a CAGR of around 9.81% from 2024 to 2035.

-

4. What are the key growth drivers of the Singapore payments market?The payments market in Singapore is driven by strong support for cashless payments, high use of smartphones, growing online shopping, and easy, fast, and secure digital payment options.

-

5. Which transaction type segment dominated the market in 2024?The consumer-to-business (C2B) segment dominated the market in 2024.

-

6. Who are the key players in the Singapore payments market?Key companies include DBS Bank Ltd., OCBC Bank, United Overseas Bank (UOB), NETS, PayPal Holdings, Inc., Stripe, Inc., GrabPay, Fave (Pine Labs), Nium, FOMO Pay, HitPay, Sunrate, and others.

-

7. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?