Singapore Patient Registry Software Market Size, Share, and COVID-19 Impact Analysis, By Product (Health Service Registry, Disease Registry, Product Registry, and Others), By Software (Integrated and Standalone), By Database Type (Commercial and Public), By Functionality (Population Health Management, Point-Of-Care, Product Outcome Evaluation, Patient Care Management, Medical Research & Clinical Studies, Health Information Exchange, and Others), and Singapore Patient Registry Software Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSingapore Patient Registry Software Market Insights Forecasts to 2035

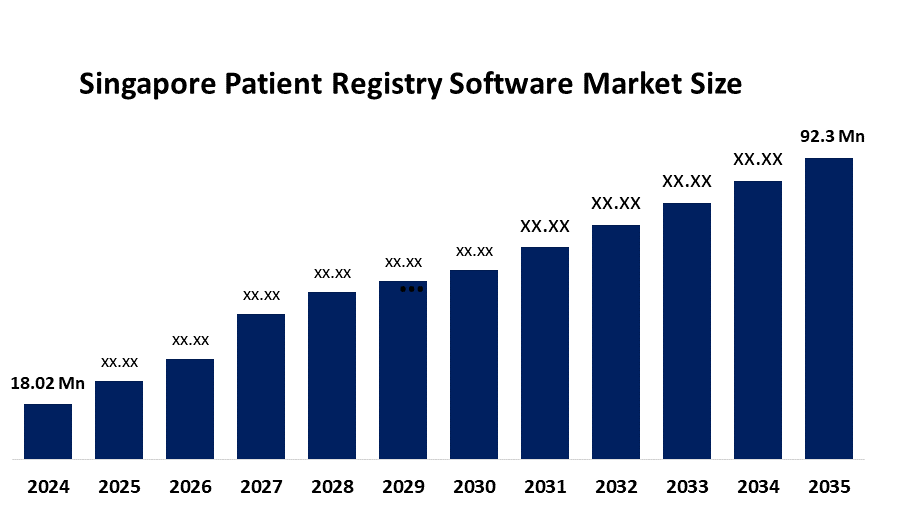

- The Singapore Patient Registry Software Market Size Was Estimated at USD 18.02 Million in 2024

- The Singapore Patient Registry Software Market Size is Expected to Grow at a CAGR of Around 16.01% from 2025 to 2035

- The Singapore Patient Registry Software Market Size is Expected to Reach USD 92.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Singapore Patient Registry Software Market Size is anticipated to reach USD 92.3 Million by 2035, Growing at a CAGR of 16.01% from 2025 to 2035. The Singapore patient registry software market is driven by the growing need for centralized digital patient data, integration with electronic health records, real-time analytics for disease management, and government initiatives promoting healthcare digitization, supporting improved clinical outcomes and research.

Market Overview

The Singapore patient registry software market is a term used to describe the market of various digital platforms that are designed for the collection, storage, and management of patient health data in a systematic manner for clinical, research, and administrative purposes. Through such software solutions, healthcare facilities, such as hospitals and clinics, as well as research organizations, are able to trace the health status of their patients, identify the development of a particular disease, take care of patients with chronic and rare conditions, and make decisions based on proper scientific evidence. Typically, these software solutions are compatible with electronic health records (EHRs), provide features for analysis and generation of reports, and are also capable of facilitating population health management, clinical trials, and healthcare planning in Singapore.

Singapore's move to a centralized digital patient record system is a response to urgent healthcare challenges that have been raised by an aging population, increased chronic diseases, and multi-provider care patterns. In order to make care more continuous and to avoid unnecessary duplication of tests or medication errors, Singapore has been deeply committed to the National Electronic Health Record (NEHR), a single record combining essential health information such as diagnoses, lab results, medications, and allergies that can be accessed at any point of care. Public hospitals and general practitioners have been contributing to NEHR, and all nine private hospitals have pledged to be integrated, so that a complete set of patients' information would be accessible to doctors for making safer and more well-informed decisions.

The government has strengthened the digital healthcare platform by bringing in new mandates and providing funding support. The government will provide compliance support and training to help with the transition to digital. The Ministry of Health has also set aside nearly SGD 200 million via the MOH Health Innovation Fund for the implementation of AI, automation, and digital tools among healthcare institutions. Among other things, these funds will be used to improve patient record systems and implement automated data updating that will help lessen the clinicians' workload. These moves clearly indicate a firm government commitment towards the digital health infrastructure and, at the same time, create a strong market for patient registry software solutions that support interoperability, real-time analytics, and integrated care in Singapore.

Report Coverage

This research report categorizes the market for the Singapore patient registry software market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore patient registry software market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore patient registry software market.

Singapore Patient Registry Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18.02 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 16.01% |

| 2035 Value Projection: | USD 92.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product , By Software |

| Companies covered:: | Synapxe Pte Ltd, Napier Healthcare, IQVIA Holdings Inc., IBM Corporation, Optum (UnitedHealth Group), Global Vision Technologies, Inc., FIGmd, Inc., Dacima Software Inc., ImageTrend Inc., McKesson Corporation, Oracle Health (Oracle Corporation), Athenahealth, Others, and key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore patient registry software market is driven by the need for centralized, digitized patient data. Integration with electronic health records, government initiatives like NEHR, rising chronic disease prevalence, and demand for real-time analytics to support clinical care and research.

Restraining Factors

The Singapore patient registry software market is restrained by high implementation and maintenance costs, concerns over data privacy and cybersecurity, limited IT infrastructure in smaller clinics, and resistance to technology adoption among some healthcare professionals. Integration challenges with existing hospital systems also slow widespread adoption.

Market Segmentation

The Singapore patient registry software market share is classified into product, software, database type, and functionality.

- The disease registry segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore patient registry software market is segmented by product into health service registry, disease registry, product registry, and others. Among these, the disease registry segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The disease registry segment is growing because of the increasing prevalence of chronic and rare diseases in Singapore, the need for systematic tracking of patient outcomes, and the demand for accurate, real-time data to support research, treatment optimization, and government health initiatives.

- The integrated segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore patient registry software market is segmented by software into integrated and standalone. Among these, the integrated segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The integrated segment is growing because it offers seamless connectivity with electronic health records (EHRs) and hospital information systems, enabling real-time data sharing, improved care coordination, and efficient management of patient information across multiple healthcare providers in Singapore.

- The commercial segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore patient registry software market is segmented by database type into commercial and public. Among these, the commercial segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The commercial segment is growing because private healthcare providers and research organizations in Singapore increasingly prefer ready-to-use, secure, and scalable database solutions that offer advanced analytics, customization, and compliance with regulatory standards for efficient patient data management.

- The population health management segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore patient registry software market is segmented by functionality into population health management, point-of-care, product outcome evaluation, patient care management, medical research & clinical studies, health information exchange, and others. Among these, the population health management segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The population health management segment is growing because healthcare providers and government agencies in Singapore increasingly rely on patient registry software to analyze population-level health data, identify disease trends, manage chronic conditions, and implement preventive care programs efficiently.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore patient registry software market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Synapxe Pte Ltd

- Napier Healthcare

- IQVIA Holdings Inc.

- IBM Corporation

- Optum (UnitedHealth Group)

- Global Vision Technologies, Inc.

- FIGmd, Inc.

- Dacima Software Inc.

- ImageTrend Inc.

- McKesson Corporation

- Oracle Health (Oracle Corporation)

- Athenahealth

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore patient registry software market based on the below-mentioned segments:

Singapore Patient Registry Software Market, By Product

- Health Service Registry

- Disease Registry

- Product Registry

- Others

Singapore Patient Registry Software Market, By Software

- Integrated

- Standalone

Singapore Patient Registry Software Market, By Database Type

- Commercial

- Public

Singapore Patient Registry Software Market, By Functionality

- Population Health Management

- Point-Of-Care

- Product Outcome Evaluation

- Patient Care Management

- Medical Research & Clinical Studies

- Health Information Exchange

- Others

Frequently Asked Questions (FAQ)

-

1.What is the Singapore patient registry software market size in 2024?The Singapore patient registry software market size was estimated at USD 18.02 million in 2024.

-

2.What is the projected market size of the Singapore patient registry software market by 2035?The Singapore patient registry software market size is expected to reach USD 92.3 million by 2035.

-

3.What is the CAGR of the Singapore patient registry software market?The Singapore patient registry software market size is expected to grow at a CAGR of around 16.01% from 2024 to 2035.

-

4.What are the key growth drivers of the Singapore patient registry software market?The Singapore patient registry software market is driven by the growing need for centralized digital patient data, integration with electronic health records, real-time analytics for disease management, and government initiatives promoting healthcare digitization, supporting improved clinical outcomes and research.

-

5.Which software segment dominated the market in 2024?The integrated segment dominated the market in 2024.

-

6.What segments are covered in the Singapore patient registry software market report?The Singapore patient registry software market is segmented on the basis of product, software, database type, and functionality.

-

7.Who are the key players in the Singapore patient registry software market?Key companies include Synapxe Pte Ltd, Napier Healthcare, IQVIA Holdings Inc., IBM Corporation, Optum (UnitedHealth Group), Global Vision Technologies, Inc., FIGmd, Inc., Dacima Software Inc., ImageTrend Inc., McKesson Corporation, Oracle Health (Oracle Corporation), Athenahealth, and others.

-

8.Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?