Singapore Oxygen Therapy Market Size, Share, and COVID-19 Impact Analysis, By Product (Oxygen Source Equipment and Oxygen Delivery Devices), By Application (Chronic Obstructive Pulmonary Disease, Asthma, Respiratory Distress Syndrome, Cystic Fibrosis, Pneumonia, and Others), By End Use (Home healthcare and Non-Home Healthcare), and Singapore Oxygen Therapy Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSingapore Oxygen Therapy Market Size Insights Forecasts to 2035

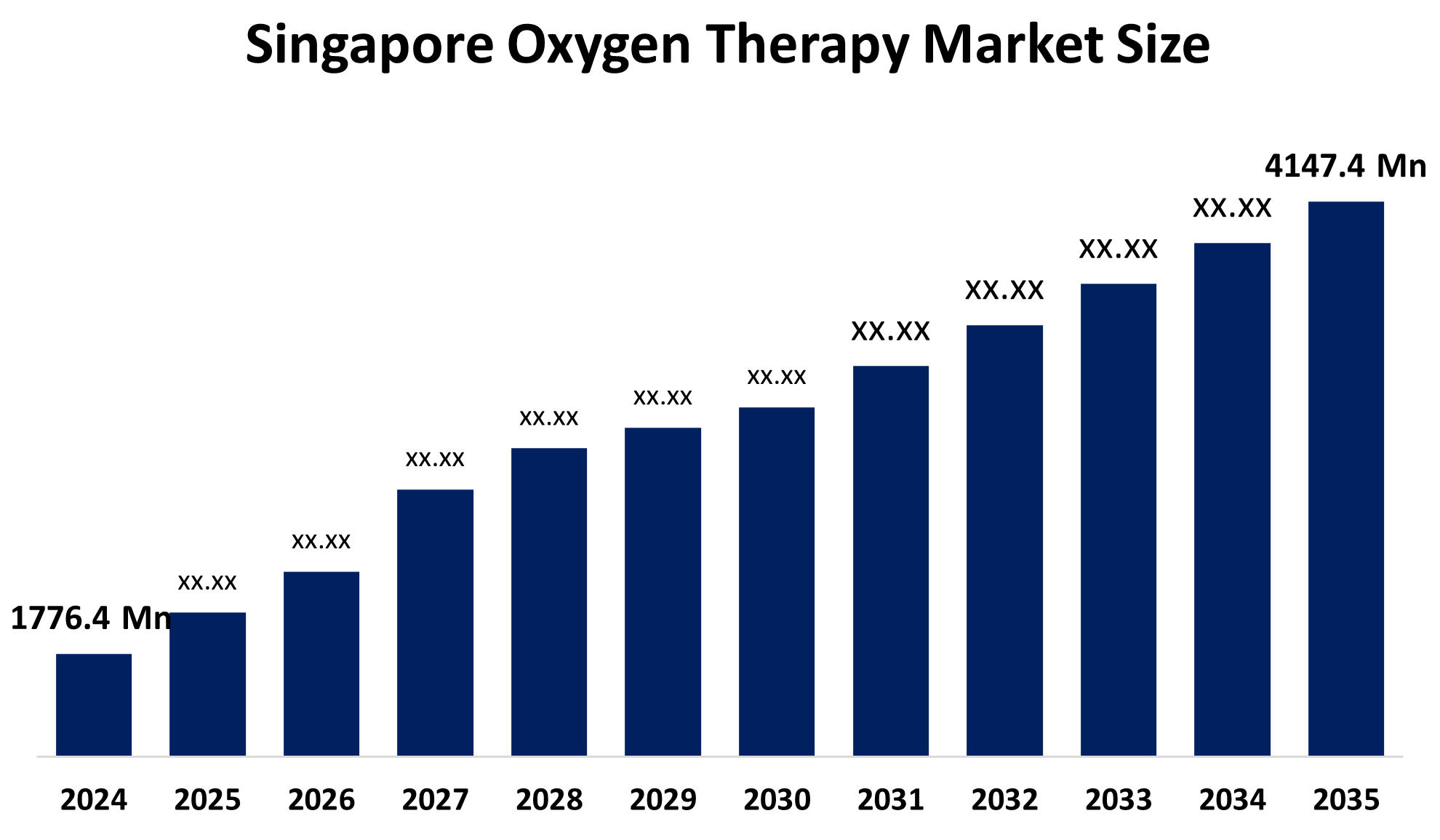

- The Singapore Oxygen Therapy Market Size Was Estimated at USD 1,776.4 Million in 2024

- The Singapore Oxygen Therapy Market Size is Expected to Grow at a CAGR of Around 8.01% from 2025 to 2035

- The Singapore Oxygen Therapy Market Size is Expected to Reach USD 4147.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Singapore Oxygen Therapy Market Size is Anticipated to Reach USD 4147.4 Million by 2035, Growing at a CAGR of 8.01% from 2025 to 2035. The Singapore Oxygen Therapy Market Size is driven by rising respiratory diseases, an aging population, growing home healthcare adoption, and advanced portable oxygen devices, supported by strong healthcare infrastructure and government initiatives.

Market Overview

The Singapore Oxygen Therapy Market Size is essentially the market for medical oxygen equipment that is used in the treatment of patients with respiratory disorders such as COPD, asthma, pneumonia, and COVID-19 complications. It includes oxygen concentrators, cylinders, liquid oxygen systems, and portable devices used in various settings such as hospitals, clinics, and home care. The market encompasses the production, distribution, and sale of oxygen therapy devices and consumables in Singapore and is influenced by factors such as the increasing prevalence of respiratory diseases, the aging population, and the growing demand for respiratory care in both home and hospital settings.

Oxygen therapy in Singapore is becoming more and more vital due to the heavy load of chronic respiratory diseases like COPD (which affects about 5-6% of adults) and asthma (about 20% of children and 5% of adults), which often need long-term oxygen support and respiratory care. Chronic respiratory diseases make up 4.4% of the total disease burden in Singapore, and COPD is one of the main causes of death, underlining a continuous demand for oxygen therapy devices and services. The importance of the market is also indicated by government research funding and healthcare initiatives.

In 2025, Singapore granted a US$10 million research funding to The Academic Respiratory Initiative for Pulmonary Health (TARIPH), an NTU Singapore-led project, to carry out translational respiratory health research, including lung health and treatment innovations. Programs like Medisave, MediShield Life, and Medi Fund not only facilitate access to respiratory therapies, including oxygen support, but also allow citizens to use savings and insurance for the expenses of the treatment. All these factors, high prevalence of lung conditions, government-supported research investment, and enabling healthcare financing, emphasize the need and potential for the Singapore oxygen therapy market to grow.

Report Coverage

This research report categorizes the market for the Singapore Oxygen Therapy Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore oxygen therapy market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore oxygen therapy market.

Singapore Oxygen Therapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,776.4 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.01% |

| 2035 Value Projection: | USD 4147.4 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Philips Healthcare, ResMed Inc., Invacare Corporation, Linde Healthcare, CAIRE Inc. (Chart Industries), Drive DeVilbiss Healthcare, Inogen, Inc., Fisher & Paykel Healthcare, Smiths Medical, Becton, Dickinson and Company (BD), Teleflex Incorporated, Nidek Medical Products, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The Singapore Oxygen Therapy Market Size is driven by the increasing number of cases of respiratory diseases like COPD, asthma, and pneumonia, besides a fast-aging population needing long-term respiratory support. The various factors supporting the market growth include the adoption of home healthcare, an increase in the use of portable and advanced oxygen devices, a strong hospital infrastructure, and the sustained government focus on respiratory care and emergency preparedness.

Restraining Factors

The Singapore Oxygen Therapy Market Size is restrained by high device and maintenance costs that limit the buying of home care users and, additionally, strict regulatory approvals that delay the entry of products. Reliance on imported oxygen masks, scant reimbursement for long-term home oxygen therapy, and the requirement of trained medical practitioners to handle oxygen delivery safely are some of the factors that frustrate the widest possible adoption of the market.

Market Segmentation

The Singapore oxygen therapy market share is classified into product, application, and end use.

- The oxygen source equipment segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Oxygen Therapy Market Size is segmented by product into oxygen source equipment and oxygen delivery devices. Among these, the oxygen source equipment segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The oxygen source equipment segment is growing because of the rising number of patients with chronic respiratory diseases, increased demand for long-term and continuous oxygen supply in hospitals and homecare, and wider adoption of oxygen concentrators and liquid oxygen systems. Technological advancements, better portability, and strong healthcare infrastructure in Singapore further support the growth of this segment.

- The chronic obstructive pulmonary disease segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore Oxygen Therapy Market Size is segmented by application into chronic obstructive pulmonary disease, asthma, respiratory distress syndrome, cystic fibrosis, pneumonia, and others. Among these, the chronic obstructive pulmonary disease segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The chronic obstructive pulmonary disease segment is growing because of the high and rising prevalence of COPD among Singapore’s aging population, increasing exposure to smoking history and air pollution, and the need for long-term oxygen therapy in moderate to severe cases. Improved diagnosis rates, frequent hospitalizations, and growing adoption of home-based oxygen therapy further support the strong growth of this segment.

- The home healthcare segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Oxygen Therapy Market Size is segmented by end use into home healthcare and non-home healthcare. Among these, the home healthcare segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The home healthcare segment is growing because of the increasing elderly population, rising chronic respiratory diseases, preference for treatment at home, and wider use of portable, easy-to-use oxygen devices that reduce hospital visits and costs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore Oxygen Therapy Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Philips Healthcare

- ResMed Inc.

- Invacare Corporation

- Linde Healthcare

- CAIRE Inc. (Chart Industries)

- Drive DeVilbiss Healthcare

- Inogen, Inc.

- Fisher & Paykel Healthcare

- Smiths Medical

- Becton, Dickinson and Company (BD)

- Teleflex Incorporated

- Nidek Medical Products

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore Oxygen Therapy Market Size based on the below-mentioned segments:

Singapore Oxygen Therapy Market, By Product

- Oxygen Source Equipment

- Oxygen Delivery Devices

Singapore Oxygen Therapy Market, By Application

- Chronic Obstructive Pulmonary Disease

- Asthma

- Respiratory Distress Syndrome

- Cystic Fibrosis

- Pneumonia

- Others

Singapore Oxygen Therapy Market, By End Use

- Home healthcare

- Non-Home Healthcare

Frequently Asked Questions (FAQ)

-

1.What is the Singapore oxygen therapy market size in 2024?The Singapore oxygen therapy market size was estimated at USD 1,776.4 million in 2024.

-

2.What is the projected market size of the Singapore oxygen therapy market by 2035?The Singapore oxygen therapy market size is expected to reach USD 4147.4 million by 2035.

-

3.What is the CAGR of the Singapore oxygen therapy market?The Singapore oxygen therapy market size is expected to grow at a CAGR of around 8.01% from 2024 to 2035.

-

4.What are the key growth drivers of the Singapore oxygen therapy market?The Singapore oxygen therapy market is driven by rising respiratory diseases, an aging population, growing home healthcare adoption, and advanced portable oxygen devices, supported by strong healthcare infrastructure and government initiatives.

-

5.Which application segment dominated the market in 2024?The chronic obstructive pulmonary disease segment dominated the market in 2024.

-

6.What segments are covered in the Singapore Oxygen Therapy market report?The Singapore oxygen therapy market is segmented on the basis of product, application, and end use.

-

7.Who are the key players in the Singapore oxygen therapy market?Key companies include Philips Healthcare, ResMed Inc., Invacare Corporation, Linde Healthcare, CAIRE Inc. (Chart Industries), Drive DeVilbiss Healthcare, Inogen, Inc., Fisher & Paykel Healthcare, Smiths Medical, Becton, Dickinson and Company (BD), Teleflex Incorporated, Nidek Medical Products, and others.

-

8.Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?