Singapore Oral Syringes Market Size, Share, and COVID-19 Impact Analysis, By Type (Colorful Oral Syringes and Clear Oral Syringes), By Usage (Single-Use Oral Syringes and Reusable Oral Syringes), By End Use (Homecare Settings, Hospitals, Clinics, and Others), and Singapore Oral Syringes Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareSingapore Oral Syringes Market Insights Forecasts to 2035

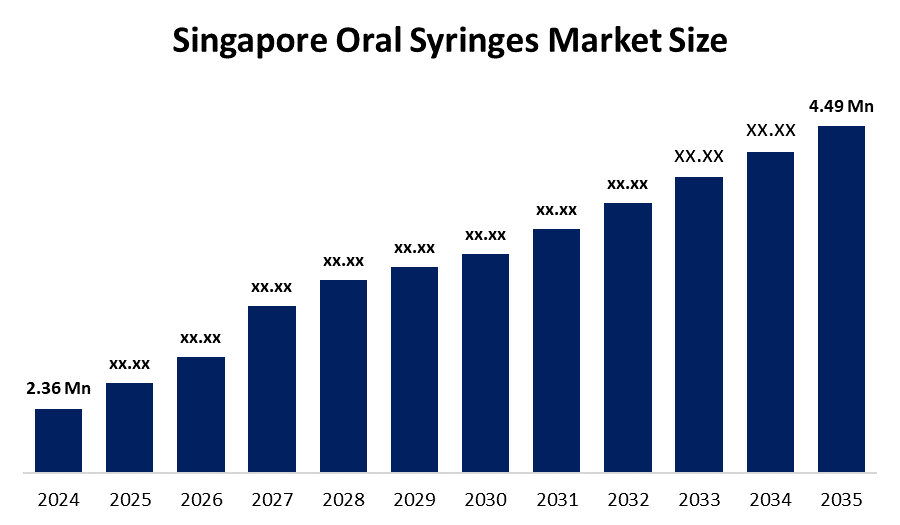

- The Singapore Oral Syringes Market Size Was Estimated at USD 2.36 Million in 2024

- The Singapore Oral Syringes Market Size is Expected to Grow at a CAGR of Around 6.02% from 2025 to 2035

- The Singapore Oral Syringes Market Size is Expected to Reach USD 4.49 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Singapore Oral Syringes Market Size is Anticipated to Reach USD 4.49 Million by 2035, Growing at a CAGR of 6.02% from 2025 to 2035. The Singapore oral syringes market is driven by growing pediatric and geriatric populations, rising chronic disease prevalence, demand for precise medication dosing, increased awareness of safe drug administration, and advancements in syringe design.

Market Overview

The Singapore Oral Syringes Market Size refers to the industry engaging in the production, selling, and utilization of syringes that are intended for the precise delivery of liquid medicine by mouth. Such syringes are mainly used for children, the elderly, and patients with special needs. Besides, these syringes guarantee exact doses, safe administrations, and convenience in the respective settings of hospitals, clinics, pharmacies, and home care. They also promote the patients' adherence to the treatment and help to reduce the risk of over- or underdosing, which is often the case when using the traditional spoons or cups.

Singapore Oral Syringes Market Size is gaining importance due to the city-state’s evolving demographic and healthcare profile. With a rapidly aging population—around 20% aged over 65—and a high prevalence of chronic conditions such as diabetes, hypertension, and hyperlipidemia affecting nearly one in three adults, the need for accurate and safe oral medication dosing is increasing across hospitals, clinics, and home-care settings. Precise liquid medication delivery is particularly critical for pediatric patients, elderly individuals, and those with swallowing difficulties, as it helps reduce dosing errors and improves treatment adherence. The market is projected to grow from approximately USD 2.5 million in 2025 to USD 3.3 million by 2030, supported by routine clinical use and growing recognition of oral health as an integral part of overall healthcare.

Singapore Oral Syringes Market Size benefits from a pro-innovation healthcare ecosystem supported by strong government initiatives. The Health Sciences Authority (HSA) offers expedited regulatory pathways and early guidance to accelerate medical device approvals. Under the RIE 2025 plan, SGD 28 billion has been allocated to health research and biomedical innovation, reinforcing Singapore’s position as a leading MedTech hub. In addition, high healthcare participation through MediSave and preventive programs such as Healthier SG supports the widespread adoption of safe and precise oral dosing solutions across both clinical and home-care settings.

Report Coverage

This research report categorizes the market for the Singapore Oral Syringes Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore oral syringes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore oral syringes market.

Singapore Oral Syringes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.36 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.02% |

| 2035 Value Projection: | USD 4.49 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Usage ,By Type |

| Companies covered:: | Becton, Dickinson and Company (BD), B. Braun Melsungen AG, Terumo Corporation, Nipro Corporation, Halyard Health (part of Owens & Minor), Cardinal Health, Inc., Medline Industries, Inc., Smiths Medical (ICU Medical), Romsons Scientific & Surgical Industries Pvt. Ltd., Weaver and Co., Ltd., AptarGroup, Inc., Unicontrols Singapore Pte. Ltd., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for oral syringes in Singapore is being driven by several factors, such as a large number of children and elderly people living in the country, increasing incidence of long-term diseases, desire for safe and accurate medicines, technological progress in the design of syringes, and the government's backing via initiatives like MediSave, Healthier SG, and MedTech R&D grants.

Restraining Factors

The Singapore Oral Syringes Market Size is restrained by several factors, such as high prices of specialized syringes, lack of awareness or adoption in smaller clinics and homes, strict regulatory requirements for medical devices, and competition from conventional dosing methods such as spoons and cups. Moreover, the rather small population size might be a hindrance to large-scale production and cost efficiencies.

Market Segmentation

The Singapore Oral Syringes Market share is classified into type, usage, and end use.

- The clear oral syringes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Oral Syringes Market Size is segmented by type into colorful oral syringes and clear oral syringes. Among these, the clear oral syringes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The clear oral syringes segment is growing because it allows precise measurement and easy visibility of liquid medication, reduces dosing errors, and is widely preferred in hospitals, pharmacies, and home care settings for safe and accurate administration.

- The single-use oral syringes segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore Oral Syringes Market Size is segmented by usage into single-use oral syringes and reusable oral syringes. Among these, the single-use oral syringes segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The single-use oral syringes segment is growing because they prevent cross-contamination and infection, ensure hygienic and convenient medication administration, and are widely adopted in hospitals, clinics, and home care, aligning with Singapore’s focus on patient safety and infection control.

- The hospitals segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore Oral Syringes Market Size is segmented by end use into homecare settings, hospitals, clinics, and others. Among these, the hospitals segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The hospital segment is growing because hospitals have a high volume of patients requiring precise liquid medication dosing, including pediatric, geriatric, and chronic disease patients. The focus on safe, accurate, and hygienic drug administration drives widespread adoption of oral syringes in clinical settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore oral syringes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Becton, Dickinson and Company (BD)

- B. Braun Melsungen AG

- Terumo Corporation

- Nipro Corporation

- Halyard Health (part of Owens & Minor)

- Cardinal Health, Inc.

- Medline Industries, Inc.

- Smiths Medical (ICU Medical)

- Romsons Scientific & Surgical Industries Pvt. Ltd.

- Weaver and Co., Ltd.

- AptarGroup, Inc.

- Unicontrols Singapore Pte. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore Oral Syringes Market Size based on the below-mentioned segments:

Singapore Oral Syringes Market, By Type

- Colorful Oral Syringes

- Clear Oral Syringes

Singapore Oral Syringes Market, By Usage

- Single-Use Oral Syringes

- Reusable Oral Syringes

Singapore Oral Syringes Market, By End Use

- Homecare Settings

- Hospitals

- Clinics

- Others

Frequently Asked Questions (FAQ)

-

1. What is the Singapore oral syringes market size in 2024?The Singapore oral syringes market size was estimated at USD 2.36 million in 2024.

-

2. What is the projected market size of the Singapore oral syringes market by 2035?The Singapore oral syringes market size is expected to reach USD 4.49 million by 2035.

-

3. What is the CAGR of the Singapore oral syringes market?The Singapore oral syringes market size is expected to grow at a CAGR of around 6.02% from 2024 to 2035.

-

4. What are the key growth drivers of the Singapore oral syringes market?The Singapore oral syringes market is driven by growing pediatric and geriatric populations, rising chronic disease prevalence, demand for precise medication dosing, increased awareness of safe drug administration, and advancements in syringe design.

-

5. Which usage segment dominated the market in 2024?The single-use oral syringe segment dominated the market in 2024.

-

6. What segments are covered in the Singapore oral syringes market report?The Singapore oral syringes market is segmented on the basis of type, usage, and end use.

-

7. Who are the key players in the Singapore oral syringes market?Key companies include Becton, Dickinson and Company (BD), B. Braun Melsungen AG, Terumo Corporation, Nipro Corporation, Halyard Health (part of Owens & Minor), Cardinal Health, Inc., Medline Industries, Inc., Smiths Medical (ICU Medical), Romsons Scientific & Surgical Industries Pvt. Ltd., Weaver and Co., Ltd., AptarGroup, Inc.; and Unicontrols Singapore Pte. Ltd.

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?