Singapore Neobanking Market Size, Share, and COVID-19 Impact Analysis, By Account Type (Business Accounts and Savings Accounts), By Services (Mobile Banking, Payments & Money Transfers, Savings, Loans, and Others), By Application Type (Personal and Enterprises), and Singapore Neobanking Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialSingapore Neobanking Market Insights Forecasts to 2035

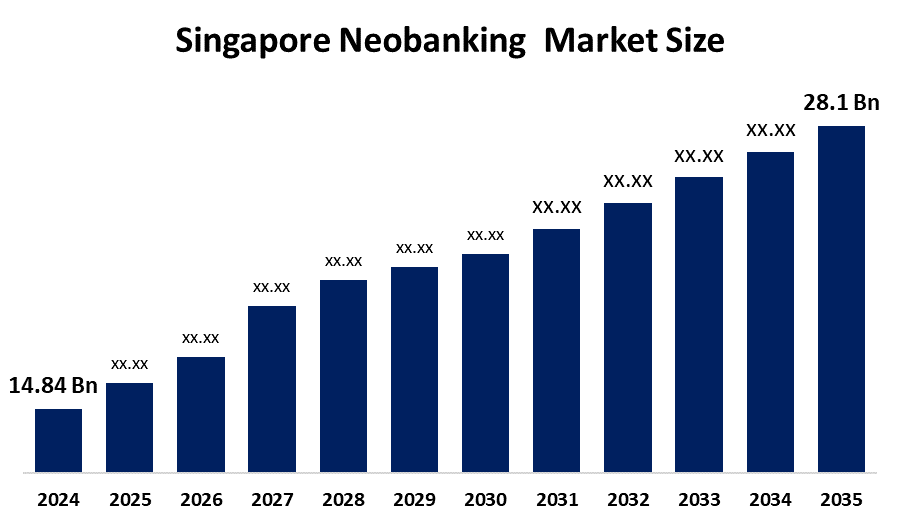

- The Singapore Neobanking Market Size Was Estimated at USD 14.84 Billion in 2024

- The Singapore Neobanking Market Size is Expected to Grow at a CAGR of Around 5.98% from 2025 to 2035

- The Singapore Neobanking Market Size is Expected to Reach USD 28.1 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Singapore Neobanking Market Size Is Anticipated To Reach USD 28.1 Billion By 2035, Growing At A CAGR Of 5.98% From 2025 To 2035. The Singapore Neobanking Market Size is driven by high digital and smartphone usage, demand for easy and low-cost banking services, strong government and MAS support for fintech, and growing use by young consumers and small businesses.

Market Overview

The Singapore Neobanking Market Size is the industry comprising digital-only banks and fintech platforms that provide banking services entirely online or via mobile apps, including payments, deposits, loans, and financial management without traditional physical branches, offering convenient, fast, and cost-effective banking solutions to consumers and businesses.

Singapore's excellent fit for the Neobanking Market Size is mainly due to its digitally mature population and changing financial needs. The country has a population of about 5.6 million; more than 90% of the population owns a smartphone, and almost 98% of adults are already banked; hence, consumers are very open to fully digital financial services. Young people, gig economy workers, expatriates, and SMEs are increasingly looking for low-cost, app-based, fast, and personalized banking services, which traditional banks find it very difficult to provide at scale. The fast adoption of digital banks, as shown by the top neobanks reaching one million customers in a very short time after the launch, illustrates strong demand for seamless onboarding, instant payments, data-driven financial tools, and 24/7 access, which in turn confirms the necessity and importance of neobanking adoption in Singapore.

Government support acts as a major driver for the Singapore Neobanking Market Size . The Monetary Authority of Singapore (MAS) has rolled out a specific Digital Bank License scheme to foster innovation without jeopardizing the stability of the financial sector, and thus, a total of 20+ license applications were submitted, demonstrating a strong enthusiasm for investors and the industry. Within the national Smart Nation Initiative, the Singapore government has committed a budget of around SGD 2.4 billion for the purpose of rapidly advancing digitization, which also covers fintech and digital finance infrastructure.

Furthermore, regulations such as the Payment Services Act and MAS, supported by research institutions like the Asian Institute of Digital Finance, are helping fintech R&D, talent development, and responsible innovation. All these sets of initiatives put the spotlight on neobanks as a main area of growth, thus turning Singapore into one of the most attractive and best-regulated markets for digital banking in the Asia-Pacific region from the viewpoint of both commerce and marketing.

Report Coverage

This research report categorizes the market for the Singapore Neobanking Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore Neobanking Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore neobanking market.

Singapore Neobanking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.84 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 5.98% |

| 2035 Value Projection: | USD 28.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Account Type, By Services |

| Companies covered:: | Aspire Financial Technologies Pte. Ltd. Wise (formerly TransferWise) YouTrip Pte. Ltd. Revolut Ltd. Singlife Pte. Ltd. StashAway Pte. Ltd. Grab Financial Group Nium Pte. Ltd. MatchMove Pay Pte. Ltd. Minterest Holdings Pte. Ltd. GXS Bank ANEXT Bank And Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore Neobanking Market Size is driven by the extensive use of smartphones and the internet. There is also a growing demand for easy, cheap, and 24/7 banking services. The Monetary Authority of Singapore (MAS) is very supportive of the fintech sector. Furthermore, increasing adoption by SMEs and startups is getting on board with the trend. Lastly, the use of AI, big data, and cloud computing, which allow for personalized and secure financial services, is one of the other factors.

Restraining Factors

The Singapore Neobanking Market Size is restrained by several factors, including stringent regulatory requirements, stiff competition from traditional banks and other neobanks, concerns about cybersecurity and data privacy, and a lack of trust, mainly among those users who have been accustomed to banking with established institutions.

Market Segmentation

The Singapore neobanking market share is classified into account type, services, and application type.

- The business accounts segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Neobanking Market Size is segmented by account type into business accounts and savings accounts. Among these, the business accounts segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The business accounts segment is growing because small and medium-sized enterprises (SMEs) and startups in Singapore use neobanks for easy payments, payroll, and real-time money management, as they are fast, flexible, and cost-effective compared to traditional banks.

- The mobile banking segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore Neobanking Market size is segmented by services into mobile banking, payments & money transfers, savings, loans, and others. Among these, the mobile banking segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The mobile banking segment is growing because most consumers and businesses in Singapore prefer managing their finances through smartphones, allowing easy access to accounts, payments, transfers, and financial services anytime and anywhere.

- The enterprise segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Neobanking Market Size is segmented by application type into personal and enterprise. Among these, the enterprise segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The enterprise segment is growing because businesses in Singapore increasingly use neobanks for managing payments, payroll, and finances efficiently, benefiting from real-time monitoring, lower costs, and flexible digital banking solutions compared to traditional banks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore Neobanking Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aspire Financial Technologies Pte. Ltd.

- Wise (formerly TransferWise)

- YouTrip Pte. Ltd.

- Revolut Ltd.

- Singlife Pte. Ltd.

- StashAway Pte. Ltd.

- Grab Financial Group

- Nium Pte. Ltd.

- MatchMove Pay Pte. Ltd.

- Minterest Holdings Pte. Ltd.

- GXS Bank

- ANEXT Bank

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2025, Nikko Asset Management took an equity stake in Singapore-based neobank Chocolate Finance, backing its regional expansion and fintech innovation while enabling knowledge sharing and broader digital financial solutions across Asia.

- In March 2025, GXS Bank partnered with global tech consultancy Thoughtworks to build a scalable, secure digital banking platform that supports the launch and expansion of its Singapore and regional neobanking services, accelerating innovation and product rollout.

- In February 2025, Singapore’s digital banks are expanding beyond basic accounts by offering investment and loan products like MariBank’s investment services and Trust Bank’s TrustInvest to boost profitability and attract more active users.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore Neobanking Market Size based on the below-mentioned segments:

Singapore Neobanking Market, By Account Type

- Business Accounts

- Savings Accounts

Singapore Neobanking Market, By Services

- Mobile Banking

- Payments & Money Transfers

- Savings

- Loans

- Others

Singapore Neobanking Market, By Application Type

- Personal

- Enterprises

Frequently Asked Questions (FAQ)

-

1. What is the Singapore neobanking market size in 2024?The Singapore neobanking market size was estimated at USD 14.84 billion in 2024

-

2. What is the projected market size of the Singapore neobanking market by 2035?The Singapore neobanking market size is expected to reach USD 28.1 billion by 2035.

-

3. What is the CAGR of the Singapore neobanking market?The Singapore neobanking market size is expected to grow at a CAGR of around 5.98% from 2024 to 2035

-

4. What are the key growth drivers of the Singapore neobanking market?The Singapore neobanking market is driven by high digital and smartphone usage, demand for easy and low-cost banking services, strong government and MAS support for fintech, and growing use by young consumers and small businesses.

-

5. Which services industry segment dominated the market in 2024?The mobile banking segment dominated the market in 2024.

-

6. What segments are covered in the Singapore neobanking market report?The Singapore neobanking market is segmented on the basis of account type, services, and application type.

-

7. Who are the key players in the Singapore neobanking market?Key companies include Aspire Financial Technologies Pte. Ltd., Wise, YouTrip Pte. Ltd., Revolut Ltd., Singlife Pte. Ltd., StashAway Pte. Ltd., Grab Financial Group, Nium Pte. Ltd., MatchMove Pay Pte. Ltd., Minterest Holdings Pte. Ltd., GXS Bank, ANEXT Bank, and others

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?