Singapore Electric Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Car and Commercial Vehicles), By Drive Train Technology (Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), Fuel Cell Electric Vehicles (FCEV), and Others), By Battery Capacity (Up to 50 kWh, 51 to 75 kWh, Above 75 kWh, and Others), By End User (Private Individual Owners, Commercial Fleet Operators, Government & Public-Sector Fleets, and Others), and Singapore Electric Vehicle Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationSingapore Electric Vehicle Market Insights Forecasts to 2035

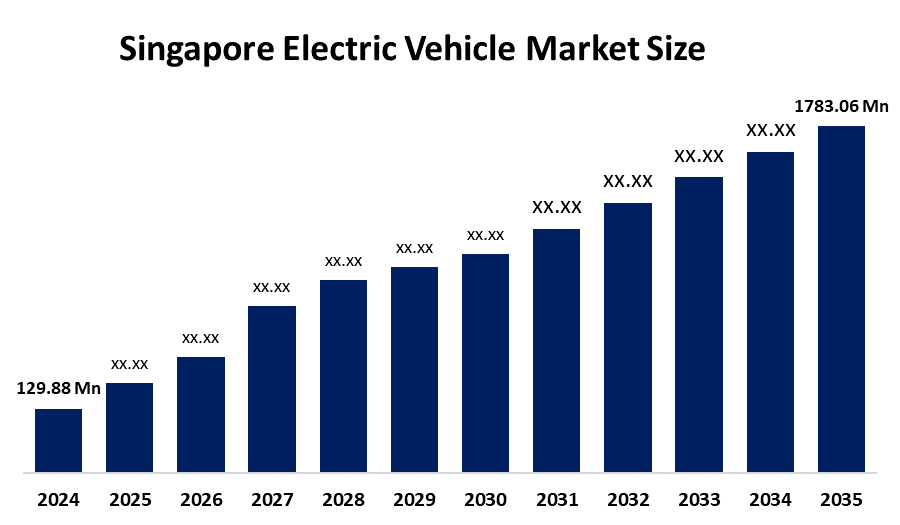

- The Singapore Electric Vehicle Market Size Was Estimated at USD 129.88 Million in 2024

- The Singapore Electric Vehicle Market Size is Expected to Grow at a CAGR of Around 26.89% from 2025 to 2035

- The Singapore Electric Vehicle Market Size is Expected to Reach USD 1783.06 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Singapore Electric Vehicle Market Size is Anticipated to Reach USD 1783.06 Million by 2035, Growing at a CAGR of 26.89% from 2025 to 2035. The Singapore electric vehicle market is driven by strong government policies promoting clean transport, rising fuel costs, strict vehicle emission regulations, expanding charging infrastructure, and incentives such as tax rebates and grants that encourage consumers and fleets to shift toward electric vehicles.

Market Overview

The Singapore Electric Vehicle Market Size encompasses the manufacturing, import, sale, and adoption of electric vehicles such as battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), along with the development of charging infrastructure and related mobility services. The market includes passenger cars, commercial vehicles, public transport fleets, charging stations, battery systems, and software platforms that support vehicle charging and energy management. It is shaped by Singapore’s push toward cleaner transportation, reduced carbon emissions, improved air quality, and long-term energy efficiency through electrified mobility solutions.

Singapore’s electric vehicle (EV) market is shaped by a population of 5.9 million, high urban density, and an active vehicle fleet of about 1 million vehicles, which contributes significantly to urban emissions and air-quality concerns. Land transport accounts for a notable share of Singapore’s carbon output, while reliance on imported fuels exposes motorists to price volatility. These conditions have accelerated the shift toward EVs as a cleaner, quieter, and more energy-efficient mobility option suited to short urban travel distances and dense city driving.

Government action strongly supports market adoption. Under the Singapore Green Plan 2030, all new car registrations must be cleaner-energy vehicles from 2030, with internal combustion vehicles phased out by 2040. The government targets 60,000 EV charging points by 2030 (including 40,000 public chargers) to ensure nationwide accessibility. Financial incentives such as the Vehicular Emissions Scheme (VES) and EV Early Adoption Incentive offer rebates of up to SGD 25,000, reducing upfront costs. On the innovation side, the RIE2025 program (SGD 25 billion) funds clean mobility, battery technology, and energy systems research, while agencies like LTA and EMA support pilot projects and fleet electrification, creating a strong commercial and policy environment for EV manufacturers, charging providers, and mobility solution companies.

Report Coverage

This research report categorizes the market for the Singapore Electric Vehicle Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore electric vehicle market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore electric vehicle market.

Singapore Electric Vehicle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 129.88 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 26.89% |

| 2035 Value Projection: | USD 1783.06 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Drive Train Technology ,By Vehicle Type |

| Companies covered:: | BYD Company Limited, Tesla Inc., BMW AG, Hyundai Motor Company, Toyota Motor Corporation, Nissan Motor Company, BlueSG Pte Ltd, GetGo Technologies Pte. Ltd., Singapore Electric Vehicles Pte Ltd (SEV), Oyika Pte. Ltd., Charge+, SP Group, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Singapore Electric Vehicle Market Size is driven by strong government support through the Green Plan 2030, which includes incentives of up to SGD 40,000, a plan to phase out petrol and diesel vehicles by 2040, and a national target of 60,000 EV charging points by 2030. High fuel costs, increased environmental consciousness, short travel distances in the city, and the expanding range of EV models are some of the factors that facilitate the speedy uptake of EVs.

Restraining Factors

The Singapore Electric Vehicle Market Size faces restraints such as high upfront EV prices despite incentives, limited availability of private home charging for residents in older apartments, and range anxiety among first-time buyers. Additionally, longer charging times compared to refueling, concerns over battery replacement costs, and reliance on a still-expanding public charging network slow adoption, particularly among conservative consumers and small fleet operators.

Market Segmentation

The Singapore Electric Vehicle Market share is classified into vehicle type, drive train technology, battery capacity, and end user.

- The passenger car segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Electric Vehicle Market Size is segmented by vehicle type into passenger cars and commercial vehicles. Among these, the passenger car segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The passenger car segment is growing because electric vehicles are cheaper to run, the government gives incentives, charging points are increasing, and most daily travel in Singapore is short, making electric passenger cars easy and convenient to use.

- The battery electric vehicle (BEV) segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Singapore Electric Vehicle Market Size is segmented by drive train technology into battery electric vehicles (BEV), plug-in hybrid electric vehicles (PHEV), fuel cell electric vehicles (FCEV), and others. Among these, the battery electric vehicle (BEV) segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The battery electric vehicles (BEV) segment is growing because they get more government incentives, cost less to run, have more charging points available, and produce zero emissions, making them the easiest and most practical EV option in Singapore.

- The 51 to 75 kWh segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Electric Vehicle Market Size is segmented by battery capacity into up to 50 kWh, 51 to 75 kWh, above 75 kWh, and others. Among these, the 51 to 75 kWh segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The 51 to 75 kWh segment is growing because it offers the best balance between driving range, vehicle cost, and charging time for Singapore’s urban driving needs. Vehicles in this range comfortably cover daily travel distances, qualify for government incentives, and remain more affordable and practical than higher-capacity batteries, making them the preferred choice among EV buyers.

- The private individual owners segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore Electric Vehicle Market Size is segmented by end user into private individual owners, commercial fleet operators, government & public-sector fleets, and others. Among these, the private individual owners segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The private individual owners’ segment is growing because government incentives reduce costs, EVs are cheaper to run, charging points are increasing, and most people travel short distances, making EVs convenient for personal use in Singapore.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore Electric Vehicle Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

- BYD Company Limited

- Tesla Inc.

- BMW AG

- Hyundai Motor Company

- Toyota Motor Corporation

- Nissan Motor Company

- BlueSG Pte Ltd

- GetGo Technologies Pte. Ltd.

- Singapore Electric Vehicles Pte Ltd (SEV)

- Oyika Pte. Ltd.

- Charge+

- SP Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

• In January 2026, Chinese EV maker Nio launched its first right-hand-drive Firefly electric vehicle at the Singapore Motorshow, marking its official entry into Singapore’s EV market, with sales expected to begin around Chinese New Year.

• In Oct 2025, BYD launched the Seal 6 EV, a new fully electric, Category A COE-eligible sedan in Singapore, offering up to 425 km of range, advanced tech, and competitive pricing to boost urban EV adoption in the local market.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore electric vehicle market based on the below-mentioned segments:

Singapore Electric Vehicle Market, By Vehicle Type

- Passenger Car

- Commercial Vehicles

Singapore Electric Vehicle Market, By Drive Train Technology

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Fuel Cell Electric Vehicles (FCEV)

- Others

Singapore Electric Vehicle Market, By Battery Capacity

- Up to 50 kWh

- 51 to 75 kWh

- Above 75 kWh

- Others

Singapore Electric Vehicle Market, By End User

- Private Individual Owners

- Commercial Fleet Operators

- Government & Public-Sector Fleets

- Others

Frequently Asked Questions (FAQ)

-

1. What is the Singapore electric vehicle market size in 2024?The Singapore electric vehicle market size was estimated at USD 129.88 million in 2024.

-

2. What is the projected market size of the Singapore electric vehicle market by 2035?The Singapore electric vehicle market size is expected to reach USD 1783.06 million by 2035

-

3. What is the CAGR of the Singapore electric vehicle market?The Singapore electric vehicle market size is expected to grow at a CAGR of around 26.89% from 2024 to 2035.

-

4. What are the key growth drivers of the Singapore electric vehicle market?The Singapore electric vehicle market is driven by strong government policies promoting clean transport, rising fuel costs, strict vehicle emission regulations, expanding charging infrastructure, and incentives such as tax rebates and grants that encourage consumers and fleets to shift toward electric vehicles.

-

5. Which drive train technology segment dominated the market in 2024?The battery electric vehicle (BEV) segment dominated the market in 2024.

-

6. What segments are covered in the Singapore electric vehicle market report?The Singapore electric vehicle market is segmented on the basis of vehicle type, drive train technology, battery capacity, and end user.

-

7. Who are the key players in the Singapore electric vehicle market?Key companies include BYD Company Limited, Tesla Inc., BMW AG, Hyundai Motor Company, Toyota Motor Corporation, Nissan Motor Company, BlueSG Pte Ltd, GetGo Technologies Pte. Ltd., Singapore Electric Vehicles Pte Ltd (SEV), Oyika Pte. Ltd., Charge+, SP Group, and others.

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?