Singapore Duty Free and Travel Retail Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, and Others), By Distribution Channel (Airports, Airlines, Ferries, and Others), and Singapore Duty Free and Travel Retail Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsSingapore Duty Free and Travel Retail Market Insights Forecasts to 2035

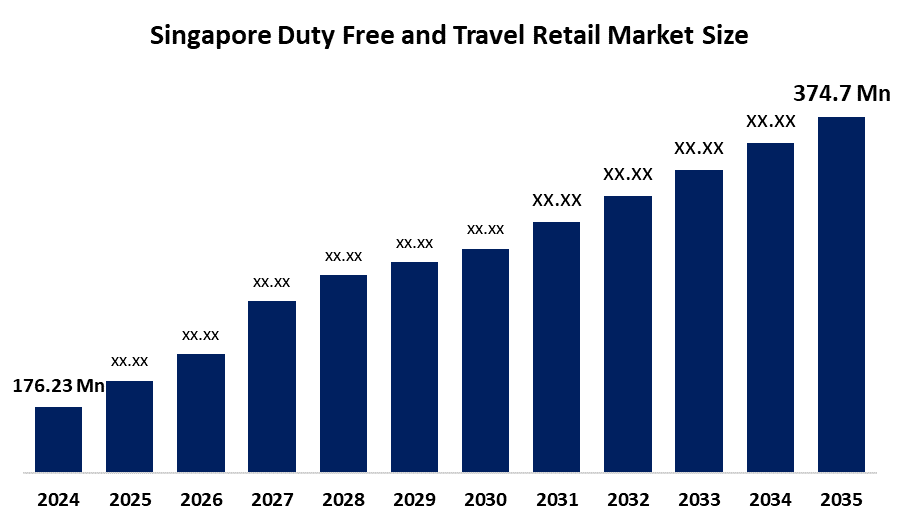

- The Singapore Duty Free and Travel Retail Market Size Was Estimated at USD 176.23 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.1% from 2025 to 2035

- The Singapore Duty Free and Travel Retail Market Size is Expected to Reach USD 374.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Singapore Duty Free and Travel Retail Market Size is anticipated to reach USD 374.7 Million by 2035, growing at a CAGR of 7.1% from 2025 to 2035. The market for duty-free and travel retail in Singapore is mostly driven by increasing traveler numbers, robust airport infrastructure, the availability of luxury brands, rising middle-class spending, planned Changi Airport extensions, improved regional air connectivity, digitalized shopping experiences, duty-free shopping, government support for travel, and an emphasis on customized luxury goods.

Market Overview

The ability of passengers to purchase goods at stores located in major transportation hubs, such as airports, that are exempt from local taxes or duties is known as duty-free. The market is growing due to the well-known duty-free sections of Singapore's Changi Airport, which have become destinations in and of themselves due to their high duty-free spending per passenger.

The Government of Singapore has declared that returning visitors would now only be permitted to consume two liters of duty-free booze instead of three. A reduced allowance for tax-exempt international purchases will also be implemented starting on February, 2019. The new duty-free alcohol allowance rules, which take effect on April 1st, are a serious setback for DFS Group, which operates the duty-free liquor stores for arrivals at Singapore Changi Airport.

Singapore is generally a free port and open economy, and the average tariff is 0%. Around 99% of all Singapore’s imports enter duty free. The country's total trade of goods and services is equivalent to more than 300% of GDP. Electrical machinery, equipment, and parts are major export items, with 161.7 million in 2023. On behalf of the Inland Revenue Authority of Singapore (IRAS), Singapore Customs oversees the administration of the Tourist Refund Scheme (TRS).

To promote the ESG agenda, the Monetary Authority of Singapore (MAS) has put in place some initiatives, such as the Green Finance Action Plan and the requirement that listed companies provide information on climate change.

Report Coverage

This research report categorizes the market for Singapore duty-free and travel retail market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore duty-free and travel retail market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore duty-free and travel retail market.

Singapore Duty Free and Travel Retail Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 176.23 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.1% |

| 2035 Value Projection: | USD 374.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 141 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | SATS Ltd, DFS Venture, SUTL Group of Companies, Fair Breeze Trading Pte. Ltd, Travelite Holdings Ltd, Global Travel Pte Ltd, Lagardere Travel Retail, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The duty-free and travel retail market in Singapore is driven by increased disposable income, improved living standards, and the affordability and convenience of air travel. Middle-class people are taking more trips and purchasing at these duty-free stores. The leading suppliers are developing consumer-focused companies, especially for this end-user market, in an effort to grow the travel retail sector during the ensuing years.

Restraining Factors

The Singaporean duty-free and travel retail market is constrained by the intense competition from neighboring countries with more lenient regulations and lower operating expenses, such as Thailand and Malaysia. The high expense of leasing space in coveted locations like Changi Airport is another factor putting pressure on retailers to maintain profitability. Changes in visitor numbers brought on by global economic and geopolitical events can have an impact on the market. Conventional retail architecture has also changed as a result of the rise of e-commerce, which has also changed consumer shopping habits.

Market Segmentation

The Singapore duty-free and travel retail market share is classified into product type and distribution channel.

- The beauty and personal care segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore duty-free and travel retail market is segmented by product type into beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others. Among these, the beauty and personal care segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by Many people are concerned about their skin and skin health, and nowadays the advantages of skin care are known to everyone. New technologies and methods are available in the market, such as the use of organic or natural ingredients, anti-aging therapies, and creams used to treat skin infections or acne, and sensitivity.

- The airport segment accounted for the largest revenue share in 2024 during the forecast period.

The Singapore duty-free and travel retail market is segmented by distribution channel into airports, airlines, ferries, and others. Among these, the airport segment accounted for the largest revenue share in 2024 during the forecast period. The growth of segment is driven by a substantial increase in international air travel, and airports are evolving from being merely transit hubs to being major shopping locations. With many airports growing their retail areas and improving the range and caliber of goods they provide to passengers, shopping and entertainment are becoming more and more important parts of the contemporary airport experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore duty-free and travel retail market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SATS Ltd

- DFS Venture

- SUTL Group of Companies

- Fair Breeze Trading Pte. Ltd

- Travelite Holdings Ltd

- Global Travel Pte Ltd

- Lagardere Travel Retail

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In May 2025, Lagardere Travel Retail secured the Master Duty-Free & General Merchandise Concession at Singapore Cruise Centre’s HarbourFront and Tanah Merah terminals. This strengthens its footprint in Asia, offering full-service operations in duty-free travel essentials and dining. The partnership with SCC, which runs three ferry terminals and one international cruise terminal, supports Lagardere’s growth strategy and aims to enhance the travel retail experience in Singapore.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore Duty Free and Travel Retail market based on the below-mentioned segments:

Singapore Duty Free and Travel Retail Market, By Product Type

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

Singapore Duty Free and Travel Retail Market, By Distribution Channel

- Airports

- Airlines

- Ferries

- Others

Frequently Asked Questions (FAQ)

-

What is the Singapore Duty Free and Travel Retail Market size?The Singapore duty-free and travel retail market was estimated at USD 176.23 million in 2024 and is projected to reach USD 374.7 million by 2035, growing at a CAGR of 7.1% during 2025–2035.

-

What are the key growth drivers of the market?Market growth is driven by increased disposable income, improved living standards, and the affordability and convenience of air travel. Middle-class people are taking more trips and purchasing at these duty-free stores. The leading suppliers are developing consumer-focused companies, especially for this end-user market, in an effort to grow the travel retail sector during the ensuing years.

-

What factors restrain the Singapore Duty Free and Travel Retail Market?Constraints the intense competition from neighbouring countries with more lenient regulations and lower operating expenses, such as Thailand and Malaysia. The high expense of leasing space in coveted locations like Changi Airport is another factor putting pressure on retailers to maintain profitability. Changes in visitor numbers brought on by global economic and geopolitical events can have an impact on the market. Conventional retail architecture has also changed as a result of the rise of e-commerce, which has also changed consumer shopping habits.

-

How is the market segmented by product type?The market is segmented into beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others

-

Who are the key players in the Singapore Duty Free and Travel Retail market?Key companies include SATS Ltd, DFS Venture, SUTL Group of Companies, Fair Breeze Trading Pte. Ltd, Travelite Holdings Ltd, Global Travel Pte Ltd, Lagardere Travel Retail, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?