Singapore Dishwasher Market Size, Share, By Product Type (Built-in Dishwashers, Portable Dishwashers, Drawer Dishwashers), By Technology (Smart, Standard), By Application (Residential, Commercial), By Distribution Channel (Multi-brand Stores, Wholesalers, Specialty Stores, Online Retails, Others) and COVID-19 Impact Analysis, and Singapore Dishwasher Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsSingapore Dishwasher Market Insights Forecasts to 2035

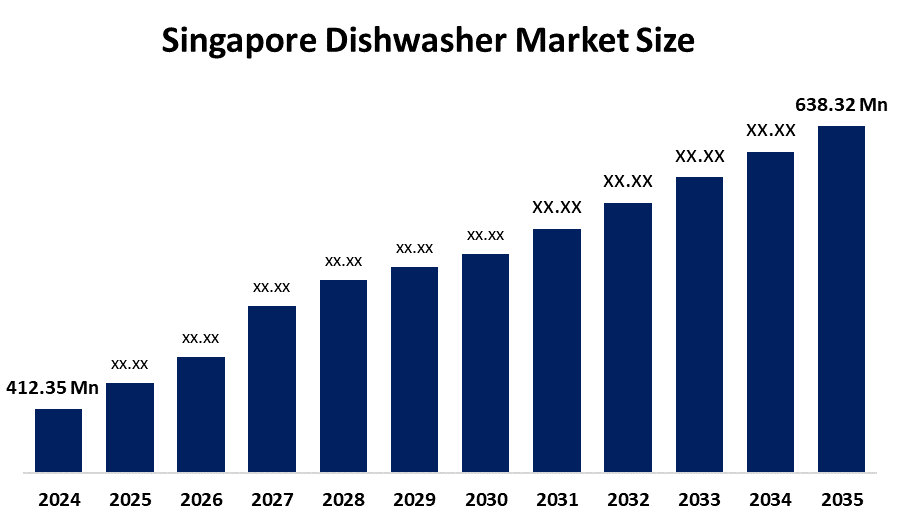

- The Singapore Dishwasher Market Size Was Estimated at USD 412.35 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.05% from 2025 to 2035

- The Singapore Dishwasher Market Size is Expected to Reach USD 638.32 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Singapore Dishwasher Market size is anticipated to reach USD 638.32 Million by 2035, growing at a CAGR of 4.05% from 2025 to 2035. The market for dishwashers in Singapore is mostly driven by an increased focus on mechanizing dishwashing as a result of growing disposable income, the proportion of female workers, and a heightened awareness of hygiene.

Market Overview

A dishwasher is a common household dishwashing appliance. The dishwasher seeks to thoroughly wet the dishes, the entire vicinity, and the region underneath them to remove any filth by applying the mechanical force necessary to distribute and direct the detergent solution. Dishwashers save water consumption by 74% and enhance and expedite kitchen cleanup when used regularly.

The government rule related to dishwashers is the Mandatory Water Efficiency Labelling Scheme, regulated by the Public Utilities Board. This scheme will be extended to include dishwashers with effect from 1 October 2018. Due to the Mandatory WELS for dishwashers, it is still possible to import dishwashers into Singapore. However, all dishwashers intended for household use must be documented and labeled with details regarding their water efficiency level before they can be distributed, offered, exhibited, or promoted for sale in Singapore.

Under the newly created Singapore Green Labelling Scheme (SGLS) for commercial water consumption equipment, two manufacturers, EcoLab Pte Ltd and Electrolux S.E.A. Pte Ltd, have submitted applications to get their appliances accredited.

Technology advancements, changing consumer preferences, and supportive government laws are all contributing to Singapore's compact dishwasher market's rapid transformation. The World Bank reports that Singapore's regulatory environment is becoming more conducive to eco-friendly practices, encouraging manufacturers to integrate eco-sensors, variable wash cycles, and water recycling systems into their fully integrated dishwashers.

Report Coverage

This research report categorizes the market for Singapore Dishwasher Market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore Dishwasher Market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore Dishwasher Market.

Singapore Dishwasher Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 412.35 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.05% |

| 2035 Value Projection: | USD 638.32 Million by 2035 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Technology |

| Companies covered:: | Fotile Singapore, Dishy Sales & Services Pte Ltd, GreatSolutions Pte Ltd, Irys Chem, Electrolux S.E.A. Pte Ltd, EcoLab Pte Ltd, SuperStream Asia Pacific Pte Ltd, Miele, Siemens, And Other player |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The dishwasher market in Singapore is driven by an increased personal disposable income, busy lifestyles, increased consumer awareness of cleanliness and health, the growth of small and medium-sized restaurants, increased tourism, an increase in the number of working women, and the growing popularity of eating out.

Restraining Factors

The Singaporean dishwasher market is constrained by the expensive dishwasher; in addition to the dishwasher's purchase price, the customer must pay for installation and upkeep. Furthermore, dishwasher use is rare in Singapore because handwashing is the norm there, and machines are frequently viewed as an unnecessary expenditure of money.

Market Segmentation

The Singapore dishwasher market share is classified into product type, technology, application, and distribution channel.

- The built-in dishwashers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Singapore dishwasher market is segmented by product type into built-in dishwashers, portable dishwashers, and drawer dishwashers. Among these, the built-in dishwashers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is driven by an integrated dishwasher that blends in perfectly with any kitchen design and doesn't take up any counter space. Typically included supplementary features include a third rack, additional capacity, and customized drying and washing settings.

- The standard segment accounted for the largest revenue share in 2024 during the forecast period.

The Singapore dishwasher market is segmented by technology into smart, standard. Among these, the standard segment accounted for the largest revenue share in 2024 during the forecast period. The segment is driven by these dishwashing models save energy, are safe, and are convenient. But smart dishwashers are becoming more and more popular and marketable.

- The commercial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Singapore dishwasher market is segmented by application type into residential, commercial. Among these, the commercial segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is driven by the growing travel and hospitality sectors. The increasing number of restaurants, hotels, pubs, and cafés is driving up the need for efficient dishwashers to ensure a smooth workforce for the service.

- The multi-brand stores segment holds the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the Singapore dishwasher market is segmented into multi-brand stores, wholesalers, specialty stores, online retails, and others. Among these, the multi-brand stores segment holds the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is driven by allowing customers to choose from a diverse range of products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore Dishwasher Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fotile Singapore

- Dishy Sales & Services Pte Ltd

- GreatSolutions Pte Ltd

- Irys Chem

- Electrolux S.E.A. Pte Ltd

- EcoLab Pte Ltd

- SuperStream Asia Pacific Pte Ltd

- Miele

- Siemens

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In August 2025, Fotile Singapore, a global leader in premium kitchen solutions, is proud to announce its latest strategic partnership with Palate Sensations Culinary School, one of Singapore’s most esteemed culinary training centres. This collaboration brings Fotile’s state-of-the-art kitchen appliances into a professional, real-world setting where consumers can experience the power and precision of Fotile’s innovations firsthand.

In Dec 2024, LG Electronics (LG) fully opened the Application Programming Interface (API) of its smart home platform, LG ThinQ, enabling developers to easily create smart spaces with LG appliances.

Market Segment

This study forecasts revenue at the Singapore, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Singapore Dishwasher market based on the below-mentioned segments:

Singapore Dishwasher Market, By Product Type

- Built-in Dishwashers

- Portable Dishwashers

- Drawer Dishwashers

Singapore Dishwasher Market, By Technology

- Smart

- Standard

Singapore Dishwasher Market, By Application

- Residential

- Commercial

Singapore Dishwasher Market, By Distribution Channel

- Multi-brand Stores

- Wholesalers

- Specialty Stores

- Online Retails

- Others

Frequently Asked Questions (FAQ)

-

What is the Singapore Dishwasher Market size?The Singapore Dishwasher market was estimated at USD 412.35 million in 2024 and is projected to reach USD 638.32 million by 2035, growing at a CAGR of 4.05% during 2025–2035.

-

What are the key growth drivers of the market?Market growth is driven by increased personal disposable income, busy lifestyles, increased consumer awareness of cleanliness and health, the growth of small and medium-sized restaurants, increased tourism, an increase in the number of working women, and the growing popularity of eating out.

-

What factors restrain the Singapore Dishwasher Market?Constraints the expensive dishwasher; in addition to the dishwasher's purchase price, the customer must pay for installation and upkeep. Furthermore, dishwasher use is rare in Singapore because handwashing is the norm there, and machines are frequently viewed as an unnecessary expenditure of money

-

How is the market segmented by product type?The market is segmented into built-in dishwashers, portable dishwashers, and drawer dishwashers.

-

Who are the key players in the Singapore Dishwasher market?Key companies include Fotile Singapore, Dishy Sales & Services Pte Ltd, GreatSolutions Pte Ltd, Irys Chem, Electrolux S.E.A. Pte Ltd, EcoLab Pte Ltd, SuperStream Asia Pacific Pte Ltd, Miele, and Siemens.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?